Facebook Asking Bank Account Info A Users Guide

Facebook asking bank account info and card transactions of users? It’s a chilling thought, isn’t it? This isn’t a drill; we’re diving deep into the unsettling reality of scams, phishing attempts, and the potential security risks associated with connecting your financial life to your Facebook account. We’ll explore Facebook’s official stance on this, examine common scams, and arm you with the knowledge to protect yourself.

Get ready to navigate the tricky waters of online financial security on Facebook – your peace of mind is at stake!

This post isn’t just about fear-mongering; it’s about empowerment. We’ll cover everything from identifying phishing emails to understanding Facebook’s security measures (or lack thereof), and how to report suspicious activity. We’ll also delve into the role of third-party apps and the legal implications of Facebook’s data handling practices. By the end, you’ll be better equipped to protect your financial information online.

Facebook’s Security Practices Regarding Financial Information

Facebook’s handling of user financial data is a complex issue, particularly given the platform’s vast user base and the sensitive nature of the information involved. While Facebook offers various services that integrate with financial institutions, understanding their security protocols and comparing them to industry standards is crucial for users to assess the risks involved.Facebook’s official policy states that they do not directly store users’ bank account numbers or credit card details.

Instead, they rely on third-party payment processors like PayPal or Stripe to handle these transactions. This approach aims to reduce Facebook’s direct exposure to sensitive financial data. However, this doesn’t entirely eliminate risks, as data breaches at these third-party processors could potentially expose user information.

Facebook’s Claimed Security Measures

Facebook claims to utilize various security measures to protect user data, including encryption, both in transit and at rest, multi-factor authentication, and intrusion detection systems. They also emphasize their commitment to complying with relevant data privacy regulations like GDPR and CCPA. However, the specifics of their security infrastructure are not publicly available in detail, making independent verification difficult.

This lack of transparency raises concerns about the true effectiveness of their security protocols. The company also states that they invest heavily in security research and development, but quantifiable results of these investments are not readily available to the public.

Comparison with Other Social Media Platforms

Compared to other major social media platforms, Facebook’s approach to handling financial information is relatively similar. Most platforms avoid direct storage of sensitive financial data, opting instead for third-party payment processors. However, the level of transparency regarding security protocols varies significantly. Some platforms, like Apple, are known for their robust security measures and detailed public disclosures, while others provide less information, leaving users to rely on trust rather than verifiable evidence.

A comprehensive comparative analysis across all platforms requires access to detailed information which is not consistently publicly available.

Best Practices for Facebook to Implement

To enhance user trust and security, Facebook could implement several best practices. These include increasing the transparency of their security protocols, publishing regular security audits conducted by independent third-party firms, and offering more granular control over data sharing with third-party payment processors. Implementing advanced threat detection mechanisms, including AI-powered systems to identify and mitigate sophisticated attacks, would also significantly improve their security posture.

Furthermore, stronger user authentication methods beyond multi-factor authentication, such as biometric authentication, could be considered. Finally, proactive measures to educate users about online financial security best practices would further minimize risks.

Phishing and Impersonation Scams Targeting Facebook Users

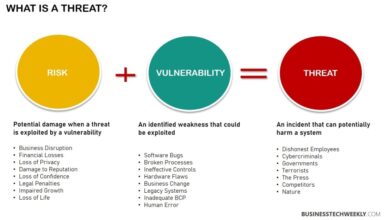

Facebook, despite its robust security measures, remains a prime target for phishing and impersonation scams aimed at stealing users’ financial information. These scams exploit the trust users place in the platform and leverage various deceptive tactics to gain access to sensitive data, leading to significant financial losses and identity theft. Understanding these tactics and recognizing warning signs is crucial for staying safe.

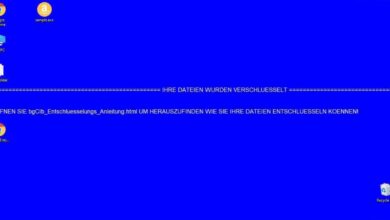

Scammers employ a range of sophisticated methods to trick users. Common tactics include creating fake Facebook profiles that mimic legitimate businesses or individuals, sending fraudulent messages appearing to be from Facebook itself, or using compromised accounts to spread malicious links. These links often lead to fake websites designed to look exactly like legitimate banking sites, prompting users to enter their account details and credit card information.

Another common tactic involves creating a sense of urgency, often by claiming there’s a problem with the user’s account or a prize to be claimed, pushing users to act quickly without thinking critically.

Common Tactics Used by Scammers

Scammers utilize several methods to deceive users. They might send messages claiming to be from Facebook support, notifying the user of a security breach or account suspension, requiring immediate action to rectify the situation. These messages often include links to fake login pages or request users to verify their account details, including banking information. Another approach involves creating fake profiles that imitate friends, family, or celebrities, leveraging existing trust to gain access to personal information.

These fake profiles might send direct messages containing links to phishing websites or requests for financial assistance.

Warning Signs of Phishing Attempts

Several red flags can help users identify phishing attempts. Be wary of unexpected messages requesting personal or financial information, especially those that create a sense of urgency or threaten account suspension. Look closely at the sender’s profile – fake profiles often have incomplete information, few friends, or recently created accounts. Links in suspicious messages should be examined carefully; legitimate websites usually have secure HTTPS connections (indicated by “https://” in the URL).

Always verify the authenticity of any communication by contacting the purported sender directly through official channels, rather than responding to the initial message.

Examples of Phishing and Impersonation Scams

A table summarizing different scam types, their methods, warning signs, and prevention strategies will help clarify the issue further. Understanding these elements empowers users to protect themselves more effectively.

| Scam Type | Method | Warning Signs | Prevention Strategies |

|---|---|---|---|

| Fake Facebook Profile | Impersonates a friend or business; sends friend requests or messages with malicious links. | Incomplete profile, few friends, suspicious requests for money or personal information. | Verify the identity of the sender, avoid clicking on links from unknown sources. |

| Phishing Email/Message | Claims to be from Facebook; requests login credentials or personal information. | Suspicious email address, grammatical errors, sense of urgency, request for financial information. | Never click on links in suspicious emails, contact Facebook directly through official channels. |

| Fake Website | Looks identical to a legitimate banking website; asks for login details and credit card information. | Incorrect URL, lack of HTTPS, unusual requests for personal information. | Always verify the website URL, look for the HTTPS padlock symbol. |

| Compromised Account | A friend’s account is used to send malicious links or requests. | Unexpected messages from a known contact, suspicious links or requests. | Contact the friend directly through alternative channels, report the compromised account to Facebook. |

Public Service Announcement: Protect Yourself from Facebook Financial Scams

This PSA aims to raise awareness about phishing and impersonation scams targeting Facebook users. The visual element would feature a split screen. One side depicts a happy, unsuspecting Facebook user clicking on a suspicious link, while the other side shows the same user, distraught, realizing they’ve been scammed. The text would overlay the image, highlighting key warnings: “Think Before You Click,” “Verify Senders,” “Don’t Share Financial Information Online Unless Absolutely Secure.” The overall tone is urgent and cautionary, with clear, concise language.

User Reporting Mechanisms and Facebook’s Response: Facebook Asking Bank Account Info And Card Transactions Of Users

Protecting user financial data is paramount for Facebook, and a robust reporting system is crucial in mitigating risks associated with phishing and fraudulent activities. Users need to understand how to report suspicious activity effectively, and Facebook needs transparent and efficient processes for investigating and resolving these issues. This section details Facebook’s user reporting mechanisms and their response procedures, drawing on publicly available information and reported incidents.Facebook provides several avenues for users to report suspicious requests for financial information.

The most common method is through the reporting tools integrated directly into the platform. Users can typically report a profile, post, message, or ad they suspect is involved in a phishing attempt. The reporting options usually include categories such as “phishing,” “fraud,” or “spam.” Providing as much detail as possible, including screenshots, is highly recommended. Additionally, users can contact Facebook’s help center directly through their website, though this method might be less efficient for immediate responses.

Facebook’s Investigation and Response Process

Upon receiving a report, Facebook’s security team initiates an investigation. This involves analyzing the reported content, identifying patterns of fraudulent activity, and verifying the user’s claims. The process may involve reviewing the reported account’s activity, examining the content of suspicious messages or posts, and collaborating with law enforcement agencies if necessary. The speed and thoroughness of the investigation vary depending on the complexity of the case and the evidence provided.

Facebook’s response might include removing fraudulent content, disabling suspicious accounts, and issuing warnings to users.

Examples of Facebook’s Response to Past Incidents

While Facebook doesn’t publicly detail specific instances of financial data breaches and their responses for privacy reasons, we can extrapolate from public statements and news reports. In numerous cases involving large-scale phishing campaigns targeting Facebook users, Facebook has been reported to have taken swift action, disabling fraudulent accounts and removing malicious links. For example, in instances where fake login pages mimicking Facebook’s interface were identified, the company quickly took them down and alerted affected users.

The effectiveness of these responses varies depending on the scale and sophistication of the attack, with larger, more complex attacks potentially taking longer to fully resolve.

Comparison with Other Platforms

Comparing Facebook’s response time and effectiveness to other social media platforms in handling similar security incidents is difficult due to the lack of publicly available, comparable data across platforms. Each platform has its own internal security protocols and reporting mechanisms. However, based on publicly available information and news reports, it can be observed that the response times and effectiveness of various platforms vary, influenced by factors such as the size of the user base, the complexity of the attack, and the resources dedicated to security.

Generally, larger platforms with greater resources tend to respond more quickly and effectively to large-scale attacks.

The Role of Third-Party Apps and Integrations

Facebook’s vast ecosystem of third-party apps offers users a wide range of functionalities, from games and productivity tools to specialized services. However, this convenience comes with inherent security risks, particularly when dealing with apps that request access to sensitive financial information. Understanding these risks and practicing safe app usage is crucial for protecting your financial data.The potential for malicious apps to exploit Facebook’s integration system is a significant concern.

Many seemingly legitimate apps might request broader permissions than necessary, potentially granting access to more than just the data explicitly stated. This could lead to unauthorized access to your financial details, either through direct data theft or by using your account to commit fraudulent transactions. Moreover, poorly secured apps can become vulnerable to hacking, exposing your data indirectly through a compromised third-party service.

Security Risks Associated with Third-Party Apps Requesting Financial Information

Many apps, especially those offering financial services or related functionalities (such as budgeting tools or investment platforms), require access to financial information to operate. However, this access creates a significant vulnerability. A compromised app, even one with initially good intentions, could be used to steal login credentials, track spending habits, or even directly access linked bank accounts. The risk is magnified by the potential for data breaches within the app itself, leading to the exposure of user financial data to malicious actors.

The lack of transparency in some apps’ data handling practices further exacerbates this risk.

Best Practices for Evaluating the Trustworthiness of Facebook Apps

Before granting any app access to your Facebook account, particularly those requesting financial information, careful scrutiny is essential. Users should thoroughly investigate the app’s developer, its reputation, and its privacy policies. Checking online reviews and looking for independent security assessments can offer valuable insights into an app’s trustworthiness. Additionally, comparing the app’s requested permissions to its stated functionality is crucial; if the requested permissions seem overly broad, it’s a red flag.

Seriously, Facebook asking for my bank account info and card transactions? That’s a huge red flag! It highlights the critical need for robust cloud security, which is why I’ve been researching solutions like those offered by bitglass and the rise of cloud security posture management ; understanding how these platforms work is crucial in a world where protecting your financial data online is more important than ever.

This whole Facebook situation makes me even more determined to bolster my online security.

Finally, prioritizing well-known and established apps from reputable developers reduces the risk of encountering malicious or poorly-secured software.

Security Questions Users Should Ask Before Granting App Access to Financial Data, Facebook asking bank account info and card transactions of users

Before granting any app access to your financial information, consider these critical questions:

- What specific financial data does the app require, and why is this data necessary for its functionality?

- What security measures does the app implement to protect user financial data from unauthorized access and breaches?

- What is the app developer’s privacy policy, and how does it address the handling and protection of user financial information?

- Are there independent security audits or certifications that verify the app’s security practices?

- What is the app’s reputation, and are there any negative reviews or reports concerning data security or privacy violations?

Reviewing Permissions Granted to Third-Party Apps

Facebook provides tools to manage the permissions granted to connected apps. To review these permissions, navigate to your Facebook settings. Look for a section related to “Apps and Websites” or a similar designation. Within this section, you’ll find a list of all the apps connected to your account. Each app will display the permissions it has been granted.

You can revoke access for any app individually, effectively cutting off its ability to access your Facebook data, including any financial information it may have previously obtained. Regularly reviewing and updating these permissions is a crucial step in maintaining your online security.

Legal and Regulatory Implications

Facebook’s handling of user financial data carries significant legal and regulatory responsibilities, demanding a robust framework to ensure data protection and compliance. Failure to do so exposes the company to substantial legal and financial repercussions. The sheer volume of user data processed, coupled with the sensitive nature of financial information, necessitates a deep understanding and adherence to relevant laws and regulations.The legal responsibilities Facebook shoulders stem from its role as a data controller and processor.

As a data controller, Facebook determines the purposes and means of processing user data, including financial information collected directly or indirectly. As a processor, it handles financial data on behalf of third-party apps and services integrated into its platform. This dual role necessitates stringent security measures and transparent data handling practices.

Data Privacy Regulations

Several key data privacy regulations directly impact Facebook’s handling of financial information. The General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in California are prominent examples. The GDPR establishes a broad framework for data protection, including the right to access, rectification, erasure, and data portability, with stringent requirements for consent and data security.

Seriously, Facebook asking for my bank account details and card transactions? That’s a huge red flag! I’m thinking about building a more secure personal finance app myself, maybe using the low-code/pro-code approach described in this article on domino app dev the low code and pro code future. It’s crazy how much sensitive information these big platforms demand, and building something more secure is starting to look very appealing.

I need to figure out how to better protect my financial data.

The CCPA grants California residents similar rights, including the right to know what personal information is collected, the right to delete data, and the right to opt-out of the sale of personal information. Facebook must comply with these regulations when processing the financial data of users residing in the EU or California, respectively. Non-compliance can lead to significant fines and reputational damage.

Potential Consequences of Inadequate Data Protection

Inadequate protection of user financial data can expose Facebook to a multitude of serious consequences. These include hefty fines imposed by regulatory bodies for violations of data privacy laws like the GDPR and CCPA. For example, the GDPR allows for fines of up to €20 million or 4% of annual global turnover, whichever is higher. Beyond financial penalties, Facebook could face class-action lawsuits from affected users seeking compensation for damages resulting from data breaches or unauthorized access to their financial information.

Such lawsuits can lead to substantial financial settlements and further damage to Facebook’s reputation and brand trust. Moreover, regulatory investigations and reputational harm can negatively impact investor confidence and the company’s overall valuation.

Past Legal Cases and Regulatory Actions

Several past legal cases and regulatory actions involving social media platforms and user financial data highlight the importance of robust data protection measures. While specific cases involving Facebook and direct handling of user financial data are less prevalent (due to Facebook’s primarily indirect handling through third-party apps), the Cambridge Analytica scandal serves as a stark reminder of the potential consequences of data misuse, even if not directly financial data.

This case demonstrated the severe reputational damage and regulatory scrutiny that can arise from inadequate data protection practices. Other instances of data breaches across various social media platforms have resulted in significant fines and legal battles, setting a precedent for the importance of data security and regulatory compliance. These examples underscore the critical need for proactive and comprehensive data protection strategies within the social media landscape.

Conclusive Thoughts

So, is Facebook directly asking for your bank details? Officially, no. But the reality is far more nuanced. The threat landscape is complex, involving sophisticated phishing scams and potentially risky third-party apps. This post served as a wake-up call, highlighting the need for vigilance and proactive security measures.

Remember, your online safety is your responsibility. Stay informed, stay aware, and protect your financial data fiercely.

Questions Often Asked

Q: What should I do if I accidentally shared my bank information on Facebook?

A: Immediately contact your bank to report potential fraud and change your passwords and security questions. Then, report the incident to Facebook.

Q: How can I tell if a Facebook app is safe?

A: Check the app’s reviews, look for a verified badge, and carefully review the permissions it requests before granting access. Avoid apps that ask for unnecessary financial information.

Q: Does Facebook ever legitimately need my bank information?

A: No. Legitimate businesses will never ask for your banking details through Facebook.

Q: What are some common warning signs of a phishing scam?

A: Suspicious links, urgent requests for information, grammatical errors, requests for sensitive information, and emails from unknown senders.