France Company OVH Acquires VMwares vCloud Air

France company ovh acquires vmwares vcloud air – France company OVH acquires VMware’s vCloud Air – a move that sent ripples through the cloud computing world! This acquisition isn’t just a simple business deal; it’s a strategic power play reshaping the competitive landscape. OVH, a major player in European hosting, snagged VMware’s vCloud Air, significantly boosting its cloud infrastructure capabilities and challenging the established giants. This blog post dives into the details, exploring the implications for OVH, VMware, and the broader cloud market.

We’ll unpack OVH’s acquisition strategy, analyzing the synergies between their existing offerings and vCloud Air’s strengths. We’ll also examine the impact on VMware, considering their future cloud plans and relationships with other providers. The market analysis will reveal how this deal shifts the competitive balance, impacting different customer segments and potentially changing the way businesses approach cloud services.

Finally, we’ll look at the technical integration challenges, customer impact, financial implications, and the future outlook for OVH in the wake of this significant acquisition.

OVH’s Acquisition Strategy

OVH’s acquisition of VMware’s vCloud Air wasn’t a random move; it was a strategic play reflecting a broader pattern in the company’s growth trajectory. Historically, OVH has demonstrated a preference for acquisitions that bolster its existing infrastructure and expand its service offerings, often targeting companies with complementary technologies or a strong customer base. This acquisition fits squarely within that pattern, allowing OVH to leverage VMware’s established presence in the enterprise market.

Synergies between OVH and VMware’s vCloud Air

The acquisition created significant synergies. VMware’s vCloud Air brought a substantial enterprise customer base accustomed to a specific type of cloud service, while OVH offered a robust, scalable, and cost-effective infrastructure. The combination allowed OVH to immediately tap into a new segment of the market, offering existing vCloud Air clients a seamless transition to OVH’s infrastructure and potentially upgrading them to more advanced services.

This also provided OVH with valuable expertise in managing enterprise-grade cloud deployments and enhanced its overall market standing. The integration of vCloud Air’s technology and expertise into OVH’s existing platform represented a substantial technological leap forward.

So OVH, that French cloud giant, just snagged VMware’s vCloud Air – a pretty big deal in the cloud infrastructure world. It makes you wonder about data security though, especially considering this news I just saw about facebook asking bank account info and card transactions of users ; it highlights how crucial robust security is for any company handling sensitive data, regardless of size.

Hopefully, OVH’s acquisition will lead to even better security measures for their expanded customer base.

Strategic Rationale for the Acquisition

OVH’s decision to acquire vCloud Air stemmed from a clear strategic objective: to strengthen its position in the competitive cloud market. At the time of the acquisition, the cloud market was – and continues to be – fiercely competitive, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominating the landscape. By acquiring vCloud Air, OVH gained access to a significant portion of the enterprise market, which is often more lucrative and less price-sensitive than the consumer market.

This acquisition broadened OVH’s customer base, diversified its revenue streams, and enhanced its ability to compete effectively against the larger cloud providers.

OVH’s Cloud Offerings: Before and After the Acquisition

Before the acquisition, OVH’s cloud offerings primarily focused on Infrastructure-as-a-Service (IaaS), targeting a largely developer and small-to-medium-sized business (SMB) clientele. Post-acquisition, OVH significantly expanded its enterprise-grade cloud solutions, incorporating VMware’s expertise in virtualized environments and cloud management. This broadened their service portfolio to include more sophisticated managed services and catered to a wider range of enterprise clients’ needs. The integration resulted in a more comprehensive and competitive cloud platform capable of handling complex enterprise workloads.

SWOT Analysis of the Acquisition for OVH

| Strength | Weakness |

|---|---|

| Expanded customer base, particularly in the enterprise sector. | Integration challenges and potential disruption to existing OVH services. |

| Access to VMware’s technology and expertise. | Increased competition in the enterprise cloud market. |

| Enhanced market position and brand recognition. | Potential for customer churn due to changes in service offerings. |

| Opportunity | Threat |

| Upselling existing vCloud Air clients to higher-tier OVH services. | Aggressive pricing strategies from larger cloud providers. |

| Expansion into new geographic markets leveraging VMware’s existing infrastructure. | Economic downturns impacting enterprise spending on cloud services. |

| Development of new hybrid cloud solutions. | Emergence of new technologies and disruptive cloud providers. |

Impact on VMware

The sale of vCloud Air to OVH represented a significant strategic shift for VMware, marking a retreat from the public Infrastructure-as-a-Service (IaaS) market. While VMware remained heavily invested in its software-defined data center strategy and hybrid cloud offerings, the divestiture signaled a prioritization of other areas of growth. This decision had cascading effects on VMware’s overall cloud strategy and its relationships with other players in the industry.The divestiture of vCloud Air impacted VMware’s cloud strategy by allowing them to focus resources on their core competencies: virtualization software, cloud management platforms (like vRealize), and hybrid cloud solutions.

By exiting the competitive IaaS market, VMware could avoid direct competition with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), allowing them to concentrate on providing the underlying software and management tools that enable these cloud environments to function effectively. This strategy aligns with VMware’s long-term vision of being a critical component of any cloud environment, regardless of the underlying infrastructure provider.

VMware’s Relationships with Other Cloud Providers

The vCloud Air sale altered VMware’s relationships with other cloud providers in a complex way. While it removed a direct competitor from the IaaS space, it also potentially impacted partnerships. Before the sale, VMware had partnerships with several cloud providers who offered vCloud Air services. The transition to OVH may have required renegotiation of agreements and potentially caused some disruption for customers previously relying on the vCloud Air platform through these partners.

However, VMware’s continued focus on hybrid cloud solutions meant maintaining strong relationships with major cloud providers remained crucial for their overall success. The shift likely involved a recalibration of partnerships, focusing on collaborations where VMware provides the software and management tools, rather than competing directly as an IaaS provider.

Timeline of Events Surrounding the vCloud Air Acquisition

A precise, publicly available timeline of every internal decision within VMware leading to the sale is unavailable. However, key publicly announced events paint a picture. The gradual decline in vCloud Air’s market share and profitability likely spurred internal discussions regarding its future. This period of evaluation and strategic review would have included assessing the market landscape, potential buyers, and the overall strategic implications of retaining or divesting vCloud Air.

The eventual announcement of the sale to OVH represented the culmination of this process. Following the acquisition, OVH integrated vCloud Air into its existing infrastructure, likely leading to a period of customer migration and service adjustments.

Arguments For and Against the vCloud Air Divestiture

Arguments in favor of the sale often centered on resource allocation and strategic focus. VMware could refocus its engineering and marketing efforts on more profitable and strategically important areas, such as hybrid cloud management, security, and networking. Divesting a less profitable business unit allowed VMware to improve its overall financial performance and enhance shareholder value. The sale also reduced direct competition in a highly saturated IaaS market.Conversely, arguments against the sale highlighted potential loss of market share and customer relationships.

OVH’s acquisition of VMware’s vCloud Air is a big deal for the cloud infrastructure space, impacting how companies manage their data and applications. This shift towards robust cloud solutions highlights the importance of efficient application development, which is why I’ve been researching the future of app building, particularly looking at the exciting developments in domino app dev, the low-code and pro-code future.

Ultimately, the OVH acquisition underscores the need for agile development processes to keep pace with these evolving cloud landscapes.

Some argued that vCloud Air, despite its struggles, still represented a foothold in the IaaS market that could be nurtured and potentially become more profitable with further investment. Concerns also existed regarding the potential impact on existing vCloud Air customers during the transition to OVH. The loss of a direct IaaS offering might have also limited VMware’s ability to influence the direction of the cloud market in certain areas.

OVH’s acquisition of VMware’s vCloud Air is a big deal, expanding their cloud offerings significantly. This highlights the growing importance of robust cloud security, especially as more companies migrate their data. Understanding the complexities of this is crucial, which is why I found this article on bitglass and the rise of cloud security posture management so insightful.

Ultimately, OVH’s move underscores the need for strong security solutions as the cloud landscape continues to evolve.

Market Analysis

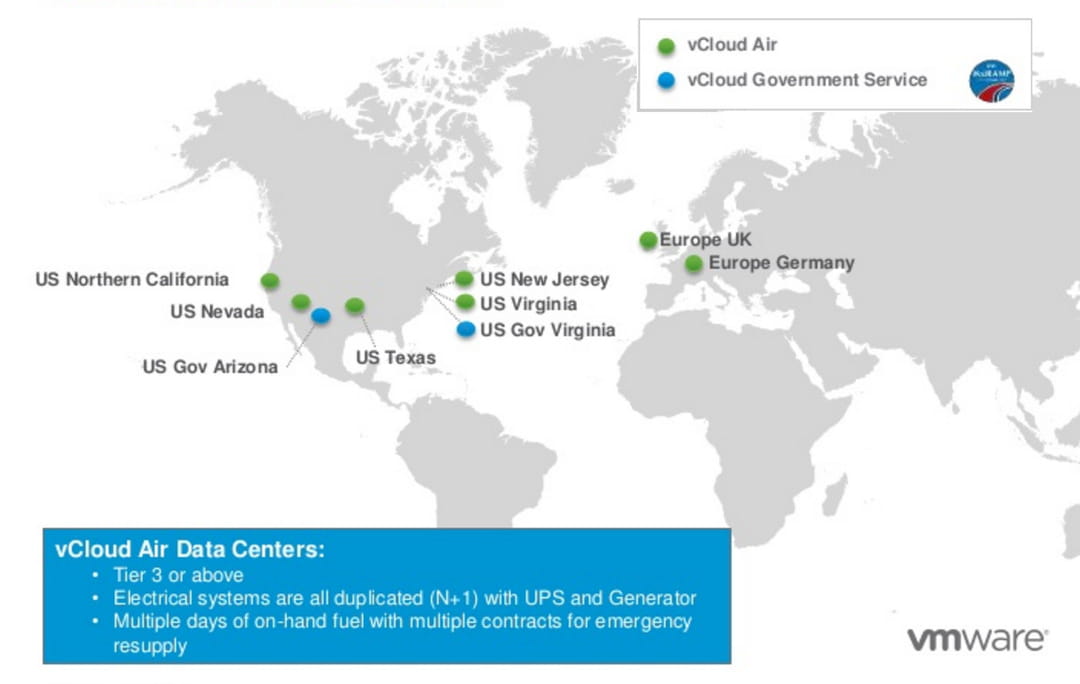

The OVH acquisition of VMware’s vCloud Air significantly altered the competitive landscape of the cloud computing market. Prior to the acquisition, the market was already a fiercely competitive arena dominated by a few major players, but this deal introduced a new dynamic, shifting power balances and prompting strategic responses from competitors. Analyzing the market before and after this event reveals valuable insights into the industry’s evolution and future trajectory.The cloud computing market, before OVH’s acquisition, was characterized by a strong presence of hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), alongside established players like IBM Cloud and Oracle Cloud.

These companies offered a broad range of services, from Infrastructure-as-a-Service (IaaS) to Platform-as-a-Service (PaaS) and Software-as-a-Service (SaaS). VMware, with its vCloud Air, occupied a niche focusing on hybrid cloud solutions, catering to enterprises already invested in VMware’s on-premises virtualization technologies. This segment represented a significant, albeit less dominant, part of the overall market.

Competitive Dynamics Before and After the Acquisition

Before the acquisition, competition focused primarily on pricing, service offerings, and geographic reach. Hyperscalers competed on scale and global infrastructure, while smaller players often focused on niche markets or specific industry verticals. VMware’s vCloud Air faced competition from both hyperscalers and other hybrid cloud providers. Post-acquisition, OVH gained immediate access to VMware’s existing vCloud Air customer base and technology, strengthening its position in the hybrid cloud market.

This forced competitors to reassess their strategies, particularly those targeting enterprise clients using VMware technologies. Some might have intensified their own hybrid cloud offerings or focused on differentiating features like enhanced security or specialized industry solutions to maintain their competitive edge.

Key Player Responses

The acquisition prompted varying responses from key players. AWS, Azure, and GCP likely saw the move as a consolidation within the market, potentially solidifying their dominance in IaaS. However, they also had to consider the potential for increased competition in the hybrid cloud space, especially as OVH leveraged VMware’s technology and customer base. Other hybrid cloud providers might have experienced increased pressure, prompting them to innovate or focus on specific niches to remain competitive.

For example, a smaller provider might have doubled down on a specific industry vertical or a particular geographic region to avoid direct competition with the now larger OVH.

Market Segmentation Analysis

The acquisition impacted different customer segments differently. Enterprises already using VMware’s on-premises virtualization solutions likely saw the acquisition as a potential benefit, offering a smoother path to hybrid cloud deployments. Smaller businesses might have found OVH’s expanded hybrid cloud offerings more accessible and cost-effective. Conversely, customers heavily invested in other cloud platforms might have experienced little direct impact.

The acquisition’s primary effect was on the enterprise segment relying on VMware, potentially shifting their cloud provider choices towards OVH.

Reshaping the Competitive Landscape

OVH’s acquisition of vCloud Air undeniably reshaped the competitive landscape of cloud infrastructure services. It consolidated market share, strengthened OVH’s position in the hybrid cloud space, and increased pressure on other players. The acquisition also highlighted the ongoing consolidation trend within the cloud industry, where larger players seek to acquire smaller companies to expand their offerings and gain market share.

This trend suggests a future where fewer, larger players dominate the market, forcing smaller providers to specialize or innovate to remain competitive.

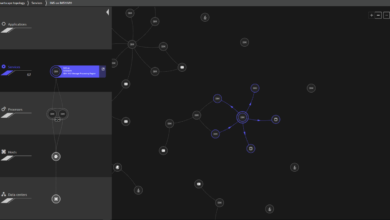

Technological Integration

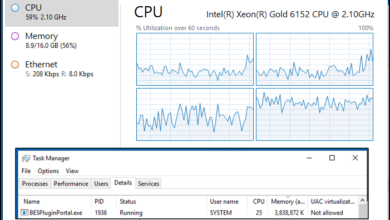

The acquisition of vCloud Air by OVH presented a significant technological integration challenge. Merging two distinct cloud infrastructures, each with its own architecture, management systems, and customer base, required careful planning and execution. The success of the integration hinged on minimizing disruption to existing vCloud Air customers while simultaneously leveraging the strengths of both platforms to create a more robust and comprehensive offering.The technical challenges were multifaceted.

Differences in virtualization technologies, network configurations, storage solutions, and security protocols needed to be addressed. Data migration, application compatibility, and ensuring seamless service continuity were also critical considerations. The scale of the operation, involving potentially millions of virtual machines and terabytes of data, amplified the complexity.

Migration Strategies for vCloud Air Customers

Several migration strategies were likely considered to move vCloud Air customers onto OVH’s infrastructure. These strategies ranged from simple lift-and-shift approaches, where virtual machines are moved with minimal changes, to more complex re-architecting efforts, involving optimizing applications for OVH’s platform. A phased approach, prioritizing customers based on factors like application criticality and data volume, was probably employed to manage the risk and ensure a smooth transition.

Automated migration tools would have been crucial to streamline the process and reduce manual intervention. Direct connectivity options, such as dedicated lines, could have been used to facilitate efficient data transfer. Thorough testing and validation were necessary to prevent any data loss or service disruption.

Comparison of OVH and vCloud Air Architectures

OVH and vCloud Air employed different architectural approaches. OVH, known for its focus on bare-metal servers and public cloud infrastructure, likely had a more distributed and scalable architecture compared to vCloud Air’s more integrated, possibly more centrally managed approach. Areas of compatibility might have included common virtualization technologies like VMware vSphere, which both providers likely supported. However, differences in network architectures, storage systems (e.g., SAN vs.

object storage), and management consoles would have required careful mapping and potentially some level of reconfiguration or adaptation. Security protocols and compliance certifications would also need careful reconciliation to ensure consistent security posture. Incompatibilities likely focused on the management interfaces, automation tools, and specific service offerings that were unique to each provider.

Hypothetical Timeline for Integration

A realistic timeline for complete integration of vCloud Air into OVH’s systems would likely span several quarters, perhaps even a year or more. The initial phase, focusing on assessment and planning, would involve detailed analysis of both infrastructures, defining migration strategies, and establishing communication channels with customers. This would be followed by a phased migration process, starting with less critical workloads and gradually moving to more demanding applications.

Parallel efforts would be undertaken to integrate billing systems, customer support, and other operational aspects. Continuous testing and monitoring would be essential throughout the process. A final phase would involve consolidating redundant systems and optimizing the integrated infrastructure for maximum efficiency. A hypothetical timeline could look like this:

| Phase | Duration | Activities |

|---|---|---|

| Assessment & Planning | 3-6 months | Infrastructure analysis, migration strategy definition, customer communication |

| Phased Migration | 6-12 months | Migration of workloads, testing, and validation |

| System Consolidation & Optimization | 3-6 months | Integration of billing and support systems, infrastructure optimization |

This timeline is a hypothetical example, and the actual integration process could vary based on unforeseen challenges and complexities. The success of the integration would depend on careful planning, efficient execution, and strong communication with affected customers.

Customer Impact

The OVH acquisition of VMware’s vCloud Air presents a complex picture for existing customers. While the potential for cost savings and expanded service offerings exists, there are also legitimate concerns regarding service continuity, support quality, and the overall transition process. Understanding the potential benefits and drawbacks is crucial for customers to make informed decisions about their future cloud strategies.The acquisition’s impact will likely manifest in several key areas: service levels, pricing, and support.

OVH’s reputation for competitive pricing and robust infrastructure could lead to more affordable cloud solutions for vCloud Air customers. However, the integration process itself could temporarily disrupt service levels, and the quality of support might fluctuate during the transition period. Open communication and proactive management of customer expectations will be vital for OVH to maintain trust and loyalty.

Service Level Changes

OVH’s infrastructure is known for its scale and reliability. However, migrating vCloud Air services to OVH’s platform presents a significant undertaking. Initial service disruptions are possible during the migration process, which could include temporary outages or reduced performance. OVH will need to carefully manage this transition to minimize disruption and communicate transparently with customers about expected downtime and service level agreements (SLAs).

For example, a phased migration approach, prioritizing critical applications and services first, could mitigate the impact on customers. Furthermore, robust monitoring and proactive communication during the migration process would be crucial.

Pricing and Support Adjustments

Existing vCloud Air customers might see changes in their pricing plans. OVH might offer new, more competitive pricing structures, potentially leading to cost savings. However, there’s also a possibility of price increases for certain services, especially if OVH integrates additional features or enhances service levels. Changes to support options are also likely. OVH might consolidate support channels or introduce new support tiers, impacting the level of support customers receive.

For example, vCloud Air’s premium support might be replaced by a similar tier within OVH’s support structure, possibly with different pricing or service level guarantees. Clear communication about these changes, including detailed explanations of new pricing models and support options, is essential.

OVH’s Communication Strategy

Effective communication is paramount during the transition. OVH needs a multi-pronged approach, including proactive email updates, detailed FAQs on their website, webinars explaining the transition, and potentially dedicated customer success managers to guide customers through the process. Transparency is key; OVH should clearly articulate the timeline for the migration, potential service disruptions, and the changes to pricing and support.

Regular updates, both planned and unplanned, will build confidence and trust. Open forums or community platforms could also allow for direct interaction with OVH’s team and other customers, facilitating open dialogue and addressing concerns proactively. Examples of successful transitions in the tech industry, such as the acquisition of GitHub by Microsoft, illustrate the importance of clear and frequent communication.

Comparison of vCloud Air Before and After Acquisition

| Feature | vCloud Air (Before) | OVH vCloud Air (After – Projected) | Notes |

|---|---|---|---|

| Pricing | VMware’s pricing structure | Potentially lower pricing, new tiered plans | Subject to OVH’s pricing strategy |

| Support | VMware’s support channels | Integration with OVH’s support system | Potential changes in support levels and response times |

| Service Level Agreements (SLAs) | VMware’s SLAs | Potentially revised SLAs | OVH might offer different SLAs based on their infrastructure |

| Data Centers | VMware’s data center locations | Expansion to OVH’s global data center network | Increased geographic reach and potentially improved redundancy |

Financial Implications: France Company Ovh Acquires Vmwares Vcloud Air

OVH’s acquisition of VMware’s vCloud Air, while strategically significant, carries considerable financial implications for both companies. Understanding the financial terms, potential short-term and long-term effects, and inherent risks and opportunities is crucial for evaluating the success of this merger. The lack of publicly available details surrounding the exact purchase price necessitates a discussion based on industry norms and reasonable estimations.

Acquisition Cost and Financing

While the precise purchase price remains undisclosed, acquisitions of this nature often involve a combination of cash and stock. Given OVH’s history and financial standing, it’s plausible that a significant portion of the acquisition was funded through a mix of existing cash reserves, debt financing (potentially through loans or bond issuances), and possibly some equity issuance. Similar acquisitions in the cloud computing sector have seen valuations in the hundreds of millions, or even billions, of dollars depending on the size and market share of the acquired assets.

The absence of specific figures necessitates reliance on comparable transactions for estimation. For example, a comparable deal could be analyzed to project a potential range, considering factors like revenue, customer base, and technology value of vCloud Air.

Short-Term and Long-Term Financial Impact on OVH

In the short term, OVH will likely experience increased expenses related to integration costs, potential restructuring, and employee retention. This could lead to a temporary dip in profitability. However, the long-term outlook is more positive. The acquisition of vCloud Air’s customer base and technology could significantly boost OVH’s market share in the hybrid cloud space, leading to increased revenue and improved profitability over time.

This positive impact is contingent upon successful integration and the ability to retain and upsell existing vCloud Air customers. We can look to other successful acquisitions in the tech industry for similar examples; often, a slight initial dip in profitability is followed by a period of strong growth as synergies are realized.

Financial Risks and Opportunities

One key risk is the successful integration of vCloud Air’s technology and customer base into OVH’s existing infrastructure. Integration challenges could lead to service disruptions, customer churn, and increased costs, negatively impacting financial performance. Another risk is the potential for unforeseen liabilities associated with the acquired assets. However, significant opportunities exist. The acquisition could lead to economies of scale, improved operational efficiency, and access to new markets and customer segments, all contributing to long-term financial growth.

Furthermore, the combined technological expertise could lead to the development of innovative hybrid cloud solutions, creating a competitive advantage.

Impact on Investor Relations and Stock Price

The acquisition’s impact on OVH’s investor relations and stock price is likely to be complex and depend heavily on the successful execution of the integration and the company’s ability to communicate its strategic vision effectively. A well-managed integration process, demonstrating clear synergies and a path to improved profitability, will likely positively influence investor sentiment and potentially boost the stock price.

Conversely, challenges in integration or a lack of clear communication could lead to negative investor reactions and a decline in the stock price. This is a common scenario in the tech industry where market perception of strategic acquisitions is a major factor in share price fluctuations.

Future Outlook

OVH’s acquisition of VMware’s vCloud Air marks a significant step in its ambition to become a leading global cloud provider. The integration of vCloud Air’s technology and customer base, coupled with OVH’s existing infrastructure and expertise, positions the company for substantial growth and expansion in the coming years. This acquisition isn’t just about adding capacity; it’s about strategically enhancing OVH’s offerings and market position.The future direction of OVH’s cloud business will likely involve a multifaceted approach focusing on leveraging the strengths of both companies.

This includes expanding its hybrid cloud capabilities, strengthening its enterprise-level offerings, and potentially exploring new geographical markets. The acquisition also provides OVH with a valuable opportunity to refine its existing cloud services, integrating the best features and functionalities from both platforms to create a more comprehensive and competitive product suite.

Potential Growth Areas

OVH can capitalize on several key areas for future growth. First, the integration of vCloud Air’s technology will significantly enhance OVH’s hybrid cloud solutions, catering to the growing demand from enterprises seeking flexible and scalable cloud deployments. This allows them to seamlessly integrate their on-premise infrastructure with OVH’s public cloud services. Second, OVH can leverage vCloud Air’s existing customer base to expand its reach into new enterprise markets, offering them a compelling alternative to existing cloud providers.

Third, international expansion, particularly into regions where vCloud Air had a strong presence, represents a significant growth opportunity. For example, OVH could focus on expanding its services in North America, building upon the existing customer relationships established by vCloud Air.

Further Acquisitions and Partnerships

Following the successful integration of vCloud Air, OVH might explore further acquisitions to bolster its cloud portfolio and expand its technological capabilities. Acquisitions could target companies specializing in specific cloud technologies, such as artificial intelligence, machine learning, or edge computing, thereby enhancing OVH’s overall service offerings and competitiveness. Similarly, strategic partnerships with software vendors and technology providers could facilitate the development of innovative cloud solutions and expand OVH’s market reach.

An example would be a partnership with a leading cybersecurity firm to offer enhanced security features for its cloud services, appealing to security-conscious enterprises.

Potential Future Challenges, France company ovh acquires vmwares vcloud air

The integration of vCloud Air into OVH’s existing infrastructure and operations presents several potential challenges:

- Technical Integration Complexity: Merging two distinct cloud platforms requires significant technical expertise and resources. Challenges could arise in ensuring seamless data migration, application compatibility, and overall system stability during the integration process.

- Customer Retention: Retaining vCloud Air’s existing customer base will be crucial. OVH needs to effectively communicate the benefits of the acquisition and ensure a smooth transition for these customers to avoid losing market share to competitors.

- Competition: The cloud computing market is highly competitive. OVH will need to continually innovate and differentiate its services to maintain its competitive edge against established players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- Financial Burden: The acquisition itself represents a significant financial investment. OVH will need to manage its financial resources effectively to ensure the successful integration of vCloud Air and to fund future growth initiatives.

- Regulatory Compliance: Navigating the complexities of data privacy regulations and compliance requirements across different jurisdictions will be a critical challenge, especially given the global nature of the cloud computing market.

Conclusion

The OVH acquisition of VMware’s vCloud Air is a game-changer, promising a more competitive and dynamic cloud computing market. While challenges remain in integrating vCloud Air and managing customer expectations, OVH’s strategic move positions them strongly for future growth. The long-term impact on both companies and the industry as a whole remains to be seen, but one thing is clear: this acquisition marks a significant shift in the cloud landscape, creating both opportunities and uncertainties for players across the board.

Keep an eye on this space – it’s going to be an interesting ride!

User Queries

What are the potential downsides for existing vCloud Air customers?

Potential downsides include temporary service disruptions during integration, changes in pricing or support plans, and potential incompatibility issues with existing workflows. However, OVH has committed to ensuring a smooth transition for its new customers.

How much did OVH pay for vCloud Air?

The exact financial details of the acquisition, including the purchase price, were not publicly disclosed. This information is often considered confidential between the buyer and seller.

What is OVH’s long-term strategy following this acquisition?

OVH likely aims to leverage vCloud Air’s technology and customer base to expand its market share, particularly in regions where vCloud Air had a strong presence. They may also integrate vCloud Air’s capabilities into their existing offerings to provide a more comprehensive cloud solution.

Will OVH continue to support vCloud Air’s existing technology stack?

While the long-term plan might involve migrating customers to OVH’s infrastructure, OVH is likely to support the existing vCloud Air technology for a transition period to minimize disruption for existing clients. Specific timelines and migration strategies would be communicated directly to customers.