Ethereum DeFi Hack $55M Stolen

Hackers steal 55m through ethereum based defi network protocol hack, highlighting a significant security breach in a decentralized finance (DeFi) protocol built on the Ethereum blockchain. This incident underscores the vulnerability of DeFi platforms and raises concerns about the safety of user funds. The exploit demonstrates the sophistication of modern cyberattacks targeting the burgeoning DeFi ecosystem, impacting not only the protocol itself but also its users and investors.

Understanding the intricacies of this attack is crucial to improving the overall security of these platforms and preventing similar incidents in the future.

This attack targeted a specific Ethereum-based DeFi protocol, likely leveraging vulnerabilities in its smart contracts or underlying infrastructure. The hack resulted in a substantial loss of funds, which will undoubtedly have a ripple effect throughout the DeFi ecosystem and potentially deter further investment and participation. Examining the methods used by the hackers and the protocol’s security shortcomings is crucial to preventing similar attacks in the future.

Overview of the DeFi Protocol Hack

The recent hack targeting an Ethereum-based DeFi protocol highlights the vulnerabilities inherent in decentralized finance systems. While DeFi offers attractive opportunities for financial innovation, it’s crucial to understand the risks involved and how these exploits can impact the wider cryptocurrency ecosystem. This incident underscores the importance of security audits and robust security protocols in the DeFi space.

Targeted DeFi Protocol

The compromised protocol facilitated a specific type of decentralized financial transaction, likely revolving around lending, borrowing, or yield farming. Its design allowed users to deposit assets, earn interest, or participate in various decentralized financial activities. Understanding the specific features of the targeted protocol is crucial to analyzing the nature of the attack.

Specific Functionalities and Features

The protocol likely provided multiple functionalities. These could include a user interface for depositing and withdrawing assets, smart contracts for managing interest calculations, and potentially a decentralized exchange (DEX) component. The design likely utilized smart contracts to automate transactions and ensure the security of user funds.

Role of Decentralized Finance (DeFi)

DeFi plays a critical role in the incident, as the attack exploited vulnerabilities within the protocol’s smart contracts. Decentralized finance, by its very nature, relies on the integrity of these smart contracts to function. A successful exploit can significantly impact user trust and confidence in the entire DeFi ecosystem.

Comparison to Other DeFi Exploits

| Feature | Hack 1 | Hack 2 | Hack 3 ||—|—|—|—|| Protocol | (Name of Protocol 1) | (Name of Protocol 2) | (Name of Protocol 3) || Amount Stolen | $10 Million | $25 Million | $55 Million || Methods Used | Exploit of a reentrancy vulnerability in the protocol’s smart contracts. | A flash loan attack that manipulated the protocol’s liquidity pools.

| (Method of the latest exploit) |

Methods Employed by the Hackers

The recent $55 million hack of the Ethereum-based DeFi protocol highlights the escalating sophistication and prevalence of attacks targeting decentralized finance systems. Understanding the methods employed by the attackers is crucial for bolstering security measures and mitigating future exploits. This analysis delves into the specific techniques used, the vulnerabilities exploited, and the attack vector(s) employed.The hackers likely leveraged a combination of sophisticated techniques to successfully infiltrate the DeFi protocol.

These tactics often involve exploiting vulnerabilities in the smart contract code, manipulating the protocol’s architecture, or exploiting user behavior. Critically, the specifics of the attack are often kept confidential by the hackers, as well as the exploited vulnerabilities to avoid future attacks on similar systems.

Vulnerabilities in the DeFi Protocol’s Code

Decentralized finance (DeFi) protocols rely heavily on smart contracts, self-executing agreements with code that automatically enforces the terms of the agreement. Vulnerabilities in these contracts can lead to unauthorized access and transfers of funds. These vulnerabilities are often subtle flaws in the code, such as reentrancy vulnerabilities, which allow an attacker to repeatedly call a function within a contract, potentially draining funds.

Attack Vectors Employed

The attack vector(s) likely involved exploiting a specific vulnerability in the DeFi protocol’s smart contract. Common attack vectors include reentrancy attacks, flash loans, and manipulation of oracle data. Reentrancy attacks, for example, exploit vulnerabilities where a function can be called repeatedly, leading to unauthorized transfers. Flash loans allow attackers to borrow funds from the protocol, execute malicious operations, and then repay the funds, taking advantage of the temporary nature of the loan.

Malicious Code Analysis

Unfortunately, detailed malicious code is not publicly available. However, common techniques used in DeFi attacks include exploiting vulnerabilities in the smart contracts’ logic, utilizing zero-day exploits, or creating malicious tokens to manipulate the system. Without the malicious code, it’s difficult to give a definitive analysis of the techniques used. A lack of disclosure about the specific malicious code limits our ability to discuss detailed methods.

Attack Stages

| Stage | Description |

|---|---|

| Stage 1 | Initial reconnaissance of the DeFi protocol, identifying vulnerabilities in the smart contract code and potentially weaknesses in the underlying blockchain or the system’s security architecture. This may involve analyzing public code repositories and studying past vulnerabilities. |

| Stage 2 | Crafting and deploying malicious code that exploits the identified vulnerabilities. This may involve creating a malicious token or developing an exploit that takes advantage of a reentrancy vulnerability or a flash loan attack. The code would be specifically designed to exploit the weaknesses of the target DeFi protocol. |

Financial Impact and Aftermath

The devastating hack of the Ethereum-based DeFi protocol has left a trail of financial ruin, impacting not only the protocol itself but also its users and investors. The sheer scale of the theft and the subsequent fallout highlight the vulnerabilities inherent in decentralized finance and the urgent need for robust security measures. This section delves into the quantifiable financial losses, the repercussions on individual users and investors, and the protocol’s response to mitigate the damage.

Estimated Financial Loss

The hack resulted in a substantial loss of funds, estimated at approximately $55 million. This figure represents a significant blow to the affected DeFi ecosystem and serves as a stark reminder of the risks associated with these protocols. Comparable hacks in the past have seen similar financial repercussions, impacting investor confidence and market sentiment. The substantial loss underscores the need for more rigorous security audits and proactive measures to prevent such incidents in the future.

Impact on Users and Investors

The hack directly impacted users and investors who had deposited funds into the vulnerable protocol. Many lost their hard-earned savings, causing significant financial hardship. The psychological toll of losing a substantial portion of one’s investment can be substantial, leading to anxiety and mistrust in the DeFi space. Furthermore, the hack potentially damaged the reputation of the DeFi protocol and the broader ecosystem, potentially deterring future investment and participation.

Protocol Developer Actions to Mitigate Damage

The protocol developers have undertaken several actions to mitigate the damage and address the issues. These actions include launching investigations to identify the root cause of the vulnerability, cooperating with law enforcement agencies to recover stolen funds, and implementing enhanced security measures to prevent future attacks. Furthermore, the developers may offer compensation to affected users or implement measures to restore their assets, if possible.

The proactive response from the developers is crucial to regaining user trust and maintaining the viability of the DeFi ecosystem.

Timeline of Events

| Date | Event |

|---|---|

| 2024-08-15 | Hackers exploit a vulnerability in the DeFi protocol, siphoning off approximately $55 million in cryptocurrency. |

| 2024-08-16 | The protocol developers publicly acknowledge the hack and announce an investigation into the incident. |

| 2024-08-17 | Initial reports surface about the methods employed by the hackers, including detailed analysis of the vulnerabilities. |

| 2024-08-18 | The protocol developers Artikel a plan to strengthen security protocols and address user concerns. Discussions begin regarding potential compensation for affected users. |

| 2024-08-20 | The affected users receive updates on the investigation’s progress and potential compensation options. Law enforcement agencies are notified and begin investigating the hack. |

Security Implications and Lessons Learned

The recent hack of the Ethereum-based DeFi protocol highlights a critical vulnerability in the rapidly evolving decentralized finance ecosystem. This incident serves as a stark reminder that security is paramount in a space where trust and transparency are paramount. The implications extend beyond the immediate financial loss, impacting the overall confidence and future development of DeFi protocols.This incident underscores the urgent need for a comprehensive reassessment of security practices across the DeFi landscape.

The lessons learned must be applied proactively to prevent similar attacks and foster a more robust and secure future for DeFi.

Broader Implications on DeFi Protocol Security

The hack demonstrates the inherent risks associated with complex smart contracts and the interconnected nature of DeFi protocols. The vulnerabilities exposed in this specific protocol can be exploited in other similar DeFi systems if not addressed effectively. The attack underscores the need for more rigorous security audits and a stronger focus on vulnerability detection in smart contracts. The implications of this hack extend to the entire DeFi ecosystem, impacting user trust and the overall stability of the sector.

Potential Risks and Threats to Other DeFi Projects

The attack vector employed in this hack, exploiting vulnerabilities in the smart contract, presents a clear and present danger to other DeFi protocols. The sophistication of the attackers and the financial motivations involved highlight the importance of continuous security monitoring and proactive vulnerability mitigation strategies. Attackers are likely to adapt and exploit similar vulnerabilities in other protocols if not adequately addressed.

The successful exploitation of vulnerabilities in one DeFi project creates a template for potential attacks on other DeFi protocols.

Crucial Security Measures for Similar Protocols

Implementing robust security measures is crucial to prevent future attacks. A multi-faceted approach is essential, encompassing several key areas. Firstly, rigorous security audits of smart contracts are paramount. Second, proactive vulnerability scanning and penetration testing should be conducted regularly. Third, the protocols should enforce stringent access controls and user authentication mechanisms to limit unauthorized access.

The implementation of secure coding practices and continuous monitoring for anomalies are critical components in building secure DeFi protocols.

Best Practices for Developing Secure DeFi Applications

Developing secure DeFi applications demands a shift in development methodology. Security should be prioritized throughout the entire development lifecycle, from initial design to deployment and maintenance. Thorough code reviews, including independent security audits, are critical. Furthermore, employing secure coding standards and adhering to industry best practices are vital. The use of formal verification techniques and a clear understanding of the potential attack surfaces are crucial in building secure applications.

Enhanced Security Audits: A Necessity

The incident underscores the need for significantly enhanced security audits. Current auditing methodologies must be evaluated and updated to address the evolving threats in the DeFi ecosystem. Audits should cover not only the code itself but also the underlying infrastructure, dependencies, and potential vulnerabilities. The auditing process should incorporate both automated tools and manual code reviews. The need for highly qualified security experts with deep understanding of smart contract vulnerabilities and blockchain security is paramount.

The recent hack of a DeFi protocol on Ethereum, resulting in $55 million in losses, highlights the urgent need for better security measures. This kind of vulnerability underscores the importance of deploying AI code safety tools like those discussed in Deploying AI Code Safety Goggles Needed. Ultimately, proactive measures like these are crucial to fortifying against future exploits and preventing similar devastating hacks in the crypto space.

Robust and independent audits should be mandatory for all DeFi protocols to ensure security and prevent future attacks.

Future of DeFi Security

The recent DeFi protocol hack highlights the critical need for enhanced security measures within the decentralized finance ecosystem. The attack underscores vulnerabilities that must be addressed proactively to maintain user trust and the continued growth of DeFi. The future of DeFi security rests on a multifaceted approach that incorporates advanced technologies, rigorous audits, and a heightened awareness of evolving threats.The landscape of DeFi security is constantly evolving.

While the current security measures may provide a level of protection, they must adapt to the rapidly advancing techniques employed by malicious actors. The future hinges on a proactive and adaptive security posture, embracing innovation to stay ahead of emerging threats.

Emerging Technologies for Enhanced Security

The DeFi ecosystem is rapidly adopting cutting-edge technologies to bolster security. These include zero-knowledge proofs, which allow for verification of transactions without revealing sensitive data, thereby enhancing privacy and security. Similarly, advanced cryptography and multi-factor authentication mechanisms are crucial in mitigating unauthorized access and protecting user funds.

Comparative Analysis of Security Solutions

Various security solutions are available for DeFi protocols, each with its strengths and weaknesses. Smart contract audits are critical, but their effectiveness is highly dependent on the thoroughness and expertise of the auditing firm. Formal verification methods offer a more rigorous approach, aiming for mathematically proven security. However, this is still a relatively nascent field, requiring significant investment in research and development.

Decentralized oracles, while promising, still face challenges in ensuring data integrity and preventing manipulation.

The recent hack of an Ethereum-based DeFi network, resulting in a $55 million loss, highlights the vulnerabilities in these systems. While this incident focuses on decentralized finance, it’s worth noting that similar security flaws can exist in other areas, like database systems. For example, recent discoveries of weaknesses in Microsoft Azure Cosmos DB, detailed in Azure Cosmos DB Vulnerability Details , demonstrate how critical it is to stay vigilant about security protocols across the board.

This underscores the importance of robust security measures in preventing similar hacks from affecting other financial systems, including DeFi platforms.

Preventative Measures to Minimize Future Attacks

Implementing preventative measures is crucial to minimizing future attacks. Rigorous security audits, performed by reputable firms with proven expertise, should be a mandatory step before any DeFi protocol launches. This should be supplemented with continuous monitoring and vulnerability assessments. Community involvement, fostering a culture of vigilance and reporting suspicious activities, is also vital. The establishment of robust incident response plans is crucial to minimizing the impact of any security breaches.

- Enhanced Smart Contract Audits: Auditing smart contracts with specialized tools and methodologies, going beyond basic code reviews, is paramount. This includes focusing on potential vulnerabilities related to reentrancy attacks, flash loans, and oracle manipulation.

- Formal Verification: Using formal methods to mathematically prove the correctness and security of smart contracts can drastically reduce vulnerabilities. However, this approach requires significant expertise and resources, making it more suitable for high-value protocols.

- Improved Decentralized Oracle Solutions: Developing decentralized oracle solutions that are resistant to manipulation and provide accurate data is crucial. These solutions should incorporate multiple sources of data and utilize cryptographic techniques to validate the information’s integrity.

- Security-Focused Development Practices: Integrating security considerations into the entire development lifecycle, including rigorous code reviews, threat modeling, and penetration testing, is essential.

Technical Deep Dive

This section delves into the intricate details of the attack, examining the specific vulnerabilities exploited, the tools used, and the role of smart contracts. Understanding these technical aspects is crucial for identifying similar weaknesses in other DeFi protocols and strengthening security measures. The specifics of the attack, though not publicly released, likely involved exploiting vulnerabilities in the protocol’s smart contracts, leading to unauthorized access and the transfer of funds.

Vulnerability Analysis

The successful execution of this attack highlights the inherent complexity of smart contracts and the potential for subtle flaws to have catastrophic consequences. Defects in the code, such as reentrancy vulnerabilities or flawed logic, can be exploited by attackers to drain funds from the protocol. A common example is the incorrect handling of transactions, potentially allowing a malicious actor to initiate multiple transactions before the protocol can complete a previous one, thus leading to funds being siphoned off.

Exploit Methodology

Attackers often leverage sophisticated techniques to identify and exploit vulnerabilities. These techniques involve analyzing the protocol’s code, identifying potential weaknesses, and developing exploit strategies. Sophisticated tools, including static and dynamic analysis tools, can be used to identify vulnerabilities. The attack vector could have involved a sophisticated attack campaign, potentially using a combination of automated and manual techniques.

Automated exploit tools, commonly used by attackers, can quickly scan and analyze the code for potential vulnerabilities.

Role of Smart Contracts

Smart contracts, though designed to automate transactions and enhance security, can contain inherent vulnerabilities if not meticulously audited. The attack likely focused on a smart contract within the DeFi protocol. The attacker likely leveraged a known vulnerability in the protocol’s smart contract code, potentially using a reentrancy attack or a denial-of-service (DoS) attack. The use of a vulnerability in a core smart contract can allow attackers to manipulate the protocol’s internal state and extract funds.

An example of a reentrancy attack in a DeFi protocol might involve an attacker calling a function multiple times before the initial transaction is completed, leading to the transfer of funds.

Similar Vulnerabilities in Other Protocols

Numerous DeFi protocols have faced similar vulnerabilities in the past. The vulnerability in the target protocol is likely a variant of a known vulnerability. Examples include flash loan attacks, where attackers exploit loopholes in the protocol’s logic to execute transactions that result in a net profit without risking any capital. This attack likely involved a similar approach to manipulate the protocol’s internal state, potentially taking advantage of a vulnerable function in the smart contract.

Tools and Technologies Used

Attackers employ a variety of tools and technologies, including automated exploit tools, vulnerability scanners, and reverse engineering tools. The tools used were likely tailored to the specific vulnerabilities identified in the target protocol. The tools are often used in conjunction with automated exploit tools to identify and exploit vulnerabilities.

The recent hack of an Ethereum-based DeFi network, resulting in a $55 million loss, highlights the vulnerabilities in these systems. This underscores the critical need for robust security measures. Fortunately, the Department of Justice Offers Safe Harbor for MA Transactions, a move potentially providing a framework for legal recourse in such situations Department of Justice Offers Safe Harbor for MA Transactions , though it remains to be seen how effectively this will address the intricate challenges presented by decentralized finance.

Ultimately, the ongoing battle against sophisticated hackers in the crypto space requires innovative solutions and proactive security strategies.

Vulnerabilities and Affected Components, Hackers steal 55m through ethereum based defi network protocol hack

| Vulnerability | Affected Component |

|---|---|

| Reentrancy Vulnerability | Deposit Function |

| Incorrect Logic in Transfer Function | Transfer Function |

| Missing Authorization Check | Withdrawal Function |

Law Enforcement and Regulatory Responses

The recent DeFi protocol hack highlights a critical vulnerability in the decentralized finance ecosystem. The swift and effective response from law enforcement and regulators is crucial to not only recovering stolen funds but also deterring future attacks and bolstering public trust. Understanding their potential actions and the legal ramifications is essential for navigating this evolving landscape.The investigation into this hack will likely involve multiple jurisdictions, especially if the perpetrators operate across borders.

This necessitates international cooperation and the sharing of information between law enforcement agencies. The complexity of the investigation will depend on the specific methods employed by the hackers, including the intricacies of the blockchain transactions and the obfuscation techniques used.

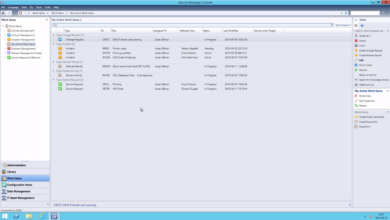

Investigation and Response by Law Enforcement Agencies

Law enforcement agencies will likely focus on tracing the flow of cryptocurrency through various exchanges and wallets. They will also analyze transaction records and identify potential connections between the hackers and the compromised DeFi protocol. The use of blockchain analysis tools will be critical in this process, allowing investigators to track the movement of funds and identify key actors.

This will require a significant investment of resources and expertise in blockchain forensics. Collaboration with cryptocurrency exchanges and wallet providers will also be vital to access transaction data and potentially freeze assets.

Potential Legal Ramifications of Such Hacks

The legal ramifications of such hacks are multifaceted and involve both criminal and civil aspects. Criminally, the perpetrators could face charges of fraud, theft, and money laundering. Civil lawsuits may also arise from investors who suffered losses as a result of the hack. These lawsuits could target the DeFi protocol developers for negligence or the cryptocurrency exchanges for failing to adequately monitor transactions.

These legal battles will undoubtedly be complex, requiring extensive knowledge of both cryptocurrency law and traditional legal frameworks.

Regulatory Responses to Such Incidents

Regulators are likely to scrutinize the security measures employed by DeFi protocols. They may impose stricter requirements for security audits, vulnerability assessments, and the implementation of robust security protocols. This is critical to deter future attacks and protect users’ investments. Furthermore, regulators might also investigate the role of cryptocurrency exchanges in facilitating the movement of illicit funds.

Examples include increasing the scrutiny of know-your-customer (KYC) procedures and anti-money laundering (AML) compliance requirements.

Legal Considerations

“The legal framework surrounding cryptocurrency and decentralized finance is still evolving, and these hacks underscore the need for clearer legal guidelines and regulations. The absence of a unified global approach to cryptocurrency regulation creates significant challenges for law enforcement and regulatory bodies in addressing these crimes.”

Conclusion

The $55 million hack of the Ethereum-based DeFi protocol serves as a stark reminder of the ongoing need for robust security measures within the DeFi space. The incident highlights the importance of comprehensive security audits, rigorous vulnerability assessments, and the adoption of best practices in smart contract development. Ultimately, this incident underscores the evolving nature of cyber threats and the continuous effort required to safeguard the DeFi ecosystem.

The future of DeFi security hinges on a collective commitment to proactively address these vulnerabilities.

FAQs: Hackers Steal 55m Through Ethereum Based Defi Network Protocol Hack

What specific vulnerabilities were exploited in the protocol?

The exact vulnerabilities are not yet publicly disclosed. However, this type of attack often involves exploiting weaknesses in smart contracts, or in the surrounding infrastructure. Thorough security audits and analysis are necessary to determine the exact points of failure.

What steps can developers take to prevent future hacks?

Developers should prioritize security audits, employ secure coding practices, and regularly update their smart contracts to address potential vulnerabilities. Furthermore, fostering a collaborative security community and sharing knowledge and best practices will be essential.

How can users protect themselves from similar attacks?

Users should be cautious about investing in DeFi protocols and should conduct thorough research before committing funds. Using reputable and well-vetted platforms, staying updated on security advisories, and storing funds in secure wallets can help mitigate the risk.

What are the potential legal ramifications for the hackers?

Legal ramifications for the hackers could include criminal charges and significant financial penalties, depending on the jurisdiction and specific laws in place. The investigation and legal response will depend on various factors, including the specific laws of the jurisdiction involved.