5 Advantages of Fraud Scoring

5 Advantages of Fraud Scoring: Ever wondered how businesses protect themselves from the sneaky world of fraud? It’s not just about gut feelings anymore. Sophisticated fraud scoring systems are revolutionizing how companies assess risk, detect suspicious activity, and ultimately, save money. This isn’t just about catching bad guys; it’s about streamlining operations and improving the experience for honest customers.

Let’s dive into the five key benefits that make fraud scoring a must-have in today’s digital landscape.

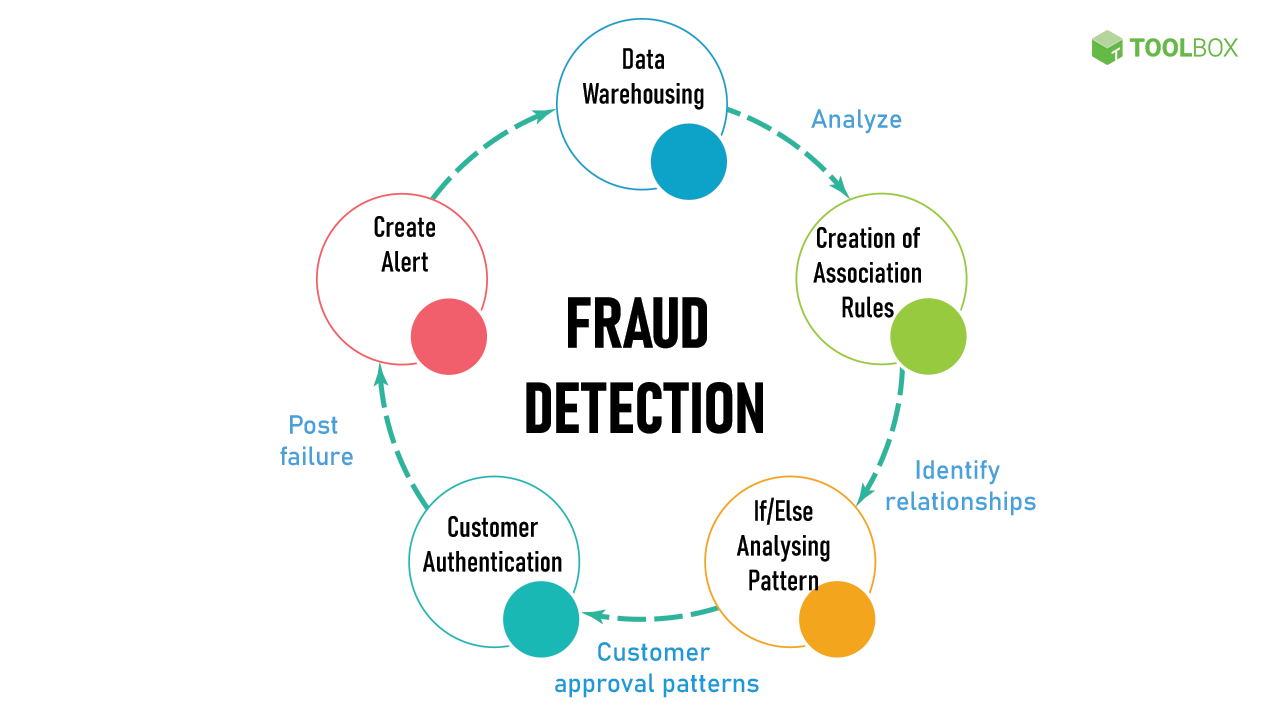

Fraud scoring leverages advanced analytics to analyze vast amounts of data – from transaction details to customer behavior – to assign a risk score to each individual or transaction. This allows businesses to prioritize investigations, allocate resources effectively, and ultimately, create a safer and more efficient environment for everyone. It’s a game-changer, moving away from reactive measures to a proactive, data-driven approach.

Improved Risk Assessment

Fraud scoring revolutionizes risk assessment by moving beyond rudimentary methods, offering a more nuanced and accurate understanding of potential threats. Traditional methods often rely on gut feelings or simple rule-based systems, leaving significant gaps in identifying truly high-risk individuals or transactions. Fraud scoring leverages sophisticated algorithms and vast datasets to provide a quantifiable risk score, enabling businesses to prioritize their resources and mitigate losses more effectively.Fraud scoring significantly enhances the accuracy of risk assessments by employing advanced statistical techniques and machine learning.

Unlike traditional methods that might flag only obvious red flags, fraud scoring models analyze numerous data points simultaneously, identifying subtle patterns and correlations that indicate fraudulent behavior. This holistic approach significantly reduces false positives and false negatives, leading to more efficient and effective risk management.

Industries Benefiting from Fraud Scoring

The benefits of fraud scoring extend across numerous industries. Financial institutions, for example, utilize fraud scoring to detect credit card fraud, money laundering, and loan application fraud. E-commerce companies employ it to identify and prevent fraudulent online purchases and account takeovers. Insurance companies use it to combat insurance fraud, and healthcare providers leverage it to detect medical billing fraud.

In each case, fraud scoring provides a significant competitive advantage by reducing losses and improving operational efficiency.

So, you’re thinking about the 5 advantages of fraud scoring – reduced losses, improved customer experience, better risk management, regulatory compliance, and enhanced operational efficiency, right? Building robust fraud detection systems often involves leveraging powerful, adaptable technology, and that’s where the future of app development comes in. Check out this article on domino app dev the low code and pro code future to see how it can help.

Ultimately, efficient app development directly impacts the effectiveness of your fraud scoring, leading to even better results across all five advantages.

Data Points Used in Fraud Scoring Models

Fraud scoring models draw on a wide range of data points to build a comprehensive risk profile. These include demographic information (age, location), transactional data (amount, frequency, location), device information (IP address, browser type), behavioral data (login attempts, purchase history), and even social media activity. The specific data points used vary depending on the industry and the specific type of fraud being targeted.

For instance, a model designed to detect credit card fraud might heavily weigh factors like transaction value and location compared to a model focused on insurance fraud which may prioritize claims history and policy details.

Hypothetical Scenario: Preventing Significant Financial Loss

Imagine a large online retailer processing thousands of transactions daily. Without fraud scoring, they might rely on simple rules like flagging transactions exceeding a certain amount or originating from unusual locations. However, a sophisticated fraudster could easily bypass these rules by using multiple small transactions or employing techniques to mask their location. With fraud scoring, the system analyzes a broader range of data points – including the customer’s purchase history, shipping address, device information, and even their social media activity – to generate a risk score.

If the score exceeds a predefined threshold, the transaction is flagged for manual review or automatically blocked, preventing a potentially significant financial loss from a large-scale fraud operation that might have otherwise gone undetected.

Enhanced Fraud Detection

Fraud scoring significantly enhances fraud detection capabilities by providing a proactive, data-driven approach. Unlike reactive methods that only address fraud after it occurs, fraud scoring allows for the identification of potentially fraudulent transactions or accountsbefore* significant losses are incurred. This predictive power is crucial in today’s rapidly evolving digital landscape, where sophisticated fraud schemes are becoming increasingly common.Fraud scoring leverages historical data and advanced algorithms to assign a risk score to each transaction or customer.

This score represents the likelihood of fraudulent activity, enabling businesses to prioritize investigations and allocate resources effectively. Higher scores trigger immediate alerts, allowing for timely intervention and prevention of fraudulent events.

Real-World Examples of Fraud Scoring’s Impact on Early Fraud Detection

Consider a major online retailer using a fraud scoring system. The system flagged a series of unusually large orders placed from a new account with a previously unknown shipping address. These orders, exhibiting characteristics consistent with known fraud patterns (e.g., unusual purchase volume, inconsistent billing and shipping information), received high fraud scores. The retailer’s fraud team was immediately alerted, allowing them to investigate and prevent the shipment of goods, thereby avoiding significant financial losses.

Similarly, a financial institution using a similar system identified a series of suspicious transactions from a long-standing customer’s account, triggering an alert and enabling them to contact the customer to confirm the transactions and prevent further unauthorized activity.

Comparison of Fraud Scoring with Other Fraud Detection Methods

Traditional fraud detection methods often rely on rule-based systems and manual reviews, which are reactive and prone to missing sophisticated fraud schemes. These methods are often slow and inefficient, requiring significant human intervention. Fraud scoring, in contrast, offers a more proactive and efficient approach, automatically analyzing vast datasets to identify patterns and anomalies indicative of fraud. While rule-based systems may identify clear-cut cases of fraud, fraud scoring can detect subtle anomalies that might be missed by human analysts, leading to higher detection rates and reduced false negatives.

Key Performance Indicators (KPIs) for Fraud Scoring Systems

Several key performance indicators (KPIs) are used to evaluate the effectiveness of a fraud scoring system. These include:* Fraud Detection Rate: The percentage of actual fraudulent transactions correctly identified by the system.

False Positive Rate

The percentage of legitimate transactions incorrectly flagged as fraudulent.

False Negative Rate

The percentage of fraudulent transactions incorrectly classified as legitimate.

Precision

The proportion of correctly identified fraudulent transactions out of all transactions flagged as fraudulent.

Recall

The proportion of correctly identified fraudulent transactions out of all actual fraudulent transactions.

Comparison of False Positive and False Negative Rates

The following table illustrates a hypothetical comparison of false positive and false negative rates between a traditional rule-based system and a fraud scoring system:

| Method | False Positive Rate (%) | False Negative Rate (%) |

|---|---|---|

| Traditional Rule-Based System | 5 | 20 |

| Fraud Scoring System | 2 | 5 |

Note: These are hypothetical figures and actual rates vary depending on the specific system, data quality, and fraud patterns.

Reduced Financial Losses

Implementing a robust fraud scoring system offers significant financial advantages, far outweighing the initial investment. By proactively identifying and mitigating fraudulent activities, businesses can drastically reduce their financial losses and improve their bottom line. This translates to not only immediate cost savings but also long-term financial stability and increased profitability.The financial benefits of fraud scoring extend beyond simply preventing direct losses from fraudulent transactions.

It allows for a more efficient allocation of resources, leading to a better return on investment (ROI) across the entire organization. The system’s predictive capabilities enable businesses to proactively address potential threats, minimizing the impact of fraud before it escalates into significant financial damage. This proactive approach is key to achieving substantial long-term cost reductions.

Return on Investment (ROI) of Fraud Scoring

Implementing a fraud scoring system involves upfront costs for software, hardware, integration, and training. However, the long-term ROI is typically substantial. A well-implemented system quickly pays for itself through reduced losses from fraud, decreased operational costs associated with investigations and remediation, and improved operational efficiency. Quantifying ROI requires careful consideration of the costs of implementation against the projected savings from fraud prevention.

For example, a company might invest $50,000 in a fraud scoring system. If that system prevents $100,000 in fraudulent activity within the first year, the ROI is a clear 100%. This ROI can increase year over year as the system learns and adapts, becoming more effective at identifying and preventing fraud.

Operational Cost Reduction through Fraud Investigation and Remediation

Fraud investigations and remediation are resource-intensive processes. They involve time spent by investigators, legal fees, and potential reputational damage. A fraud scoring system significantly reduces the need for extensive investigations by prioritizing cases with a high probability of fraud. This prioritization allows investigators to focus their efforts on the most critical cases, leading to faster resolution times and reduced operational costs.

For instance, a company might spend an average of $5,000 per fraud investigation. If the fraud scoring system reduces the number of investigations by 50%, it results in a direct saving of $2,500 per investigation. This saving is multiplied by the number of investigations avoided annually.

Case Study: Acme Corporation’s Fraud Reduction

Acme Corporation, a large e-commerce retailer, implemented a fraud scoring system two years ago. Before implementation, they experienced an average annual loss of $2 million due to fraudulent transactions. Their investigation and remediation costs averaged $500,000 annually. After implementing the fraud scoring system, their annual losses from fraud decreased by 75% to $500,000. Furthermore, their investigation and remediation costs dropped by 60% to $200,000.

This resulted in annual savings of $1.3 million ($750,000 in reduced fraud losses + $500,000 in reduced investigation costs). The initial investment in the fraud scoring system was recouped within the first year, demonstrating a significant and rapid ROI.

Streamlined Operations

Fraud scoring significantly boosts operational efficiency in fraud prevention. By automating key processes, it frees up valuable time and resources, allowing your team to focus on more complex investigations and strategic initiatives. The automated nature of scoring leads to quicker response times and a more proactive approach to fraud management.Automating Fraud Detection and PreventionFraud scoring automates a large portion of the initial screening process.

Instead of manually reviewing every transaction or application, a scoring system quickly assesses the risk level of each case. This automated triage allows investigators to prioritize high-risk cases, ensuring that limited resources are used effectively. For example, a system might automatically flag transactions exceeding a certain threshold or originating from high-risk IP addresses, leaving investigators to focus on the suspicious flagged items instead of manually checking every transaction.

This automated pre-screening dramatically reduces the workload and allows for quicker identification of potentially fraudulent activities.

Improved Efficiency of Internal Processes

The streamlined workflow resulting from fraud scoring improves efficiency across the entire fraud management department. Faster processing times translate to quicker resolutions for legitimate customers, enhancing their overall experience. The reduction in manual review also minimizes human error, leading to more accurate and consistent decision-making. Imagine a credit card company processing thousands of transactions daily. Manual review would be incredibly time-consuming and prone to errors.

Fraud scoring automates this initial screening, allowing for near-instantaneous risk assessment and a much faster processing time.

Resource Allocation Optimization

Fraud scoring allows for better allocation of resources within a fraud prevention department. By prioritizing high-risk cases, investigators can concentrate their efforts where they are most needed. This targeted approach maximizes the impact of each investigation, leading to a higher detection rate and a greater return on investment. Previously, resources might have been spread thinly across numerous low-risk cases.

Now, the focus is shifted to areas with the highest potential for financial loss, resulting in more effective fraud prevention. This optimization can lead to significant cost savings and improved overall efficiency.

Streamlined Workflow Illustrated

A simplified flowchart illustrating the streamlined workflow enabled by fraud scoring:[Imagine a flowchart here. The flowchart would start with “Transaction/Application Received”. This would lead to a “Fraud Scoring Engine” box, which then branches into two paths: “High-Risk Score” leading to “Manual Investigation” and “Low-Risk Score” leading to “Automated Approval/Processing”. Both paths ultimately lead to a final “Outcome” box.] The flowchart visually demonstrates how fraud scoring acts as a filter, separating high-risk cases requiring manual review from low-risk cases that can be processed automatically.

This visual representation clarifies the efficiency gains from automated risk assessment.

Improved Customer Experience

Fraud scoring, while crucial for protecting businesses from financial losses, shouldn’t come at the cost of a frustrating experience for legitimate customers. A well-implemented fraud scoring system should seamlessly blend robust security with a smooth and positive customer journey. This means minimizing false positives and ensuring that genuine transactions are processed quickly and efficiently.The primary benefit of a well-tuned fraud scoring system is the reduction of friction for legitimate customers.

False positives, where a legitimate transaction is flagged as potentially fraudulent, lead to delays, declined purchases, and frustrated customers. A sophisticated system, however, learns to differentiate between genuine and fraudulent activity, minimizing these instances. This leads to increased customer satisfaction and loyalty.

Minimizing Inconvenience from False Positives

By using machine learning algorithms and regularly updating the fraud detection models, businesses can improve the accuracy of their fraud scoring. This allows the system to learn from past transactions and adapt to evolving fraud techniques, thereby reducing the number of false positives. For example, a system might initially flag purchases from unfamiliar locations as suspicious. However, as it learns that a particular customer frequently travels for business, it will adjust its scoring accordingly, avoiding future false positives.

This adaptive learning is key to a positive customer experience.

Balancing Fraud Prevention and Positive Customer Experience

Strategies for achieving this balance involve a multi-pronged approach. This includes using a combination of different data points in the scoring process, incorporating feedback loops to refine the system’s accuracy, and implementing flexible authentication methods. For instance, a system might utilize multiple factors like IP address, device information, and transaction history, rather than relying on a single data point.

If a low-risk transaction is flagged, a secondary verification method, like a one-time password, might be used instead of an outright rejection. This ensures security without significantly inconveniencing the customer.

Communicating with Customers about Fraud Scoring

Transparency is key to building trust and managing customer expectations. Communicating proactively about the use of fraud scoring and its purpose can alleviate concerns and improve understanding. This communication should clearly explain why certain security measures are in place, emphasizing the benefits of fraud prevention for both the business and the customer in protecting against identity theft and financial losses.

A simple, concise email explaining the process, or a clear message on the website, can go a long way in building trust.

Communication Plan to Inform Customers, 5 advantages of fraud scoring

A well-structured communication plan should involve several stages. Initially, a brief explanation of fraud prevention measures can be included during account creation or registration. Subsequent communications can focus on specific security updates or improvements to the system, highlighting the enhanced security and smoother transaction processes resulting from these improvements. Regularly updating customers on the system’s effectiveness and any changes implemented helps maintain transparency and reinforces the commitment to protecting both the business and its customers.

The goal is to educate, not alarm. Framing the communication in terms of enhanced security and a more seamless experience for loyal customers fosters a positive perception.

Final Review: 5 Advantages Of Fraud Scoring

In short, implementing a robust fraud scoring system offers a compelling blend of enhanced security, operational efficiency, and improved customer satisfaction. The financial benefits are undeniable, but the real win lies in creating a more secure and trustworthy environment for both businesses and their customers. By embracing data-driven insights, companies can not only minimize losses but also cultivate a more positive and seamless experience for their loyal clientele.

Ready to level up your fraud prevention strategy? It’s time to explore the power of fraud scoring.

Expert Answers

What types of data are used in fraud scoring?

Fraud scoring models use a wide range of data, including transactional data (amount, location, frequency), customer demographics, device information, and historical behavior patterns. The specific data points vary depending on the industry and the specific model used.

How accurate is fraud scoring?

Accuracy varies depending on the model and data quality. While not perfect, fraud scoring significantly improves accuracy compared to traditional methods by providing a probabilistic assessment of risk, allowing for better prioritization of investigations.

What if a legitimate customer is flagged as high-risk?

False positives are a concern, but robust models and careful implementation minimize this. Strategies include implementing tiered responses (e.g., additional verification steps) and clear communication with customers to avoid unnecessary friction.

How much does fraud scoring cost to implement?

The cost varies depending on the complexity of the system, the size of the business, and the chosen vendor. However, the ROI often outweighs the initial investment due to reduced losses and improved efficiency.