Avaddon Ransomware Gang Targets AXA Insurance

Avaddon ransomware gang targets AXA insurance – a headline that sent shockwaves through the cybersecurity world. This massive attack highlighted the vulnerability of even the largest insurance companies to sophisticated ransomware operations. We’ll delve into the details of this incident, exploring Avaddon’s tactics, AXA’s response, and the broader implications for the insurance industry and its customers. Get ready for a deep dive into the world of cybercrime and the fight against it.

The attack on AXA wasn’t just a data breach; it was a strategic assault targeting a critical component of the global financial system. The potential for widespread disruption and financial loss was immense, underscoring the need for robust cybersecurity measures within the insurance sector. We’ll examine the specific vulnerabilities exploited by Avaddon, the type of data potentially compromised, and the long-term consequences of this significant event.

Avaddon Ransomware

Avaddon, a notorious ransomware-as-a-service (RaaS) operation, operated from approximately 2019 to 2020 before mysteriously shutting down. Despite its relatively short lifespan, it left a significant mark on the cybersecurity landscape, demonstrating sophisticated tactics and a considerable impact on victims. Its sudden disappearance, however, remains a subject of speculation and debate within the cybersecurity community.Avaddon’s Modus Operandi and Techniques

Initial Access and Data Exfiltration

Avaddon employed a multi-pronged approach to gaining initial access to victim systems. Common methods included phishing emails containing malicious attachments or links, exploiting vulnerabilities in outdated software, and leveraging compromised credentials obtained through other cybercriminal activities. Once inside a network, Avaddon operators would move laterally, gaining access to sensitive data before initiating encryption. Data exfiltration, the process of stealing data before or during encryption, was a key component of their operations, providing leverage during ransom negotiations and increasing the pressure on victims.

They often targeted high-value data, such as financial records, intellectual property, and customer databases.

Encryption Techniques, Avaddon ransomware gang targets axa insurance

Avaddon utilized strong encryption algorithms, typically AES-256, to encrypt victim files. AES-256 is a widely used and robust encryption standard, making decryption without the decryption key extremely difficult, if not impossible, for those lacking the proper tools. The ransomware would append a unique extension to encrypted files, typically “.avaddon,” making identification of affected files straightforward. The effectiveness of the encryption relied heavily on the strength of the algorithm and the secrecy of the encryption key, both of which Avaddon diligently protected.

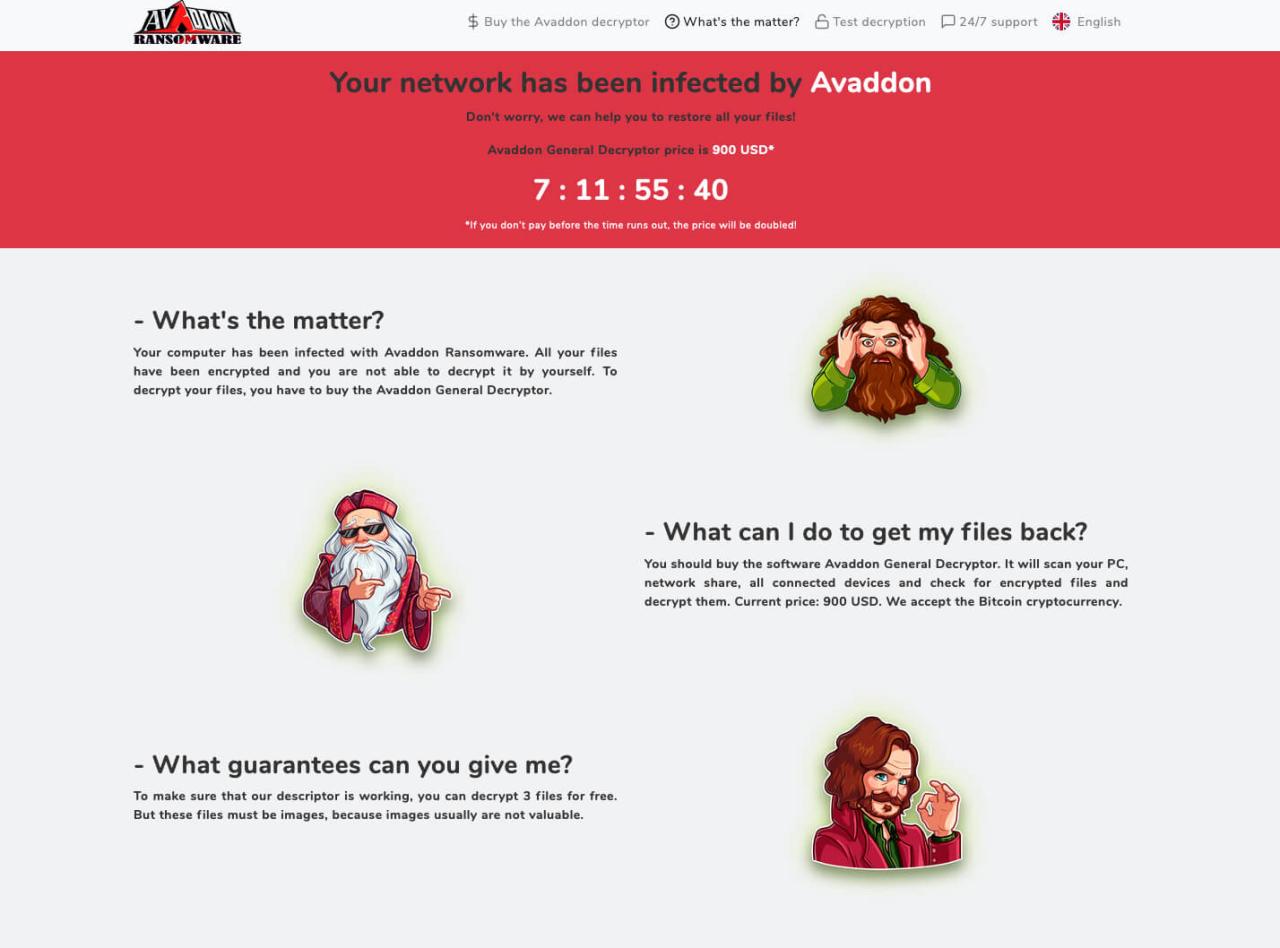

Ransom Negotiation and Payment Methods

Avaddon’s ransom demands varied depending on factors such as the size and sensitivity of the stolen data and the perceived financial capacity of the victim. The ransomware operators typically communicated with victims through a dedicated Tor network site, providing instructions for payment. Payment was usually demanded in cryptocurrency, such as Bitcoin, offering a degree of anonymity to the perpetrators.

The negotiation process, if any occurred, was often conducted under duress, with the threat of data release to the dark web acting as a strong motivator for victims to comply with the ransom demands. While some victims may have received decryption keys after payment, there’s no guarantee of such a successful outcome. Furthermore, paying the ransom doesn’t guarantee that the stolen data won’t be leaked, and it encourages further attacks by rewarding malicious actors.

Axa Insurance

The Avaddon ransomware attack on Axa, though not publicly confirmed by the insurer to the extent of other attacks, highlights the vulnerability of even the largest financial institutions to sophisticated cyber threats. Understanding Axa’s infrastructure, potential weaknesses, and the potential impact of such an attack is crucial for assessing the broader implications for the insurance industry and its customers.

Axa’s Cybersecurity Infrastructure and Potential Vulnerabilities

Axa, as a global insurance giant, possesses a vast and complex cybersecurity infrastructure. This includes numerous interconnected systems managing customer data, financial transactions, claims processing, and internal operations. Potential vulnerabilities could exist across various points in this infrastructure. For instance, outdated software, insufficient network segmentation, weak access controls, and a lack of robust endpoint protection could all create entry points for malicious actors.

Human error, such as phishing attacks targeting employees, also remains a significant risk. The complexity of Axa’s global operations, with numerous subsidiaries and diverse technological platforms, presents a significant challenge for maintaining consistent and effective security across the entire organization. A successful attack could exploit any weakness in this sprawling network.

Impact of a Successful Ransomware Attack on Axa’s Operations

A successful ransomware attack on Axa could have far-reaching consequences. The immediate impact would likely involve disruption of core business functions, leading to delays in claims processing, policy issuance, and customer service. Financial losses from ransom payments, business interruption, and potential legal liabilities could be substantial. Reputational damage from a data breach, particularly if sensitive customer information is compromised, could severely impact Axa’s brand image and client trust.

Regulatory fines and penalties are also a likely outcome, adding to the financial burden. The scale of the disruption would depend on the extent of the encryption and the effectiveness of Axa’s incident response plan. For example, a major disruption to claims processing could lead to significant delays for customers needing urgent financial assistance.

Data Types Potentially Compromised

The types of data potentially compromised in an Axa ransomware attack are extensive and sensitive. This could include personally identifiable information (PII) of customers, such as names, addresses, social security numbers, and driver’s license information. Financial records, including policy details, claims history, and banking information, would also be at risk. Internal operational data, such as employee information, financial statements, and strategic plans, could also be targeted.

The potential for significant financial and reputational damage is amplified by the sensitive nature of this data. A breach involving such information could lead to identity theft, fraud, and significant legal repercussions for Axa.

Axa’s Cybersecurity Posture: Pre- and Post-Avaddon Attack

While specific details about Axa’s internal cybersecurity measures and their evolution after the Avaddon attack remain undisclosed, we can construct a hypothetical comparison based on industry best practices and common responses to ransomware incidents.

| Security Measure | Pre-Attack Status | Post-Attack Status | Improvements Implemented |

|---|---|---|---|

| Endpoint Detection and Response (EDR) | Potentially inadequate coverage or outdated software | Enhanced EDR with improved threat detection and response capabilities | Deployment of a more comprehensive EDR solution, regular software updates, and enhanced employee training on phishing awareness. |

| Network Segmentation | Limited segmentation, allowing lateral movement of attackers | Improved network segmentation to isolate critical systems | Implementation of micro-segmentation techniques to limit the impact of a breach. |

| Data Backup and Recovery | Regular backups, but potentially vulnerable to ransomware encryption | Air-gapped backups and improved recovery procedures | Implementation of immutable backups stored offline and rigorous testing of recovery procedures. |

| Incident Response Plan | Existing plan, but potentially lacking in effectiveness against sophisticated ransomware | Revised and improved incident response plan | Improved communication protocols, enhanced collaboration with law enforcement, and more frequent security audits. |

The Attack

The Avaddon ransomware attack on AXA, while not publicly confirmed by either party to the full extent, highlights the vulnerability of even the largest insurance companies to sophisticated cyberattacks. The lack of detailed public information makes a precise timeline challenging, but piecing together news reports and cybersecurity analyses allows for a reasonable reconstruction of events. The impact, however, is clear: a significant disruption to operations and a substantial financial burden.The precise date of the initial infection remains undisclosed.

However, reports suggest the attack likely involved a phishing campaign or a vulnerability exploit, gaining initial access to AXA’s systems. The attackers then proceeded to encrypt sensitive data, crippling various aspects of the company’s operations. The ransomware deployment likely involved a wide-scale encryption strategy, targeting crucial databases and servers. The subsequent ransom demand, also undisclosed publicly, presumably reflected the perceived value of the stolen and encrypted data.

AXA’s response involved a swift mobilization of its incident response team, leveraging its internal expertise and potentially engaging external cybersecurity firms for assistance. The recovery efforts involved a complex process of system restoration, data recovery (possibly from backups), and the implementation of enhanced security measures to prevent future incidents.

Timeline of Events

While a precise timeline is unavailable publicly, a plausible sequence of events can be inferred. The attack likely began with an initial compromise, followed by lateral movement within AXA’s network to identify valuable targets. Data encryption would have occurred shortly after, potentially disrupting business operations immediately. The ransom demand would have followed, giving AXA a deadline to pay or face permanent data loss.

The recovery phase would have been lengthy, involving system restoration, data recovery, and forensic analysis. The entire process likely spanned several weeks or even months.

Impact on Business Operations and Financial Performance

The Avaddon attack undoubtedly caused significant disruption to AXA’s operations. Specific services affected remain undisclosed, but the impact likely included delays in claims processing, difficulties in communicating with clients, and potential disruptions to internal systems. The financial impact, though unquantified publicly, would have included costs associated with incident response, system restoration, data recovery, potential legal fees, and reputational damage.

Furthermore, lost productivity and the potential for business interruption insurance claims further contribute to the financial burden.

AXA’s Response Strategies

AXA’s response involved a multi-faceted approach. The immediate response would have focused on containing the attack, preventing further spread, and securing affected systems. This would have included isolating infected systems, shutting down network segments, and implementing emergency access controls. The company likely deployed its internal incident response team, potentially augmented by external cybersecurity specialists. The restoration phase involved rebuilding affected systems from backups, restoring data, and verifying system integrity.

Finally, a post-incident review would have identified vulnerabilities and implemented enhanced security measures to prevent future attacks. This could include improved phishing awareness training, strengthened network segmentation, and the implementation of advanced threat detection technologies.

Incident Response Process Flowchart

A simplified flowchart representing AXA’s likely incident response process would depict the following steps:

1. Detection

Identification of the ransomware attack.

2. Containment

Isolation of infected systems and network segments.

3. Eradication

Removal of the ransomware and malware.

4. Recovery

Restoration of systems and data from backups.

5. Analysis

Forensic analysis to determine the attack vector and extent of damage.

6. Remediation

Implementation of security enhancements to prevent future attacks.

So, the Avaddon ransomware gang hit Axa Insurance – a massive blow to a global player. It makes you think about data security and how robust systems need to be, especially considering the advancements in app development. Building secure and efficient applications is crucial, and that’s why I’ve been researching the future of app development, like what’s discussed in this great article on domino app dev the low code and pro code future , which highlights how we can better protect sensitive information.

The Axa breach underscores just how important this is; we need better, more secure systems to prevent future attacks like this.

7. Post-Incident Review

Assessment of the incident and lessons learned.

Legal and Regulatory Implications

The Avaddon ransomware attack on AXA Insurance carries significant legal and regulatory implications, primarily stemming from data privacy regulations and the company’s obligations to its customers. The fallout extends beyond immediate financial losses and encompasses potential legal battles, reputational damage, and hefty fines. Understanding these implications is crucial for assessing the long-term consequences for AXA and the broader insurance industry.Axa’s legal exposure is multifaceted and hinges on several key areas of data protection legislation.

The most prominent is likely to be the General Data Protection Regulation (GDPR) in Europe, if European citizen data was compromised, and potentially state-specific data breach notification laws in other regions where AXA operates. Failure to comply with these regulations could result in severe penalties.

Data Privacy Regulation Compliance

The GDPR, for instance, mandates specific data protection measures, including data minimization, purpose limitation, and robust security protocols. A breach like this raises serious questions about whether AXA met these requirements. Investigations will likely scrutinize AXA’s data security practices before, during, and after the attack to determine if they were adequate to prevent the breach and mitigate its impact.

Non-compliance could lead to significant fines, potentially reaching millions of euros, depending on the severity of the breach and the number of affected individuals. Similar investigations and potential penalties could arise under other data privacy laws in jurisdictions where AXA operates.

Customer Notification and Compensation

AXA’s legal obligations extend to promptly notifying affected customers about the data breach and the potential risks involved. Delayed or inadequate notification could expose the company to further legal action from customers. Furthermore, AXA might face lawsuits from customers seeking compensation for damages resulting from the breach, such as identity theft or financial losses. The extent of these claims will depend on the nature and scope of the stolen data and the demonstrable harm suffered by individual customers.

This could lead to substantial legal costs and payouts.

Potential Fines and Penalties

The potential fines and penalties AXA faces are substantial and depend on various factors, including the volume of data breached, the severity of the breach, the effectiveness of AXA’s response, and the applicable regulations in the affected jurisdictions. As previously mentioned, GDPR violations can result in fines up to €20 million or 4% of annual global turnover, whichever is higher.

Similar penalties exist under other data protection laws worldwide. Regulatory bodies might also impose further sanctions, including corrective actions and reputational damage.

Comparison to Similar Attacks

The AXA case mirrors several other ransomware attacks against insurance companies. For example, the attack on CNA Financial in 2021, which resulted in a $40 million ransom payment, highlights the financial impact and the vulnerability of the insurance sector to these attacks. Other insurance companies have faced similar legal challenges, including class-action lawsuits from affected customers and regulatory investigations.

The cumulative effect of these attacks is a growing awareness of the need for stronger cybersecurity measures within the insurance industry and increased regulatory scrutiny of data protection practices. These precedents suggest that AXA will likely face a protracted and costly legal battle.

Lessons Learned and Future Mitigation Strategies: Avaddon Ransomware Gang Targets Axa Insurance

The Avaddon ransomware attack on AXA highlighted critical vulnerabilities in even the most robust organizations. Understanding the weaknesses exploited and implementing proactive mitigation strategies are crucial for preventing future incidents. This analysis focuses on the technical and procedural shortcomings that allowed the attack to succeed, and Artikels practical steps insurance companies can take to bolster their cybersecurity defenses.

Security Weaknesses Exploited by Avaddon

Avaddon, like many ransomware groups, likely exploited a combination of technical vulnerabilities and human error. While the precise methods used in the AXA attack remain undisclosed, we can extrapolate from similar attacks and publicly available information. Common vectors include phishing emails containing malicious attachments or links, exploiting unpatched software vulnerabilities (particularly in legacy systems), and leveraging compromised credentials gained through brute-force attacks or social engineering.

The attackers may have used spear-phishing, tailoring their attacks to specific individuals within AXA, increasing the likelihood of success. Furthermore, a lack of robust multi-factor authentication (MFA) could have significantly weakened AXA’s defenses, allowing attackers to easily gain unauthorized access even if initial credentials were compromised. Insufficient network segmentation may have also facilitated lateral movement within AXA’s network once initial access was gained.

Best Practices for Preventing Ransomware Attacks

Preventing ransomware attacks requires a multi-layered approach combining technical safeguards and robust security policies. Regular security awareness training for employees is paramount. This training should focus on identifying and reporting phishing attempts, understanding the risks of clicking on suspicious links or opening unknown attachments, and adhering to strict password hygiene practices. Implementing and regularly updating a robust patching schedule for all software and systems is critical to mitigate vulnerabilities exploited by attackers.

This includes operating systems, applications, and network devices. A strong emphasis on least privilege access control ensures that users only have access to the resources necessary for their roles, limiting the impact of a successful breach. Finally, robust network segmentation prevents attackers from moving laterally within the network, even if they gain initial access to one system.

Importance of Robust Data Backup and Recovery Mechanisms

Even with the best preventative measures, a ransomware attack may still occur. Therefore, a robust data backup and recovery strategy is essential. This strategy should include regular backups to offline storage, ensuring that backups are not accessible to attackers even if the primary systems are compromised. The 3-2-1 backup rule (three copies of data, on two different media, with one copy offsite) is a widely accepted best practice.

Furthermore, regularly testing the backup and recovery process is crucial to ensure its effectiveness in a real-world scenario. A well-defined incident response plan should Artikel the steps to be taken in the event of a ransomware attack, including how to quickly restore systems and data from backups.

Benefits of Advanced Threat Detection and Response Technologies

Implementing advanced threat detection and response technologies can significantly improve an organization’s ability to detect and respond to ransomware attacks. These technologies include security information and event management (SIEM) systems, endpoint detection and response (EDR) solutions, and threat intelligence platforms. SIEM systems aggregate security logs from various sources, enabling analysts to identify suspicious activity and potential threats. EDR solutions provide real-time visibility into endpoint activity, enabling detection of malicious behavior and rapid response.

Threat intelligence platforms provide access to information about emerging threats, enabling proactive mitigation strategies. By leveraging these technologies, organizations can detect and respond to ransomware attacks more quickly, minimizing the impact and reducing recovery time.

Final Summary

The Avaddon ransomware attack on AXA serves as a stark reminder of the ever-evolving threat landscape. While the specifics of the attack and its aftermath remain partially shrouded in confidentiality, the lessons learned are invaluable. Strengthening cybersecurity defenses, implementing robust incident response plans, and fostering a culture of proactive security are no longer optional but essential for survival in the digital age.

The insurance industry, and indeed all businesses, must learn from this incident and invest in robust preventative measures to avoid becoming the next victim.

FAQ

What type of data was potentially compromised in the AXA attack?

While AXA hasn’t publicly disclosed the exact nature of the compromised data, it’s likely to include sensitive customer information like personal details, financial records, and policy information.

Did AXA pay the ransom?

AXA has not publicly confirmed whether or not they paid a ransom. Many organizations choose not to disclose this information for various reasons, including avoiding incentivizing future attacks.

What legal repercussions might AXA face?

AXA could face significant legal ramifications, including fines and lawsuits, depending on the extent of the data breach and its impact on customers. Data privacy regulations like GDPR could play a major role.

How did Avaddon gain initial access to AXA’s systems?

The precise method of initial access remains undisclosed. However, common vectors for ransomware attacks include phishing emails, exploited software vulnerabilities, and compromised credentials.