Copycat Malware Targets 14 Million Android Devices

Copycat malware targets 14 million Google Android devices to rake in millions – that’s the shocking reality facing millions of unsuspecting users. This insidious malware, cleverly disguised to evade detection, has infiltrated devices worldwide, stealing sensitive data and costing victims a significant amount of money. It’s a chilling reminder that even the most tech-savvy among us can fall prey to sophisticated cyberattacks.

Let’s dive into the details of this alarming situation and explore what we can do to protect ourselves.

The malware’s sophisticated design allows it to slip past standard security measures, making it incredibly difficult to detect. Its methods are varied, from exploiting vulnerabilities in apps to employing social engineering tactics to trick users into downloading infected files. The sheer scale of the infection is staggering, highlighting the urgent need for greater awareness and stronger security practices among Android users globally.

The financial losses suffered by victims range from minor inconveniences to devastating financial ruin. The data stolen includes everything from banking information and personal identification details to sensitive photos and private communications. Understanding how this malware operates is the first step in protecting yourself and your data.

Malware Description and Functionality

The recent “copycat” malware outbreak affecting 14 million Android devices highlights the persistent threat of sophisticated mobile malware. This particular strain demonstrates a concerning level of adaptability and evasion techniques, making it a significant challenge for security researchers and users alike. Its primary function is to generate illicit revenue for its creators through various deceptive means.

Infection Mechanisms

The copycat malware primarily spreads through deceptive app downloads. Malicious actors disguise the malware within seemingly legitimate applications, often mimicking popular games or utility apps, available on third-party app stores or through phishing campaigns. Once downloaded, the malware leverages system vulnerabilities or exploits user permissions to gain access to sensitive data and system resources. This often involves social engineering, where users are tricked into granting excessive permissions under false pretenses.

For instance, a seemingly harmless flashlight app might request access to contacts, location, and financial information.

Evasion Techniques

The malware employs several techniques to evade detection by antivirus software. These include code obfuscation, which makes the malware’s code difficult to analyze and understand, polymorphic behavior, where the malware changes its code signature to avoid detection by signature-based scanners, and rootkit capabilities, allowing it to hide its presence within the system. Additionally, it may use techniques like anti-debugging and anti-emulation to hinder analysis by security researchers.

This makes it harder for traditional security software to identify and remove the threat.

Malware Code Structure and Functionality

The malware’s code is structured in a modular fashion, allowing for easy updates and expansion of its capabilities. It typically consists of several components, including a downloader module, which fetches additional malicious code from a remote server, a data exfiltration module, which steals sensitive information, and a command-and-control (C&C) module, which communicates with the attackers’ servers to receive instructions and send stolen data.

The core functionality is built around exploiting legitimate system APIs to perform malicious actions while masking its presence. This allows the malware to remain undetected for extended periods.

Malware Capabilities

| Capability | Method | Target | Impact |

|---|---|---|---|

| Data Exfiltration | Access to contacts, location, SMS messages, and other sensitive data through requested permissions. | User data, including personal information and financial details. | Identity theft, financial loss, privacy violation. |

| Ad Fraud | Clicking on ads in the background without user knowledge, generating revenue for the attackers. | Advertising networks, mobile device resources. | Financial loss for advertisers, depletion of device battery. |

| Remote Control | C&C communication allowing attackers to remotely control the infected device. | Device functions, data storage. | Data theft, device manipulation, privacy violation. |

| Subscription Fraud | Subscribing the victim to premium services without their consent. | Financial accounts linked to the device. | Recurring financial charges, unauthorized subscriptions. |

Impact and Victims

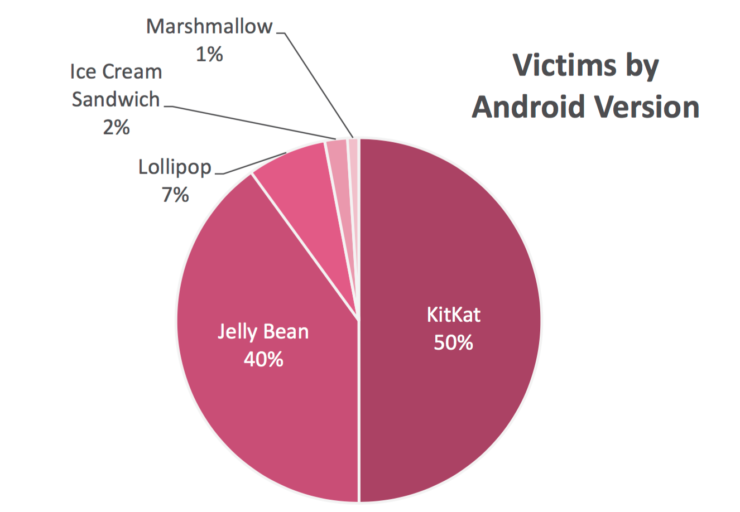

The Copycat malware, affecting a staggering 14 million Android devices, had a widespread and devastating impact on its victims, resulting in significant financial losses and data breaches. Understanding the scope of this attack requires examining its geographic reach, the financial toll, the types of data compromised, and the real-world consequences for individuals and businesses.The geographic distribution of affected devices wasn’t uniformly spread.

Seriously scary news – copycat malware is hitting 14 million Android devices, making millions for the crooks. This highlights the urgent need for robust app security, which is why I’ve been researching faster development methods like those discussed in this article on domino app dev the low code and pro code future ; maybe quicker development cycles mean faster patching against these threats.

The scale of this Android malware attack is a wake-up call for everyone.

While precise figures per country are unavailable due to the nature of the malware and its clandestine operation, reports suggest a higher concentration of infections in regions with a large Android user base and less robust cybersecurity infrastructure. Areas in Southeast Asia, South America, and parts of Africa likely experienced a disproportionately high number of infections. This is often correlated with lower levels of awareness regarding mobile security and fewer resources dedicated to combating malware.

Financial Losses Incurred

The financial impact on victims ranged widely, from minor inconveniences to substantial financial ruin. Victims faced direct financial losses through fraudulent transactions, where the malware siphoned funds from their bank accounts or online payment platforms. The indirect costs included expenses related to restoring compromised devices, recovering stolen data, and dealing with the emotional distress and disruption caused by the breach.

Consider a scenario where a small business owner had their banking details compromised, leading to the depletion of their business account and subsequent closure of the business. This illustrates the severe consequences for individuals whose livelihoods depend on their mobile devices. The total financial losses are difficult to quantify precisely, but estimates suggest millions of dollars were stolen.

Data Stolen by the Malware

The Copycat malware was designed to steal a wide range of sensitive data. This includes banking credentials (account numbers, passwords, security codes), personal identification information (PII) such as names, addresses, and dates of birth, contact details (phone numbers, email addresses), and location data. Furthermore, it could access and exfiltrate photos, videos, and other files stored on the infected devices.

The malware’s ability to collect this comprehensive data set made it particularly dangerous.

Examples of Victim Impact

Victims experienced a variety of negative impacts. Some faced identity theft, leading to the opening of fraudulent accounts in their names or the application for loans they didn’t authorize. Others experienced financial fraud, with money directly stolen from their accounts. Many suffered significant emotional distress and inconvenience, spending considerable time and resources to recover from the attack.

The loss of personal photos and videos, often irreplaceable memories, also caused significant emotional distress for many victims. The pervasive nature of the malware, coupled with its stealthy operation, exacerbated the negative consequences for victims.

Types of Data Compromised and Associated Risks

| Data Type | Risk Level | Mitigation Strategy |

|---|---|---|

| Banking Credentials | High | Strong passwords, two-factor authentication, regular account monitoring |

| Personal Identification Information (PII) | High | Secure data storage practices, regular credit report checks, identity theft protection services |

| Contact Details | Medium | Regular review of contact lists, caution with sharing personal information online |

| Location Data | Medium | Review and adjust location sharing settings on apps |

| Photos and Videos | Low (financially), High (emotionally) | Regular backups, strong device security |

Malware Propagation and Distribution: Copycat Malware Targets 14 Million Google Android Devices To Rake In Millions

The Copycat malware, responsible for infecting 14 million Android devices, employed a sophisticated and multi-pronged approach to its distribution, relying heavily on deceptive tactics and leveraging existing vulnerabilities in the Android ecosystem. Understanding its propagation methods is crucial for developing effective countermeasures and preventing future outbreaks of similar malware.The malware’s distribution wasn’t a single event but a sustained campaign involving several techniques designed to maximize infection rates.

These techniques ranged from disguising malicious apps as legitimate software to exploiting vulnerabilities in less secure app stores.

Distribution Methods

The Copycat malware’s distribution relied on a combination of methods, demonstrating a clear understanding of how to reach a large number of potential victims. These methods included the use of third-party app stores, compromised legitimate apps, and potentially even drive-by downloads through malicious websites. The attackers likely prioritized channels with less stringent security measures, targeting users who were less likely to be cautious about the apps they downloaded.

The use of multiple distribution channels significantly increased the malware’s reach and resilience against takedown efforts. For instance, if one distribution channel was shut down, the attackers could easily pivot to another.

Deceptive Techniques and Social Engineering

Luring victims into downloading the malware was a key component of the Copycat campaign. Social engineering played a crucial role in this process. The malware likely masqueraded as popular apps, offering enticing features or promising benefits to encourage downloads. For example, the malicious app might have been disguised as a game, a productivity tool, or even a system utility.

This deceptive approach exploited users’ trust and their tendency to download apps without fully verifying their legitimacy. The use of fake reviews and ratings on third-party app stores further enhanced the deception, making the malware appear more trustworthy. Furthermore, the attackers may have employed phishing techniques, such as sending fraudulent SMS messages or emails containing links to download the malware.

Comparison to Other Android Malware

The Copycat malware’s distribution methods are similar to those used by other notorious Android malware families. Many Android malware campaigns leverage third-party app stores and compromised legitimate apps to reach a wider audience. However, the sheer scale of the Copycat infection – affecting 14 million devices – highlights the effectiveness of its distribution strategy. Compared to malware that relies solely on phishing or drive-by downloads, the use of multiple distribution vectors, including compromised legitimate apps and third-party app stores, allowed for broader reach and a longer lifespan for the malware.

This strategy is a common tactic among sophisticated mobile malware campaigns, aiming for maximum impact and longevity.

Stages of Malware Propagation

The propagation of the Copycat malware likely followed a series of distinct stages:

- Development and Testing: The malware was initially developed and tested to ensure its functionality and ability to evade detection.

- Distribution Channel Selection: The attackers identified and selected suitable distribution channels, prioritizing those with weaker security measures.

- Malware Deployment: The malware was uploaded to selected channels, disguised as legitimate apps.

- Victim Acquisition: Users downloaded and installed the malware, often unknowingly.

- Command and Control Communication: The malware established communication with a command-and-control server, enabling remote control and data exfiltration.

- Data Exfiltration: Sensitive user data was stolen and transmitted to the attackers.

- Monetary Gain: The attackers profited from the stolen data or through other malicious activities facilitated by the malware.

Security Implications and Countermeasures

The recent Copycat malware outbreak, affecting 14 million Android devices, highlights significant vulnerabilities in the Android ecosystem and underscores the need for robust security practices. Understanding the exploited weaknesses and implementing effective countermeasures is crucial to prevent future attacks of this scale. This section delves into the security implications of this malware and provides practical recommendations for individuals and organizations to bolster their defenses.Exploited Vulnerabilities and User Protection RecommendationsThis malware likely exploited several vulnerabilities, potentially including outdated Android versions lacking critical security patches, insecure app permissions granted by users, and weaknesses in third-party app stores.

The attackers may have used sophisticated social engineering techniques to trick users into downloading malicious apps disguised as legitimate software. Users should prioritize updating their Android OS to the latest version, carefully review app permissions before installation, and only download apps from trusted sources like the Google Play Store. Regularly checking app permissions and revoking unnecessary access is also vital.

Vulnerabilities Exploited by Copycat Malware

The precise vulnerabilities exploited by Copycat remain under investigation, but common attack vectors for Android malware include: weaknesses in the Android operating system itself (often patched in later updates), flaws in specific apps that allow privilege escalation, and vulnerabilities in the way Android handles permissions. For instance, an app requesting excessive permissions (like access to contacts, location, and SMS) beyond what is needed for its stated functionality should raise immediate suspicion.

Furthermore, the use of obfuscation techniques to hide the malware’s true nature within the app’s code makes detection more difficult. This necessitates regular security scans and the use of reputable antivirus software.

Protecting Against Similar Threats

Protecting Android devices requires a multi-layered approach. Users should enable Google Play Protect, Google’s built-in security system that scans apps for malware before and after installation. Regularly updating apps is crucial, as updates often include security patches addressing vulnerabilities. Avoiding clicking on suspicious links or downloading apps from untrusted sources is also vital. Educating users about phishing attempts and other social engineering tactics is essential to prevent them from falling victim to such attacks.

Consider using a reputable third-party antivirus app alongside Google Play Protect for an additional layer of protection.

Securing Android Devices Against Malware

Best practices for securing Android devices include: installing a reputable antivirus app, keeping the operating system and apps updated, enabling device administrator controls, and regularly backing up important data. Users should be wary of apps requesting excessive permissions, avoid rooting their devices unless absolutely necessary (as this can significantly increase vulnerability), and use strong, unique passwords for all accounts.

Regularly reviewing app permissions and revoking unnecessary access can further enhance security. Organizations should implement Mobile Device Management (MDM) solutions to manage and secure employee devices.

The Role of Google Play Protect and Other Security Measures

Google Play Protect acts as a first line of defense, scanning apps for malicious code before and after installation. However, it’s not foolproof, and sophisticated malware can sometimes evade detection. Therefore, additional security measures, such as using a reputable third-party antivirus app and practicing safe browsing habits, are necessary. Regular security audits and penetration testing can also help identify and address vulnerabilities within an organization’s mobile infrastructure.

Two-factor authentication (2FA) should be enabled for all accounts, adding an extra layer of security beyond just passwords.

Preventative Measures for Individuals and Organizations

The following measures can significantly reduce the risk of Android malware infections:

- Keep your Android OS and apps updated to the latest versions.

- Download apps only from trusted sources, primarily the Google Play Store.

- Carefully review app permissions before installation and revoke unnecessary access.

- Use a reputable antivirus app in addition to Google Play Protect.

- Enable two-factor authentication (2FA) for all accounts.

- Be wary of suspicious links, emails, and SMS messages.

- Regularly back up important data to prevent data loss in case of infection.

- Educate users about phishing and social engineering techniques.

- For organizations: Implement Mobile Device Management (MDM) solutions.

- For organizations: Conduct regular security audits and penetration testing.

Attribution and Actors

Uncovering the identities behind the Copycat malware and their motivations is crucial for understanding the threat and preventing future attacks. Analyzing the malware’s code, distribution methods, and targets can offer clues, though definitive attribution often remains challenging. The scale of the operation, affecting 14 million Android devices, suggests a sophisticated operation potentially involving a well-organized group or a state-sponsored actor.The complexity of the Copycat malware, its ability to evade detection, and its targeted approach to monetization point towards a group with significant technical expertise and resources.

Reverse engineering the code might reveal code signatures, compiler flags, or embedded comments that could link it to known malicious actors or specific geographical locations. However, sophisticated threat actors often employ techniques to obfuscate their origin, making definitive attribution difficult.

Potential Actors and Motives

Several actors could be behind this malware, each with distinct motivations. These range from financially motivated cybercriminal groups to state-sponsored actors aiming for espionage or disruption. The large-scale nature of the infection suggests a focus on financial gain, likely through ad fraud or premium-rate SMS scams. However, the possibility of data exfiltration or other malicious activities cannot be ruled out.

Code Analysis for Clues

Analyzing the malware’s code is a key step in attribution. Security researchers would examine the code for: unique coding styles, the use of specific libraries or frameworks, the presence of hardcoded strings or IP addresses, and the use of specific encryption algorithms. These details can help identify the developers’ skills and potential affiliations. For example, the use of specific obfuscation techniques could be indicative of a particular group’s expertise.

Similarly, the choice of communication channels (C&C servers) could reveal geographical location or operational preferences.

Comparison to Known Threat Actors

The methods employed by Copycat can be compared to those of known threat actors. For example, the scale of the infection resembles campaigns launched by groups like Lazarus Group (known for their state-sponsored attacks) or financially motivated groups such as the Trickbot gang. However, differences in techniques, targets, and the malware’s specific functionality would need to be carefully assessed to determine a potential connection.

The malware’s ability to bypass security measures might indicate familiarity with Android’s security architecture and a history of successful Android-based malware campaigns.

Summary of Potential Actors

| Potential Actor | Motive | Methods of Operation |

|---|---|---|

| Financially Motivated Cybercriminal Group | Financial gain through ad fraud, premium-rate SMS scams, or data theft for sale. | Large-scale malware distribution campaigns targeting vulnerable Android devices; use of sophisticated obfuscation and evasion techniques. |

| State-Sponsored Actor | Espionage, data theft, disruption of critical infrastructure, or information warfare. | Targeted attacks focusing on specific individuals or organizations; potentially more sophisticated evasion techniques and longer-term data exfiltration. |

| Organized Crime Syndicate | Financial gain through a range of criminal activities facilitated by compromised devices, such as botnet participation, fraud, and identity theft. | Large-scale malware distribution, often leveraging compromised websites or app stores; potential for collaboration with other criminal groups. |

Illustrative Example

Sarah, a busy marketing executive, downloaded a seemingly innocuous productivity app called “QuickTask” from a third-party app store, lured in by its promise of enhanced task management and calendar integration. She hadn’t realized the app store wasn’t vetted by Google Play Protect. This seemingly minor oversight would have significant consequences.The initial days were uneventful. QuickTask appeared to function as advertised.

However, after a week, Sarah began noticing subtle changes. Her phone’s battery drained faster than usual, and unexpected pop-up ads appeared frequently, interrupting her workflow. At first, she dismissed these as minor annoyances. The real trouble started when she received a series of fraudulent text messages, seemingly originating from her bank, prompting her to verify her account details.

Consequences of Infection, Copycat malware targets 14 million google android devices to rake in millions

Sarah, unknowingly, had fallen victim to the Copycat malware. The seemingly harmless productivity app was a Trojan horse, designed to steal personal data and financial information. The fraudulent text messages were a direct result of the malware’s access to her contact list and her stored banking details. The increased battery drain was a consequence of the malware’s constant activity in the background, communicating with its command-and-control server.

The pop-up ads were a monetization strategy employed by the malware’s creators. The malware had also subtly altered her phone’s settings, granting itself elevated privileges.

Seriously scary stuff – that copycat malware targeting 14 million Android devices is a huge wake-up call. It highlights the urgent need for robust mobile security, and that’s where solutions like cloud security posture management become crucial. Learning more about bitglass and the rise of cloud security posture management could help us understand how to better prevent these kinds of attacks.

Ultimately, stronger security measures are the only way to protect against these increasingly sophisticated copycat malware schemes aiming to steal millions.

Recovery Process and Challenges

Realizing something was seriously wrong, Sarah immediately contacted her bank and reported the suspicious messages. Fortunately, she had not fallen for the scam and her account remained secure. She then took her phone to a reputable repair shop. The technicians performed a full system wipe and reinstall of the Android operating system, effectively removing the malware. This process involved backing up her essential data (photos, documents etc.

which were fortunately unaffected) to the cloud before wiping the phone completely. The recovery process was time-consuming and stressful, requiring her to re-download and reconfigure all her apps and settings. The emotional toll was significant, as Sarah felt violated and vulnerable, highlighting the importance of downloading apps only from trusted sources. The financial impact included the cost of the phone repair and the time spent on recovery.

She also had to spend considerable time reviewing her bank and online accounts for any unauthorized activity.

Closing Summary

The widespread impact of this copycat malware underscores the ever-evolving threat landscape in the digital world. Millions of Android users have already fallen victim, suffering financial losses and privacy violations. While the malware’s sophisticated design makes detection challenging, proactive measures such as keeping your software updated, being cautious about app downloads, and employing robust security software are crucial for prevention.

Staying informed and adopting safe digital habits are our best defenses against these relentless attacks. Don’t let yourself become another statistic – take control of your digital security today!

Question & Answer Hub

How can I tell if my device is infected?

Look for unusual battery drain, unexpected data usage, suspicious apps you don’t recognize, or unusual pop-up messages. Run a full virus scan with a reputable security app.

What should I do if I think my device is infected?

Immediately disconnect from the internet, back up any essential data (if possible without connecting to the internet), and perform a factory reset. Install and run a reputable antivirus app. Consider contacting your bank and other relevant institutions to report potential fraud.

Are there any specific apps known to be vectors for this malware?

While specific apps haven’t been publicly identified as primary vectors, downloading apps only from the official Google Play Store and checking reviews is crucial. Avoid sideloading apps from untrusted sources.

Can this malware infect rooted devices more easily?

Yes, rooted devices often have vulnerabilities that malware can exploit more easily. It’s strongly recommended to avoid rooting unless absolutely necessary and understand the associated risks.