Almost All Financial Apps Are Vulnerable to Cyber Attacks

Almost all financial apps are vulnerable to cyber attacks. It’s a scary thought, isn’t it? We trust these apps with our most sensitive information – bank accounts, credit card details, even our salaries. But the reality is that these apps, despite their security measures, are constantly under siege from sophisticated cybercriminals employing increasingly clever tactics. From phishing scams designed to trick you into handing over your login details, to malware silently lurking on your device, the threats are real and ever-evolving.

This post dives deep into the vulnerabilities, the risks, and most importantly, what you can do to protect yourself.

We’ll explore the various types of cyberattacks targeting these apps, from the common phishing expeditions to more complex malware infections and denial-of-service attacks. We’ll also examine the vulnerabilities inherent in the design and development of many financial apps, including weak coding practices, insecure APIs, and inadequate authentication methods. Understanding user behavior and the risks associated with things like using public Wi-Fi for financial transactions is crucial, and we’ll cover that too.

Finally, we’ll discuss mitigation strategies, best practices, and the role of artificial intelligence in bolstering the security of these vital applications.

Types of Cyberattacks Targeting Financial Apps

Financial applications, while designed to protect our sensitive financial data, are unfortunately prime targets for cybercriminals. The increasing reliance on mobile banking and online transactions makes these apps lucrative targets, demanding robust security measures to mitigate the risks. This section will explore the various types of cyberattacks aimed at compromising these applications and the data they hold.

Phishing Attacks Targeting Financial App Users

Phishing attacks remain a highly effective method for compromising financial app security. These attacks typically involve deceptive emails, text messages (smishing), or even phone calls (vishing) that trick users into revealing their login credentials or other sensitive information. Sophisticated phishing campaigns often mimic legitimate financial institutions’ branding and communication styles to increase their credibility. For instance, a phisher might send an email appearing to be from a bank, urging the recipient to update their account information through a link leading to a fake login page.

This fake page meticulously replicates the genuine app’s interface, collecting the user’s credentials as they attempt to log in. Once obtained, these credentials are then used to access the victim’s actual account.

Malware Infections to Compromise Financial Apps

Malware, malicious software designed to damage or disable systems, can severely compromise financial apps. Trojans, a type of malware that disguises itself as legitimate software, can be installed on a user’s device through various means, including deceptive downloads or compromised websites. Once installed, these Trojans can silently monitor user activity, stealing login credentials, transaction details, and other sensitive information.

Keyloggers, a specific type of malware, record every keystroke made by the user, allowing attackers to capture passwords and other sensitive data directly as they are typed. Ransomware, another harmful type of malware, encrypts a user’s data, holding it hostage until a ransom is paid. This can disrupt access to financial apps and potentially lead to significant financial losses.

Denial-of-Service Attacks Against Financial Apps

Denial-of-service (DoS) attacks aim to disrupt the availability of a service by flooding it with traffic. In the context of financial apps, a DoS attack can make it impossible for legitimate users to access their accounts or conduct transactions. Distributed denial-of-service (DDoS) attacks, which utilize multiple compromised devices (botnets) to launch the attack, are particularly potent, capable of overwhelming even robust systems.

These attacks can range from simple flooding attacks, sending massive amounts of data to overwhelm the app’s servers, to more sophisticated attacks that exploit vulnerabilities in the application’s infrastructure. The impact of a successful DoS attack can range from temporary service interruptions to complete outages, leading to significant financial losses and reputational damage for the financial institution.

Types of Cyberattacks, Methods, and Impact

| Attack Type | Method | Potential Impact | Example |

|---|---|---|---|

| Phishing | Deceptive emails, SMS, or phone calls; fake login pages. | Credential theft, account takeover, financial loss. | Email mimicking a bank, urging password reset via a malicious link. |

| Malware (Trojan) | Deceptive downloads, compromised websites; keylogging, data theft. | Credential theft, transaction monitoring, financial loss, identity theft. | A seemingly legitimate app secretly stealing banking details. |

| Malware (Ransomware) | Infected files or emails; data encryption. | Data loss, service disruption, ransom demands, financial loss, reputational damage. | Encryption of financial app data, demanding Bitcoin for decryption. |

| DoS/DDoS | Flooding the app’s servers with traffic; exploiting vulnerabilities. | Service disruption, inability to access accounts, financial losses, reputational damage. | Overwhelming a bank’s mobile app with fake login requests, making it inaccessible. |

Vulnerabilities in Financial App Design and Development

Financial applications, while offering incredible convenience, often harbor significant security flaws stemming from vulnerabilities in their design and development. These weaknesses can expose sensitive user data to malicious actors, leading to substantial financial losses and reputational damage for both users and the financial institutions involved. Understanding these vulnerabilities is crucial for developers and users alike to mitigate the risks.

Common Coding Vulnerabilities

Poor coding practices are a primary source of vulnerabilities in financial apps. These can range from simple errors to more complex flaws that exploit weaknesses in programming languages and frameworks. For example, SQL injection vulnerabilities allow attackers to manipulate database queries, potentially granting them unauthorized access to user data. Similarly, cross-site scripting (XSS) vulnerabilities allow attackers to inject malicious scripts into web pages, potentially stealing user credentials or session tokens.

Buffer overflow attacks can crash the application or allow attackers to execute arbitrary code, leading to complete system compromise. These vulnerabilities often arise from a lack of rigorous code review and testing processes.

Insecure APIs and Data Breaches

Application Programming Interfaces (APIs) are essential for connecting financial apps to various services and databases. However, insecure APIs can be a significant point of attack. Weaknesses in API authentication and authorization can allow unauthorized access to sensitive data, leading to data breaches. For example, a poorly secured API might allow an attacker to retrieve all user account details without proper authentication.

A well-publicized example of an API vulnerability is the 2017 Equifax breach, where a vulnerability in their API allowed attackers to access sensitive personal information of millions of consumers. Data breaches resulting from insecure APIs can have devastating consequences, impacting both the financial institution and its customers.

Inadequate Authentication and Authorization Mechanisms

Robust authentication and authorization are critical for protecting user accounts and data. Weak passwords, lack of multi-factor authentication (MFA), and insufficient session management can all contribute to vulnerabilities. For instance, an app that only relies on a single password for authentication is highly susceptible to credential stuffing attacks, where attackers use stolen credentials from other websites to try to gain access.

Similarly, a lack of proper authorization can allow users to access features or data that they are not authorized to view, potentially leading to data leakage or unauthorized transactions. Implementing strong authentication mechanisms, such as MFA and biometric authentication, is crucial for enhancing security.

Poor Data Encryption Practices

Sensitive data, such as user credentials, transaction details, and personal information, should always be encrypted both in transit and at rest. Failure to implement proper encryption can expose this data to attackers, leading to identity theft and financial fraud. For example, storing passwords in plain text is a grave security risk. Similarly, transmitting sensitive data over unencrypted channels makes it easily accessible to eavesdroppers.

The use of outdated or weak encryption algorithms also increases vulnerability. Employing strong encryption algorithms, such as AES-256, and implementing secure key management practices are essential for protecting sensitive information.

Best Practices for Secure App Development

Implementing secure coding practices is paramount for protecting financial applications from cyber threats. Here are some best practices:

- Conduct thorough code reviews and security testing throughout the development lifecycle.

- Use secure coding techniques to prevent common vulnerabilities such as SQL injection and XSS.

- Implement robust authentication and authorization mechanisms, including multi-factor authentication.

- Encrypt sensitive data both in transit and at rest using strong encryption algorithms.

- Regularly update and patch software and libraries to address known vulnerabilities.

- Implement secure API design and access controls.

- Follow secure development lifecycle (SDLC) methodologies.

- Regularly conduct security audits and penetration testing.

- Educate developers on secure coding practices and security best practices.

- Implement a comprehensive incident response plan to handle security breaches.

User Behavior and Security Risks

Let’s face it, even the most secure financial app is vulnerable if its users aren’t practicing good security habits. A strong app is only as strong as its weakest link – and that often turns out to be the user. This section explores the common user behaviors that contribute to financial app security breaches and how to mitigate those risks.User negligence plays a significant role in financial app security breaches.

Many users fall prey to simple scams or overlook basic security measures, leaving their accounts wide open to attack. This isn’t about blaming users, but about understanding how human error interacts with technological vulnerabilities to create a dangerous combination. Understanding these behaviors is crucial to improving overall security.

Risks Associated with User Negligence

Poor password practices are a major contributor to security breaches. Many users choose easily guessable passwords or reuse the same password across multiple accounts. A single compromised password can provide access to all linked accounts, including financial apps. Similarly, ignoring software updates leaves apps vulnerable to known exploits. These updates often patch security holes that hackers actively target.

Finally, clicking on suspicious links or downloading malicious attachments can lead to malware infections, granting attackers access to sensitive data. These actions, while seemingly minor, significantly increase the risk of financial loss.

Risks of Using Public Wi-Fi for Financial Transactions, Almost all financial apps are vulnerable to cyber attacks

Using public Wi-Fi for financial transactions exposes users to significant risks. Public Wi-Fi networks are often unsecured, meaning data transmitted over them can be easily intercepted by malicious actors. This is especially dangerous when dealing with sensitive financial information, as hackers can use this opportunity to steal login credentials, account numbers, and other personal data. Even seemingly secure networks may be compromised.

Consider a scenario where a hacker sets up a fake Wi-Fi hotspot with a name similar to a legitimate one (e.g., “Free Airport Wi-Fi” instead of “Airport Free Wi-Fi”). Users unknowingly connecting to this malicious hotspot would be vulnerable to attacks. Always prioritize secure, private networks when conducting financial transactions.

Common Social Engineering Tactics Targeting Financial App Users

Social engineering tactics manipulate users into revealing sensitive information. Phishing attacks, for example, involve deceptive emails or text messages that mimic legitimate financial institutions. These messages often contain links to fake websites that look identical to real banking apps. Once a user enters their credentials, they are stolen by the attacker. Another common tactic is pretexting, where an attacker pretends to be a representative of a financial institution and requests personal information under false pretenses.

Vishing, or voice phishing, uses phone calls to trick users into revealing sensitive data. These tactics exploit human psychology, relying on trust and urgency to bypass security measures.

Importance of Strong Passwords and Multi-Factor Authentication

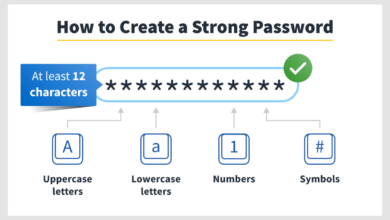

Strong passwords are the first line of defense against unauthorized access. A strong password is long, complex, and unique to each account. It should incorporate a mix of uppercase and lowercase letters, numbers, and symbols. Password managers can help users create and manage strong, unique passwords for multiple accounts. Multi-factor authentication (MFA) adds an extra layer of security by requiring users to verify their identity through multiple methods.

This could involve a one-time code sent to a registered phone number or email address, a biometric scan, or a security key. MFA significantly reduces the risk of unauthorized access even if a password is compromised.

Protecting Yourself: A Step-by-Step Guide

The following flowchart illustrates the steps users can take to protect themselves from financial app security risks.[Imagine a flowchart here. The flowchart would begin with a box labeled “Start.” This would branch to boxes representing: “Use a Strong, Unique Password,” “Enable Multi-Factor Authentication,” “Avoid Public Wi-Fi for Financial Transactions,” “Be Wary of Suspicious Emails/Texts/Calls,” “Keep Your Software Updated,” and “Report Suspicious Activity Immediately.” All paths would ultimately converge on a final box labeled “Secure Financial App Usage.”] This visual representation would clearly demonstrate the sequence of actions for enhanced security.

Regulatory and Compliance Issues

The financial technology (fintech) landscape is rapidly evolving, and with it, the regulatory environment designed to protect consumers and maintain financial stability. The increasing reliance on financial apps necessitates robust regulatory frameworks to address the unique cyber risks associated with these platforms. Failure to comply with these regulations can lead to significant financial penalties and reputational damage.The role of financial regulations in mitigating cyber risks is paramount.

These regulations establish minimum security standards, data protection requirements, and reporting obligations for financial institutions. They aim to create a more secure environment for both consumers and businesses by promoting responsible data handling and incident response procedures. Compliance with these regulations is not merely a legal requirement but a crucial step in building trust and fostering a resilient financial ecosystem.

The Impact of Data Privacy Laws on Financial App Security

Data privacy laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, significantly impact the security of financial apps. These laws mandate stringent data protection measures, including data minimization, purpose limitation, and the implementation of robust security controls to prevent data breaches. Financial institutions must ensure that they comply with these laws, which often require comprehensive data security assessments, regular audits, and transparent data handling practices.

Failure to comply can result in substantial fines and legal action. For example, the GDPR imposes fines of up to €20 million or 4% of annual global turnover, whichever is higher, for non-compliance.

Challenges Faced by Financial Institutions in Complying with Security Standards

Financial institutions face numerous challenges in complying with evolving security standards. The rapid pace of technological advancements often outstrips the ability of regulators to update regulations, creating a gap between best practices and legal requirements. Furthermore, the complexity of modern financial systems and the interconnected nature of different apps and platforms make it difficult to implement comprehensive security measures across the entire ecosystem.

Resource constraints, including budget limitations and a shortage of skilled cybersecurity professionals, also pose significant challenges. The need for continuous monitoring and adaptation to emerging threats adds another layer of complexity to compliance efforts.

Comparison of Regulatory Frameworks and Their Effectiveness

Different regulatory frameworks vary in their scope, stringency, and effectiveness. The GDPR, for example, is considered a more comprehensive and stringent framework than many national-level regulations. Its focus on data protection by design and default necessitates proactive security measures throughout the development lifecycle of financial apps. In contrast, some jurisdictions may have less robust frameworks, potentially leading to greater vulnerabilities.

The effectiveness of any regulatory framework also depends on the level of enforcement and the resources allocated to its implementation. Effective enforcement is crucial to deterring non-compliance and ensuring that institutions take security seriously.

Consequences of Non-Compliance with Security Regulations

Non-compliance with security regulations can result in severe consequences for financial institutions. These consequences can include substantial financial penalties, reputational damage, loss of customer trust, and legal action. Data breaches can lead to significant financial losses due to remediation costs, legal fees, and potential compensation to affected customers. Reputational damage can result in the loss of business and a decline in market value.

In some cases, non-compliance can even lead to criminal charges against individuals or the organization. The 2017 Equifax data breach, for example, resulted in a multi-million dollar settlement and significant reputational damage to the company. The consequences highlight the importance of prioritizing security and regulatory compliance.

Mitigation Strategies and Best Practices: Almost All Financial Apps Are Vulnerable To Cyber Attacks

Protecting financial applications from cyberattacks requires a multi-layered approach encompassing robust security measures, secure coding practices, and a well-defined incident response plan. Ignoring any one of these areas significantly increases the vulnerability of the application and the sensitive data it handles. This section details practical strategies and best practices for bolstering the security of financial apps.

Encryption and Secure Data Storage

Encryption is paramount for safeguarding sensitive data both in transit and at rest. Data in transit, such as user login credentials and transaction details, should be protected using Transport Layer Security (TLS) or its successor, TLS 1.3, which provides strong encryption and authentication. Data at rest, stored on databases or servers, should be encrypted using strong encryption algorithms like AES-256.

Furthermore, employing techniques like data masking and tokenization can further reduce the risk of data breaches, even if an attacker gains access to the database. For example, instead of storing a user’s credit card number directly, a token representing the number can be stored, with the actual number securely stored separately and accessed only when absolutely necessary. This minimizes the impact of a potential breach.

Intrusion Detection and Prevention Systems

Intrusion Detection and Prevention Systems (IDPS) are crucial for monitoring network traffic and application activity for malicious behavior. These systems can detect anomalies, such as unauthorized access attempts, unusual login patterns, or suspicious data transfers. A robust IDPS should integrate with other security tools, such as firewalls and security information and event management (SIEM) systems, to provide a comprehensive view of the security posture of the application.

For instance, an IDPS could flag a sudden surge in login attempts from a single IP address, indicating a potential brute-force attack. This alert can then trigger automated responses, such as temporarily blocking the IP address or initiating a security investigation.

Incident Response and Recovery Strategy

A comprehensive incident response plan is vital for minimizing the impact of a successful cyberattack. This plan should Artikel clear procedures for detecting, containing, eradicating, recovering from, and learning from security incidents. It should include designated roles and responsibilities, communication protocols, and a detailed recovery process. Regular testing and drills are crucial to ensure the plan’s effectiveness. For example, the plan might include procedures for isolating affected systems, conducting forensic analysis to determine the extent of the breach, and restoring data from backups.

It should also detail communication strategies for informing affected users and regulatory bodies. A well-rehearsed incident response plan ensures a swift and efficient response, minimizing potential damage and reputational harm.

Best Practices for Securing Financial Applications

The security of a financial application is a continuous process that requires ongoing vigilance and improvement. A robust security posture relies on a combination of technical controls, processes, and people.

- Regular security audits and penetration testing to identify and address vulnerabilities.

- Implementation of multi-factor authentication (MFA) to enhance user authentication security.

- Secure coding practices to minimize vulnerabilities in the application’s codebase.

- Regular software updates and patching to address known vulnerabilities.

- Robust access control mechanisms to restrict access to sensitive data based on the principle of least privilege.

- Employee training programs to raise awareness of security threats and best practices.

- Compliance with relevant industry regulations and standards (e.g., PCI DSS, GDPR).

- Use of strong, unique passwords and password managers.

- Monitoring user activity for suspicious behavior.

- Data loss prevention (DLP) measures to prevent sensitive data from leaving the organization’s control.

The Role of Artificial Intelligence in Security

AI is rapidly transforming cybersecurity, and the financial sector, with its high-value targets and sensitive data, is at the forefront of this revolution. The ability of AI to analyze vast amounts of data at incredible speeds makes it a powerful tool in detecting and preventing cyberattacks against financial applications. However, it’s crucial to understand both its strengths and limitations.AI’s application in financial app security is multifaceted.

It can analyze network traffic, user behavior, and application logs to identify anomalies that might indicate malicious activity. This proactive approach allows for the detection of threats before they can cause significant damage. Furthermore, AI can automate many security tasks, freeing up human analysts to focus on more complex issues.

AI-Driven Threat Detection and Prevention

AI algorithms, particularly machine learning models, are trained on massive datasets of known attacks and normal activity. This allows them to identify patterns and deviations indicative of malicious behavior. For example, an AI system might detect unusual login attempts from unfamiliar geographic locations or unusual transaction patterns that deviate significantly from a user’s established behavior. This proactive detection is a significant advantage over traditional signature-based security systems, which rely on identifying known threats and are often ineffective against novel attacks.

Real-time analysis allows for immediate responses, such as blocking suspicious transactions or locking accounts.

Limitations of AI in Financial App Security

While AI offers significant advantages, it’s not a silver bullet. AI models are only as good as the data they are trained on. If the training data is biased or incomplete, the AI system may produce inaccurate results, leading to false positives or missed threats. Furthermore, sophisticated attackers are constantly evolving their techniques, attempting to circumvent AI-based security measures.

This necessitates continuous retraining and adaptation of AI models to stay ahead of emerging threats. Another limitation is the explainability of AI decisions. Understanding

why* an AI system flagged a particular event as suspicious can be challenging, potentially hindering effective investigation and remediation.

Examples of AI-Powered Security Tools

Several AI-powered security tools are already deployed in the financial sector. For instance, many banks utilize AI-driven fraud detection systems that analyze transaction data in real-time to identify potentially fraudulent activities. These systems can flag suspicious transactions based on factors such as transaction amount, location, and the user’s past behavior. Similarly, AI is used in security information and event management (SIEM) systems to analyze security logs and identify potential threats.

These systems can automatically correlate events across different sources to provide a comprehensive view of security incidents. Another example includes AI-powered vulnerability scanners that automatically identify and assess security weaknesses in financial applications.

Comparison with Traditional Methods

Traditional security methods, such as signature-based intrusion detection systems and firewalls, rely on predefined rules and signatures to identify known threats. While effective against known attacks, they are often ineffective against zero-day exploits and sophisticated attacks that employ novel techniques. AI-based security solutions offer a significant advantage by their ability to learn and adapt to new threats. They can detect anomalies and deviations from normal behavior that traditional methods might miss.

However, traditional methods still play a vital role, often acting as a first line of defense, complementing AI systems. A layered security approach combining both traditional and AI-based methods is often the most effective strategy.

It’s scary how many financial apps are vulnerable to hacks; we’re practically handing over our money on a silver platter! Building secure apps requires robust development, and that’s where learning more about domino app dev, the low-code and pro-code future , becomes crucial. Understanding these development approaches could be key to creating more secure financial apps, hopefully mitigating the ever-present risk of cyberattacks.

The Future Role of AI in Financial App Security

The future of AI in financial app security looks promising. We can expect to see more sophisticated AI-powered solutions that leverage advanced machine learning techniques, such as deep learning and reinforcement learning, to enhance threat detection and prevention capabilities. Furthermore, AI will likely play an increasingly important role in automating security tasks, such as vulnerability management and incident response.

The integration of AI with other emerging technologies, such as blockchain and quantum computing, will further enhance the security of financial applications. For example, AI could be used to analyze blockchain transactions to detect fraudulent activities or to develop quantum-resistant cryptographic algorithms. The ongoing evolution of AI will continuously reshape the landscape of financial app security, offering more robust and adaptive protection against evolving cyber threats.

Illustrative Case Studies

Understanding the vulnerabilities of financial apps requires examining real-world examples of successful and unsuccessful cyberattacks. These case studies highlight the methods employed, the consequences, and the responses of affected organizations, providing valuable insights into improving app security. Analyzing both successful and unsuccessful attacks offers a comprehensive understanding of the evolving threat landscape.

Successful Cyberattacks Against Financial Apps

The following case studies illustrate successful cyberattacks targeting financial applications, emphasizing the diverse methods used and their significant impact. Each example showcases the potential consequences of vulnerabilities and the importance of robust security measures.

| Attack Name/Description | Method Used | Impact | Organizational Response |

|---|---|---|---|

| The 2016 Yahoo! Data Breach | SQL injection vulnerabilities exploited to steal user data, including financial information. | Millions of user accounts compromised, leading to significant identity theft and financial losses. | Notification of affected users, implementation of enhanced security measures, and cooperation with law enforcement. Significant financial penalties and reputational damage. |

| The 2017 Equifax Data Breach | Exploitation of a known vulnerability in Apache Struts framework, allowing unauthorized access to sensitive data. | Compromise of personal information, including Social Security numbers and financial details, for millions of individuals. | Notification of affected users, credit monitoring services offered, and significant financial settlements and legal repercussions. Resignation of top executives. |

| 2023 MOVEit Transfer vulnerability | Exploitation of a zero-day vulnerability in the MOVEit Transfer file transfer application, allowing attackers to steal data. Many organizations utilizing MOVEit Transfer for financial data transfers were impacted. | Massive data breaches across multiple organizations, exposing sensitive financial data, leading to significant financial losses and reputational damage. The full impact is still unfolding. | Patching of vulnerabilities, investigation of the extent of the breach, and notification of affected individuals. Legal action and regulatory scrutiny are anticipated. |

Unsuccessful Cyberattacks and Defensive Measures

While many attacks succeed, some are thwarted due to effective security measures. These examples showcase the positive impact of proactive security strategies and highlight best practices.

| Incident | Attack Method Attempted | Defensive Measures | Outcome |

|---|---|---|---|

| A Hypothetical Case: Distributed Denial of Service (DDoS) Attack on a Bank’s Mobile App | A large-scale DDoS attack attempting to overwhelm the app’s servers, making it inaccessible to legitimate users. | Implementation of robust DDoS mitigation techniques, including cloud-based load balancing and traffic filtering. | The attack was successfully mitigated, minimizing disruption to users and maintaining service availability. |

| Another Hypothetical Case: Phishing Attempt Targeting Customers of a Fintech Company | Phishing emails were sent to customers, attempting to trick them into revealing their login credentials. | Employee training on phishing awareness and multi-factor authentication (MFA) for all users. | The phishing attempt was largely unsuccessful due to the combination of employee training and MFA. |

Ultimate Conclusion

In the end, securing your financial information in the digital age requires a multi-pronged approach. It’s not just about relying on the security measures of your financial apps; it’s about being proactive and vigilant. By understanding the common attack vectors, practicing good digital hygiene, and staying informed about the latest threats, you can significantly reduce your risk of becoming a victim.

Remember, your financial well-being depends on it. Stay informed, stay safe, and keep a watchful eye on your accounts!

Popular Questions

What are some signs my financial app has been compromised?

Unusual account activity (unexpected transactions), login attempts from unknown locations, emails or texts you didn’t request related to your account, and difficulty logging in are all red flags.

Should I use public Wi-Fi for banking?

No, avoid using public Wi-Fi for any financial transactions. These networks are often unsecured, making your data vulnerable to interception.

How often should I change my passwords?

Experts recommend changing your passwords every 3-6 months, or immediately if you suspect a breach.

What is multi-factor authentication (MFA) and why is it important?

MFA adds an extra layer of security by requiring multiple forms of verification (password, code from your phone, etc.) to access your account, making it much harder for hackers to gain unauthorized access.