American Express Acquires Mobile Security Firm Inauth

American Express acquires mobile security firm Inauth – that headline alone speaks volumes about the evolving landscape of financial technology! This strategic move by AmEx isn’t just another acquisition; it’s a bold statement about their commitment to bolstering mobile payment security in an increasingly digital world. We’re diving deep into the details of this deal, exploring what it means for AmEx, Inauth, and the future of secure mobile transactions.

Get ready to uncover the strategic brilliance (or potential pitfalls!) behind this fascinating partnership.

This acquisition isn’t just about adding another company to the AmEx portfolio; it’s a strategic play to enhance their position in the fiercely competitive mobile payments market. By bringing Inauth’s cutting-edge mobile security technology in-house, AmEx aims to solidify its reputation for security and build even greater customer trust. We’ll examine Inauth’s unique selling points, how their technology integrates with AmEx’s existing infrastructure, and what this all means for the average user.

Expect a detailed look at the market implications, competitive responses, and the potential financial windfall (or challenges) for AmEx.

American Express’ Acquisition Strategy

American Express’ recent acquisition of Inauth, a mobile security firm, is a strategic move reflecting a broader trend within the financial services industry: a focus on enhancing digital security and bolstering mobile payment capabilities. This acquisition isn’t an isolated incident; it’s part of a larger pattern of strategic acquisitions designed to solidify Amex’s position in the evolving fintech landscape.American Express’ recent acquisition history reveals a clear preference for companies operating in the fintech and cybersecurity sectors.

This targeted approach signals a commitment to technological innovation and risk mitigation within its rapidly expanding digital ecosystem. Acquisitions aren’t simply about adding features; they’re about integrating cutting-edge technology and expertise to improve existing services and create new revenue streams. This strategy allows Amex to rapidly adapt to the changing demands of a digitally driven consumer base and stay ahead of competitors.

Strategic Rationale Behind Acquiring Inauth, American express acquires mobile security firm inauth

The acquisition of Inauth directly addresses American Express’ need to strengthen its mobile security infrastructure. Inauth’s expertise in mobile authentication and fraud prevention is crucial in a market increasingly reliant on mobile payments. By integrating Inauth’s technology, Amex can enhance the security of its mobile payment platform, reducing the risk of fraud and boosting customer confidence. This is particularly vital in light of increasing sophisticated cyber threats targeting financial institutions.

The acquisition represents a proactive approach to safeguarding sensitive customer data and maintaining the integrity of its payment systems.

Comparison to Other Acquisitions in the Payments Industry

American Express’ acquisition of Inauth mirrors similar moves by other major players in the payments industry. Companies like PayPal and Visa have also made significant investments in cybersecurity and fintech companies to enhance their platforms and expand their capabilities. These acquisitions often involve companies specializing in areas like fraud detection, authentication, and data analytics. The common thread is a recognition of the growing importance of robust security measures in a digital payments environment and the strategic value of acquiring specialized expertise rather than building it from scratch.

This approach allows for faster integration and a quicker return on investment.

SWOT Analysis of American Express’ Mobile Payments Market Position Post-Acquisition

American Express’ position in the mobile payments market, post-Inauth acquisition, can be analyzed using a SWOT framework:

Strengths:

- Enhanced security infrastructure through Inauth’s technology, reducing fraud risk and increasing customer trust.

- Strong brand reputation and established customer base.

- Existing robust payment processing capabilities.

Weaknesses:

Opportunities:

- Expansion into new mobile payment services and markets leveraging Inauth’s capabilities.

- Development of innovative security solutions for emerging payment technologies.

- Increased customer loyalty through enhanced security and a seamless mobile experience.

Threats:

- Evolving cyber threats and the constant need to adapt security measures.

- Regulatory changes impacting the mobile payments industry.

- Competition from innovative fintech startups.

Inauth’s Technology and Capabilities

American Express’s acquisition of Inauth signifies a significant leap forward in mobile payment security. Inauth isn’t just another security firm; they possess a unique and powerful technology stack designed to address the evolving threats in the mobile landscape. Their expertise lies in providing robust, real-time protection against sophisticated attacks targeting mobile transactions.Inauth’s core technology revolves around advanced behavioral biometrics and machine learning.

Their system continuously analyzes user behavior patterns – such as typing rhythm, touch pressure, and device movement – to create a unique digital fingerprint. This fingerprint is then used to authenticate users and detect anomalies indicative of fraudulent activity. This goes beyond simple password authentication, providing a much more robust and adaptable security layer. The application of machine learning allows the system to constantly learn and adapt to new attack vectors, ensuring its effectiveness remains high even as fraud techniques evolve.

Inauth’s Unique Selling Propositions

Inauth’s competitive advantage stems from its combination of highly accurate behavioral biometrics, sophisticated machine learning algorithms, and a seamless user experience. Unlike many security solutions that rely heavily on passwords or one-time codes, Inauth’s technology operates largely in the background, requiring minimal user interaction while providing comprehensive protection. This passive approach minimizes friction for users while maximizing security. Their system also boasts a very low false-positive rate, minimizing disruptions caused by legitimate users being mistakenly flagged as fraudulent.

This combination of high accuracy, low friction, and adaptability is what sets Inauth apart.

Synergies with American Express’s Infrastructure

The integration of Inauth’s technology into American Express’s existing infrastructure promises significant enhancements to their mobile payment security. Inauth’s behavioral biometrics can be seamlessly integrated with Amex’s existing authentication systems, creating a multi-layered security approach. This would bolster the security of Amex’s mobile wallet and payment applications, making them significantly more resilient to fraud attempts. Furthermore, Inauth’s machine learning capabilities can be used to analyze vast amounts of transaction data, identifying potential fraud patterns and proactively mitigating risks.

This proactive approach, combined with real-time authentication, will significantly reduce fraud losses for American Express.

Enhancing American Express’ Mobile Payment Security

Inauth’s technology offers several concrete ways to enhance American Express’ mobile payment security. For example, it could provide real-time fraud detection during mobile transactions, instantly flagging suspicious activity and preventing unauthorized payments. Imagine a scenario where a user’s phone is compromised: Inauth’s system could detect the change in behavior patterns (e.g., different typing rhythm, unusual device movement) and immediately block the transaction, even if the thief has access to the user’s password or PIN.

Another example involves enhancing the security of mobile P2P payments. By incorporating Inauth’s behavioral biometrics, Amex can ensure that only the legitimate account holder can authorize such transactions, significantly reducing the risk of unauthorized transfers. This multi-layered approach, combining traditional security measures with Inauth’s advanced behavioral biometrics, will create a virtually impenetrable defense against mobile payment fraud.

Market Impact and Competition

American Express’s acquisition of Inauth significantly alters the competitive landscape of the mobile security market. By integrating Inauth’s advanced authentication technology, AmEx gains a powerful advantage in securing its mobile payment platform and potentially expanding its services to other sectors. This move will likely trigger responses from competitors and reshape the dynamics of the industry.The acquisition presents a compelling case study in how established financial institutions are leveraging cutting-edge technology to maintain a competitive edge in the rapidly evolving digital payments ecosystem.

AmEx’s strategic move underscores the increasing importance of robust mobile security in building trust and driving user adoption.

Competitive Response Analysis

Competitors in the mobile payments and security sectors are likely to respond to AmEx’s acquisition in several ways. We might see increased investment in research and development of similar authentication technologies, partnerships with smaller security firms, or a greater focus on marketing their existing security features. Some competitors might even explore acquisitions of their own to strengthen their positions.

For example, PayPal might accelerate its investment in fraud detection and biometric authentication, while Apple could further integrate its existing security features within its payment ecosystem. The competitive pressure will drive innovation and lead to a more secure mobile payment landscape overall.

Key Players and Comparative Analysis

Several major players dominate the mobile security market, each with its strengths and weaknesses. Comparing Inauth’s capabilities to these competitors reveals its unique value proposition and potential impact on the market. Below is a comparison of Inauth with three major competitors. Note that this comparison is based on publicly available information and may not reflect the full scope of each company’s capabilities.

| Company Name | Key Features | Target Market | Strengths |

|---|---|---|---|

| Inauth | Behavioral biometrics, risk-based authentication, fraud detection, adaptable authentication solutions. | Financial institutions, enterprises with high-security needs. | Advanced behavioral biometrics, strong fraud detection capabilities, customization options. |

| Authy (Twilio) | Two-factor authentication (2FA), multi-factor authentication (MFA), push notifications, one-time passwords (OTPs). | Broad range of businesses and individuals. | Widely adopted, integrates well with various platforms, strong reputation. |

| RSA Security | Hardware security modules (HSMs), risk-based authentication, identity and access management (IAM) solutions. | Large enterprises, government agencies. | Established leader in security, comprehensive suite of solutions, strong enterprise focus. |

| Okta | Cloud-based identity and access management (IAM), single sign-on (SSO), multi-factor authentication (MFA). | Businesses of all sizes. | User-friendly interface, strong cloud-based infrastructure, wide range of integrations. |

Customer Experience and Data Security: American Express Acquires Mobile Security Firm Inauth

American Express’ acquisition of Inauth represents a significant leap forward in protecting customer data and enhancing the overall user experience. Inauth’s advanced mobile security technology will seamlessly integrate with Amex’s existing infrastructure, creating a more robust and secure digital ecosystem for millions of cardholders. This isn’t just about adding another layer of security; it’s about fundamentally redefining how we approach data protection in the age of increasingly sophisticated cyber threats.Inauth’s technology will bolster American Express’ existing security measures by providing real-time threat detection and prevention capabilities specifically tailored for mobile devices.

This includes advanced techniques like behavioral biometrics and machine learning algorithms that can identify and neutralize fraudulent activity before it impacts customers. The integration will also improve the speed and efficiency of authentication processes, making transactions smoother and more convenient for users while simultaneously enhancing security.

Improved Data Protection Measures

Inauth’s technology will enhance data security in several key ways. Firstly, its advanced authentication methods will reduce the risk of unauthorized access to customer accounts. Secondly, its real-time threat detection system will proactively identify and mitigate potential security breaches, minimizing the impact of any successful attacks. Finally, the system’s ability to analyze user behavior patterns will help to identify and prevent fraudulent transactions more effectively than traditional methods.

American Express snapping up InAuth, a mobile security firm, highlights the growing importance of robust security measures in the fintech world. This acquisition underscores the need for secure, scalable applications, which is where the future of app development comes in, as discussed in this insightful article on domino app dev the low code and pro code future.

Ultimately, Amex’s move shows their commitment to protecting user data and transactions in an increasingly complex digital landscape.

This multi-layered approach significantly reduces the likelihood of data breaches and protects sensitive customer information.

Benefits for American Express Customers

The acquisition translates into tangible benefits for American Express customers. They can expect faster and more convenient transactions due to streamlined authentication processes. Enhanced security will lead to a reduced risk of fraud and identity theft, providing greater peace of mind. Improved data protection will foster greater trust in the American Express brand, encouraging increased usage and loyalty.

The overall experience will be more seamless and secure, ultimately leading to increased customer satisfaction.

Building Customer Trust and Loyalty

Enhanced security measures are paramount in building and maintaining customer trust. By proactively investing in cutting-edge security technologies like those offered by Inauth, American Express demonstrates its commitment to protecting customer data. This proactive approach builds confidence and loyalty, reinforcing the brand’s reputation for reliability and security. In today’s digital landscape, where data breaches are unfortunately commonplace, a strong security posture is not just a desirable feature but a critical differentiator that fosters customer trust and loyalty.

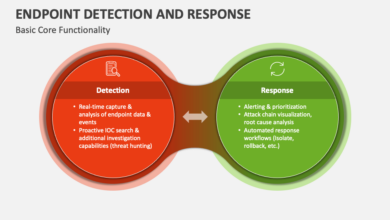

Infographic: Enhanced Security Measures

The infographic would depict a layered security model. The first layer would represent traditional security measures (password protection, encryption). The second layer would showcase Inauth’s real-time threat detection and prevention capabilities (depicted as a shield with a radar icon). The third layer would highlight behavioral biometrics and machine learning (depicted as interconnected nodes analyzing data flows). The final layer would show the overall result: a secure and protected customer account (depicted as a locked vault with a green checkmark).

Arrows would connect each layer, visually demonstrating the enhanced protection provided by the integration of Inauth’s technology.

Outcome Summary

The American Express acquisition of Inauth represents a significant leap forward in mobile payment security. This isn’t just about patching vulnerabilities; it’s about proactively shaping the future of secure transactions. By integrating Inauth’s innovative technology, AmEx is signaling a commitment to protecting customer data and fostering trust in a digital age. While the long-term impact remains to be seen, this move undoubtedly positions AmEx as a leader in the evolving landscape of mobile financial security.

The question now is: how will competitors respond, and what innovative solutions will emerge as a result of this significant industry shake-up?

Query Resolution

What is Inauth’s specific technology?

Inauth’s technology likely focuses on areas like fraud detection, authentication, and data encryption tailored for mobile environments. The specifics are often kept confidential due to competitive reasons.

How much did American Express pay for Inauth?

The financial terms of the acquisition are typically not publicly disclosed immediately. This information might become available later through regulatory filings.

Will this acquisition affect my American Express account?

It’s likely to lead to improved security features over time, but immediate changes to your account are unlikely. AmEx will likely communicate any significant changes directly to customers.

What are the potential downsides of this acquisition?

Potential downsides could include integration challenges, unexpected costs, or unforeseen competition. However, a successful integration could significantly strengthen AmEx’s market position.