Apple Acquires Intels Smartphone Modem Business for 5G

Apple acquires Intel smartphone modem business for 5G – that headline shook the tech world! This massive move by Apple isn’t just about grabbing some tech; it’s a strategic power play in the rapidly evolving 5G landscape. It signals Apple’s ambition to control every aspect of its devices, from the silicon inside to the connectivity outside. This acquisition has huge implications for the future of iPhones, and the entire mobile industry, really.

Let’s dive into the details and explore what this means for consumers, competitors, and the future of 5G itself.

The deal, reportedly worth hundreds of millions, gives Apple access to Intel’s valuable intellectual property and engineering talent specializing in modem technology. This isn’t Apple’s first acquisition, of course, but the scale and strategic importance of this one are undeniable. It’s a bold step toward self-sufficiency and potentially a significant blow to Intel’s struggling mobile division, while simultaneously setting the stage for a potential long-term rivalry with Qualcomm, the current 5G market leader.

The long-term impact remains to be seen, but the immediate effect is certainly a ripple throughout the industry.

Apple’s Acquisition Strategy: Apple Acquires Intel Smartphone Modem Business For 5g

Apple’s acquisition of Intel’s smartphone modem business, while significant, is just one piece in a larger, long-term strategy of strategic acquisitions to bolster its core products and expand its technological capabilities. This approach isn’t new; Apple has a history of carefully selecting companies to integrate into its ecosystem, focusing on technology that complements its existing offerings or fills crucial gaps.Apple’s acquisition strategy typically centers around acquiring smaller, specialized technology companies, often those possessing niche expertise in hardware, software, or services.

This allows them to integrate innovative technologies directly into their products without the lengthy and resource-intensive process of in-house development. The company favors acquisitions that enhance its existing product lines, improve user experience, or address emerging technological trends. This approach minimizes risk by leveraging existing infrastructure and expertise while rapidly accelerating development in critical areas.

Comparison with Previous Acquisitions

The Intel modem acquisition is notable for its size, representing a significant investment compared to many previous acquisitions. While Apple has made larger acquisitions in the past (like Beats Electronics), the Intel deal directly addresses a core component of its flagship product line – the iPhone. Previous acquisitions, such as those of smaller companies focusing on specific technologies like image processing or audio technology, while strategically important, did not have the same direct impact on the core functionality of its primary revenue generator.

The strategic importance of this acquisition is therefore much higher than many previous smaller-scale acquisitions. For instance, the acquisition of AuthenTec, a fingerprint sensor technology company, improved the security and user experience of the iPhone, but it didn’t impact the fundamental functionality of the device in the same way a 5G modem does.

Examples of Successful and Unsuccessful Acquisitions

Google’s acquisition of Android is a prime example of a wildly successful acquisition in the tech world. This acquisition gave Google a powerful foothold in the mobile operating system market, dramatically increasing its influence and market share. Conversely, Yahoo!’s acquisition of Tumblr, while initially appearing promising, ultimately failed to integrate successfully and resulted in significant losses. The key difference often lies in the ability of the acquiring company to effectively integrate the acquired technology, culture, and talent into its existing operations.

Successful acquisitions often involve a careful and strategic integration plan that respects the acquired company’s strengths while aligning its goals with the larger organization.

Hypothetical Alternative Acquisition Strategy

Instead of acquiring Intel’s modem business outright, Apple could have pursued a strategic partnership or a series of smaller acquisitions focused on specific aspects of 5G modem technology. This approach might have involved collaborating with several companies specializing in different components of 5G technology, such as radio frequency chips, antenna design, or software optimization. This alternative strategy would have involved a greater level of risk, requiring more coordination and potentially leading to longer development timelines.

However, it might have offered greater flexibility and allowed Apple to tailor the technology more precisely to its needs, potentially avoiding the integration challenges associated with a large-scale acquisition. Qualcomm’s extensive experience in the 5G modem market provides a relevant case study for the complexities and potential challenges of building a comprehensive 5G solution through internal development and strategic partnerships.

A collaborative approach, while potentially more complex, might have mitigated the risk of integrating a large, established entity like Intel’s modem division.

Intel’s Smartphone Modem Business

Intel’s foray into the smartphone modem market, while ambitious, ultimately proved to be a significant challenge. Their late entry and struggles to compete with established giants like Qualcomm resulted in the eventual sale of their modem business to Apple. This acquisition, however, highlights the underlying value of Intel’s technology and intellectual property, even amidst market difficulties.Intel’s Challenges in the Smartphone Modem MarketIntel faced numerous hurdles in its attempt to gain a foothold in the fiercely competitive smartphone modem market.

Their primary challenge was the dominance of Qualcomm, which held a significant market share and possessed a substantial technological lead. Qualcomm’s long-standing relationships with major smartphone manufacturers gave them a considerable advantage in securing design wins and securing early access to new technologies. Additionally, Intel’s late entry meant they had to play catch-up in terms of both technology and market penetration.

This required significant investment in R&D and marketing, which ultimately proved insufficient to overcome Qualcomm’s established position. Further compounding the problem was the intense competition from other players like MediaTek and Huawei, each with its own strengths and market presence. Intel struggled to differentiate its products effectively, leading to limited adoption by major smartphone manufacturers.Key Technologies and Intellectual Property Acquired by AppleThe acquisition included a wealth of intellectual property and cutting-edge technologies related to 5G modem development.

This encompassed various patents, software, and hardware designs crucial for the design and manufacture of advanced cellular modems. Specifically, Intel’s expertise in advanced signal processing, power management techniques, and antenna technologies were key assets. The acquired portfolio also included designs for advanced modem architectures, enabling high data rates and improved network connectivity. While specifics remain largely undisclosed due to the nature of the deal, industry experts believe the intellectual property encompassed crucial elements for future 5G and potentially 6G modem development.

Apple’s acquisition of Intel’s smartphone modem business for 5G is a huge move, solidifying their control over their hardware ecosystem. This kind of vertical integration makes me wonder about the future of app development, and how platforms like Domino are evolving to meet the demands of this changing landscape. Check out this great article on domino app dev the low code and pro code future to get a better understanding of the tech behind it all.

Ultimately, Apple’s move will likely influence the kinds of apps we see built in the coming years, especially with regards to 5G optimization.

The acquisition likely provided Apple with a significant boost in their internal modem development capabilities, reducing their reliance on external suppliers and enhancing their control over the design and manufacturing process.Comparison of Intel’s Modem Technology to CompetitorsCompared to Qualcomm, Intel’s modem technology was generally considered to be less mature and less efficient in terms of power consumption and performance.

Qualcomm’s Snapdragon modems were widely regarded as industry leaders, boasting superior performance and power efficiency. While Intel invested heavily in catching up, they never quite reached the same level of market penetration or technological advancement. Compared to other competitors like MediaTek, Intel’s market share was significantly smaller. MediaTek focused on a broader range of market segments, offering more competitive pricing and a wider range of modem options.

Huawei, before the US trade restrictions, also presented a significant challenge with their own competitive modem solutions. Intel’s technology, however, did possess some unique features, particularly in areas like specific signal processing algorithms, but these were not enough to offset the overall advantages held by their competitors.Timeline of Intel’s Involvement in the Smartphone Modem Market

Intel’s Smartphone Modem Timeline

Intel’s journey in the smartphone modem market, while ultimately short-lived in terms of significant market impact, was marked by both ambitious investments and considerable setbacks. Understanding this timeline helps contextualize the reasons behind Apple’s acquisition.

- Early 2010s: Initial investment in R&D and acquisition of smaller modem companies to build expertise and technology.

- Mid-2010s: Launch of initial modem products, facing challenges in securing design wins with major smartphone manufacturers.

- Late 2010s: Increased investment in 5G technology, facing ongoing competition and challenges in achieving market share.

- 2019: Announcement of the cessation of the development and sale of 5G smartphone modems, and the subsequent sale of the business to Apple.

Impact on the 5G Landscape

Apple’s acquisition of Intel’s smartphone modem business sent ripples through the 5G landscape, significantly altering the competitive dynamics and potentially reshaping the future of mobile connectivity. This move, while seemingly focused on securing Apple’s 5G future, has broader implications for the entire industry, impacting both consumers and other technology players.The acquisition’s immediate impact is a reduction in the number of major players in the 5G modem market.

This consolidation could lead to less competition in the short term, potentially affecting pricing and innovation. However, the long-term effects are less certain and depend heavily on Apple’s strategic direction.

Apple’s Enhanced Competitive Position

The most obvious benefit for Apple is increased control over its 5G technology. Previously reliant on external suppliers, Apple now possesses the capability to design and manufacture its own modems, potentially leading to better integration with its hardware and software, improved performance, and enhanced power efficiency. This vertical integration mirrors Apple’s strategy in other areas, such as processors, and allows for tighter optimization across its product ecosystem.

This could translate to faster data speeds, longer battery life, and improved network performance in future iPhones and other Apple devices. Furthermore, it grants Apple a significant advantage in negotiating terms with cellular carriers.

Influence on Future 5G Technology Development

Apple’s acquisition is likely to accelerate the development of specific 5G technologies tailored to its needs. We can expect to see innovations in areas like power management, antenna design, and software integration. This focused development could lead to advancements that benefit Apple’s products first, but eventually could influence broader industry trends. For example, Apple might prioritize specific 5G frequency bands or develop novel modem architectures that others later adopt.

Think of it like how Apple’s early adoption of certain technologies in its processors has, over time, become industry standard.

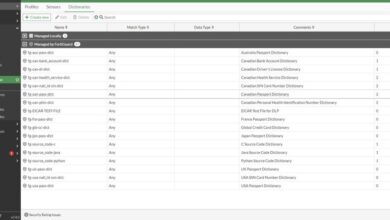

Market Share Comparison of Major 5G Modem Providers

Before the acquisition, the 5G modem market was dominated by Qualcomm, with a significant market share. Other players, including Intel (before the acquisition) and MediaTek, held smaller but still important portions of the market. The acquisition significantly altered this landscape, with Apple’s new in-house modem division becoming a major player. Predicting precise market share percentages is difficult without internal Apple data, but a reasonable estimate is possible based on public information and industry analysis.

The following table provides a simplified comparison, acknowledging the inherent uncertainties:

| Modem Provider | Approximate Market Share Before Acquisition (%) | Approximate Market Share After Acquisition (%) | Notes |

|---|---|---|---|

| Qualcomm | 60-70 | 50-60 | Likely experienced a decrease due to Apple’s internal production |

| MediaTek | 15-20 | 15-20 | Likely remained relatively stable |

| Intel | 5-10 | 0 | Completely absorbed by Apple |

| Apple | 0 | 10-15 | New entrant based on acquired Intel assets |

Financial Implications

Apple’s acquisition of Intel’s smartphone modem business carries significant financial implications for both companies. The deal’s success hinges on several factors, including the ultimate cost, the integration process, and the long-term impact on Apple’s product strategy and market position. Understanding these financial aspects is crucial for assessing the overall strategic value of the acquisition.The purchase price itself remains undisclosed, leading to speculation about its valuation.

Analysts have offered various estimates, attempting to reconcile the price with the perceived value of Intel’s modem technology, intellectual property, and engineering talent. A high purchase price could strain Apple’s resources, potentially impacting other investments or slowing down innovation in other areas. Conversely, a low price might signal that Intel was eager to divest this underperforming unit, presenting a potentially lucrative opportunity for Apple.

Purchase Price and Valuation

Determining the fair market value of Intel’s modem business is complex. It involved assessing the value of existing patents, ongoing research and development efforts, the talent pool acquired, and the potential future revenue streams. The lack of transparency around the actual purchase price makes definitive analysis difficult. However, we can compare it to other similar acquisitions in the semiconductor industry to gain some perspective.

For instance, the acquisition of smaller semiconductor firms often trades at multiples of revenue or book value, reflecting the strategic value of the acquired technology. The eventual revelation of the price, coupled with a post-acquisition performance analysis, will provide a more accurate picture of the deal’s financial success.

Impact on Apple’s Financial Statements

The acquisition will undoubtedly impact Apple’s financial statements, both in the short term and long term. In the short term, we can expect to see increased capital expenditures and potentially some acquisition-related expenses, such as legal and integration costs. These will likely reduce short-term profitability. In the long term, however, Apple anticipates increased revenue from its own 5G-enabled devices, assuming successful integration and market adoption.

The amortization of acquired intangible assets (like patents) will also affect Apple’s balance sheet and income statement. Successfully integrating the technology and achieving cost synergies will be crucial for long-term profitability. A failure to achieve these synergies could lead to write-downs and negatively impact long-term earnings.

Financial Risks and Rewards for Apple

The acquisition presents both substantial risks and rewards for Apple. Careful consideration of these factors is essential for assessing the overall strategic value of the deal.

- Short-Term Risks: High integration costs, potential for delays in 5G technology development, disruption to existing operations, and immediate impact on profitability due to acquisition-related expenses.

- Short-Term Rewards: Securing access to critical 5G technology, potential for enhanced bargaining power with suppliers, and potential for accelerated 5G product development.

- Long-Term Risks: Failure to integrate the technology successfully, increased competition in the 5G modem market, technological obsolescence of acquired assets, and the potential for regulatory hurdles.

- Long-Term Rewards: Increased market share in the 5G smartphone market, reduced reliance on third-party modem suppliers, enhanced control over the design and performance of its devices, and potential for increased profitability through cost savings and improved product offerings.

Future of Apple’s Modem Technology

Apple’s acquisition of Intel’s smartphone modem business marks a significant step towards greater control over its hardware ecosystem. This move isn’t just about securing 5G capabilities; it’s about long-term strategic advantage, allowing Apple to tailor modem technology precisely to its devices and future innovations. This vertical integration will likely lead to significant changes in how Apple designs and manufactures its products.Apple’s likely plan involves integrating Intel’s technology into its existing design and manufacturing processes, ultimately aiming for complete in-house modem development and production.

This will allow for tighter integration between the modem and other components, potentially leading to improved performance and energy efficiency. They will likely leverage Intel’s existing expertise and intellectual property, while simultaneously investing heavily in research and development to push the boundaries of modem technology. This includes not only enhancing 5G performance but also exploring future wireless communication standards beyond 5G, such as 6G.

Integration into Apple Products

The acquisition’s impact on future iPhones and other Apple devices will be multifaceted. We can expect more seamless integration of cellular connectivity with other features, leading to enhanced performance in areas like data speeds, latency, and power management. For example, improved power management could translate to longer battery life for iPhones, a feature highly valued by consumers. Future iPads and MacBooks might also benefit from faster cellular data speeds, particularly crucial for users relying on mobile internet connectivity.

The tighter integration could also lead to more efficient use of the device’s power, resulting in a longer-lasting battery and less heat generation.

Apple’s 5G Strategy Compared to Competitors, Apple acquires intel smartphone modem business for 5g

Apple’s approach to 5G differs significantly from its competitors. While some rivals rely heavily on external modem suppliers, Apple’s acquisition demonstrates a commitment to vertical integration and in-house expertise. This strategy allows for greater control over the entire design and manufacturing process, potentially leading to innovations that are uniquely tailored to Apple’s hardware and software ecosystem. Companies like Samsung, while also having in-house modem capabilities, might face challenges in matching Apple’s level of vertical integration and resulting optimization for its specific devices.

Qualcomm, a major player in the modem market, will likely see its market share affected, prompting increased competition and innovation across the industry.

Improved Device Performance and Energy Efficiency

Integrating Intel’s technology could significantly improve Apple’s devices in several key areas. For instance, Intel’s expertise in power efficiency could lead to more optimized power consumption within the modem, resulting in longer battery life for iPhones and other devices. Moreover, Intel’s advancements in signal processing could translate to improved cellular reception, especially in areas with weak signal strength.

This enhanced signal processing might also improve data throughput, resulting in faster download and upload speeds. Specifically, we might see improvements in the modem’s ability to handle complex signal interference, reducing dropped calls and improving overall network reliability. This could manifest as a noticeable improvement in data speeds even in congested network environments. For example, imagine a scenario where an iPhone 15, leveraging Intel’s technology, maintains a consistent 4G LTE connection at speeds comparable to 5G in an area with significant signal interference, where other devices experience frequent drops.

This level of optimization is a direct result of Apple’s vertical integration and fine-tuned control over hardware and software interactions.

Final Summary

Apple’s acquisition of Intel’s smartphone modem business for 5G is a game-changer. It’s a bold move that speaks volumes about Apple’s commitment to controlling its own destiny in the mobile market. While the long-term consequences are yet to unfold, one thing is certain: this deal will significantly reshape the 5G landscape and likely influence the design and functionality of future Apple devices for years to come.

It’s a fascinating story to follow, and I, for one, can’t wait to see how it all plays out.

Popular Questions

What specific 5G technologies did Intel possess that Apple acquired?

The exact details are confidential, but it likely includes patents, designs, and engineering expertise related to 5G modem chipsets, including specific technologies for signal processing and power efficiency.

Will this affect the price of future iPhones?

It’s too early to say definitively. While increased control over components

-could* lead to cost savings down the line, it’s also possible that R&D costs related to integrating the technology could offset any savings.

How long will it take Apple to fully integrate Intel’s technology?

Integrating complex technology like this takes time. We’re likely looking at a multi-year process, with gradual integration into future iPhone models.

What are the potential antitrust concerns?

Regulators will likely scrutinize the deal to ensure it doesn’t stifle competition in the 5G modem market. The outcome will depend on their assessment of the impact on the competitive landscape.