UK Banks Forcing Customers into Online Frauds?

Banks in the uk forcing customers to online frauds – UK Banks Forcing Customers into Online Frauds? It sounds unbelievable, right? But the reality is far more nuanced than a simple accusation. This isn’t about banks actively

-pushing* people into scams, but rather a complex interplay of inadequate security measures, sophisticated phishing techniques, and a lack of customer awareness. We’ll delve into the murky world of online banking fraud in the UK, exploring how vulnerable systems and unsuspecting individuals collide, resulting in devastating financial losses.

We’ll examine the types of fraud most prevalent, the demographics most at risk, and the effectiveness (or lack thereof) of current bank security protocols. We’ll also look at the role customers play in protecting themselves, the regulatory landscape, and how technological advancements both enhance and hinder the fight against online crime. Prepare for a deep dive into a crucial issue impacting millions.

The Prevalence of Online Fraud Targeting UK Bank Customers

Online banking fraud in the UK is a significant and growing problem, costing individuals and businesses millions of pounds annually. The sophisticated nature of these scams, coupled with the increasing reliance on digital banking, makes it a persistent threat requiring constant vigilance and proactive measures. This post examines the current landscape of online banking fraud in the UK, focusing on the types of fraud, the most vulnerable demographics, and the typical financial losses involved.

Types of Online Banking Fraud in the UK

Several types of online fraud plague UK bank customers. Phishing scams, where criminals impersonate legitimate organisations to steal login credentials, remain incredibly prevalent. Smishing, a similar tactic using text messages, is also widely used. Furthermore, authorised push payment (APP) fraud, where victims are tricked into transferring money directly to fraudsters, represents a substantial portion of losses. Other methods include vishing (fraudulent phone calls), malware infections leading to account takeover, and investment scams promising unrealistic returns.

These scams continuously evolve, making it crucial for consumers to stay informed.

Demographics Most Vulnerable to Online Banking Fraud

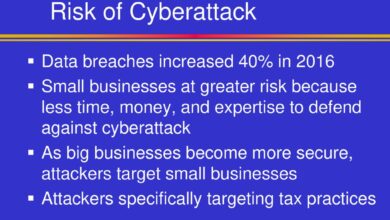

While anyone can fall victim to online fraud, certain demographics are disproportionately targeted. Older individuals, often less familiar with online security practices, are frequently victims of phishing and smishing campaigns. Those with limited digital literacy are also more vulnerable, as are individuals experiencing financial hardship, who may be more susceptible to get-rich-quick schemes. Businesses, particularly small and medium-sized enterprises (SMEs), are also prime targets, often lacking the robust security measures of larger corporations.

Frequency and Typical Losses of Online Banking Fraud

Precise figures on the frequency and average losses associated with specific fraud types are difficult to obtain due to variations in reporting and the constantly evolving nature of the scams. However, based on reports from UK Finance and Action Fraud, we can construct a general overview. Note that these figures are estimates and can vary significantly depending on the specific scam and the victim’s circumstances.

| Fraud Type | Target Demographic | Frequency (Illustrative) | Typical Loss (£) |

|---|---|---|---|

| Phishing | Older adults, those with low digital literacy | High | Varies greatly, can range from hundreds to thousands |

| Smishing | Older adults, those with low digital literacy | High | Similar to phishing, often hundreds to thousands |

| APP Fraud | Broad range, including businesses | High | Often significant, thousands or tens of thousands |

| Investment Scams | Individuals seeking high returns | Moderate | Can be extremely high, potentially reaching hundreds of thousands |

| Malware Infections | Individuals with less secure devices | Moderate | Varies, depending on the extent of the compromise |

Bank Security Measures and Their Effectiveness

UK banks employ a multi-layered approach to online security, aiming to protect customers from the ever-evolving threat of fraud. However, the effectiveness of these measures is a complex issue, with successes and failures highlighting the ongoing arms race between financial institutions and cybercriminals. This section will explore the current security landscape, examining both the strengths and weaknesses of existing systems.

The most common security measures implemented by UK banks include two-factor authentication (2FA), fraud detection software, and robust encryption protocols. 2FA adds an extra layer of security by requiring users to verify their identity through a second method, such as a one-time code sent via SMS or an authenticator app. Fraud detection software utilises sophisticated algorithms to analyse transaction patterns, identifying potentially fraudulent activity in real-time.

Encryption protects sensitive data transmitted between the customer and the bank, making it unreadable to unauthorised parties. These measures, while effective in many cases, are not foolproof.

Two-Factor Authentication Effectiveness

Two-factor authentication significantly reduces the risk of successful fraudulent transactions. By requiring a second verification step, even if a criminal obtains login credentials, they are unlikely to access the account without the second factor. However, vulnerabilities exist. SIM swapping, where criminals convince a mobile provider to transfer a victim’s phone number to a SIM card they control, can bypass SMS-based 2FA.

Similarly, sophisticated phishing attacks can trick users into revealing their 2FA codes. The effectiveness of 2FA depends heavily on its implementation and the user’s awareness of potential threats.

Fraud Detection Software Capabilities

Fraud detection software plays a crucial role in identifying and preventing fraudulent activity. These systems analyse numerous data points, including transaction amounts, locations, times, and patterns of spending, flagging suspicious activity for review. However, sophisticated fraudsters are constantly developing new techniques to evade detection. For example, they might use stolen identities and carefully planned transactions to blend in with legitimate activity, making it harder for algorithms to identify fraudulent behaviour.

The effectiveness of this software depends on the sophistication of the algorithms and the ability to adapt to evolving fraud tactics.

Instances of Security Measure Failure

While UK banks invest heavily in security, instances of fraud still occur. News reports frequently detail cases where customers have lost significant sums of money due to successful phishing scams or compromised accounts, despite the presence of security measures. For example, in 2022, several high-profile cases involved individuals being targeted through sophisticated phishing emails that mimicked legitimate bank communications, leading to successful account takeovers and substantial financial losses.

These instances highlight the limitations of current security systems and the need for ongoing improvements.

Hypothetical Improved Security System

An improved security system could incorporate several enhancements. Firstly, a more robust approach to biometric authentication, such as fingerprint or facial recognition, could be integrated with existing 2FA systems. Secondly, behavioural biometrics, which analyse typing patterns and mouse movements, could add another layer of protection, identifying unusual activity even if credentials are compromised. Thirdly, improved fraud detection algorithms, using machine learning and artificial intelligence, could learn and adapt to new fraud techniques more effectively.

Finally, proactive security measures, such as automatically flagging suspicious login attempts from unfamiliar locations or devices, could significantly reduce the success rate of attacks. This hypothetical system would represent a more proactive and adaptable approach to security, focusing on preventing fraud before it occurs rather than simply reacting to it.

Customer Responsibility and Awareness

Online banking fraud is a significant threat, and while banks bear responsibility for robust security, customers play a crucial role in protecting themselves. A proactive and informed approach is the best defence against sophisticated scams. Understanding the tactics employed by fraudsters and adopting preventative measures is paramount to safeguarding personal finances.The effectiveness of bank security measures is significantly impacted by the vigilance and awareness of their customers.

Even the most advanced security systems can be bypassed if customers fall prey to phishing emails or divulge sensitive information unknowingly. Therefore, a shared responsibility between banks and their customers is essential to combatting online fraud effectively.

Phishing Scams and Social Engineering Tactics

Phishing scams and social engineering tactics are prevalent methods used by fraudsters to gain access to customers’ online banking details. Phishing typically involves deceptive emails or text messages that mimic legitimate communications from banks, urging customers to click on malicious links or reveal personal information. Social engineering, on the other hand, uses psychological manipulation to trick individuals into divulging confidential data.

This could involve a fraudulent phone call where the perpetrator impersonates a bank employee or uses a sense of urgency to pressure the victim into acting quickly without thinking. These tactics exploit human psychology, preying on our trust and fear of missing out. For example, a common tactic is to create a sense of urgency, claiming an account has been compromised and immediate action is required to prevent further losses.

This often leads to individuals rushing into actions without verifying the legitimacy of the communication.

Best Practices for Protecting Against Online Fraud

It’s vital for customers to understand and implement practical steps to minimise their risk. This involves being vigilant about suspicious emails and messages, never clicking on links from unknown senders, and regularly reviewing bank statements for any unauthorised transactions. Furthermore, utilising strong, unique passwords for online banking accounts and enabling two-factor authentication wherever possible are crucial preventative measures.

Remembering that banks will never ask for passwords or PINs via email or text message is another vital piece of knowledge.

Actionable Steps to Minimise Risk

The following steps can significantly reduce the likelihood of becoming a victim of online banking fraud:

- Never click on links in unsolicited emails or text messages.

- Always type the bank’s website address directly into your browser’s address bar.

- Use strong, unique passwords for all online accounts, and consider using a password manager.

- Enable two-factor authentication (2FA) on all your online banking accounts.

- Regularly review your bank statements for any unauthorised transactions.

- Be wary of unsolicited phone calls or emails requesting personal information.

- Report any suspicious activity to your bank immediately.

- Educate yourself and your family about the latest online fraud techniques.

The Role of UK Financial Regulators: Banks In The Uk Forcing Customers To Online Frauds

The UK’s financial landscape relies heavily on robust regulatory oversight to protect consumers and maintain the stability of the financial system. Online banking fraud presents a significant challenge, demanding a proactive and effective regulatory response. The Financial Conduct Authority (FCA) plays a central role in this, alongside other relevant bodies, in setting standards, enforcing rules, and taking action against those who fail to meet their obligations.The Financial Conduct Authority (FCA) is the primary regulator responsible for protecting consumers and ensuring the integrity of the UK financial services market.

Its mandate extends to banks, building societies, and other financial institutions, covering a wide range of activities, including online banking services. The FCA sets rules and guidelines aimed at preventing and mitigating online banking fraud, focusing on both the security measures implemented by financial institutions and the level of consumer protection offered. Other relevant regulators include the Prudential Regulation Authority (PRA), which focuses on the financial stability of banks and other regulated entities, and the Information Commissioner’s Office (ICO), which addresses data protection issues related to online banking.

The collaborative efforts of these regulatory bodies are crucial in establishing a comprehensive framework for combating online banking fraud.

FCA Regulations and Guidelines for Online Banking Security

The FCA has established various regulations and guidelines to protect consumers from online banking fraud. These include requirements for banks to implement robust security measures, such as strong customer authentication, fraud detection systems, and clear procedures for reporting and handling fraud incidents. The FCA’s guidance emphasizes the importance of clear and concise communication with customers regarding online security risks and best practices.

The regulations also address the responsibilities of banks in promptly investigating and remedying fraud incidents, compensating victims where appropriate, and reporting suspicious activity to the relevant authorities. Compliance with these regulations is essential for banks to maintain their authorization and avoid penalties. Failure to comply can lead to significant financial penalties and reputational damage.

Enforcement of Regulations and Effectiveness

The FCA employs various methods to enforce its regulations, including on-site inspections, thematic reviews, and investigations into specific complaints or suspected breaches. The effectiveness of these enforcement actions is subject to ongoing evaluation and debate. While the FCA has taken action against banks for failures in protecting customers from online fraud, the scale and impact of these actions remain a topic of discussion.

The FCA publishes regular reports and updates on its enforcement activities, providing insights into the types of breaches identified, the actions taken, and the outcomes achieved. These reports offer valuable information for understanding the effectiveness of regulatory oversight in combating online banking fraud. Measuring the true effectiveness is challenging, however, as the nature of fraud is constantly evolving, and the full extent of fraudulent activity is often unknown.

Examples of Regulatory Actions Against Banks, Banks in the uk forcing customers to online frauds

Several examples exist of regulatory actions taken against UK banks for failings related to online banking fraud. While specific details of cases are often confidential due to commercial sensitivity and ongoing legal processes, the FCA’s public statements and reports frequently highlight instances where banks have been fined for inadequate security measures or poor handling of fraud complaints. For instance, cases involving failures to implement adequate customer authentication protocols, resulting in significant customer losses, have led to substantial fines.

Other instances involve inadequate fraud detection systems or delays in investigating and resolving fraud incidents, leading to regulatory action. These cases demonstrate the FCA’s commitment to holding banks accountable for their role in protecting customers from online fraud. The penalties imposed aim to deter future failings and incentivize banks to invest in robust security measures and customer protection.

The Impact of Technological Advancements

The rapid evolution of technology is a double-edged sword in the fight against online banking fraud. While it offers powerful tools for prevention and detection, it also creates new avenues for sophisticated attacks. Understanding this complex interplay is crucial for both banks and customers to navigate the increasingly digital landscape of financial transactions.Technological advancements significantly impact both the prevention and perpetration of online banking fraud.

Artificial intelligence (AI) and biometrics, for example, offer enhanced security measures, but simultaneously, cybercriminals leverage these same technologies to refine their fraudulent activities. This creates a continuous arms race between security providers and fraudsters.

It’s infuriating how UK banks are pushing customers towards online banking, leaving many vulnerable to sophisticated scams. The sheer speed at which these attacks evolve highlights the need for robust, rapidly deployable security solutions. Learning more about faster development methods, like those discussed in this article on domino app dev the low code and pro code future , could help financial institutions build better defenses against fraud.

Ultimately, better tech is crucial to protect customers from these increasingly prevalent online banking heists.

AI and Machine Learning in Fraud Detection

AI-powered systems analyze vast datasets of transactions in real-time, identifying patterns and anomalies indicative of fraudulent activity. This allows banks to flag suspicious transactions instantly and potentially prevent losses before they occur. Machine learning algorithms continuously adapt and improve their accuracy as they are exposed to new data, making them more effective at detecting increasingly complex fraud schemes. For example, an AI system might identify a series of small, seemingly innocuous transactions that, when aggregated, reveal a larger pattern consistent with account takeover.

Conversely, AI is also used by fraudsters to create more convincing phishing emails or generate synthetic identities to open fraudulent accounts.

Biometric Authentication

Biometric authentication methods, such as fingerprint scanning, facial recognition, and voice recognition, offer a more secure alternative to traditional passwords. These technologies verify a user’s identity based on unique biological characteristics, making it significantly harder for fraudsters to gain unauthorized access to accounts. However, biometric data itself can become a target for theft. Sophisticated deepfakes, for example, can be used to bypass biometric systems, highlighting a critical vulnerability.

Enhanced Security Measures Through Technology

Advancements in encryption technology and blockchain offer stronger protection against data breaches and unauthorized access. Multi-factor authentication (MFA), often incorporating biometric elements, adds an extra layer of security, significantly reducing the risk of successful attacks. Real-time transaction monitoring systems, coupled with AI-driven anomaly detection, provide immediate alerts to potential fraud, enabling rapid intervention.

Technological Vulnerabilities

While new technologies enhance security, they also introduce new vulnerabilities. The reliance on complex algorithms and vast datasets creates potential points of failure. Data breaches targeting biometric databases, for instance, could compromise the security of millions of accounts. Furthermore, the sophistication of AI-powered attacks makes it increasingly challenging for security systems to keep pace. Zero-day exploits, where vulnerabilities are unknown to developers, pose a significant threat.

The Interplay Between Technology and Online Banking Fraud: A Visual Representation

Imagine a dynamic, constantly shifting landscape. On one side, we have a fortified castle representing robust bank security, with walls built from layers of technology: AI-powered surveillance systems (represented as radar), strong encryption (represented as impenetrable walls), and biometric authentication (represented as a complex gate system). On the other side, a group of agile attackers, representing fraudsters, continuously probe the castle’s defenses.

They utilize advanced tools (represented as sophisticated siege weapons – AI-powered phishing emails, deepfakes, and malware) to breach the security. The landscape itself represents the constantly evolving technological environment, with new technologies adding new layers of defense (e.g., blockchain as a new section of the wall) and attackers developing new weapons in response. The visual emphasizes the ongoing arms race and the need for continuous adaptation and improvement in both security measures and fraud detection strategies.

Case Studies of High-Profile Fraud Incidents

Online banking fraud in the UK has resulted in significant financial losses and reputational damage for both banks and customers. Examining specific high-profile cases reveals recurring patterns, highlighting vulnerabilities in banking systems and customer practices. Understanding these incidents is crucial for improving security measures and raising public awareness.

Analysis of the Tesco Bank Fraud Incident

Tesco Bank experienced a significant data breach in November 2016, affecting approximately 9,000 customers. Fraudsters gained access to customer accounts and stole a total of £2.5 million. The bank’s failure to adequately secure customer data was a major contributing factor. Customers were left vulnerable due to insufficient security protocols and a lack of timely notification of the breach.

Tesco Bank responded by reimbursing all affected customers and implementing enhanced security measures. However, the incident damaged the bank’s reputation and highlighted the potential consequences of inadequate cybersecurity.

The 2018 NatWest Phishing Scam

In 2018, NatWest customers fell victim to a sophisticated phishing scam. Fraudsters sent convincing emails appearing to be from the bank, prompting customers to reveal their login details. This resulted in significant financial losses for a number of individuals. The contributing factors included the sophistication of the phishing emails and the vulnerability of some customers to social engineering tactics.

NatWest responded by issuing warnings to customers and improving its fraud detection systems. The case underscores the importance of customer education in recognizing and avoiding phishing attempts.

Table of High-Profile UK Banking Fraud Incidents

| Case Name | Date | Description | Outcome |

|---|---|---|---|

| Tesco Bank Data Breach | November 2016 | Fraudsters gained access to customer accounts, stealing £2.5 million. The breach highlighted vulnerabilities in the bank’s security systems. | Tesco Bank reimbursed all affected customers and implemented enhanced security measures. |

| NatWest Phishing Scam | 2018 | Sophisticated phishing emails tricked customers into revealing login details, resulting in financial losses. | NatWest issued warnings and improved fraud detection systems. |

| Barclays SIM Swap Fraud | Various dates (ongoing issue) | Criminals used SIM swap fraud to gain access to customers’ mobile banking apps, resulting in significant financial losses. This highlights the vulnerability of relying solely on mobile phone verification. | Barclays has implemented enhanced security measures, but the issue continues to affect customers. This emphasizes the ongoing challenge of adapting to evolving fraud techniques. |

Summary

The fight against online banking fraud in the UK is a continuous battle, a complex game of cat and mouse between criminals and financial institutions. While banks bear a significant responsibility for robust security, customer vigilance and awareness are equally crucial. Understanding the tactics employed by fraudsters, coupled with the adoption of best practices and the ongoing evolution of security technology, are key to minimizing risk.

Ultimately, a collaborative approach – involving banks, regulators, and individuals – is the only way to truly safeguard against this pervasive threat. Let’s stay informed and protect ourselves.

Answers to Common Questions

What are some common signs of a phishing email?

Suspicious links, urgent requests for personal information, grammatical errors, unfamiliar sender addresses, and requests to update banking details outside of official channels are all red flags.

What should I do if I think I’ve been a victim of online banking fraud?

Immediately contact your bank and report the incident. Then, report it to Action Fraud (the UK’s national fraud and cybercrime reporting centre).

Are all UK banks equally vulnerable to online fraud?

While all banks are potential targets, their security measures and responses to fraud vary. Some have stronger security protocols and better fraud detection systems than others.

How can I improve my own online banking security?

Use strong, unique passwords, enable two-factor authentication, regularly review your account statements, be cautious of suspicious emails and links, and keep your software updated.