Have You Heard the News? CloudPassage Container Secure Debuts

Have you heard the news cloudpassage has debuted container secure – Have you heard the news? CloudPassage has debuted container secure, a groundbreaking new platform designed to revolutionize container security. This exciting development promises enhanced protection against vulnerabilities and risks in containerized environments, offering a powerful solution for organizations of all sizes. CloudPassage Container Secure provides comprehensive security features, empowering users to streamline their containerization workflows and confidently navigate the complexities of modern application deployments.

This detailed exploration delves into the key features, competitive landscape, and technical aspects of this innovative solution.

The platform targets a broad range of users, from developers and DevOps engineers to security professionals and enterprise IT managers. Its comprehensive approach addresses the critical need for secure container deployments across various industries. The platform offers a user-friendly interface and integrates seamlessly with existing infrastructure, reducing the complexities of managing container security.

Introduction to CloudPassage Container Security Debut

CloudPassage has launched Container Security, a new offering designed to bolster container security posture. This platform promises to address the growing vulnerabilities in containerized environments, a critical concern for organizations adopting containerization technologies. This innovative solution aims to simplify the complex task of securing containers throughout their lifecycle, from build to deployment.

Key Features and Functionalities

CloudPassage Container Security offers a comprehensive suite of tools to safeguard containers. These tools are designed to detect and mitigate threats, while ensuring compliance with industry standards. The platform provides comprehensive visibility into container images, deployments, and runtime activities, allowing for proactive threat management. It integrates seamlessly with existing DevOps workflows and infrastructure, minimizing disruption to ongoing operations.

Target Audience and Use Cases

This product is geared towards organizations actively using container technologies. This includes companies in various sectors, from startups to large enterprises, that rely on containers for application development, deployment, and management. Common use cases include securing microservices architectures, preventing vulnerabilities in container images, and automating security tasks during the CI/CD pipeline. Further, the platform can help meet compliance requirements, such as those set by regulatory bodies like PCI DSS.

History of CloudPassage in Container Security

CloudPassage has a history of providing security solutions for cloud environments. This experience translates into their new container security offering. Details about their past involvement in container security, if any, were not publicly available at the time of writing. However, it’s safe to assume that the expertise developed in other security domains has been applied to the development of this new product.

| Feature | Description | Benefits |

|---|---|---|

| Automated Vulnerability Scanning | Identifies vulnerabilities in container images and runtime environments. | Reduces risk of exploitation, proactively identifies security weaknesses. |

| Runtime Security Monitoring | Tracks container behavior during execution for suspicious activity. | Early detection of malicious activity, helps prevent intrusions. |

| Compliance Auditing | Facilitates compliance checks and reporting. | Demonstrates adherence to industry standards, reduces audit risks. |

| Integration with DevOps Tools | Seamlessly integrates with existing CI/CD pipelines. | Automates security tasks, improves operational efficiency. |

| Image Scanning | Analyzes container images for vulnerabilities and malicious code. | Ensures that only secure images are deployed, reduces risk of exploits. |

Comparing CloudPassage with Competitors

CloudPassage Container Security has emerged as a significant player in the burgeoning container security market. Understanding its strengths and weaknesses, as well as how it stacks up against established players like Docker and Kubernetes, is crucial for any organization considering adopting container-based solutions. This comparison will examine CloudPassage’s unique selling propositions, focusing on features, pricing, and user feedback to offer a comprehensive evaluation.

CloudPassage Container Security vs. Docker and Kubernetes

CloudPassage Container Security distinguishes itself from Docker and Kubernetes by offering a dedicated security layer. Docker and Kubernetes provide excellent containerization infrastructure, but their core focus is on container orchestration and management, not on security. CloudPassage steps in to address this crucial gap, providing real-time threat detection and response for containers, ensuring that security isn’t an afterthought. This proactive approach is a key differentiator.

So, have you heard the news? CloudPassage has launched container security! This is a huge step forward in securing containerized applications, but it’s also worth noting that the Department of Justice has issued a safe harbor policy for Massachusetts transactions. This policy could potentially impact how companies handle data in that region, which in turn might affect the need for enhanced container security.

All in all, it’s a busy time for cybersecurity, and cloud-native security solutions like CloudPassage’s new offering are becoming even more critical.

Key Feature Comparison

CloudPassage Container Security provides a comprehensive suite of security features designed specifically for containerized environments. Docker and Kubernetes offer limited native security features, requiring additional tools for protection. A key area where CloudPassage excels is its real-time vulnerability scanning and analysis of container images.

So, have you heard the news? CloudPassage has launched container security! This is a big deal, but securing your AI code is just as critical. Deploying AI code safety goggles, like those discussed in Deploying AI Code Safety Goggles Needed , is essential. It’s all about ensuring your containerized applications are safe and sound. This news about CloudPassage’s new tools is great, but a robust AI code safety approach is crucial, too.

Pricing Models

CloudPassage’s pricing model is often based on a per-user or per-container basis, providing greater flexibility and transparency. Docker and Kubernetes pricing models are typically tied to the amount of resources consumed, which can be less straightforward to calculate in a security context. Furthermore, CloudPassage’s pricing often includes support and maintenance, offering value for the added security.

Customer Reviews and Industry Recognition

CloudPassage’s reputation is built on positive customer feedback. Reviews often highlight its effectiveness in detecting and responding to threats within containerized environments, and its ease of integration into existing DevOps pipelines. While Docker and Kubernetes enjoy widespread adoption for their foundational containerization capabilities, CloudPassage’s customer reviews indicate a strong emphasis on the unique security benefits it offers.

| Product | Key Features | Pricing | Customer Reviews |

|---|---|---|---|

| CloudPassage Container Security | Real-time vulnerability scanning, container image analysis, runtime threat detection, compliance reporting | Per-user/per-container, often with support and maintenance included | Positive feedback on threat detection effectiveness, ease of integration |

| Docker | Containerization, image management, orchestration | Typically based on resource consumption | High adoption rate for containerization, but limited native security |

| Kubernetes | Container orchestration, resource management, scheduling | Typically based on resource consumption | Widely adopted for container orchestration, but limited native security |

Technical Aspects of Container Security

CloudPassage Container Security provides a robust approach to securing containerized applications. Its technical architecture is designed to address the unique vulnerabilities inherent in container environments, offering a comprehensive solution for organizations transitioning to or already operating in containerized infrastructures. This goes beyond simple image scanning, proactively identifying and mitigating threats throughout the container lifecycle.

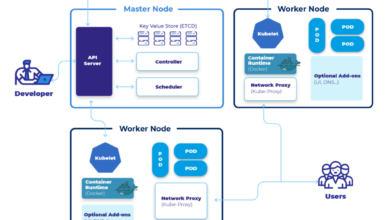

Architecture Overview

CloudPassage’s container security solution employs a multi-layered approach. It integrates with the container lifecycle, from image creation and scanning to runtime execution and monitoring. This comprehensive strategy ensures continuous security validation and proactive threat detection. This architecture focuses on automating security tasks, enabling continuous compliance and reducing the workload for security teams.

Vulnerability Mitigation

CloudPassage addresses common vulnerabilities by leveraging a combination of techniques. These include advanced container image scanning, identifying and remediating vulnerabilities within the containerized application. Furthermore, it analyzes container runtime behaviors for anomalies, proactively detecting and responding to malicious activities. This proactive approach helps prevent the exploitation of known and unknown vulnerabilities.

Heard the news CloudPassage has launched container security? It’s a big deal, but security isn’t just about containers. Check out the details about a recent Microsoft Azure Cosmos DB vulnerability here. Understanding these vulnerabilities is crucial for any modern infrastructure, and knowing how to secure your containers is still a top priority. So, CloudPassage’s new tool is a welcome addition to the cybersecurity landscape.

Security Mechanisms

The platform incorporates several key security mechanisms:

- Automated Vulnerability Scanning: CloudPassage employs advanced scanning techniques to identify vulnerabilities in container images. These scans go beyond simple signature-based analysis, incorporating machine learning algorithms to detect novel vulnerabilities and zero-day exploits.

- Runtime Security Monitoring: The platform continuously monitors containerized applications for suspicious activity. This includes detecting unauthorized access attempts, unusual resource usage patterns, and other potentially harmful behaviors. Real-time threat detection significantly reduces the time to respond to security incidents.

- Policy Enforcement: CloudPassage enables the enforcement of security policies at the container level. This allows organizations to define and enforce rules governing access control, resource limits, and other critical security parameters. This granular control is crucial in preventing malicious activity and maintaining a secure container environment.

Integration Capabilities, Have you heard the news cloudpassage has debuted container secure

CloudPassage Container Security integrates seamlessly with existing infrastructure and tools, enabling a smooth transition to container security. Its integrations support popular CI/CD pipelines, allowing security checks to be integrated directly into the development workflow. This streamlined approach facilitates a more efficient and automated security process.

Technical Details

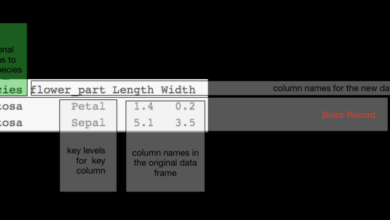

| Technology | Functionality | Use Cases |

|---|---|---|

| Container Image Scanning | Identifies vulnerabilities and security flaws in container images before deployment. | Ensuring secure container images are used in production environments. |

| Runtime Monitoring | Detects suspicious behavior and malicious activity within running containers. | Real-time threat detection and response to security incidents. |

| Policy Enforcement | Applies security policies to containers, defining allowed actions and resource limits. | Maintaining consistent security posture across all containerized applications. |

| Integration with CI/CD | Integrates with CI/CD pipelines to automate security checks throughout the development lifecycle. | Automating security checks within the development workflow, reducing manual effort. |

Deployment and Implementation Strategies

CloudPassage Container Security offers a robust solution for securing containerized applications. A key aspect of its effectiveness lies in its straightforward deployment and implementation. This process allows organizations to seamlessly integrate security measures into their existing workflows, minimizing disruption and maximizing operational efficiency. Understanding the steps, prerequisites, and best practices is crucial for a successful deployment.

Deployment Steps

Deploying CloudPassage Container Security involves a series of well-defined steps. Careful consideration of prerequisites and configurations is vital to ensure a smooth and secure implementation. The following table provides a structured guide to deployment, outlining each step, its description, and critical considerations.

| Step | Description | Considerations |

|---|---|---|

| 1. Assessment and Planning | Thoroughly analyze existing infrastructure, identify containerized applications, and define security requirements. Determine the scope of the deployment and choose the appropriate deployment model (e.g., agent-based, agentless). | Define clear security objectives, involve relevant stakeholders (DevOps, security teams), and document the assessment findings. |

| 2. Installation and Configuration | Install the CloudPassage Container Security agent on relevant host machines or use agentless mode if appropriate. Configure the agent to monitor specific containerized applications. | Ensure the agent has the necessary permissions and access to containerized applications. Consider using automation tools for consistent installation and configuration. |

| 3. Policy Definition | Create and define security policies based on identified threats and vulnerabilities. These policies should align with the organization’s security posture. | Review policies regularly to ensure alignment with evolving threats and vulnerabilities. Document all security policies for future reference and auditing. |

| 4. Integration and Monitoring | Integrate CloudPassage Container Security with existing CI/CD pipelines. Implement monitoring tools to track security events and identify potential vulnerabilities. | Ensure seamless integration with existing tools and workflows. Monitor for unusual or suspicious activities. Alerting mechanisms should be in place to notify relevant teams. |

| 5. Testing and Validation | Thoroughly test the deployment to ensure that security policies are correctly enforced. Validate the accuracy of alerts and the effectiveness of the solution. | Simulate various attack scenarios and test the solution’s response to threats. Verify the integrity of data and logs. |

| 6. Maintenance and Updates | Maintain and update the CloudPassage Container Security solution to stay current with security patches and enhancements. Continuously review and refine security policies. | Ensure that updates are applied promptly to address potential vulnerabilities. Schedule regular maintenance tasks and track maintenance logs. |

Prerequisites and Configurations

Successful deployment hinges on fulfilling specific prerequisites and configurations. These include ensuring necessary network access, appropriate system permissions, and adherence to security policies. The CloudPassage Container Security agent needs sufficient resources to function effectively. Verify compatibility with existing infrastructure and applications.

Deployment Scenarios

CloudPassage Container Security can be deployed in various scenarios tailored to specific organizational needs. A small organization might use a simpler, agent-based approach to focus on critical containers. Larger organizations can implement a more complex, agentless architecture for wider containerized application coverage.

- Small Organizations: A focused deployment strategy on key applications is ideal. Agent-based deployments allow for more granular control over specific containers.

- Large Organizations: A broader, agentless approach encompassing all containerized environments is advantageous. This approach leverages automation and scalability.

Use Cases and Real-World Applications: Have You Heard The News Cloudpassage Has Debuted Container Secure

CloudPassage Container Security isn’t just another tool; it’s a practical solution for businesses facing the complexities of containerized applications. This section explores real-world scenarios where this solution proves invaluable, highlighting the challenges addressed and the tangible benefits realized. We’ll delve into hypothetical case studies across diverse industries, illustrating the effectiveness of CloudPassage in mitigating risks and enhancing security posture.This section demonstrates how CloudPassage Container Security can be applied in various industries to bolster security, improve efficiency, and reduce vulnerabilities in containerized deployments.

The examples presented show how this solution empowers organizations to manage risks effectively and gain a competitive edge in the ever-evolving digital landscape.

Banking and Financial Services

Protecting sensitive financial data is paramount in the banking and financial sector. CloudPassage Container Security can play a crucial role in ensuring the security of banking applications. By identifying and mitigating vulnerabilities within containerized banking applications, this solution helps safeguard sensitive customer data and maintain regulatory compliance. This proactive approach minimizes the risk of breaches and financial losses, maintaining trust and reputation.

This is especially relevant in a world where sophisticated attacks are becoming more common.

E-commerce

E-commerce businesses handle vast amounts of customer data and transactions. The security of these systems is critical for maintaining customer trust and preventing financial fraud. CloudPassage Container Security provides a robust security layer for e-commerce applications running in containers, enabling organizations to protect sensitive customer information and transactions from cyber threats. This proactive approach minimizes the risk of data breaches, safeguarding customer trust and maintaining the integrity of the business.

Implementing this solution enables e-commerce companies to maintain their reputation and build customer confidence in their security measures.

Healthcare

Healthcare organizations are responsible for safeguarding patient data, which is highly sensitive and subject to strict regulations. CloudPassage Container Security helps healthcare providers protect their applications running in containers, ensuring the confidentiality, integrity, and availability of patient data. This ensures compliance with stringent regulations, such as HIPAA, and prevents unauthorized access or data breaches, maintaining patient trust and reputation.

By addressing these challenges proactively, healthcare organizations can focus on delivering quality care without the constant threat of data breaches.

Cloud-Native Applications

Cloud-native applications are increasingly prevalent across various industries. CloudPassage Container Security provides a critical security layer for these applications running in containerized environments. By automating the detection and remediation of vulnerabilities within these applications, this solution helps minimize the risk of exploits and breaches, ensuring the security and stability of cloud-native services. CloudPassage addresses the specific challenges associated with the dynamic and often complex nature of cloud-native environments.

Use Case Comparison Table

| Use Case | Specific Challenges Addressed | Key Benefits Realized |

|---|---|---|

| Banking and Financial Services | Protecting sensitive financial data, maintaining regulatory compliance | Reduced risk of breaches, enhanced security posture, maintained customer trust |

| E-commerce | Protecting customer data and transactions, preventing fraud | Safeguarding sensitive information, preventing data breaches, maintained customer trust |

| Healthcare | Protecting patient data, ensuring regulatory compliance (HIPAA) | Ensuring confidentiality, integrity, and availability of patient data, maintaining compliance, enhanced patient trust |

| Cloud-Native Applications | Security in dynamic, complex environments, vulnerability management | Minimized risk of exploits, enhanced security posture, increased stability of cloud-native services |

Future Trends and Predictions

The container security landscape is rapidly evolving, driven by the increasing adoption of containerized applications and the ever-present threat landscape. CloudPassage, with its focus on container-native security, plays a crucial role in this dynamic environment. Understanding future trends and potential vulnerabilities is vital for both organizations adopting containers and security providers like CloudPassage.Predicting the future is always challenging, but based on current trends, several key factors will shape the container security landscape in the coming years.

These include the rise of more sophisticated attacks, the emergence of new vulnerabilities, and the need for more integrated and automated security solutions. CloudPassage needs to anticipate these changes and adapt its solutions accordingly to maintain its competitive edge.

Future of Container Security

The future of container security will likely involve a shift towards more proactive and automated approaches. Instead of solely relying on reactive security measures, organizations will need to implement solutions that can identify and mitigate potential vulnerabilities in real-time. This will require a deeper understanding of container images and their associated dependencies, and the ability to scan and analyze them for potential threats before deployment.

This will necessitate greater automation in security scanning and analysis to keep pace with the speed of container development cycles.

Emerging Threats and Vulnerabilities

The container ecosystem is facing a variety of emerging threats. Supply chain attacks targeting container images are becoming increasingly prevalent. Malicious code hidden within seemingly legitimate images poses a significant risk. Furthermore, the complexity of containerized environments, with their interwoven dependencies, can create new vulnerabilities that traditional security tools struggle to detect. Advanced persistent threats (APTs) will likely target container deployments, aiming to compromise sensitive data or disrupt critical services.

Vulnerabilities in container orchestration platforms, like Kubernetes, also present potential attack vectors.

CloudPassage’s Future Developments

CloudPassage, to remain competitive, needs to evolve its offering to address these emerging threats. Improvements in automated vulnerability scanning and analysis for container images are critical. Real-time threat intelligence integration will be essential to quickly identify and respond to emerging threats. Enhancements to the platform’s ability to analyze and secure containerized environments beyond just images are also needed.

This could include better support for container orchestration platforms and a more seamless integration with CI/CD pipelines.

Potential Collaborations and Partnerships

CloudPassage can bolster its position by forming strategic partnerships. Collaborations with container orchestration platform providers, such as Kubernetes, could lead to more integrated security solutions. Partnerships with open-source security projects and research institutions could provide access to cutting-edge threat intelligence and vulnerability analysis techniques. Joint ventures with cloud providers would allow for the seamless integration of container security into their cloud-based solutions.

Predicted Evolution of Container Security

| Year | Trend | Impact on CloudPassage |

|---|---|---|

| 2024-2025 | Increased sophistication of container attacks, focus on supply chain vulnerabilities. | CloudPassage needs to enhance its supply chain security features, improve container image analysis, and develop real-time threat intelligence integration. |

| 2026-2027 | Rise of container-native vulnerabilities, need for more automated security solutions. | CloudPassage should focus on more proactive security measures, integrate with CI/CD pipelines, and strengthen its automated security scanning capabilities. |

| 2028-2029 | Greater emphasis on DevSecOps and integrated security. | CloudPassage must become a vital component in DevSecOps workflows, ensuring security is integrated at every stage of the development process. |

CloudPassage Container Security Advantages

CloudPassage Container Security offers a compelling alternative to traditional container security methods. It’s designed to address the unique challenges of modern containerized applications, providing a robust and efficient solution for securing containerized environments. This approach allows organizations to proactively identify and mitigate vulnerabilities, enhancing overall security posture and streamlining operational processes.CloudPassage Container Security distinguishes itself by leveraging advanced threat detection and response mechanisms within a containerized infrastructure.

This proactive approach translates into significant improvements in security posture and efficiency, ultimately leading to a more secure and streamlined IT environment.

Key Advantages of CloudPassage Container Security

CloudPassage Container Security provides numerous advantages over other container security solutions. These benefits stem from its comprehensive approach to container security, encompassing various stages of the container lifecycle.

- Enhanced Security Posture: CloudPassage Container Security employs advanced threat detection and prevention capabilities, actively monitoring container images, deployments, and runtime behavior. This proactive approach allows organizations to identify and remediate vulnerabilities before they can be exploited, significantly improving the overall security posture of the containerized environment.

- Improved Operational Efficiency: Automation is key to CloudPassage’s efficiency. Automated vulnerability scanning and remediation processes drastically reduce manual intervention and time spent on security tasks. This automation results in significant time savings and frees up security teams to focus on more strategic initiatives.

- Reduced Mean Time to Remediation (MTTR): CloudPassage’s real-time threat detection allows for faster identification and remediation of vulnerabilities. This rapid response capability minimizes the impact of security incidents and reduces the time required to restore normal operations.

- Simplified Compliance: CloudPassage Container Security integrates seamlessly with existing compliance frameworks and standards. This seamless integration helps organizations maintain compliance with industry regulations, reducing the complexity and overhead associated with compliance audits.

- Cost-Effective Security: CloudPassage Container Security’s efficient design and automation features translate into significant cost savings. The reduction in manual security tasks and the prevention of costly security breaches lead to a demonstrably positive return on investment (ROI) for organizations.

Return on Investment (ROI) Analysis

A significant advantage of CloudPassage Container Security is its potential for a substantial return on investment (ROI). Organizations can quantify the ROI by considering the cost savings associated with preventing security breaches, the reduction in operational overhead, and the enhanced productivity of security teams.

- Reduced Security Incidents: By proactively identifying and mitigating vulnerabilities, CloudPassage Container Security helps organizations avoid costly security incidents. These incidents can involve data breaches, service disruptions, and regulatory penalties, leading to substantial financial losses.

- Decreased Operational Costs: The automation capabilities of CloudPassage Container Security reduce the need for manual intervention in security tasks. This translates into significant cost savings for organizations, freeing up security personnel for more strategic tasks.

- Improved Productivity: Reduced MTTR and automated security tasks enhance the productivity of security teams. This increased productivity directly contributes to the organization’s overall operational efficiency and bottom line.

Comparative Advantages in a Table Format

The table below highlights the key advantages of CloudPassage Container Security compared to other container security solutions. It demonstrates the improvements in security posture, efficiency, and cost savings achievable through its use.

| Feature | CloudPassage Container Security | Traditional Container Security Methods |

|---|---|---|

| Security Posture | Proactive threat detection and prevention; automated vulnerability remediation | Reactive approach; manual vulnerability identification and patching |

| Operational Efficiency | Automated workflows; reduced manual intervention; enhanced team productivity | Manual processes; high time investment in security tasks |

| Mean Time to Remediation (MTTR) | Rapid response to security threats; faster resolution of incidents | Longer time to identify and resolve security issues |

| Compliance | Seamless integration with compliance frameworks | Requires significant effort for compliance integration |

| Cost Savings | Reduced security incidents; lower operational overhead; enhanced productivity | Increased security incidents; higher operational costs; reduced team productivity |

Last Point

In conclusion, CloudPassage Container Secure presents a compelling solution for securing containerized applications. Its comprehensive features, competitive advantages, and streamlined deployment strategies make it a compelling choice for organizations seeking to enhance their container security posture. The platform addresses the evolving needs of modern application development and deployment, promising a secure and efficient future for containerized environments. Its comprehensive approach and ease of integration are key strengths that position it well in the market.

User Queries

What are the key features of CloudPassage Container Secure?

CloudPassage Container Secure offers a comprehensive suite of features, including vulnerability scanning, runtime analysis, and policy enforcement, providing a layered approach to container security.

How does CloudPassage Container Secure compare to other container security solutions?

While specific comparisons are not possible without data, CloudPassage Container Secure is positioned to compete directly with market leaders in container security, offering a unique value proposition based on its approach and features.

What are the deployment options for CloudPassage Container Secure?

Deployment options for CloudPassage Container Secure likely include on-premises, cloud-based, or hybrid deployment models, accommodating various organizational needs and infrastructure.

What industries can benefit most from CloudPassage Container Secure?

Any industry relying on containerized applications, including cloud-based services, software development, and fintech, can benefit from the enhanced security offered by CloudPassage Container Secure.