Breaking Down E-commerce Fraud The Five Pillars

Breaking down e commerce fraud the five pillars of fraud – Breaking Down E-commerce Fraud: The Five Pillars – sounds intense, right? But trust me, understanding the five main types of online fraud isn’t as daunting as it seems. This isn’t just about dry statistics; it’s about protecting your business and your customers from the sneaky tactics of online criminals. We’ll dive into everything from account takeovers to the surprisingly common “friendly fraud,” equipping you with the knowledge to build a stronger defense against these digital threats.

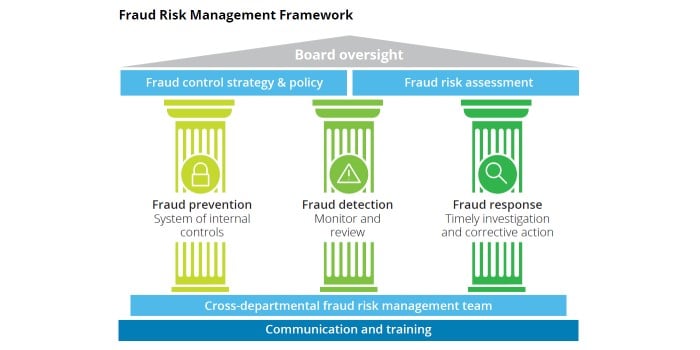

This post will break down the five key pillars of e-commerce fraud: account takeover, payment fraud, friendly fraud, chargeback fraud, and the often-overlooked nuances of defining e-commerce fraud itself. We’ll explore the methods used, the impact on businesses, and – most importantly – practical strategies to protect yourself. Think of it as your ultimate guide to navigating the sometimes murky waters of online security.

Defining E-commerce Fraud

E-commerce fraud is a significant challenge for online businesses, costing them billions annually. Understanding the various types of fraud is crucial for implementing effective prevention strategies. This post will delve into the five key pillars of e-commerce fraud, providing examples and outlining preventative measures.

These five pillars represent the core categories under which most e-commerce fraud schemes fall. They are interconnected and often overlap, making comprehensive fraud detection and prevention a complex task.

Account Takeover Fraud

Account takeover (ATO) fraud occurs when criminals gain unauthorized access to a customer’s online account. This allows them to make purchases, change personal information, or even drain the victim’s linked bank accounts. Methods include phishing scams, credential stuffing (using stolen credentials from other data breaches), and malware infections. The impact can be devastating for both the customer and the merchant, leading to financial losses, reputational damage, and legal repercussions.

Payment Fraud

Payment fraud encompasses various schemes aimed at making fraudulent transactions. This includes using stolen credit card information, creating counterfeit cards, or employing techniques like card-not-present (CNP) fraud. Methods involve acquiring stolen card details through data breaches, phishing, or skimming devices. The impact includes chargebacks for merchants, financial losses for consumers, and increased transaction processing fees.

Friendly Fraud

Friendly fraud, also known as buyer-initiated fraud, occurs when a customer disputes a legitimate charge, claiming they did not authorize the purchase. This can be done intentionally to receive a refund or unintentionally due to a forgotten purchase or a genuine misunderstanding. Methods include falsely claiming non-receipt of goods, unauthorized use of a card, or simply changing their mind after purchasing.

The impact is significant for merchants, leading to financial losses and increased operational costs associated with chargeback processing.

Return Fraud

Return fraud involves customers returning stolen or counterfeit goods for a refund, often using fraudulent receipts or labels. This can be organized through sophisticated schemes involving multiple individuals or simply opportunistic behavior by individual customers. Methods include purchasing items, returning different or damaged items, or using fake receipts. The impact includes significant financial losses for merchants, as well as increased logistical and administrative burdens.

Synthetic Identity Fraud

Synthetic identity fraud is a sophisticated type of fraud that involves combining real and fabricated personal information to create a false identity. This is used to open fraudulent accounts and make purchases without raising immediate suspicion. Methods involve using a combination of real Social Security numbers (or similar identification data) and fabricated personal details. The impact can be far-reaching and costly for both merchants and financial institutions, often taking years to detect and resolve.

| Fraud Type | Description | Methods Used | Prevention Strategies |

|---|---|---|---|

| Account Takeover Fraud | Unauthorized access to a customer’s online account. | Phishing, credential stuffing, malware. | Multi-factor authentication, strong password policies, account monitoring. |

| Payment Fraud | Fraudulent transactions using stolen or counterfeit payment information. | Stolen credit card details, counterfeit cards, CNP fraud. | Address verification, velocity checks, fraud screening tools. |

| Friendly Fraud | Disputing a legitimate charge by a customer. | False claims of non-receipt, unauthorized use. | Clear order confirmation, robust customer service, detailed order tracking. |

| Return Fraud | Returning stolen or counterfeit goods for a refund. | Using fake receipts, returning different items. | Strict return policies, verification of returned items, tracking numbers. |

| Synthetic Identity Fraud | Using a combination of real and fabricated information to create a false identity. | Combining real and fake personal data. | Advanced fraud detection systems, identity verification services. |

Account Takeover Fraud

Account takeover (ATO) fraud is a significant threat to e-commerce businesses and their customers. It involves malicious actors gaining unauthorized access to a legitimate user’s online account, often to make fraudulent purchases, steal personal information, or spread malware. The consequences can range from financial losses for both the business and the customer to severe reputational damage for the company.

Understanding the methods used and implementing robust security measures are crucial for mitigating this risk.Account Takeover methods often leverage vulnerabilities in security practices and human behavior. Criminals employ a range of techniques, from exploiting weak passwords to leveraging sophisticated social engineering tactics. The financial and personal data compromised can be used for identity theft, further expanding the damage beyond the initial account breach.

Common Methods of Account Takeover

Several methods are commonly employed in account takeover attacks. These include credential stuffing, phishing, malware infections, and exploiting vulnerabilities in websites or applications. Criminals often combine these techniques for maximum impact. For example, a phishing email might lure a user to a fake login page, collecting their credentials for later use in credential stuffing attacks against multiple websites.

Successful ATO often involves a combination of automated and manual techniques.

The Role of Phishing and Credential Stuffing

Phishing is a deceptive tactic where attackers impersonate legitimate entities (like banks or e-commerce sites) to trick users into revealing their login credentials. This is often done through cleverly crafted emails, text messages, or fake websites. Credential stuffing, on the other hand, involves using lists of stolen usernames and passwords obtained from data breaches to attempt logins on various websites.

These lists are frequently traded on the dark web. The combination of phishing to obtain initial credentials and credential stuffing to test them against numerous accounts is a highly effective and widely used method of account takeover. A successful phishing campaign can provide a large pool of credentials for subsequent credential stuffing attempts, maximizing the attacker’s chances of success.

Strategies for Protecting Customer Accounts

Protecting customer accounts requires a multi-layered approach. Implementing strong password policies, including password complexity requirements and encouraging the use of unique passwords for each account, is a fundamental step. Multi-factor authentication (MFA) adds an extra layer of security, requiring users to provide multiple forms of verification beyond just a password, significantly reducing the risk of unauthorized access. Regular security audits and penetration testing can identify and address vulnerabilities in website and application security.

Educating customers about phishing scams and safe online practices is also vital. This includes training users to recognize suspicious emails, links, and websites. Finally, implementing robust fraud detection systems that monitor account activity for suspicious patterns can help identify and prevent ATO attempts in real-time.

Account Takeover Attack Flowchart

Imagine a flowchart illustrating a typical account takeover attack using phishing and credential stuffing. The flowchart would start with the attacker crafting a phishing email designed to mimic a legitimate e-commerce platform. This email contains a malicious link leading to a fake login page. The user clicks the link, unknowingly entering their credentials into the attacker’s system. The attacker then uses these credentials in a credential stuffing attack across multiple websites, attempting to access accounts using the stolen username and password.

Understanding e-commerce fraud requires dissecting its core components – the five pillars of fraud. Building robust anti-fraud systems needs efficient development, and that’s where exploring the possibilities of domino app dev, the low-code and pro-code future , becomes crucial. These advancements could significantly streamline the creation of sophisticated fraud detection tools, ultimately strengthening our defenses against online financial crimes.

Returning to the five pillars, efficient development directly impacts our ability to effectively combat each one.

If successful, the attacker gains access to the victim’s account and can perform fraudulent actions. The flowchart would visually represent this sequence of events, highlighting the key steps in the attack and the points where security measures can be implemented to disrupt the process. A final stage would depict the attacker potentially using the compromised account for fraudulent purchases or data theft.

Payment Fraud: Breaking Down E Commerce Fraud The Five Pillars Of Fraud

Payment fraud represents a significant threat to e-commerce businesses, impacting profitability and damaging customer trust. It encompasses a wide range of deceptive activities designed to illegally obtain money or goods through online transactions. Understanding the various types of payment fraud and implementing robust preventative measures are crucial for maintaining a secure and successful online marketplace.Payment fraud is a multifaceted problem with several key vectors of attack.

Criminals leverage technological vulnerabilities and exploit human error to carry out their schemes. The financial losses associated with payment fraud can be substantial, leading to both direct financial losses and reputational damage for affected businesses. Understanding these various methods and the associated risks is essential for effective mitigation.

Credit Card Fraud

Credit card fraud remains a prevalent form of payment fraud in e-commerce. Fraudsters obtain credit card details through various means, including phishing scams, data breaches, and malware. They then use these stolen details to make unauthorized purchases online. The risks associated with credit card fraud include chargebacks, financial losses, and reputational damage. The liability for fraudulent transactions can vary depending on the specific circumstances and the card network rules.

For example, a business might be held liable for fraudulent transactions if they fail to implement adequate security measures.

ACH Fraud

ACH (Automated Clearing House) fraud involves unauthorized transfers of funds from a victim’s bank account. This type of fraud often targets businesses with weak security protocols or those that rely on outdated payment systems. The risks associated with ACH fraud include significant financial losses and potential legal repercussions. Criminals often use sophisticated techniques to disguise their activities, making detection and prevention challenging.

One example is the use of compromised business email addresses to initiate fraudulent ACH transfers.

Risks Associated with Various Payment Methods

Different payment methods carry varying levels of risk. Credit cards generally offer some level of buyer protection through chargeback mechanisms, but they are still susceptible to fraud. ACH transfers, while often less expensive for businesses, pose a higher risk due to the difficulty in reversing fraudulent transactions. Digital wallets, while convenient, can be vulnerable if security protocols are weak.

The risk also depends on the level of security implemented by the merchant and the payment processor. For instance, a business using strong authentication methods will have a lower risk than one that doesn’t.

Vulnerabilities in Online Payment Systems

Fraudsters exploit various vulnerabilities in online payment systems. These include weaknesses in website security, vulnerabilities in payment gateways, and lack of robust authentication processes. Insufficient data encryption, outdated software, and inadequate employee training can all contribute to increased risk. For example, a website with outdated SSL certificates is vulnerable to man-in-the-middle attacks, allowing fraudsters to intercept sensitive payment information.

Best Practices for Mitigating Payment Fraud Risks, Breaking down e commerce fraud the five pillars of fraud

Implementing robust security measures is crucial for mitigating payment fraud risks. This includes using strong encryption protocols, regularly updating software, and employing multi-factor authentication. Thorough employee training on security best practices is essential. Regular security audits and penetration testing can help identify and address vulnerabilities. Implementing fraud detection systems and utilizing real-time transaction monitoring can help detect and prevent fraudulent activities.

Additionally, adhering to industry best practices and regulatory compliance requirements is vital. For example, complying with PCI DSS standards is essential for businesses that process credit card payments.

Friendly Fraud

Friendly fraud, a sneaky type of e-commerce fraud, occurs when a customer intentionally initiates a chargeback or disputes a legitimate transaction. Unlike other forms of fraud, the perpetrator isn’t an external malicious actor; it’s the customer themselves. This creates a unique challenge for businesses, as it involves a breach of trust between the merchant and the consumer. The impact on businesses can be significant, leading to lost revenue, increased chargeback fees, and a damaged reputation.Friendly fraud is driven by various factors, often related to buyer’s remorse, confusion, or even deliberate attempts to exploit the chargeback system.

The consequences for businesses range from financial losses to operational inefficiencies as they grapple with investigating and resolving these disputes. Understanding the dynamics of friendly fraud is crucial for implementing effective prevention strategies.

Characteristics of Friendly Fraud

Friendly fraud is characterized by a customer’s deliberate action to dispute a transaction they knowingly authorized. This differs from cases of true fraud where a customer’s payment information is stolen or used without their consent. Key characteristics include the customer’s awareness of the purchase, followed by a later claim that the transaction was unauthorized or fraudulent. The customer might claim they didn’t receive the goods, that the product was faulty, or that the transaction was unauthorized.

This often involves a level of deception on the part of the customer.

Examples of Friendly Fraud Situations

Several scenarios illustrate how friendly fraud can manifest. For example, a customer might order an item, receive it, and then claim they never received it to get a refund. Another example involves a customer ordering multiple items, keeping one, and returning the rest, claiming the entire order was faulty. A more subtle example could be a customer purchasing a digital download, consuming the content, and then claiming a fraudulent transaction to obtain a refund.

These scenarios highlight the complexity and insidious nature of friendly fraud.

Strategies for Detecting and Preventing Friendly Fraud

Effective detection and prevention strategies are vital in mitigating the impact of friendly fraud. Implementing robust fraud detection systems that analyze transaction data, customer behavior, and shipping information is crucial. This includes monitoring patterns such as unusually high chargeback rates from specific customers or unusual purchase behaviors. Strong order confirmation processes, including email and SMS notifications, help verify that the customer authorized the purchase.

Clear return policies and straightforward dispute resolution processes can also help reduce the likelihood of friendly fraud claims.

Reducing the Likelihood of Friendly Fraud Claims

A multi-pronged approach is needed to minimize friendly fraud.

- Clear and Concise Communication: Provide detailed order confirmations, shipping updates, and clear return policies.

- Strong Customer Service: Address customer inquiries promptly and professionally to resolve issues before they escalate into disputes.

- Robust Order Tracking: Offer real-time tracking information to alleviate customer concerns about delivery.

- Secure Payment Gateways: Use secure payment gateways that comply with industry best practices to minimize the risk of unauthorized transactions.

- Fraud Detection Tools: Implement advanced fraud detection systems to identify suspicious transactions and patterns.

- Detailed Product Descriptions: Ensure accurate and detailed product descriptions to minimize misunderstandings and returns.

Chargeback Fraud

Chargeback fraud represents a significant threat to e-commerce businesses. It occurs when a customer initiates a chargeback dispute with their credit card company, claiming that a transaction was fraudulent, unauthorized, or otherwise not as described, even though the transaction was legitimate. This can lead to substantial financial losses and operational headaches for businesses. Understanding the mechanics of chargebacks and developing robust strategies to combat them is crucial for survival in the online marketplace.Chargeback procedures vary slightly depending on the card network (Visa, Mastercard, American Express, Discover), but the general process involves the customer contacting their bank to dispute a charge.

The bank then initiates a chargeback request with the merchant’s acquiring bank. The merchant then has a limited time window to respond with evidence supporting the legitimacy of the transaction. Failure to provide sufficient evidence often results in the merchant losing the dispute and being forced to refund the customer, plus potentially incurring additional fees.

The Chargeback Process and its Consequences

The chargeback process can be lengthy and complex, often involving multiple parties and considerable paperwork. The consequences for businesses can be severe, ranging from financial losses due to refunded payments and fees to reputational damage and increased processing costs. Repeated chargebacks can also lead to penalties from payment processors, potentially resulting in account suspension or termination. For example, a small business processing 100 transactions daily might experience a 1% chargeback rate, resulting in a loss of 1 transaction daily.

If the average transaction value is $50, this translates to a daily loss of $50, and $1500 per month. This quickly escalates with higher transaction volumes and higher average transaction values.

Building a Strong Case Against Fraudulent Chargebacks

Building a robust defense against fraudulent chargebacks requires meticulous record-keeping and a proactive approach. This involves gathering comprehensive evidence to support the legitimacy of the transaction. Crucial evidence includes a copy of the customer’s order confirmation, shipping confirmation, proof of delivery (tracking information), and digital signatures where applicable. Detailed transaction records, including timestamps, IP addresses, and billing/shipping addresses, are also vital.

Clear communication with the customer, documenting all attempts to resolve the issue before the chargeback is initiated, is also crucial. A well-documented response to a chargeback demonstrates a diligent effort to resolve the issue and significantly increases the chances of winning the dispute.

Best Practices for Managing Chargeback Disputes

Effective chargeback management requires a multi-pronged approach. Implementing robust fraud prevention measures, such as address verification system (AVS) and card verification value (CVV) checks, can significantly reduce the likelihood of fraudulent transactions. Proactive monitoring of chargeback rates and identifying patterns or trends can help pinpoint potential vulnerabilities in the system. Developing a clear and concise chargeback response process, ensuring timely responses within the stipulated timeframe, is crucial.

Furthermore, establishing a strong relationship with the payment processor and actively seeking their guidance on handling disputes can greatly improve the success rate in resolving chargebacks favorably. Regular training for staff on chargeback prevention and dispute resolution is also essential.

Documenting Transactions to Prevent Fraudulent Chargeback Claims

Meticulous record-keeping is paramount in preventing and combating chargeback fraud. Every transaction should be documented thoroughly, including detailed customer information, order details, payment information, and shipping information. Utilizing secure and reliable systems for storing and accessing this information is crucial. Implementing a robust audit trail for all transactions ensures that every step of the process is transparent and traceable.

This detailed documentation not only helps in defending against fraudulent chargebacks but also improves overall operational efficiency and provides valuable insights into customer behavior and potential fraud patterns. For instance, maintaining a secure database with timestamped records of each transaction, including customer IP addresses, billing and shipping addresses, and payment method details, will prove invaluable in defending against disputes.

Preventing E-commerce Fraud

E-commerce fraud is a significant threat to online businesses, impacting profitability and damaging brand reputation. A single, isolated security measure is insufficient to combat the ever-evolving tactics of fraudsters. Instead, a robust, multi-layered approach is crucial for effective fraud prevention. This strategy combines technological solutions, human expertise, and rigorous data analysis to create a comprehensive defense against fraudulent activities.Implementing a multi-layered fraud prevention strategy involves integrating various security technologies and processes to detect and mitigate risks at multiple points in the customer journey.

Each layer acts as a filter, identifying suspicious activities and escalating potential fraud cases for further review. This approach significantly reduces the likelihood of successful fraudulent transactions and minimizes financial losses.

Key Technologies and Tools for Fraud Prevention

A range of technologies plays a vital role in detecting and preventing e-commerce fraud. These tools work in conjunction to provide a comprehensive security net. The effectiveness of these technologies hinges on their ability to analyze vast amounts of data in real-time, identifying patterns and anomalies indicative of fraudulent behavior.

- Machine Learning (ML) and Artificial Intelligence (AI): These technologies analyze transaction data to identify patterns and predict fraudulent activity. ML algorithms continuously learn and adapt, improving their accuracy over time. For example, an ML model can identify unusual purchase behaviors, such as a sudden increase in order value or a change in shipping address, flagging them for review.

- Address Verification System (AVS) and Card Verification Value (CVV): These are basic but essential security measures that verify the cardholder’s address and the validity of the credit card. While not foolproof, they deter some fraudulent transactions.

- Device Fingerprinting: This technology identifies unique characteristics of a user’s device and browser, helping to detect attempts to use multiple accounts or devices for fraudulent purposes. Unusual device activity patterns can trigger alerts.

- Velocity Checks: Monitoring the frequency of transactions from a single IP address or account can reveal suspicious activity. A sudden surge in transactions might indicate a potential fraud attempt.

The Role of Human Review in Fraud Detection

While technology plays a crucial role in fraud prevention, human review remains an indispensable component. Technology can identify potential fraud, but human analysts are needed to assess the context and make informed decisions. This involves investigating flagged transactions, analyzing supporting documentation, and determining whether the activity is truly fraudulent.

Human review provides a critical layer of judgment and nuance that algorithms alone cannot replicate. It allows for the investigation of complex or ambiguous cases, ensuring accurate fraud detection and minimizing false positives.

Layered Security Model

A layered security model combines multiple security mechanisms to provide comprehensive protection. Each layer acts as a filter, reducing the number of fraudulent transactions that reach the next stage.

Layer 1: Prevention: This layer focuses on proactive measures to deter fraud, such as strong password requirements, multi-factor authentication (MFA), and secure payment gateways. This layer aims to make fraudulent activity more difficult to execute.

Layer 2: Detection: This layer employs technologies like machine learning and rule-based systems to identify suspicious transactions in real-time. Anomalies in transaction patterns or user behavior trigger alerts for further investigation.

Layer 3: Investigation: This layer involves human review of flagged transactions. Analysts assess the available evidence and determine whether a transaction is fraudulent. This stage may involve contacting the customer or verifying information with third-party sources.

Layer 4: Response: This layer involves taking action based on the investigation’s findings. This might include blocking fraudulent transactions, refunding payments, or taking legal action against perpetrators.

Layer 5: Monitoring and Adaptation: This layer involves continuous monitoring of fraud trends and adapting security measures accordingly. Regular reviews of security protocols and the implementation of new technologies ensure the system remains effective against evolving fraud techniques.

The Role of Data Analytics in Fraud Detection

E-commerce fraud is a significant threat, costing businesses billions annually. Effectively combating this requires more than just reactive measures; it demands proactive strategies built on robust data analysis. By leveraging the power of data analytics, businesses can identify patterns, predict fraudulent behavior, and ultimately minimize their losses. This involves analyzing vast amounts of transaction data to uncover subtle indicators of fraudulent activity that might otherwise go unnoticed.Data analytics plays a crucial role in identifying patterns and trends in fraudulent activity.

Understanding e-commerce fraud means tackling its five key pillars: account takeover, payment fraud, fake reviews, and more. Securing the cloud is crucial in this fight, and that’s where solutions like those discussed in this article on bitglass and the rise of cloud security posture management become vital. Strong cloud security directly impacts our ability to prevent many types of e-commerce fraud, ultimately strengthening the entire system against these attacks.

Sophisticated algorithms can sift through massive datasets, uncovering relationships and anomalies that human analysts might miss. This allows for the creation of predictive models that can flag potentially fraudulent transactions in real-time, preventing losses before they occur. This proactive approach is far more effective than relying solely on reactive measures, such as investigating fraudulent activity only after it has already taken place.

Data Points Indicative of Fraudulent Transactions

Several data points, when considered individually or in combination, can strongly suggest fraudulent activity. These indicators often involve inconsistencies or deviations from established customer behavior patterns. Analyzing these data points allows for the creation of risk profiles for individual customers and transactions. This enables businesses to prioritize investigations and allocate resources effectively.

Machine Learning Algorithms for Fraud Detection

Machine learning algorithms are particularly well-suited for detecting and preventing e-commerce fraud. These algorithms can learn from historical data, identifying complex patterns and relationships that are indicative of fraudulent behavior. For example, a machine learning model might learn to identify fraudulent transactions based on unusual purchase amounts, locations, or times of day. These models constantly adapt and improve as they are exposed to new data, making them increasingly effective over time.

One common example is using anomaly detection algorithms to identify transactions that deviate significantly from a customer’s typical spending habits. Another example is using a supervised learning algorithm trained on labeled data (fraudulent and non-fraudulent transactions) to classify new transactions with high accuracy.

Examples of Data Points and Their Indication of Fraudulent Activity

| Data Point | Indication of Fraudulent Activity |

|---|---|

| Unusual Purchase Amount | A significantly larger purchase than the customer’s typical spending habits. For example, a customer who usually spends $50 suddenly makes a $5,000 purchase. |

| Multiple Transactions in Quick Succession | A series of transactions made within a short period, suggesting potential account takeover or automated fraud attempts. |

| Shipping Address Discrepancy | The billing and shipping addresses do not match, or the shipping address is associated with multiple fraudulent transactions. |

| Unusual Location | A transaction originating from a location significantly different from the customer’s usual location, especially if combined with other suspicious activity. |

| Suspicious Email Address or IP Address | The email address or IP address associated with the transaction has been linked to previous fraudulent activities. |

| Use of Stolen Credit Card | The credit card used in the transaction has been reported as stolen or compromised. |

| High-Risk Device | The transaction was made from a device known to be associated with fraudulent activities. |

Final Wrap-Up

So, there you have it – a deep dive into the five pillars of e-commerce fraud. While the landscape of online threats is constantly evolving, understanding these core vulnerabilities is the first step towards building a robust security system. Remember, a multi-layered approach, combining technology and human vigilance, is your best defense. Don’t let fraudsters win; stay informed, stay vigilant, and stay protected!

FAQ Corner

What is the difference between friendly fraud and chargeback fraud?

Friendly fraud is when a customer intentionally disputes a legitimate charge, often after receiving and keeping the goods or services. Chargeback fraud is a broader term encompassing any fraudulent chargeback, whether friendly or not, often involving stolen credit cards or other unauthorized transactions.

Can I completely eliminate e-commerce fraud?

No, completely eliminating fraud is unrealistic. However, implementing strong security measures can significantly reduce your risk and mitigate potential losses.

What role does insurance play in e-commerce fraud protection?

E-commerce insurance can help cover losses from fraudulent transactions, but it’s crucial to have robust prevention measures in place first. Insurance is a safety net, not a primary defense.

How often should I review my fraud prevention strategies?

Regularly – at least quarterly – review and update your fraud prevention strategies to adapt to evolving threats and technological advancements.