How to Make KYC Compliance Less Difficult for Banks

How to make KYC compliance less difficult for banks is a critical issue for financial institutions today. Navigating the complexities of Know Your Customer regulations can be a significant hurdle, impacting both efficiency and customer experience. This post explores practical strategies to streamline KYC processes, enhance customer experience, and implement technological solutions while maintaining robust data security and regulatory compliance.

From simplifying onboarding to utilizing innovative technologies, we’ll cover all the key aspects to ease the burden of KYC compliance.

This comprehensive guide provides a step-by-step approach to addressing the challenges of KYC compliance. We will delve into the practicalities of streamlining processes, enhancing customer satisfaction, and implementing cutting-edge technologies to ensure smooth and secure operations. We’ll also discuss the critical aspect of data security and risk mitigation, ensuring that banks can navigate the evolving regulatory landscape while maintaining trust and customer confidence.

Streamlining KYC Processes

KYC (Know Your Customer) compliance is a critical aspect of banking operations, safeguarding financial institutions from illicit activities. However, traditional KYC processes often present significant challenges, hindering efficiency and potentially exposing banks to risks. This article delves into the complexities of current KYC compliance, proposes simplified onboarding procedures, and explores the role of technology in automating these processes.The current KYC compliance landscape is characterized by complex regulations and stringent verification requirements.

Banks face escalating costs, increased operational burdens, and extended processing times due to manual procedures, extensive documentation, and often inefficient verification systems. This frequently leads to customer dissatisfaction and a compromised customer experience.

Current KYC Compliance Challenges

Banks currently grapple with a multitude of challenges related to KYC compliance. These include maintaining compliance with evolving regulatory frameworks, adapting to diverse customer demographics and locations, managing high volumes of customer onboarding requests, and ensuring data security. Manual processes are slow and prone to errors, requiring significant human resources and leading to increased operational costs.

Simplified KYC Onboarding Procedure

A streamlined KYC onboarding process should be designed to balance security and efficiency. A five-step procedure is Artikeld below:

- Initial Customer Interaction: Collect essential customer information electronically through a secure online portal. This information should include basic details such as name, address, and contact information. The initial interaction should be focused on gathering information necessary for risk assessment and basic identity verification.

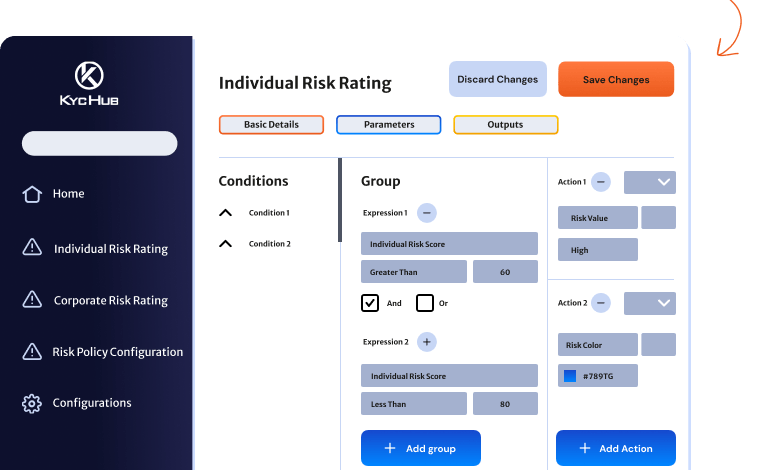

- Automated Risk Assessment: Employ sophisticated algorithms and data analytics to assess the risk profile of each customer. This automated risk assessment should consider factors like location, transaction history (if available), and other relevant data points.

- Phased Verification: Implement a tiered verification system based on risk assessment. Low-risk customers can be onboarded more quickly with simplified methods. High-risk customers require more thorough verification steps.

- Secure Document Verification: Utilize secure document verification tools and APIs to authenticate submitted documents. These tools should ensure data integrity and protect sensitive information. The use of secure document verification tools ensures compliance with regulatory standards.

- Customer Onboarding Confirmation: Provide clear confirmation of the onboarding status to the customer. This step should include an automated notification system, confirming the approval or request for additional information.

Technology for Automated KYC Verification

Technology plays a pivotal role in automating KYC verification tasks. Here are some examples:

- Automated Document Verification: Optical Character Recognition (OCR) software can automatically extract data from documents, reducing manual data entry and increasing accuracy.

- Facial Recognition: This technology can verify customer identity through biometric matching, ensuring that the customer is who they claim to be.

- AI-powered Risk Assessment: Advanced algorithms can analyze vast datasets to predict and flag potentially fraudulent or high-risk customers, proactively mitigating financial crime risks.

- Digital Identity Verification Platforms: These platforms streamline the entire verification process, providing a secure and efficient way to verify customer identities, reducing the reliance on manual processes.

KYC Verification Methods Comparison

Different verification methods have varying degrees of security and efficiency.

| Verification Method | Description | Security | Efficiency |

|---|---|---|---|

| Document Verification | Validating customer documents like passports, driver’s licenses, and utility bills | Moderate | Moderate |

| Identity Checks | Cross-referencing customer information with public databases | High | High |

| Biometric Verification | Using unique biological characteristics for identification | Very High | High |

Security Risks and Mitigation Strategies

Simplified KYC processes introduce potential security risks. These include the risk of fraudulent accounts, data breaches, and non-compliance with regulations. Mitigation strategies include:

- Robust Security Measures: Implementing strong authentication mechanisms, data encryption, and access controls.

- Continuous Monitoring: Actively monitoring accounts for suspicious activity and implementing real-time fraud detection systems.

- Employee Training: Educating employees on KYC compliance and fraud detection best practices.

- Regular Audits: Conducting regular audits of KYC processes to identify and address potential weaknesses.

Legal and Regulatory Considerations

Easing KYC procedures must adhere to existing regulations and legal frameworks. This includes:

- Compliance with AML/CFT Regulations: Ensuring all simplified procedures comply with anti-money laundering (AML) and counter-financing of terrorism (CFT) regulations.

- Data Privacy Regulations: Adhering to data privacy regulations like GDPR or CCPA to protect customer data.

- Regular Updates: Keeping abreast of evolving regulatory changes to ensure ongoing compliance.

Enhancing Customer Experience

A smooth and efficient KYC process is paramount for building customer trust and loyalty in the banking sector. Customers expect a streamlined experience that minimizes friction and maximizes ease of use. By focusing on customer experience during KYC, banks can foster positive relationships, reduce churn, and increase customer satisfaction. This approach translates into a stronger brand image and a competitive edge in the market.

Simplified KYC Process for Improved Customer Experience

A simplified KYC process significantly enhances the customer experience. This involves reducing the number of documents required, providing clear instructions, and using user-friendly technology. Customers appreciate the efficiency and convenience of a streamlined process, fostering positive feelings towards the institution. Reduced wait times and fewer hurdles contribute to a more positive perception of the banking experience.

Customer Feedback Collection Framework

Gathering customer feedback on KYC procedures is crucial for identifying areas needing improvement. A dedicated feedback mechanism can be implemented through various channels. These channels can include online surveys, feedback forms on banking apps, dedicated email addresses, and customer service representatives. These channels should be accessible and user-friendly, ensuring ease of feedback submission. A well-structured feedback collection framework provides actionable insights for process refinement.

Clear and Concise Communication of KYC Requirements

Communicating KYC requirements clearly and concisely is essential. Banks should provide comprehensive information in a readily understandable format. Using plain language, avoiding jargon, and providing visual aids, such as flowcharts or diagrams, can greatly assist customers in understanding the process. Multiple communication channels, such as email, FAQs on the website, and in-app notifications, should be used to ensure wider reach and accessibility.

This clear communication reduces confusion and minimizes the risk of errors during the KYC process.

Role of User-Friendly Interfaces in KYC Compliance

User-friendly interfaces play a pivotal role in making KYC compliance less cumbersome. The design should prioritize simplicity and intuitive navigation. Clear instructions, helpful tooltips, and progress indicators can guide customers through the process, reducing anxiety and frustration. Interactive elements, such as step-by-step guides or interactive checklists, can enhance understanding and reduce the likelihood of errors. These well-designed interfaces foster a more positive customer experience and increase user engagement.

Streamlining KYC compliance for banks is crucial, and recent developments like the Department of Justice’s new Safe Harbor policy for Massachusetts transactions ( Department of Justice Offers Safe Harbor for MA Transactions ) offer potential solutions. This policy could be a valuable model for other states, ultimately leading to less bureaucratic hurdles and potentially more streamlined processes for banks overall.

Simplifying KYC procedures is key to a more efficient and less costly banking system.

Examples of Effective Customer Communication Strategies

Effective communication during the KYC process involves proactively informing customers about the required steps. Pre-KYC emails outlining the documents needed and the process flow can be extremely helpful. During the process, progress updates and notifications can keep customers informed about the status of their application. Clear communication of potential delays, if any, and reasons behind them, helps build trust.

For instance, banks can use automated messaging to inform customers about document upload deadlines and status updates.

Potential Customer Support Resources Related to KYC

Comprehensive customer support resources are vital for addressing customer queries and concerns. A dedicated KYC helpdesk staffed with knowledgeable representatives should be available. Comprehensive FAQs, readily accessible on the bank’s website and within the mobile banking app, can address common questions and issues. Live chat support integrated into the banking platform can offer immediate assistance to customers.

This combination of support channels ensures swift resolution of issues and facilitates a positive customer experience.

Implementing Technological Solutions

Embracing technology is crucial for modernizing KYC procedures. By integrating sophisticated tools and automating tasks, banks can significantly reduce manual effort, minimize errors, and enhance the overall customer experience. This approach fosters efficiency and strengthens the bank’s ability to adapt to evolving regulatory landscapes.Advanced technologies are not just about streamlining processes; they are about building a more secure and trustworthy financial ecosystem.

Utilizing these solutions enables banks to maintain compliance while enhancing their customer base. These improvements translate to better operational efficiency and reduced operational costs.

Different Technologies for Improved KYC Efficiency

Various technological solutions can revolutionize KYC procedures. These include sophisticated fraud detection systems, robust identity verification platforms, and AI-powered tools that automate repetitive tasks. Integrating these technologies can lead to substantial cost savings and increased operational efficiency.

- Biometric Verification: Biometric identification methods, such as fingerprint scanning and facial recognition, provide a more secure and reliable way to verify customer identities. These methods reduce the risk of identity theft and improve the accuracy of customer verification.

- Advanced Analytics: Employing advanced analytical techniques, such as machine learning algorithms, enables banks to identify suspicious patterns and potential fraud attempts in real-time. This proactive approach can significantly reduce financial losses.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms can be used to automate various KYC tasks, such as document analysis, data validation, and risk assessment. This automation can drastically reduce processing time and improve accuracy.

- Cloud-Based Platforms: Cloud-based solutions provide scalable and flexible KYC platforms, enabling banks to adapt to evolving regulatory requirements and customer demands. These platforms offer enhanced security and accessibility.

Automating KYC with AI and Machine Learning

AI and machine learning are transforming the KYC process by automating several key tasks. These technologies can analyze vast datasets, identify patterns, and make predictions, enabling banks to detect and mitigate risks more effectively.Machine learning models can be trained on historical data to identify fraudulent activities and flag suspicious transactions. This allows banks to respond quickly to potential threats and protect their assets.

For example, a model trained on transaction data could identify unusual spending patterns indicative of fraud.

Comparing Fraud Detection Tools

Evaluating the effectiveness of various fraud detection tools is essential for implementing a robust KYC system. Different tools cater to specific needs and have varying strengths and weaknesses. A comprehensive approach often involves integrating multiple tools to create a more comprehensive security net.

- Rule-Based Systems: These systems use predefined rules to identify potential fraud. They are relatively straightforward to implement, but may not adapt to evolving fraud patterns.

- Statistical Models: These models analyze large datasets to identify anomalies and patterns indicative of fraud. They are more adaptable to changing fraud trends than rule-based systems, but require more sophisticated analytical expertise.

- Machine Learning Models: Machine learning algorithms are trained on historical data to identify fraudulent activities. They offer the most adaptable and accurate fraud detection capabilities, but necessitate a significant investment in data and expertise.

Framework for Integrating New Technologies

A well-defined framework is essential for successfully integrating new technologies into existing bank systems. This framework should Artikel the steps involved in the implementation process, from initial assessment to ongoing maintenance. The framework should prioritize security and data privacy.

Streamlining KYC compliance for banks often involves innovative solutions. One key area is automating the process, and a crucial step in that automation is ensuring the security of the AI code used. This means deploying AI Code Safety Goggles Needed, like those discussed in Deploying AI Code Safety Goggles Needed , to catch potential vulnerabilities before they cause costly problems.

Ultimately, this approach leads to more efficient and secure KYC processes, which benefits both the banks and their customers.

- Phased Approach: Implement new technologies in phases, starting with pilot programs and gradually expanding their use across the bank. This allows for iterative improvement and minimizes disruption.

- Data Migration Strategy: Develop a robust data migration strategy to ensure seamless integration of new data sources and formats into the existing bank systems.

- Security Considerations: Prioritize security measures throughout the integration process, ensuring data protection and compliance with regulatory requirements.

Key Factors in Choosing KYC Technology Solutions

Selecting the right KYC technology solution is critical for a bank’s success. Several key factors need consideration, including scalability, security, regulatory compliance, and cost-effectiveness. Careful evaluation of these factors is crucial for making an informed decision.

- Scalability: The solution should be able to handle increasing volumes of transactions and customers.

- Security: The solution should incorporate robust security measures to protect sensitive customer data.

- Regulatory Compliance: The solution should comply with all relevant regulations and industry standards.

- Cost-Effectiveness: The solution should provide a good balance between cost and benefits.

Benefits of Blockchain Technology in KYC

Blockchain technology offers several advantages for KYC processes, particularly in enhancing transparency and security. Its decentralized and immutable nature creates a more trustworthy and secure environment for verifying identities and tracking transactions.Blockchain can improve the efficiency of KYC by reducing manual processes and improving the accuracy of data verification. It offers the potential to significantly enhance transparency and reduce fraud risks.

For example, a bank could use blockchain to create a tamper-proof record of customer identity verification.

Data Security and Privacy

Protecting customer data is paramount in any financial institution. A robust data security strategy is not just a best practice; it’s a crucial component of building trust and maintaining a positive reputation. Breaches can have severe financial and reputational consequences, leading to substantial losses and damage to customer relationships. Prioritizing data security throughout the KYC process is vital to mitigate these risks.Maintaining the confidentiality, integrity, and availability of customer data is a top priority.

This involves implementing multiple layers of security and adhering to industry best practices. This is not merely about avoiding fines or penalties; it’s about ensuring customer trust and safeguarding their sensitive information from unauthorized access, use, or disclosure.

Importance of Data Security in KYC Processes

Robust data security is essential for maintaining customer trust and preventing fraud. Compromised KYC data can lead to identity theft, financial fraud, and reputational damage for both the bank and its customers. Protecting sensitive data throughout the entire process, from collection to storage and disposal, is crucial.

Best Practices for Handling Sensitive Customer Data

Data minimization, access control, and regular security audits are essential components of a strong data security program. This includes limiting the collection of data to only what is necessary for KYC purposes and implementing strict access controls to prevent unauthorized access. Regular security audits help identify and address vulnerabilities in the system.

Security Measures to Protect Customer Information During KYC Verification

Implementing multi-factor authentication (MFA), using strong encryption protocols, and regularly updating security software are critical security measures. These measures help protect against phishing attacks and other malicious activities.

- Multi-factor Authentication (MFA): Requiring multiple forms of verification (e.g., password, one-time code, biometric data) adds an extra layer of security to prevent unauthorized access. This enhances the security of accounts and protects against brute-force attacks. A practical example is using a text message with a one-time code to verify a login.

- Strong Encryption Protocols: Encrypting data both in transit and at rest protects sensitive information from unauthorized access. This is particularly important for storing and transmitting customer data. Examples include using HTTPS for web traffic and encryption algorithms for data storage.

- Regular Security Software Updates: Keeping security software updated with the latest patches and vulnerabilities is crucial. This ensures that systems are protected against the latest threats. Regular updates and patches are essential to protect against newly discovered vulnerabilities.

- Data Loss Prevention (DLP) Tools: Implementing DLP tools can help prevent sensitive data from leaving the organization’s control. This includes monitoring for unauthorized data transfers and implementing restrictions on data sharing.

Role of Data Encryption in Maintaining Data Privacy

Data encryption transforms readable data into an unreadable format, making it virtually impossible for unauthorized individuals to access or understand the information. Strong encryption algorithms, like AES-256, are vital for protecting sensitive data.

Complying with Data Privacy Regulations During KYC Procedures

Adherence to regulations like GDPR, CCPA, and others is critical. This involves obtaining explicit consent for data collection, providing transparency about data usage, and establishing clear procedures for data subject rights (access, rectification, erasure). Banks need to understand and comply with these regulations to avoid penalties and maintain customer trust.

Streamlining KYC compliance for banks often hinges on efficient data management. While the recent Azure Cosmos DB Vulnerability Details highlight the importance of robust security measures in cloud-based systems, Azure Cosmos DB Vulnerability Details also demonstrate the need for banks to invest in proactive security audits. Ultimately, these measures contribute to a more secure and compliant KYC process, making it less burdensome for everyone involved.

Checklist for Ensuring Data Security and Privacy in a KYC Process

This checklist Artikels key steps for a secure and compliant KYC process.

- Data Minimization Policy: Collect only the essential data for KYC purposes. This helps limit the potential attack surface.

- Data Security Training: Train all employees involved in the KYC process on data security best practices. Regular training is vital to maintain awareness of security procedures.

- Access Control Measures: Implement strict access control measures to limit access to sensitive customer data. This includes using role-based access controls and regular access reviews.

- Regular Security Audits: Conduct regular security audits to identify vulnerabilities and weaknesses in the KYC process. This helps proactively address any gaps in security.

- Incident Response Plan: Develop and implement an incident response plan to handle security breaches or data compromises. This includes clear procedures for reporting, investigation, and recovery.

- Compliance with Regulations: Ensure compliance with relevant data privacy regulations, like GDPR, to avoid penalties and maintain customer trust.

Risk Assessment and Mitigation

Navigating the complexities of KYC compliance requires a proactive approach to risk assessment. Simply streamlining processes without a robust risk framework can introduce new vulnerabilities. This section dives into crucial strategies for identifying, evaluating, and mitigating potential risks associated with any relaxation of KYC procedures. A comprehensive risk assessment is not just a theoretical exercise; it’s a vital component for safeguarding the bank’s reputation and financial stability.A well-defined risk assessment framework for KYC procedures acts as a proactive defense mechanism, identifying potential threats before they escalate.

This proactive stance helps banks anticipate and address vulnerabilities, ensuring a resilient and secure system for managing customer due diligence.

Comprehensive Risk Assessment Framework

A robust risk assessment framework for KYC processes should cover all aspects of customer onboarding, from initial identification to ongoing monitoring. It should encompass various factors, including customer demographics, transaction patterns, and geographic location, to create a holistic picture of risk. A consistent and regularly updated framework ensures that the bank’s risk appetite aligns with evolving regulatory standards and emerging threats.

This ensures compliance and minimizes the possibility of financial crime.

Potential Risks Associated with Relaxed KYC Procedures

Relaxing KYC procedures, while potentially streamlining the process, can expose banks to significant risks. These risks range from reputational damage to financial penalties. Potential risks include: increased money laundering vulnerabilities, amplified fraud opportunities, and exposure to sanctions violations. Implementing overly lenient KYC measures can lead to higher transaction processing risks. For instance, a relaxation in document verification requirements could potentially allow fraudulent accounts to be opened, while lax monitoring of high-risk transactions might enable illicit activities to go undetected.

Evaluating and Mitigating Identified Risks

Evaluating and mitigating identified risks requires a multi-faceted approach. Quantitative and qualitative analysis should be employed to assess the likelihood and impact of each risk. Mitigation strategies should be tailored to the specific risk profile of each customer or transaction. This approach ensures that the bank’s resources are directed effectively to address the most significant threats. For example, employing advanced analytics to identify unusual transaction patterns and flagging suspicious activities in real-time can effectively mitigate these risks.

Successful Risk Mitigation Strategies

Several banks have implemented successful risk mitigation strategies. One approach involves using advanced analytics to identify and flag high-risk customers based on patterns in their transaction history. Another strategy includes establishing clear escalation protocols for suspicious activity reports, ensuring timely intervention and preventing potential financial losses. Implementing AI-powered tools for real-time transaction monitoring can effectively identify potentially fraudulent activities and alert relevant personnel for swift action.

Ongoing Monitoring and Review of KYC Processes

KYC compliance is not a one-time exercise; it requires ongoing monitoring and review. Regular audits and assessments are essential to identify emerging risks and adapt mitigation strategies accordingly. Continuous monitoring enables banks to stay ahead of evolving threats and maintain a robust KYC system. Regular review and updates to the framework ensure that the process remains effective and aligned with evolving regulatory guidelines.

Comparison of Risk Mitigation Strategies

| Strategy | Description | Advantages | Disadvantages |

|---|---|---|---|

| Advanced Analytics | Using data analysis tools to identify high-risk customers and transactions. | Early detection of suspicious activity, proactive risk management. | Requires significant investment in technology and expertise, potential for false positives. |

| Escalation Protocols | Clearly defined procedures for reporting and investigating suspicious activities. | Improved response time to potential threats, enhanced accountability. | Requires careful training and adherence by personnel, potential delays in reporting. |

| AI-Powered Monitoring | Utilizing AI to monitor transactions in real-time and flag potential fraud. | High speed and accuracy in detecting anomalies, automation of monitoring tasks. | Requires substantial investment in AI tools, potential for bias in algorithms. |

Regulatory Compliance

Navigating the complex world of KYC (Know Your Customer) compliance requires a deep understanding of the regulatory landscape. Banks and financial institutions must adhere to a multitude of rules and regulations, varying significantly across jurisdictions. These regulations are crucial for maintaining financial stability, preventing illicit activities, and fostering trust in the financial system. Effective KYC compliance programs go beyond simply meeting minimum standards; they are vital for long-term sustainability and brand reputation.The regulatory landscape for KYC compliance is a dynamic environment, constantly evolving with new laws and interpretations.

This necessitates a proactive approach to staying informed about the latest requirements and adapting procedures accordingly. Compliance is not a one-time task; it demands ongoing vigilance and a commitment to continuous improvement.

Regulatory Landscape for KYC Compliance

The global regulatory landscape for KYC is not uniform. Different countries and regions have unique legal frameworks and priorities, impacting the specifics of KYC procedures. These differences stem from varying levels of risk tolerance, the nature of their economies, and historical contexts. This diverse regulatory environment demands a nuanced approach to KYC compliance, recognizing the distinct requirements in each jurisdiction.

Key Regulations Impacting KYC Procedures

Several key regulations shape KYC procedures globally. These regulations, while often focusing on similar goals, may differ in their specific requirements and enforcement mechanisms. Understanding these differences is essential for tailoring KYC programs to specific jurisdictions.

- The Bank Secrecy Act (BSA) in the United States: The BSA mandates the reporting of suspicious activity and the implementation of internal controls to prevent money laundering and terrorist financing. This is a foundational law impacting all financial institutions in the US, requiring robust KYC procedures for all customer accounts.

- The EU’s Fifth Anti-Money Laundering Directive (5AMLD): This directive sets stringent requirements for KYC processes, including enhanced due diligence procedures for high-risk customers and specific reporting obligations. It aims to create a harmonized approach across the European Union.

- The UK’s Money Laundering Regulations: The UK has its own set of regulations built upon the 5AMLD, but with its own specific requirements. This often involves adaptations for the UK’s particular financial market and economic context.

Role of Compliance Officers in KYC Implementation

Compliance officers play a critical role in ensuring that KYC procedures are not only implemented but also effectively maintained. Their expertise in regulatory knowledge, risk assessment, and operational procedures is vital for achieving and sustaining compliance.

- Developing and Maintaining KYC Policies: Compliance officers develop and update KYC policies and procedures to reflect current regulatory requirements. This is an ongoing process to stay ahead of changes and interpretations.

- Risk Assessment and Mitigation: They conduct regular risk assessments to identify and mitigate potential money laundering and terrorist financing risks. This often involves reviewing existing customer data and proactively identifying potential issues.

- Training and Monitoring: Compliance officers ensure staff are adequately trained on KYC procedures. They also monitor the implementation of KYC procedures to identify areas for improvement and maintain compliance standards.

Comparing and Contrasting KYC Regulations Across Countries, How to make kyc compliance less difficult for banks

KYC regulations vary considerably across countries. While the overarching goals of preventing illicit activities are similar, the specific requirements for data collection, customer due diligence, and reporting vary greatly.

Regulatory Requirements for KYC in Specific Sectors

Different sectors have varying KYC requirements based on the inherent risks associated with their operations. Financial institutions need to tailor their KYC procedures to these specific risks.

- Real Estate: KYC for real estate transactions might require verifying the source of funds and identifying beneficial owners, especially for high-value transactions.

- Cryptocurrency: KYC for cryptocurrency exchanges involves stringent requirements for verifying customer identities and tracking transactions, often with added complexities due to the decentralized nature of the industry.

End of Discussion

In conclusion, making KYC compliance less difficult for banks requires a multifaceted approach. By streamlining processes, enhancing customer experience, implementing appropriate technology, prioritizing data security, and understanding regulatory requirements, financial institutions can navigate the complexities of KYC regulations effectively. This guide offers a roadmap for banks to achieve efficient, customer-centric, and compliant KYC procedures. We hope this overview empowers you to create a smoother experience for both your customers and your organization.

Expert Answers: How To Make Kyc Compliance Less Difficult For Banks

What are the most common KYC documents required?

Common KYC documents include government-issued IDs (driver’s license, passport), proof of address (utility bills, bank statements), and sometimes employment verification. The specific requirements may vary based on the jurisdiction and the type of account.

How can AI help with KYC verification?

AI can automate parts of the KYC process by verifying documents, identifying potential fraud, and speeding up the overall onboarding procedure. AI algorithms can also analyze large datasets of customer information to identify patterns and potential risks.

What are some examples of effective customer communication strategies during the KYC process?

Clear and concise communication is key. Provide customers with a dedicated portal for tracking their application, send regular updates, and offer multiple channels for support (e.g., phone, email, live chat). Anticipate questions and provide comprehensive answers.

How does blockchain technology benefit KYC compliance?

Blockchain’s immutability and transparency can enhance the security and efficiency of KYC processes. It can facilitate secure document sharing and reduce the risk of fraud by creating a tamper-proof record of transactions.