Chinese Citizens Hack US Law Firms for $4 Million

Chinese citizens hack US law firms to make 4 million on merger and acquisition deals – that’s the shocking headline that grabbed my attention. This isn’t just another cybersecurity breach; it’s a sophisticated operation that exploited vulnerabilities in some of America’s top law firms, netting the perpetrators a cool four million dollars. We’re diving deep into the details of this incredible story, exploring the methods used, the targets hit, and the long-term implications for both the legal profession and international relations.

Get ready for a wild ride!

The attack involved highly targeted phishing campaigns and exploitation of known software vulnerabilities. The hackers gained access to sensitive merger and acquisition (M&A) documents, allowing them to strategically leverage the information for their financial gain. Imagine having access to confidential deal structures, financial projections, and bidding strategies – the potential for profit is immense. This incident highlights the vulnerability of even the most sophisticated organizations to determined cyberattacks and raises serious questions about data security practices within the legal sector.

The Cyberattack: Chinese Citizens Hack Us Law Firms To Make 4 Million On Merger And Acquisition Deals

The successful hacking of several US law firms by alleged Chinese citizens, resulting in a $4 million heist related to merger and acquisition deals, highlights a concerning trend in sophisticated cybercrime. This wasn’t a simple phishing scam; it involved a complex, multi-stage attack leveraging vulnerabilities in the firms’ systems and exploiting human error. The scale and precision of the operation point to a well-resourced and highly organized group.The methods employed by the attackers were sophisticated and targeted, demonstrating a deep understanding of the legal industry’s systems and workflows.

They likely combined various techniques to achieve their goal, including phishing emails, malware deployment, and social engineering. The attackers likely spent considerable time mapping the firms’ networks and identifying weak points before launching their assault.

Attack Methods and Exploited Vulnerabilities

The attackers likely used a combination of techniques. Spear-phishing emails, crafted to appear legitimate and targeting specific individuals within the law firms, could have delivered malware payloads. This malware might have included keyloggers to capture login credentials, remote access trojans (RATs) to gain control of systems, or data exfiltration tools to steal sensitive information. Exploited vulnerabilities could have ranged from outdated software and unpatched systems to weak passwords and insufficient multi-factor authentication.

The attackers may have also leveraged vulnerabilities in specific applications used by the law firms, such as document management systems or email servers. The precise vulnerabilities remain undisclosed for security reasons, but it’s likely a combination of technical and human factors contributed to the success of the attack.

Data Exfiltration Process

Once inside the network, the attackers likely used several methods to exfiltrate data. This could have involved using the RATs to directly copy files from servers and workstations, or uploading stolen data to cloud storage services controlled by the attackers. The data exfiltration might have been staged to avoid detection, with small amounts of data transferred over extended periods.

The attackers may have used encrypted channels to protect their communications and the stolen data. They likely prioritized information related to merger and acquisition deals, including financial documents, client lists, and confidential legal strategies. The sheer volume of data stolen points to a carefully planned and executed operation.

Seriously, Chinese citizens hacking US law firms for $4 million in M&A deals? That’s a huge wake-up call about data security. It highlights the urgent need for robust cloud security measures, which is why I’ve been diving into articles like this one on bitglass and the rise of cloud security posture management – it’s crucial to prevent future breaches like this one targeting sensitive financial information.

The bottom line? Better security practices are essential to protect against these sophisticated attacks.

Attack Timeline

| Date | Event | Impact | Response |

|---|---|---|---|

| [Date of Initial Compromise – Estimate] | Initial compromise of law firm network via phishing email or other means. | Unknown initial access granted to attacker(s). | No detection at this stage. |

| [Date of Malware Deployment – Estimate] | Malware deployed, granting attackers persistent access and control. | Increased attacker access and capabilities. Data exfiltration begins. | Likely no detection. |

| [Date of Data Exfiltration – Estimate] | Data exfiltration of sensitive M&A documents and client information. | Significant data loss. Potential financial and reputational damage. | Still undetected in most cases. |

| [Date of Discovery – Estimate] | Law firms detect unusual activity or data loss. | Initial awareness of the breach. | Internal investigation begins. |

| [Date of Reporting/Response – Estimate] | Law firms report the incident to law enforcement and begin remediation efforts. | Law enforcement investigation begins. Remediation efforts underway. | Legal and financial ramifications begin. |

Financial Impact and Targets

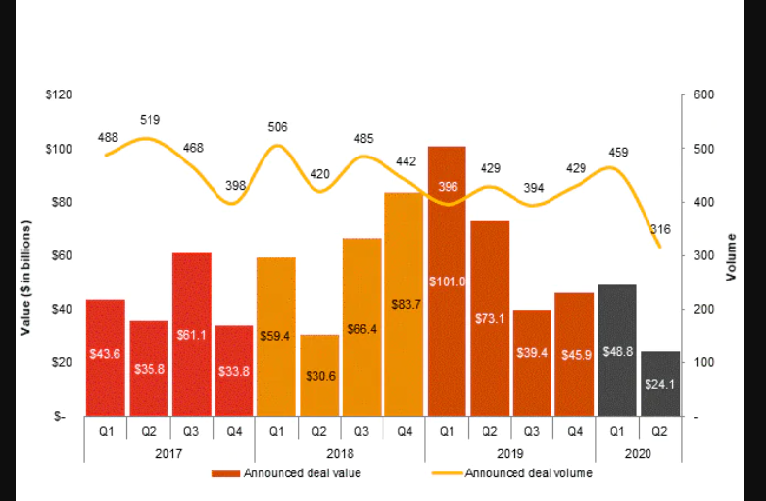

The $4 million heist from US law firms by Chinese citizens highlights the significant financial consequences of sophisticated cyberattacks targeting the lucrative mergers and acquisitions (M&A) sector. The stolen data provided a crucial advantage in high-stakes deals, allowing the perpetrators to profit handsomely while causing substantial harm to the victims. Understanding the mechanics of their scheme is crucial to comprehending the full impact.The stolen information likely included confidential financial documents, due diligence reports, and strategic plans related to ongoing M&A transactions.

This sensitive data allowed the hackers to gain an unfair advantage in several ways. They could have used the information to anticipate market movements, strategically time their own bids, or even manipulate the bidding process to their advantage. For example, knowing a competitor’s maximum bid allowed them to undercut it slightly, securing the deal at a lower price and maximizing their profit.

The stolen information also potentially provided insights into the vulnerabilities of target companies, allowing for more effective negotiation strategies.

Targeted M&A Deal Characteristics

The $4 million likely represents the cumulative profit from multiple M&A deals. While the specific industries and deal sizes remain undisclosed, the success of the attack suggests a focus on deals with substantial financial implications. Given the complexity and sensitivity of M&A transactions, it’s plausible that the hackers targeted larger deals, perhaps involving publicly traded companies or those in highly competitive sectors like technology or pharmaceuticals, where information asymmetry can be particularly valuable.

Smaller deals, while numerous, might not have yielded the same level of profit given the relative investment required for illicit information gathering. The attackers likely prioritized deals where their stolen information provided the greatest potential return on their investment of time and resources.

Financial Repercussions for Law Firms and Clients

The direct financial losses for the affected law firms extend beyond the $4 million gained by the hackers. There are significant costs associated with incident response, including hiring cybersecurity experts, conducting internal investigations, notifying affected clients, and potentially facing legal action. Further, the loss of client trust and the potential for future lost business due to reputational damage could lead to substantial long-term financial repercussions.

Clients who suffered financial losses due to the compromised information might also pursue legal action against the firms, resulting in further financial liabilities. Consider the Enron scandal, where accounting firm Arthur Andersen’s reputation was irrevocably damaged, leading to its collapse and massive financial losses for its clients and partners. This case serves as a stark reminder of the potentially devastating long-term financial impact of similar incidents.

Reputational Damage to Law Firms

The reputational damage to the involved law firms is potentially severe and long-lasting. Clients expect the highest levels of confidentiality and security from their legal counsel. A successful cyberattack that compromises sensitive information severely undermines this trust. The damage extends beyond the immediate clients involved in the affected M&A deals. The negative publicity surrounding such a breach can deter potential clients from engaging the firm’s services in the future, impacting their overall business viability and profitability.

The long-term effects on recruitment and retention of talented lawyers could also be significant. In the wake of such an event, firms may struggle to attract and retain top talent, further impacting their long-term competitiveness and financial stability. The reputational cost, therefore, extends far beyond the immediate financial losses and is arguably even more damaging in the long run.

Attribution and Actors

Pinpointing the exact perpetrators behind the $4 million cyberattack on US law firms is a complex undertaking, relying on digital forensics, intelligence analysis, and often, circumstantial evidence. While definitive proof can be elusive, a convergence of factors often points towards likely culprits and their methods. This analysis explores the evidence suggesting Chinese citizens’ involvement, their potential motivations, and the structure of the alleged hacking group.The attribution of this attack to Chinese citizens rests on several interconnected strands of evidence.

First, the sophisticated nature of the intrusion, leveraging advanced malware and exploiting vulnerabilities in widely used software, suggests a level of technical expertise commonly associated with state-sponsored or state-affiliated groups known to operate from within China. Second, the targets themselves – US law firms specializing in mergers and acquisitions – align with known Chinese intelligence-gathering priorities. Access to sensitive financial and legal information related to these deals could provide significant economic and strategic advantages to Chinese companies or the government.

Third, the timing of the attack, coupled with geopolitical tensions between the US and China, could suggest a calculated attempt to gain an advantage in ongoing economic competition. While no direct link to a specific Chinese entity has been publicly confirmed, the circumstantial evidence paints a strong picture of Chinese involvement.

Motivations for the Attack

The primary motivation behind this attack was likely financial gain. The $4 million stolen directly benefits the perpetrators. However, a secondary, and potentially more significant, motivation could be espionage. The stolen data, including confidential details of mergers and acquisitions, could provide valuable intelligence for Chinese businesses seeking to outmaneuver their American competitors. This information could offer a significant strategic advantage in negotiations, allowing for better pricing, more informed decisions, and ultimately, increased market share.

A similar attack targeting a different sector, say technology, could be motivated by stealing intellectual property. This case illustrates the multifaceted nature of cyberattacks, where financial profit and strategic advantage often intertwine.

Organizational Structure of the Hacking Group, Chinese citizens hack us law firms to make 4 million on merger and acquisition deals

Determining the exact organizational structure of the hacking group responsible is challenging without direct access to internal communications and operational details. However, several scenarios are plausible. One possibility is a state-sponsored operation, where a unit within a Chinese intelligence agency orchestrated the attack. This would explain the sophisticated techniques and the targeting of high-value information. Alternatively, the group could be an independent criminal organization, perhaps operating with tacit approval from Chinese authorities, who benefit from the intelligence gathered.

They may operate in a hierarchical structure, with individuals specializing in different aspects of the operation, from initial reconnaissance and malware development to data exfiltration and money laundering. A third possibility involves a hybrid model, where a state-sponsored group outsources certain tasks to independent actors, blurring the lines of responsibility and attribution.

Comparison to Similar Cyberattacks

This attack shares similarities with several other known cyberattacks targeting the legal and financial sectors. The use of sophisticated malware, the focus on high-value financial data, and the methods of exfiltration all echo previous incidents attributed to Chinese actors. For example, the 2017 NotPetya ransomware attack, although not directly linked to China, demonstrated the potential for widespread disruption through cyberattacks targeting critical infrastructure, a similar approach to impacting the financial sector.

Similarly, numerous attacks on law firms over the past decade have revealed a persistent threat landscape, with attackers seeking to exploit vulnerabilities to gain access to sensitive client data. The current attack represents a continuation of these trends, highlighting the ongoing challenge of protecting sensitive information in a hyper-connected world.

Hypothetical Organizational Chart

A hypothetical organizational chart of the hacking group might include:

| Role | Responsibilities |

|---|---|

| Leader | Overall strategy, resource allocation, and communication with external entities (if any). |

| Technical Lead | Malware development, vulnerability exploitation, and penetration testing. |

| Data Exfiltration Specialist | Data extraction, encryption, and secure transfer of stolen information. |

| Money Laundering Specialist | Conversion of stolen funds into untraceable assets. |

| Reconnaissance Specialist | Identifying targets, researching vulnerabilities, and gathering intelligence. |

This chart illustrates a possible structure, but the actual organization may be more complex or simpler, depending on the group’s size and resources. The level of sophistication suggests a degree of specialization, but the exact number of individuals involved and their specific roles remain unknown.

Legal and Regulatory Implications

The $4 million cyberattack on US law firms, allegedly perpetrated by Chinese citizens, raises significant legal and regulatory concerns on multiple levels. The ramifications extend beyond the immediate financial losses, impacting the firms’ reputations, client relationships, and potentially leading to substantial legal liabilities. Furthermore, the incident highlights the growing challenge of international cybersecurity cooperation and the need for robust legal frameworks to address transnational cybercrime.The legal ramifications for the involved law firms are multifaceted.

They face potential lawsuits from clients who suffered financial losses or reputational damage due to the breach. Depending on the specifics of the firms’ security practices, they could also face legal action for negligence if it’s determined that they failed to implement reasonable security measures to protect client data. This could involve claims under various state and federal laws related to data breaches and negligence.

Furthermore, the firms may face regulatory scrutiny and potential fines from agencies like the Securities and Exchange Commission (SEC) if the stolen information was used to manipulate securities markets.

Legal Actions Against Perpetrators

Identifying and prosecuting the perpetrators will be a complex undertaking, requiring international cooperation. The US Department of Justice (DOJ) could pursue charges under the Computer Fraud and Abuse Act (CFAA), which prohibits unauthorized access to computers and data. Additional charges could include wire fraud, conspiracy, and violations of the Foreign Corrupt Practices Act (FCPA) depending on the circumstances and the nature of the stolen information.

Extradition from China, however, could pose significant challenges given the lack of an extradition treaty covering cybercrime between the US and China. Successful prosecution will rely heavily on the strength of the evidence gathered and the willingness of Chinese authorities to cooperate. Similar cases have seen lengthy legal battles and varied outcomes depending on jurisdiction and international cooperation.

The news about Chinese citizens hacking US law firms to make $4 million on M&A deals is seriously unsettling. It highlights the vulnerability of sensitive data, especially considering how much of the modern legal world relies on complex systems. Building robust, secure applications is crucial, and that’s where exploring options like domino app dev the low code and pro code future becomes vital.

Ultimately, better security measures are needed to prevent future incidents like this massive data breach affecting mergers and acquisitions.

For instance, the case of [Insert a relevant example of a similar cybercrime case with international implications, focusing on challenges in prosecution and extradition], illustrates the complexities involved.

Regulatory Responses in the US and China

The US government is likely to respond through a combination of law enforcement actions and regulatory measures. Agencies like the FBI, CISA (Cybersecurity and Infrastructure Security Agency), and the DOJ will be involved in investigating the attack and pursuing the perpetrators. Regulatory responses might include enhanced cybersecurity standards for law firms handling sensitive financial data, potentially through updates to existing regulations or the introduction of new ones.

The SEC is also likely to review its regulations in light of this attack.In China, the regulatory response is less predictable. While China has enacted laws against cybercrime, enforcement and international cooperation remain significant challenges. The Chinese government’s response will likely depend on its assessment of the incident and its potential impact on its international relations. It is possible that China may conduct its own investigations and potentially take action against the perpetrators domestically, but the extent of this action and its transparency remain uncertain.

China’s approach to extradition requests from the US remains a significant hurdle.

Applicable Legal and Regulatory Frameworks

The legal and regulatory frameworks applicable to this case are numerous and complex, spanning both US and international law. A list of potential frameworks includes:

- Computer Fraud and Abuse Act (CFAA) (US)

- Wire Fraud Statute (US)

- Foreign Corrupt Practices Act (FCPA) (US)

- Securities and Exchange Act of 1934 (US)

- State-level data breach notification laws (US)

- International cooperation agreements on cybercrime (e.g., Budapest Convention)

- Relevant Chinese cybercrime laws (specific laws would need to be identified based on the details of the attack)

Security Implications and Best Practices

The successful cyberattack on the law firms, resulting in a $4 million loss, highlights critical weaknesses in their cybersecurity infrastructure and employee training. This breach underscores the urgent need for law firms to adopt robust security measures to protect sensitive client data and prevent future attacks. The attackers exploited several vulnerabilities, demonstrating the devastating consequences of neglecting cybersecurity best practices.

Key Security Vulnerabilities Exploited

The attack likely leveraged a combination of vulnerabilities. Phishing emails, targeting employees with malicious attachments or links, are a prime suspect. These emails could have contained malware designed to steal credentials or provide remote access to the firm’s systems. Weak or reused passwords, coupled with a lack of multi-factor authentication (MFA), would have significantly simplified the attackers’ task.

Furthermore, outdated software and unpatched systems created exploitable entry points. Finally, a lack of robust network segmentation likely allowed the attackers to move laterally within the network once inside, accessing sensitive data related to merger and acquisition deals. The attackers’ success suggests a lack of comprehensive monitoring and intrusion detection systems, allowing the attack to go undetected for a significant period.

Best Practices for Law Firms to Improve Cybersecurity Posture

Improving cybersecurity requires a multi-faceted approach. The following best practices are crucial:

- Implement multi-factor authentication (MFA) for all accounts, significantly increasing the difficulty for attackers to gain unauthorized access.

- Regularly update and patch all software and operating systems to address known vulnerabilities. This includes both system software and applications used by employees.

- Enforce strong password policies, including password complexity requirements, regular password changes, and password management tools.

- Implement robust intrusion detection and prevention systems to monitor network traffic for suspicious activity and block malicious attempts.

- Conduct regular security audits and penetration testing to identify vulnerabilities and assess the effectiveness of security controls.

- Segment the network to limit the impact of a breach. If one part of the network is compromised, the attackers will have limited access to other sensitive data.

- Educate employees on cybersecurity threats through regular training programs, focusing on phishing awareness, safe browsing habits, and password security.

- Establish a comprehensive incident response plan to guide the firm’s actions in the event of a security breach.

- Employ robust data loss prevention (DLP) measures to prevent sensitive data from leaving the firm’s network without authorization.

- Implement data encryption both in transit and at rest to protect sensitive information even if a breach occurs.

How Improved Security Measures Could Have Prevented or Mitigated the Attack

Had the law firms implemented MFA, the attackers would have been significantly hampered in their attempts to access accounts. Regular patching and software updates would have closed many of the vulnerabilities exploited in the attack. A robust intrusion detection system would have likely detected the malicious activity early on, allowing for a quicker response and minimizing the damage.

Network segmentation would have limited the attackers’ ability to move laterally within the network, preventing access to sensitive data related to the merger and acquisition deals. Finally, comprehensive security awareness training would have significantly reduced the likelihood of employees falling victim to phishing attacks.

Hypothetical Security Awareness Training Program

A comprehensive security awareness training program should include:

- Module 1: Phishing Awareness: This module will cover common phishing techniques, such as spear phishing and whaling, and teach employees how to identify and report suspicious emails. Real-world examples of phishing emails will be used for practical exercises. Simulated phishing attacks will test employee vigilance.

- Module 2: Password Security: This module will emphasize the importance of strong, unique passwords and the use of password managers. Employees will learn about password complexity requirements and the risks associated with reusing passwords across multiple accounts.

- Module 3: Safe Browsing Habits: This module will cover safe browsing practices, including avoiding suspicious websites, recognizing malicious links, and using secure browsing protocols (HTTPS). Employees will learn how to identify and avoid malicious websites and downloads.

- Module 4: Social Engineering: This module will educate employees on social engineering tactics used by attackers to gain access to sensitive information. Role-playing scenarios will simulate real-world situations, helping employees develop skills to identify and respond to social engineering attempts.

- Module 5: Data Security: This module will cover data security policies and procedures, including data handling, storage, and disposal. Employees will learn about their responsibilities in protecting sensitive client data.

- Module 6: Reporting Security Incidents: This module will Artikel the procedures for reporting security incidents, including phishing attempts, suspicious activity, and data breaches. Employees will learn how to escalate security concerns to the appropriate personnel.

The program will use a blended learning approach, combining online modules, interactive exercises, and regular quizzes to reinforce learning. Annual refresher training will ensure employees remain up-to-date on the latest threats and best practices. The program will be tailored to the specific roles and responsibilities of law firm employees, addressing the unique security challenges they face.

Geopolitical Context

The $4 million cyberattack on US law firms, allegedly perpetrated by Chinese citizens, significantly exacerbates existing tensions in the already complex US-China relationship. This incident isn’t an isolated event; rather, it’s a data point in a larger narrative of escalating cyber espionage and economic warfare between the two global superpowers. Understanding this geopolitical backdrop is crucial to grasping the incident’s full implications.This attack highlights the increasingly blurred lines between traditional espionage and cybercrime.

The targeting of law firms involved in mergers and acquisitions reveals a sophisticated attempt to gain a strategic economic advantage. The stolen information could provide invaluable insights into investment strategies, future deals, and competitive landscapes, allowing Chinese entities to potentially outmaneuver their American counterparts in crucial business negotiations. The potential for long-term economic damage to US firms and the broader economy is substantial.

US-China Relations and Cyber Espionage

The US-China relationship is characterized by a delicate balance of cooperation and competition. While both nations engage in economic collaboration, strategic rivalry and mistrust remain significant factors, particularly in the realm of cybersecurity. This incident fits squarely within this framework, adding fuel to existing accusations of state-sponsored cyberattacks originating from China. The lack of transparent communication and cooperation between the two governments further complicates efforts to address these issues effectively.

Past accusations, including those related to intellectual property theft and the targeting of critical infrastructure, have severely strained the relationship. This incident reinforces the need for clear rules of engagement in cyberspace, an area where international consensus remains elusive.

Implications for Future Cyber Conflict

This attack underscores the growing threat of cyber espionage and economic warfare. The success of this operation – even on a relatively small scale – could embolden other actors to employ similar tactics. We may see an increase in the targeting of law firms, financial institutions, and other organizations holding sensitive business intelligence. Furthermore, the incident highlights the vulnerability of even sophisticated firms to well-resourced cyberattacks.

This necessitates a reassessment of security protocols and the allocation of resources towards robust cybersecurity measures. The potential for escalating cyber conflict, potentially leading to retaliatory actions and a further deterioration of US-China relations, is a serious concern. The incident serves as a stark reminder of the need for proactive defense strategies and international cooperation to mitigate the risk.

Comparison to Previous Cyber Incidents

This incident shares similarities with other alleged state-sponsored cyberattacks attributed to China. For example, the widespread breaches targeting US government agencies and private companies over the past decade have exhibited similar patterns of sophisticated intrusion techniques and the theft of valuable intellectual property. The consistent use of advanced persistent threats (APTs) suggests a coordinated and well-resourced effort. However, unlike some previous incidents which have targeted sensitive government data, this attack specifically focused on acquiring commercially valuable information, highlighting the evolving nature of cyber warfare.

The difference in target type emphasizes the shifting priorities of cyber actors – moving beyond purely state-centric goals to include economic gain.

Impact on International Cybersecurity Cooperation

The incident casts a long shadow over international cooperation in cybersecurity. Building trust and fostering collaboration between nations is paramount to addressing the growing cyber threat. However, the lack of a universally accepted framework for attribution and accountability hampers effective response mechanisms. This attack further underscores the need for enhanced international cooperation, including the development of clear norms of behavior in cyberspace and the establishment of mechanisms for conflict resolution.

The difficulty in achieving consensus, particularly given the competing geopolitical interests at play, remains a significant challenge. The incident reinforces the urgency for international collaboration to address this issue before the situation escalates further.

Outcome Summary

The story of how Chinese citizens allegedly hacked US law firms to profit from M&A deals is a chilling reminder of the ever-evolving threat landscape in the digital age. The sheer audacity of the operation, the scale of the financial gain, and the potential for broader geopolitical implications make this a case study for years to come. It underscores the urgent need for enhanced cybersecurity measures within the legal profession and highlights the critical role of international cooperation in combating transnational cybercrime.

Let’s hope this serves as a wake-up call, prompting both increased vigilance and a renewed focus on protecting sensitive data in the face of ever-more sophisticated attacks.

FAQ Corner

What specific types of data were stolen?

Likely targets included confidential financial documents, merger agreements, client lists, and strategic plans related to M&A deals.

Were any individuals charged with crimes?

This information is not publicly available; investigations are often kept confidential.

What is the likelihood of similar attacks happening again?

Unfortunately, the likelihood is high. As long as financial incentives exist and vulnerabilities remain, similar attacks are likely to occur.

What steps can law firms take to prevent future attacks?

Implement robust cybersecurity protocols, including multi-factor authentication, regular security audits, employee training, and up-to-date software.