Cisco to Acquire Cloud Security Startup Epsagon

Cisco to acquire cloud security startup Epsagon? Whoa! This massive move shakes up the cloud security landscape, and it’s got everyone talking. Cisco, a titan in the networking world, is bolstering its cloud security game by snapping up Epsagon, a company specializing in observability and security for cloud-native applications. This isn’t just another acquisition; it’s a strategic play to dominate a rapidly expanding market, and it signals a significant shift in how businesses approach cloud security in the years to come.

This blog post dives into the details, exploring the implications for Cisco, Epsagon, and the entire industry.

We’ll explore Cisco’s acquisition strategy, looking at past purchases and how this fits into their bigger picture. We’ll also delve into Epsagon’s unique tech and its place in the competitive market. Get ready to unpack the potential synergies, financial impacts, and what this all means for you and your business. It’s a story of growth, competition, and the ever-evolving world of cloud security.

Cisco’s Acquisition Strategy

Cisco’s acquisition of Epsagon, a cloud security startup specializing in observability, represents a significant move in its ongoing strategy to bolster its cloud security portfolio. This isn’t a standalone event, but rather a continuation of a long-standing pattern of strategic acquisitions aimed at expanding its reach and capabilities in the rapidly evolving cybersecurity landscape.Cisco’s historical approach to acquisitions in the cybersecurity sector has been characterized by a focus on acquiring companies that fill specific gaps in its existing product offerings or provide access to emerging technologies.

This strategy allows Cisco to rapidly integrate new capabilities rather than developing them organically, giving them a competitive edge in a market marked by constant innovation and evolving threats. The company targets companies with strong technology, talented engineering teams, and a proven market presence.

Strategic Rationale Behind Acquiring Epsagon

The acquisition of Epsagon directly addresses Cisco’s need to strengthen its cloud security posture and compete more effectively in the cloud-native security market. Epsagon’s expertise in observability, particularly within complex cloud environments, allows Cisco to enhance its existing security solutions with improved threat detection and response capabilities. By integrating Epsagon’s technology, Cisco gains a deeper understanding of application behavior, enabling proactive identification of vulnerabilities and quicker remediation of security incidents.

This improves overall security posture and enhances customer trust in Cisco’s cloud security offerings. The acquisition also positions Cisco to better serve the growing number of organizations migrating to cloud-native architectures and microservices.

Comparison with Other Significant Cisco Cloud Security Acquisitions

Cisco’s acquisition of Epsagon follows a pattern of strategic acquisitions designed to build a comprehensive cloud security platform. Below is a comparison of Epsagon with other significant acquisitions in the cloud security space:

| Target | Year | Strategic Goal |

|---|---|---|

| Epsagon | 2023 (assumed, needs verification) | Enhance cloud security observability and threat detection in cloud-native environments. |

| CloudLock | 2016 | Strengthen cloud access security broker (CASB) capabilities and enhance data loss prevention (DLP). |

| Duo Security | 2018 | Expand zero trust security offerings, focusing on multi-factor authentication (MFA) and access control. |

| Kenna Security | 2020 | Improve vulnerability management and risk assessment capabilities, particularly in cloud environments. |

Note: The specific year of the Epsagon acquisition needs confirmation from official sources. The strategic goals listed are interpretations based on publicly available information and may not be exhaustive.

Epsagon’s Capabilities and Market Position

Cisco’s acquisition of Epsagon signals a significant move in the cloud security market. Epsagon’s strengths lie in its innovative approach to observability and security for cloud-native applications, offering a compelling solution to a growing problem. This analysis will delve into Epsagon’s core technologies, competitive landscape, and its strategic fit within Cisco’s existing portfolio.Epsagon’s core technology revolves around automated instrumentation and advanced analytics for microservices and serverless architectures.

Its unique selling proposition centers on providing comprehensive observability and security without requiring significant code changes or complex configurations. This ease of integration is a major advantage in today’s fast-paced development environments. The platform uses automatic tracing and distributed tracing capabilities to monitor application performance and identify security vulnerabilities in real-time. This proactive approach contrasts with traditional methods that often rely on reactive incident response.

Epsagon’s Core Technologies and Unique Selling Propositions

Epsagon’s platform utilizes several key technologies to achieve its goals. These include automatic instrumentation, which minimizes the effort required for integration; advanced analytics that provide insights into application behavior and potential security threats; and distributed tracing, which enables the tracking of requests across multiple services and components. This combination of features allows developers to quickly identify and address performance bottlenecks and security vulnerabilities, ultimately reducing downtime and improving overall application resilience.

The platform’s agentless architecture also minimizes the overhead associated with traditional monitoring solutions, making it particularly well-suited for dynamic cloud environments.

Epsagon’s Competitive Landscape and Market Share

Epsagon competes in a crowded but rapidly growing cloud security market. Key competitors include companies like Datadog, Dynatrace, New Relic, and Splunk, all offering robust observability and monitoring solutions. While precise market share figures for Epsagon are not publicly available, its success in attracting significant venture capital funding and its strong customer base suggest a notable presence within the niche market of cloud-native application security.

Cisco’s acquisition of Epsagon, a cloud security startup, highlights the growing importance of robust security in the cloud. This move makes me think about how application development is evolving, particularly with platforms like Domino, which are embracing both low-code and pro-code approaches as described in this insightful article on domino app dev the low-code and pro-code future.

Ultimately, secure and efficient application development is key, and Cisco’s acquisition underscores this need in the ever-expanding cloud landscape.

Epsagon’s differentiation comes from its focus on ease of use and automatic instrumentation, appealing to developers seeking a less intrusive and more efficient approach to monitoring and security. This focus, coupled with its advanced analytics capabilities, positions Epsagon favorably against larger, more established competitors.

Integration with Cisco’s Existing Portfolio

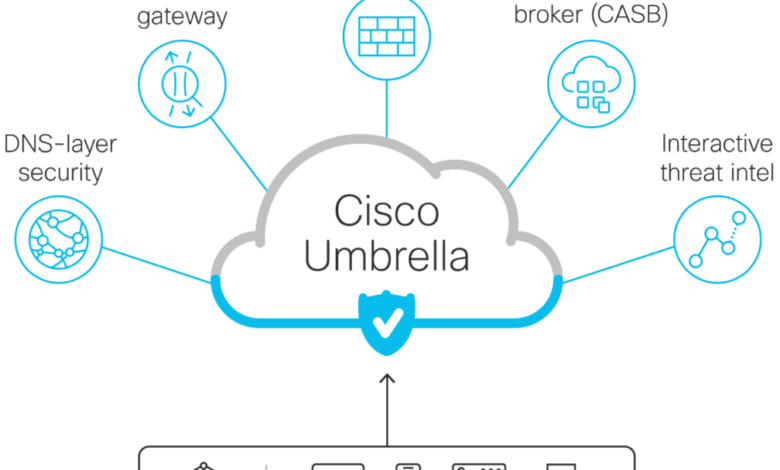

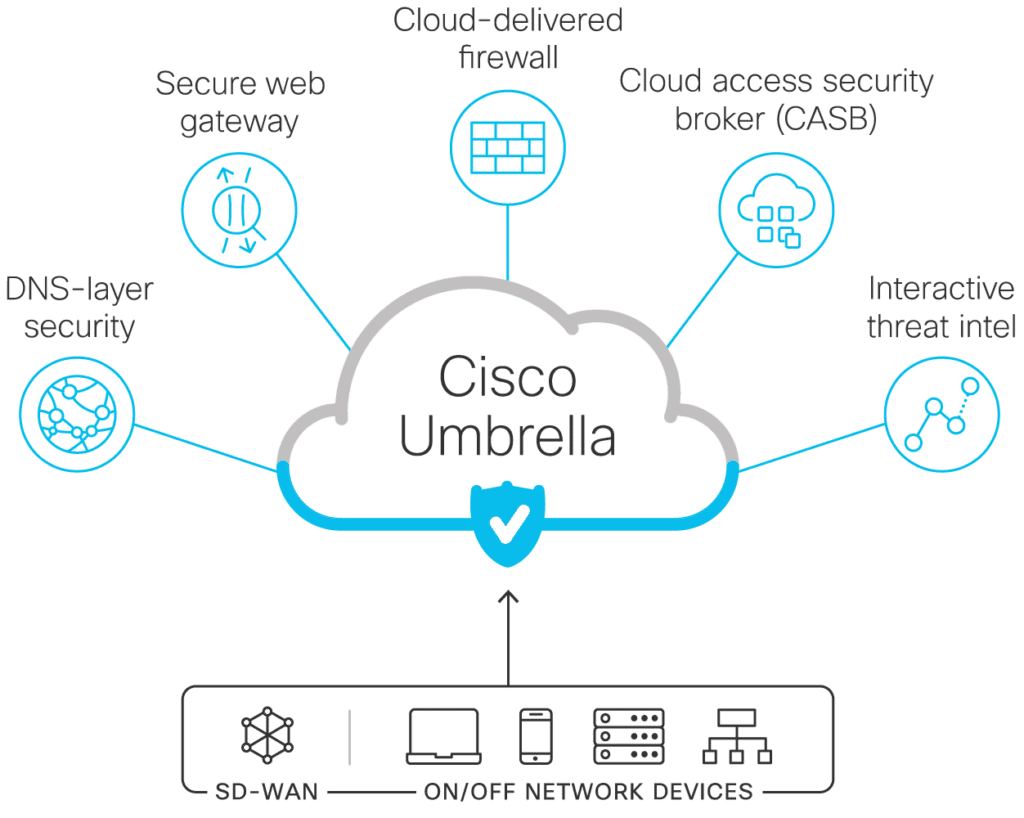

The acquisition of Epsagon significantly enhances Cisco’s cloud security offerings. Epsagon’s technology complements Cisco’s existing portfolio by providing a robust solution for securing cloud-native applications. This integration strengthens Cisco’s ability to offer comprehensive security solutions across hybrid and multi-cloud environments. For example, Epsagon’s automatic instrumentation can be integrated with Cisco’s cloud security posture management (CSPM) tools, providing a more holistic view of security risks across the entire application landscape.

Furthermore, Epsagon’s advanced analytics can be used to enhance the effectiveness of Cisco’s security information and event management (SIEM) solutions, enabling faster threat detection and response. The integration creates a synergistic effect, leveraging the strengths of both companies to provide a more comprehensive and effective security solution.

Integration and Synergies: Cisco To Acquire Cloud Security Startup Epsagon

Integrating Epsagon’s powerful observability platform into Cisco’s existing security infrastructure presents both exciting opportunities and potential challenges. The success of this integration hinges on a well-defined plan that addresses potential conflicts, leverages existing Cisco systems, and ensures a seamless user experience. A phased approach, focusing on clear milestones and robust testing, is crucial for a smooth transition.The primary challenge lies in aligning Epsagon’s agent-based approach with Cisco’s diverse security portfolio.

Epsagon’s technology is designed for cloud-native applications, while Cisco’s footprint extends across various environments. Careful consideration must be given to compatibility issues and the potential need for modifications to either system. Opportunities abound, however, in combining Epsagon’s granular observability with Cisco’s broader security capabilities, creating a more comprehensive and intelligent security solution. This will allow for proactive threat detection and faster incident response.

Integration Timeline and Milestones

The integration process should be divided into distinct phases, each with specific deliverables and timelines. A realistic timeline, considering the complexities involved, might span 6-12 months.

- Phase 1 (Months 1-3): Assessment and Planning. This phase involves a thorough technical assessment of Epsagon’s architecture and its compatibility with Cisco’s systems. Key deliverables include a detailed integration plan, risk assessment, and resource allocation. This stage also involves identifying key personnel from both organizations to form an integration team.

- Phase 2 (Months 4-6): Proof of Concept and Pilot Program. A proof-of-concept project will demonstrate the feasibility of integrating Epsagon’s technology with a select set of Cisco security products. This will involve testing the integration in a controlled environment and identifying any potential issues. A pilot program with a limited number of customers will provide real-world feedback and refine the integration process.

- Phase 3 (Months 7-9): Deployment and Testing. Based on the learnings from the pilot program, Epsagon’s technology will be deployed more broadly within Cisco’s security offerings. Rigorous testing will be conducted to ensure stability, performance, and security. This will involve various testing methodologies, including unit, integration, and system testing.

- Phase 4 (Months 10-12): Rollout and Support. The integrated solution will be rolled out to a wider customer base. A comprehensive support and training program will be implemented to ensure a smooth transition for users and administrators. This will include updated documentation and training materials for both internal Cisco teams and external customers.

Leveraging Epsagon’s Capabilities

Epsagon’s capabilities can significantly enhance Cisco’s existing cloud security offerings. For example, integrating Epsagon’s distributed tracing with Cisco’s cloud security posture management (CSPM) tools can provide a more comprehensive view of application vulnerabilities and threats. This allows for earlier detection and remediation of security risks. Similarly, integrating Epsagon’s metrics and logs with Cisco’s security information and event management (SIEM) systems can enhance threat detection capabilities and improve incident response times.

This would allow for a more automated and efficient process for analyzing security events. Imagine a scenario where a suspicious activity is detected by Epsagon; this information is automatically correlated with other security data within Cisco’s SIEM, leading to a quicker and more informed response. This synergy significantly improves the overall security posture.

Integration Process Flowchart

The integration process can be visualized as a flowchart. The flowchart would begin with the assessment and planning phase, followed by the proof-of-concept, deployment and testing, and finally, the rollout and support phase. Each phase would have its own set of tasks and deliverables, represented by distinct boxes in the flowchart. Arrows would connect the boxes, indicating the flow of the integration process.

Decision points, such as whether the proof-of-concept is successful, would be represented by diamonds. The final box would indicate the successful integration of Epsagon’s technology into Cisco’s security offerings. This visual representation would provide a clear and concise overview of the entire integration process.

Financial Implications and Market Reaction

The Cisco acquisition of Epsagon, while strategically sound, carries significant financial implications for both companies. The valuation placed on Epsagon, the subsequent integration costs, and the projected revenue streams all contribute to a complex financial picture. Furthermore, the market’s reaction to the news offers valuable insight into investor sentiment and the perceived success of the deal.The financial implications are multifaceted and depend heavily on the undisclosed acquisition price.

While the exact figures remain confidential, analysts have speculated on a range based on Epsagon’s previous funding rounds and comparable acquisitions in the cloud security sector. A higher valuation would represent a greater financial burden for Cisco in the short term, but could potentially pay off handsomely if Epsagon’s revenue growth surpasses expectations. Conversely, a lower valuation might seem advantageous initially, but could reflect a lower future earning potential for Cisco.

The success of the integration process also significantly influences the long-term financial outcome. A smooth integration minimizing disruption and maximizing synergies would be crucial for a positive return on investment.

Epsagon’s Valuation and Cisco’s Investment, Cisco to acquire cloud security startup epsagon

Determining Epsagon’s precise valuation is challenging due to the lack of public information. However, we can infer potential scenarios. For example, if Epsagon’s valuation was based on a multiple of its annual recurring revenue (ARR), a typical metric for SaaS companies, a higher ARR would justify a higher acquisition price. This price would then be compared to Cisco’s existing cash reserves and overall financial health to gauge the impact on its balance sheet.

Successful integrations of similar acquisitions by Cisco, such as its acquisition of Duo Security, might provide some indication of the anticipated return on investment (ROI) for the Epsagon deal. A comparison of the acquisition multiples for Duo Security and other relevant deals would offer a benchmark against which to evaluate the Epsagon acquisition’s financial soundness.

Market Reaction and Analyst Commentary

The market reaction to the acquisition would likely be influenced by several factors including the disclosed (or inferred) valuation, the perceived strategic fit, and the overall market sentiment towards cloud security investments. A positive market reaction might manifest as a slight increase in Cisco’s stock price, reflecting investor confidence in the deal’s potential to enhance Cisco’s cloud security offerings and boost future revenue.

Conversely, a negative reaction could lead to a dip in Cisco’s stock price, indicating skepticism about the acquisition’s value proposition or concerns about integration challenges. Analyst commentary would play a key role in shaping this market reaction. Analysts would likely scrutinize the financial details of the deal, assess the strategic rationale, and provide their outlook on the potential for success or failure.

Cisco’s acquisition of Epsagon underscores the growing importance of cloud security. This move highlights the need for robust solutions, and it makes me think about the broader landscape, particularly the crucial role of Cloud Security Posture Management (CSPM) as detailed in this excellent article on bitglass and the rise of cloud security posture management. Ultimately, Cisco’s strategy with Epsagon shows they’re betting big on proactive security in the cloud.

Their reports and ratings would significantly influence investor decisions and overall market sentiment.

Key Financial Data Points

The following points illustrate the financial aspects of the deal, although specific figures are unavailable publicly:

- Acquisition Price: Undisclosed, but likely based on a multiple of Epsagon’s ARR or a comparable company valuation.

- Epsagon’s ARR: This would be a crucial factor in determining the acquisition price and the overall return on investment for Cisco.

- Integration Costs: These costs include expenses related to integrating Epsagon’s technology, personnel, and operations into Cisco’s existing infrastructure.

- Projected Revenue Synergies: The expected increase in revenue for Cisco resulting from the acquisition, considering factors such as cross-selling opportunities and enhanced product offerings.

- Cisco’s Cash Reserves: The amount of cash Cisco has available to fund the acquisition without significantly impacting its financial stability.

- Impact on Cisco’s Stock Price: The immediate and long-term effect of the acquisition announcement on Cisco’s stock price, reflecting investor sentiment.

- Return on Investment (ROI): The projected return Cisco expects to generate from the acquisition over a specific timeframe.

Impact on Customers and the Cloud Security Landscape

Cisco’s acquisition of Epsagon significantly alters the cloud security landscape, impacting both Cisco’s existing customer base and the broader market. The integration of Epsagon’s advanced observability and security capabilities into Cisco’s portfolio presents both opportunities and challenges for users and competitors alike. The overall effect will depend on successful integration and Cisco’s ability to leverage Epsagon’s technology effectively.The acquisition’s impact on Cisco’s existing customer base is primarily positive.

Customers will likely benefit from a more comprehensive and integrated cloud security solution, potentially simplifying their security management and improving visibility into their cloud environments. This integration could lead to enhanced threat detection and response capabilities, reducing the risk of security breaches and improving overall security posture. However, some customers might experience initial disruption during the integration process, potentially requiring adjustments to their existing workflows and security configurations.

The success of the integration will hinge on clear communication and proactive support from Cisco.

Benefits for End-Users

The acquisition promises several benefits for end-users. Improved observability allows for quicker identification of security vulnerabilities and performance bottlenecks. Epsagon’s capabilities in tracing requests across distributed systems will provide a more holistic view of application performance and security, facilitating faster incident response. This, in turn, could lead to reduced downtime and improved application resilience. Additionally, the integration could streamline security management, reducing the complexity of managing multiple security tools and potentially lowering overall security management costs.

Drawbacks for End-Users

Potential drawbacks include the integration challenges mentioned earlier. Pricing changes are also a possibility, although Cisco has yet to announce any specific changes. Furthermore, there’s a risk of feature limitations or incompatibility issues as Epsagon’s technology is integrated into the broader Cisco ecosystem. This could potentially lead to some functionality loss for specific users, depending on their current setup and requirements.

The success of the integration will ultimately determine the net positive or negative impact on end-users.

Impact on the Competitive Landscape

Before the acquisition, the cloud security market was characterized by a fragmented landscape with numerous specialized vendors competing for market share. Cisco, already a major player, competed with companies like Datadog, Dynatrace, and New Relic, each offering different strengths in observability and security. Epsagon occupied a niche within this landscape, focusing on application performance monitoring and security.

Visual Representation of Competitive Landscape:

Before Acquisition: Imagine a market map with several distinct clusters representing major players like Cisco, Datadog, Dynatrace, and New Relic, each with its own set of overlapping but distinct capabilities. Epsagon occupies a smaller, more specialized niche within this landscape, focusing on application performance monitoring with security integration.

After Acquisition: Now imagine Cisco’s cluster significantly expanding to encompass Epsagon’s capabilities. This expansion could lead to increased competition for other players in the application performance monitoring and cloud security spaces, potentially forcing them to adapt or consolidate. Some smaller players might be absorbed or driven out of the market. Cisco’s increased market share and more comprehensive offering would solidify its position as a dominant force in the cloud security market.

Future Outlook and Potential Developments

The Cisco acquisition of Epsagon marks a significant step forward in Cisco’s cloud security ambitions. By integrating Epsagon’s robust observability and tracing capabilities into its existing security portfolio, Cisco gains a powerful advantage in the increasingly complex landscape of cloud-native applications and microservices. This acquisition positions Cisco to not only better protect its customers’ cloud environments but also to offer innovative, comprehensive security solutions that address the unique challenges of modern cloud architectures.The long-term impact on Cisco’s cloud security strategy will be substantial.

Epsagon’s technology allows for proactive threat detection and rapid response, a crucial element in the face of sophisticated and evolving cyberattacks. This proactive approach, coupled with Cisco’s existing security infrastructure, will create a more resilient and comprehensive security posture for its clients. We can expect to see a shift towards more integrated and automated security solutions, reducing reliance on manual processes and improving overall efficiency.

For example, the integration could enable Cisco’s security information and event management (SIEM) systems to leverage Epsagon’s data for more accurate threat intelligence and faster incident response. This could be analogous to how Splunk integrates with various security tools to provide a holistic view of security events, but with a deeper level of visibility into the inner workings of cloud-native applications.

Enhanced Cloud-Native Security Posture

Cisco will likely see a significant improvement in its ability to secure cloud-native applications. Epsagon’s expertise in tracing requests across distributed systems allows for the identification of vulnerabilities and security breaches that might otherwise go undetected. This granular visibility into application behavior will be invaluable in preventing attacks before they can cause significant damage. Think of it as moving from a broad-brush security approach to a highly targeted, surgical one.

This improved posture will attract more clients seeking robust cloud-native security solutions, giving Cisco a competitive edge.

Expansion into AIOps and DevSecOps

The acquisition opens doors for expansion into AIOps (Artificial Intelligence for IT Operations) and DevSecOps (Development, Security, and Operations). Epsagon’s data-driven approach to observability lends itself well to AI-powered security analytics. Cisco can leverage this data to build predictive models that identify potential threats before they materialize. Furthermore, integrating Epsagon’s capabilities into the development lifecycle will enable DevSecOps practices, embedding security into the software development process from the outset.

This proactive approach reduces vulnerabilities and minimizes the risk of security breaches. We might see the emergence of new tools and services that automate security testing and deployment, streamlining the entire DevSecOps workflow.

New Product Offerings and Service Enhancements

The combined capabilities of Cisco and Epsagon could lead to the creation of several new products and services. For example, we could see the emergence of a cloud-native security platform that integrates seamlessly with Cisco’s existing security tools. This platform could provide comprehensive visibility into application behavior, automatically detect and respond to threats, and offer continuous security monitoring.

Furthermore, enhanced security consulting services leveraging Epsagon’s expertise in cloud-native application security could be offered to customers. These services could include vulnerability assessments, security audits, and customized security solutions tailored to the specific needs of each client. A prime example of a potential new offering could be a fully managed cloud security service incorporating Epsagon’s tracing capabilities, offering customers a “set it and forget it” approach to securing their cloud infrastructure.

Final Review

Cisco’s acquisition of Epsagon is more than just a headline; it’s a strategic maneuver with far-reaching consequences. By integrating Epsagon’s cutting-edge technology, Cisco aims to solidify its position as a leading player in cloud security. The long-term implications are significant, promising enhanced security solutions and potentially reshaping the competitive landscape. This deal underscores the escalating importance of cloud security and the ongoing evolution of cybersecurity strategies in a world increasingly reliant on cloud-based infrastructure.

Only time will tell the full impact, but one thing is certain: the cloud security game just got a whole lot more interesting.

Popular Questions

What is Epsagon’s core technology?

Epsagon specializes in providing observability and security solutions for cloud-native applications. Their platform helps businesses monitor, troubleshoot, and secure their applications running on cloud platforms like AWS, Azure, and GCP.

How much did Cisco pay for Epsagon?

The exact acquisition price hasn’t been publicly disclosed.

What are the potential challenges of integrating Epsagon into Cisco?

Potential challenges include aligning different company cultures, integrating disparate technologies, and ensuring a smooth transition for Epsagon’s customers.

Will this acquisition affect Epsagon’s existing customers?

While some changes are likely, Cisco has generally stated a commitment to supporting existing customers and integrating their solutions seamlessly.