Fundamental Cloud Security Practices to Consider

Fundamental cloud security practices to consider are more crucial than ever in today’s interconnected world. Think of it like this: your cloud is your digital castle, and neglecting security is like leaving the gates wide open. This post dives into the essential practices you need to safeguard your valuable data and applications, exploring everything from access management and data encryption to network security and incident response.

We’ll uncover the secrets to building a robust and resilient cloud security posture, ensuring your digital kingdom remains safe and sound.

We’ll cover key areas like implementing least privilege access, choosing the right authentication methods, securing your data both in transit and at rest, and establishing a solid network security perimeter. We’ll also delve into the importance of regular patching, robust logging and monitoring, and leveraging the security features offered by major cloud providers. Get ready to strengthen your cloud defenses and navigate the complex world of cloud security with confidence!

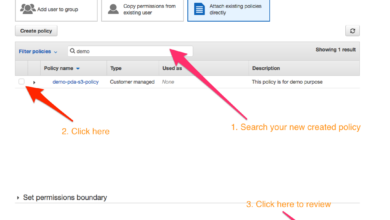

Access Management & Identity

Securing your cloud environment starts with robust access management and identity control. In this increasingly interconnected world, where data resides across various cloud platforms and services, understanding and implementing effective access controls is paramount to maintaining data integrity, confidentiality, and availability. Neglecting this crucial aspect leaves your organization vulnerable to a wide range of security threats.

Least Privilege Access in Cloud Environments

The principle of least privilege dictates that users and applications should only have access to the minimum resources necessary to perform their assigned tasks. This significantly reduces the potential impact of a security breach. If a compromised account only has access to a limited set of resources, the attacker’s ability to cause damage is severely curtailed. In cloud environments, this principle is even more critical due to the shared responsibility model.

While cloud providers secure the underlying infrastructure, organizations are responsible for securing their own data and applications. Implementing least privilege access helps limit the blast radius of any compromise, confining damage to a smaller area. For example, a database administrator should only have access to the specific databases they need to manage, not the entire cloud infrastructure.

Cloud Resource Authentication Methods

Several authentication methods exist for securing access to cloud resources, each with its own strengths and weaknesses.Password-based authentication remains common but suffers from vulnerabilities like phishing and password reuse. Multi-factor authentication (MFA), which requires multiple forms of verification (e.g., password and a one-time code from a mobile app), significantly enhances security. However, MFA can be inconvenient for users.API keys provide programmatic access but require careful management to prevent unauthorized use.

If compromised, they grant extensive access. Certificate-based authentication offers strong security through digital certificates, but managing certificates can be complex. Finally, biometric authentication, using fingerprints or facial recognition, offers a high level of security but may raise privacy concerns. The optimal choice depends on the sensitivity of the data and the level of security required.

Robust Authorization Strategy for a Multi-Tenant SaaS Application

Role-Based Access Control (RBAC) is a crucial component of a robust authorization strategy for multi-tenant SaaS applications. RBAC assigns permissions based on roles, rather than individual users. This simplifies management and ensures consistency. For example, a “customer administrator” role might have access to manage users and settings within their tenant, while a “support engineer” role might have access to view and manage support tickets across multiple tenants, but not modify customer data.

This granular control prevents unauthorized access and maintains data segregation between tenants. RBAC can be further enhanced by implementing attribute-based access control (ABAC) to add more context-aware policies.

Common Access Management Vulnerabilities and Mitigation Strategies

| Vulnerability | Impact | Mitigation | Example |

|---|---|---|---|

| Weak or default passwords | Unauthorized access | Enforce strong password policies, implement MFA | Using “password123” as a password |

| Unpatched systems | Exploitable vulnerabilities | Regular patching and updates | Failing to update a web server with known security vulnerabilities |

| Lack of MFA | Increased risk of account compromise | Implement MFA for all privileged accounts | Allowing login with only a username and password |

| Over-privileged accounts | Excessive access, increased risk | Implement least privilege access | A developer account with administrative privileges on the entire system |

| Insufficient logging and monitoring | Difficulty detecting breaches | Implement robust logging and monitoring | Lack of audit trails for access to sensitive data |

Data Security & Privacy: Fundamental Cloud Security Practices To Consider

Protecting your data in the cloud is paramount. It’s not just about keeping your information safe from malicious actors, but also about ensuring you comply with various regulations and maintain the trust of your users. This section explores crucial aspects of data security and privacy within cloud environments.Data security and privacy in the cloud requires a multi-faceted approach encompassing encryption, data residency, compliance, data loss prevention, and robust backup and recovery strategies.

Neglecting any of these can lead to significant breaches, financial losses, and reputational damage.

Data Encryption Methods

Data encryption is the cornerstone of cloud security. It transforms readable data (plaintext) into an unreadable format (ciphertext), protecting it from unauthorized access. Two primary types of encryption are used: data in transit and data at rest. Data in transit encryption protects data while it’s being transmitted over a network, typically using protocols like TLS/SSL. Data at rest encryption protects data stored on servers or storage devices, often employing techniques like AES-256 encryption.

The choice of encryption method depends on the sensitivity of the data and the specific requirements of the application. For example, highly sensitive financial data might require both TLS/SSL and AES-256 encryption, while less sensitive data may only require one or the other.

Data Residency and Compliance

Data residency refers to the geographical location where data is stored. Many regulations, like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), mandate specific data residency requirements. GDPR, for instance, requires that personal data of EU citizens be stored within the EU or in countries with adequate data protection levels. Meeting these requirements involves careful selection of cloud providers and storage locations.

Organizations must carefully map their data to the relevant regulations and ensure that their cloud infrastructure complies. Failure to do so can result in hefty fines and legal repercussions. For example, a company storing EU citizen data on servers in a country without adequate data protection measures under GDPR would be in violation and face penalties.

Data Loss Prevention (DLP) Best Practices

Data loss prevention (DLP) aims to prevent sensitive data from leaving the organization’s control. Effective DLP in cloud environments involves a combination of technical and procedural measures. This includes implementing access controls to restrict who can access sensitive data, using data encryption to protect data both in transit and at rest, and employing data loss prevention tools that monitor data movement and identify potential leaks.

Regular security audits and employee training on data security best practices are also crucial. For instance, a DLP system might alert administrators if a user attempts to download a large amount of sensitive data to an unauthorized location.

Cloud-Based Application Backup and Recovery Plan

A robust backup and recovery plan is essential for any cloud-based application. This plan should detail how data will be backed up, where it will be stored, and how it will be restored in case of data loss or a disaster. The plan should consider factors such as recovery time objective (RTO) and recovery point objective (RPO). RTO specifies the maximum tolerable downtime, while RPO specifies the maximum acceptable data loss.

The plan should also Artikel procedures for testing the backup and recovery process regularly. For example, a plan might involve backing up data daily to a geographically separate region using a cloud-based backup service and regularly testing the restoration process to ensure a quick recovery in case of an outage. This could also include utilizing different cloud regions for redundancy.

In the event of a major disaster, a secondary cloud environment or a on-premise backup could be utilized.

Network Security

Cloud environments, while offering incredible scalability and flexibility, introduce new network security challenges. Traditional network security perimeters become blurred, demanding a more nuanced and proactive approach to protect data and applications. Understanding and mitigating these risks is crucial for maintaining a secure cloud infrastructure.

So, you’re thinking about fundamental cloud security practices to consider? It’s crucial to protect your data, especially given recent news like this alarming article about facebook asking bank account info and card transactions of users. This highlights the importance of strong passwords, multi-factor authentication, and regularly reviewing your privacy settings – all key aspects of fundamental cloud security practices.

Don’t let your data become another victim!

Common Network Security Threats in Cloud Environments

Cloud-specific threats often exploit the shared responsibility model inherent in cloud computing. Attacks can target the network infrastructure itself, or leverage vulnerabilities in applications and services running within the cloud. Distributed Denial-of-Service (DDoS) attacks, for example, flood a target with overwhelming traffic, rendering it unavailable to legitimate users. These attacks can be amplified in the cloud due to the ease of launching attacks from numerous compromised machines globally.

Man-in-the-middle (MitM) attacks intercept communication between two parties, allowing the attacker to eavesdrop or manipulate the data exchanged. In cloud environments, MitM attacks can target API calls or communication between microservices, potentially leading to data breaches or service disruption. Other common threats include unauthorized access to virtual networks, data exfiltration through misconfigured storage services, and exploitation of vulnerabilities in cloud-based applications.

Virtual Private Clouds (VPCs) and Enhanced Cloud Security

VPCs provide a logically isolated section of a cloud provider’s infrastructure, dedicated to a specific organization or user. This isolation enhances security by creating a virtual network separate from other tenants’ networks, reducing the risk of lateral movement of attacks. Within a VPC, users can define subnets, security groups, and network access control lists (ACLs) to further restrict access to resources.

This granular control allows for the implementation of the principle of least privilege, ensuring that only authorized users and applications have access to specific resources. The use of VPCs also simplifies network segmentation, allowing organizations to isolate sensitive applications and data from less critical systems. For example, a company might create separate VPCs for development, testing, and production environments, enhancing security and preventing cross-contamination of data.

Securing Cloud-Based APIs and Microservices

Cloud-native applications often rely heavily on APIs and microservices. Securing these components is crucial, as vulnerabilities can expose sensitive data or disrupt application functionality. Implementing robust authentication and authorization mechanisms is paramount, using technologies like OAuth 2.0 and OpenID Connect. Input validation and sanitization should be rigorously enforced to prevent injection attacks. API gateways can provide an additional layer of security by acting as a central point of control for all API traffic, enabling features like rate limiting, request filtering, and bot detection.

Microservices should be designed with security in mind, utilizing principles like least privilege and secure communication channels. Regular security assessments and penetration testing should be conducted to identify and address vulnerabilities in APIs and microservices.

Comparison of Cloud Network Security Tools

Choosing the right network security tools is crucial for a robust cloud security posture. The following table compares three common types:

| Tool | Features | Strengths/Weaknesses |

|---|---|---|

| Firewalls (e.g., AWS Web Application Firewall, Azure Firewall) | Network traffic filtering based on rules, stateful inspection, intrusion prevention capabilities | Strengths: Basic network security, relatively easy to implement. Weaknesses: Can be complex to manage for large deployments, may not detect sophisticated attacks. |

| Intrusion Detection/Prevention Systems (IDS/IPS) (e.g., Amazon GuardDuty, Azure Security Center) | Real-time monitoring of network traffic for malicious activity, signature-based and anomaly-based detection, automated response capabilities | Strengths: Detect sophisticated attacks, provide real-time alerts. Weaknesses: Can generate false positives, requires expertise to configure and manage effectively. |

| Web Application Firewalls (WAFs) (e.g., AWS WAF, Azure Web Application Firewall) | Protection against web application attacks such as SQL injection, cross-site scripting (XSS), and cross-site request forgery (CSRF) | Strengths: Specifically designed for web applications, protects against common web vulnerabilities. Weaknesses: Requires accurate configuration, may not protect against zero-day exploits. |

Infrastructure Security

Securing your cloud infrastructure is paramount to the overall success and safety of your cloud deployment. A robust security posture for your infrastructure goes beyond simply choosing a reputable cloud provider; it requires ongoing vigilance and proactive measures to mitigate risks. This involves everything from regularly updating software to implementing stringent access controls for your virtual machines and databases.Regular patching and updates are fundamental to maintaining a secure cloud infrastructure.

Vulnerabilities are constantly being discovered in software and hardware, and attackers are quick to exploit them. Failing to keep your systems up-to-date leaves your organization exposed to significant security risks, including data breaches, malware infections, and denial-of-service attacks. A well-defined patching strategy, incorporating automated updates where possible, is essential.

Securing Virtual Machines

Virtual machines (VMs) are the building blocks of many cloud deployments. Securing them requires a multi-layered approach. This includes employing strong passwords or using key-based authentication, regularly scanning VMs for malware, implementing robust firewall rules to control network traffic, and ensuring operating systems and applications are patched and updated. Employing technologies like intrusion detection and prevention systems (IDPS) can further enhance security by monitoring VM activity for malicious behavior.

Consider using dedicated security tools for VMs, such as those that offer vulnerability scanning and real-time threat detection. Regular security audits of VM configurations should also be performed.

Securing Cloud-Based Databases

Cloud-based databases, while offering scalability and flexibility, require specific security considerations. Implementing strong access controls, using encryption both in transit and at rest, and regularly backing up data are crucial steps. Database activity monitoring (DAM) can help detect and respond to suspicious behavior. Employing the principle of least privilege, granting only necessary access rights to users and applications, minimizes the potential impact of a security breach.

So, you’re building cloud apps? Fundamental cloud security practices, like robust authentication and data encryption, are paramount. This is especially true when considering modern development approaches, such as those explored in this insightful article on domino app dev the low code and pro code future , which highlights how efficient development can sometimes overshadow security considerations. Remember, secure coding practices are essential from the outset, regardless of your chosen development methodology.

Regularly reviewing and updating database configurations is also essential to maintain a strong security posture. Consider using database-specific security tools that offer features like automated vulnerability assessments and threat detection.

Migrating On-Premise Applications to the Cloud: Security Checklist

Migrating on-premise applications to the cloud presents unique security challenges. A thorough risk assessment and careful planning are essential. The following checklist highlights key security considerations:

- Inventory and Assess Existing Security Controls: Document all current security controls and assess their suitability for the cloud environment.

- Data Classification and Security Controls: Classify data according to sensitivity and implement appropriate security controls, including encryption and access control lists.

- Network Security Configuration: Configure firewalls, VPNs, and other network security components to protect cloud resources.

- Vulnerability Scanning and Penetration Testing: Conduct regular vulnerability scans and penetration testing to identify and address security weaknesses.

- Compliance Requirements: Ensure compliance with relevant industry regulations and standards (e.g., HIPAA, PCI DSS).

- Security Monitoring and Logging: Implement robust security monitoring and logging to detect and respond to security incidents.

- Incident Response Plan: Develop and test a comprehensive incident response plan to handle security breaches effectively.

- Access Management and Identity: Implement strong access control measures using IAM services provided by your cloud provider.

- Data Backup and Recovery: Implement a robust data backup and recovery strategy to ensure business continuity.

- Security Automation: Automate security tasks such as patching, vulnerability scanning, and incident response.

Security Monitoring & Logging

Effective security monitoring and logging are paramount in maintaining a robust cloud security posture. Without comprehensive logging and real-time monitoring, detecting and responding to threats becomes significantly more difficult, potentially leading to data breaches, service disruptions, and reputational damage. A proactive approach to monitoring and logging is crucial for identifying vulnerabilities and mitigating risks before they escalate.Centralized logging and monitoring provide a single pane of glass view into the security posture of your entire cloud infrastructure.

This consolidated approach streamlines threat detection, incident response, and compliance reporting. It allows security teams to quickly identify patterns, anomalies, and suspicious activities across various cloud services and resources. Without this centralization, security teams would be forced to manually correlate logs from disparate sources, a time-consuming and error-prone process.

Implementing Security Information and Event Management (SIEM) in the Cloud

SIEM solutions are essential for aggregating and analyzing security logs from diverse cloud sources. These solutions ingest log data from various cloud services (like AWS CloudTrail, Azure Activity Log, GCP Cloud Audit Logs), network devices, and security tools, correlating them to identify potential threats. Effective implementation involves configuring log forwarding from cloud resources to the SIEM, defining appropriate security rules and alerts based on known threats and compliance requirements, and establishing processes for incident response based on SIEM alerts.

So, you’re thinking about fundamental cloud security practices? Data encryption and access controls are absolute must-haves, right? But managing all that across your various cloud services can feel overwhelming. That’s where tools like cloud security posture management (CSPM) come in; check out this great article on bitglass and the rise of cloud security posture management for a deeper dive.

Ultimately, strong CSPM solutions are key to reinforcing those fundamental security practices and maintaining a solid security posture.

Consider factors like scalability, cost, and integration with existing security tools when selecting a cloud-based SIEM solution. Many vendors offer cloud-native SIEM platforms optimized for scalability and performance in cloud environments.

Detecting and Responding to Security Incidents in the Cloud

Effective incident response begins with robust threat detection. This involves using SIEM alerts, security orchestration, automation, and response (SOAR) tools, and continuous monitoring of security dashboards to identify anomalies. Key indicators of compromise (IOCs) such as unusual login attempts, data exfiltration, or unauthorized access attempts should trigger immediate investigation. Incident response plans should Artikel clear steps for containment, eradication, recovery, and post-incident activity.

Regular security drills and simulations are crucial to test the effectiveness of these plans and ensure the team is well-prepared to handle real-world incidents. The speed and effectiveness of response directly impact the severity of damage and the time needed for recovery.

Security Dashboards and Reporting

Security dashboards provide a real-time overview of the security posture, displaying key metrics and visualizations. A sample dashboard might include:A hypothetical security dashboard could display the following:

- Number of security alerts: A graph showing the number of alerts generated over time, categorized by severity (critical, high, medium, low).

- Top 10 vulnerabilities: A bar chart showing the top ten most prevalent vulnerabilities identified through vulnerability scanning.

- Login failures: A real-time counter showing the number of failed login attempts in the last hour, broken down by source IP address.

- Data exfiltration attempts: A table listing any detected attempts to exfiltrate data, including the source, destination, and amount of data transferred.

- Compliance status: A summary of the organization’s compliance status against relevant regulations and standards (e.g., GDPR, HIPAA).

These visualizations allow security teams to quickly identify trends, prioritize incidents, and track the effectiveness of security controls. Regular reporting provides an audit trail and helps to demonstrate compliance with security standards. Reports should include summaries of security incidents, vulnerability scans, and overall security posture assessments.

Cloud Provider Security Features

Choosing a cloud provider involves a thorough assessment of their security capabilities. Each major player – AWS, Azure, and GCP – offers a robust suite of security features, but their strengths and weaknesses vary depending on specific needs. Understanding these differences is crucial for building a secure cloud infrastructure. This section explores the key features, the shared responsibility model, and how to leverage these tools effectively.

Shared Responsibility Model in Cloud Security

The shared responsibility model is a fundamental concept in cloud security. It Artikels the division of security responsibilities between the cloud provider and the customer. The provider is responsible for securing the underlying infrastructure (the physical hardware, network, and global infrastructure), while the customer is responsible for securing everything they deploy and manage

on* that infrastructure. This includes operating systems, applications, data, and user configurations. Think of it like renting an apartment

the landlord (cloud provider) is responsible for the building’s security (fire alarms, locks, etc.), while the tenant (customer) is responsible for securing their own apartment (locking doors, securing valuables). A failure to understand and adhere to this model can lead to significant security vulnerabilities. For example, a customer neglecting to patch their operating systems leaves them vulnerable, even if the underlying cloud infrastructure is perfectly secure.

Comparison of Security Features Across Major Cloud Providers

AWS, Azure, and GCP each provide comprehensive security features, but their specific offerings and strengths differ. AWS boasts a mature and extensive ecosystem, with services like AWS Shield (DDoS protection), GuardDuty (threat detection), and IAM (Identity and Access Management) widely recognized for their effectiveness. Azure offers strong integration with Active Directory and other Microsoft products, making it attractive to organizations already invested in the Microsoft ecosystem.

Its Azure Security Center provides a centralized view of security posture across resources. GCP, known for its strong compliance offerings, excels in areas like data encryption and compliance certifications. Its Cloud Security Command Center offers a similar centralized view to Azure Security Center and AWS Security Hub. The best choice depends on an organization’s specific requirements, existing infrastructure, and expertise.

Leveraging Cloud Provider Security Tools and Services, Fundamental cloud security practices to consider

Effectively leveraging cloud provider security tools is essential for a robust security posture. This involves utilizing features like:

- Identity and Access Management (IAM): Implementing strong IAM policies, using least privilege access, and regularly reviewing user permissions are critical. This prevents unauthorized access to sensitive resources.

- Data Encryption: Employing both in-transit and at-rest encryption for sensitive data using provider-managed encryption keys or customer-managed encryption keys (CMKs) significantly enhances data security.

- Virtual Private Clouds (VPCs): Creating isolated networks within the cloud using VPCs improves network security by segmenting resources and limiting access.

- Security Information and Event Management (SIEM): Utilizing cloud provider SIEM solutions like Amazon CloudWatch, Azure Sentinel, or Google Cloud’s Chronicle allows for centralized monitoring and analysis of security logs, enabling quicker detection of threats.

- Intrusion Detection and Prevention Systems (IDPS): Deploying cloud-based IDPS solutions helps identify and mitigate potential security breaches in real-time.

By proactively utilizing these tools and services, organizations can significantly reduce their attack surface and improve their overall security posture.

Relevant Security Certifications and Compliance Standards

Cloud providers invest heavily in obtaining industry-recognized security certifications and complying with various standards. These certifications and compliance demonstrate their commitment to security and help organizations meet regulatory requirements. Some key certifications and standards include:

- ISO 27001 (Information Security Management System)

- SOC 2 (System and Organization Controls 2)

- PCI DSS (Payment Card Industry Data Security Standard)

- HIPAA (Health Insurance Portability and Accountability Act)

- FedRAMP (Federal Risk and Authorization Management Program)

It is crucial to verify that the chosen cloud provider possesses the necessary certifications and complies with the relevant standards for your specific industry and regulatory needs.

Closing Summary

Securing your cloud environment isn’t a one-time task; it’s an ongoing journey. By implementing the fundamental cloud security practices discussed—from robust access control and data encryption to vigilant monitoring and incident response—you can significantly reduce your risk exposure. Remember, a proactive approach is key. Regularly review your security posture, stay updated on emerging threats, and leverage the powerful tools and services offered by cloud providers.

Your digital assets are worth protecting – let’s keep them safe!

FAQ Guide

What is the shared responsibility model in cloud security?

The shared responsibility model Artikels how security responsibilities are divided between the cloud provider and the customer. The provider is responsible for the underlying infrastructure’s security, while the customer is responsible for securing their data and applications running on that infrastructure.

How often should I patch my cloud infrastructure?

Patching should be done frequently, ideally as soon as security updates are released. The exact frequency depends on your specific needs and risk tolerance, but a regular schedule is crucial to minimize vulnerabilities.

What are some common cloud security certifications?

Common certifications include the Certified Cloud Security Professional (CCSP), Certified Information Systems Security Professional (CISSP), and various cloud provider-specific certifications (e.g., AWS Certified Security Specialty).

How can I detect and respond to security incidents in the cloud?

Implement robust logging and monitoring, utilize a SIEM system for threat detection, and establish clear incident response procedures. Regular security audits and penetration testing can also help identify vulnerabilities before they’re exploited.