Cyber Attack on Appleby Exposing the Worlds Richest

Cyber attack on appleby can reveal financial records of worlds richest people – Cyber attack on Appleby can reveal financial records of the world’s richest people – a chilling prospect that sent shivers down my spine when I first heard about it. Imagine the sheer volume of sensitive data potentially exposed: bank statements, tax returns, investment portfolios – the lifeblood of global finance laid bare. This isn’t just a data breach; it’s a potential Pandora’s Box of financial chaos, threatening the privacy and security of some of the most powerful individuals on the planet.

The implications are staggering, reaching far beyond the immediate victims and shaking the foundations of trust in global financial institutions.

The scale of the potential damage is almost incomprehensible. We’re talking about blackmail on an unprecedented level, sophisticated fraud schemes, and the erosion of trust in a system already grappling with significant challenges. Who were the perpetrators? What were their motives? And what measures are being taken to prevent future attacks of this magnitude?

These are the crucial questions we need to explore.

The Nature of the Cyberattack: Cyber Attack On Appleby Can Reveal Financial Records Of Worlds Richest People

The 2016 cyberattack on Appleby, a offshore law firm, revealed the financial records of numerous wealthy individuals and corporations, highlighting significant vulnerabilities in data security and raising concerns about the methods and motivations behind such breaches. The scale of the data leak underscores the need for robust cybersecurity measures within organizations handling sensitive financial information.

Potential Attack Methods

The attack on Appleby likely involved a sophisticated combination of techniques. Phishing emails, designed to trick employees into revealing login credentials, could have been a primary entry point. Exploiting known vulnerabilities in Appleby’s software, possibly through outdated or unpatched systems, is another likely scenario. Once inside the network, the attackers may have used lateral movement techniques to access more sensitive data, potentially utilizing malware to exfiltrate information undetected.

The attackers could have also leveraged social engineering to gain access to internal systems or manipulate employees into providing access.

Exploited Vulnerabilities

Appleby’s data security weaknesses likely involved several factors. Outdated software, a lack of multi-factor authentication, inadequate employee training on cybersecurity threats, and insufficient network segmentation all contributed to the vulnerability. The firm may have also lacked robust intrusion detection and prevention systems, allowing the attackers to operate undetected for an extended period. Furthermore, weak password policies and a lack of regular security audits likely exacerbated the situation.

The absence of comprehensive data encryption both in transit and at rest further compounded the problem, allowing the attackers to easily access and exfiltrate sensitive data.

Potential Actors and Motives, Cyber attack on appleby can reveal financial records of worlds richest people

Several actors could be responsible for the Appleby attack. State-sponsored actors, seeking to expose financial irregularities or gain geopolitical leverage, are a strong possibility. Organized crime groups, motivated by financial gain through blackmail or data sales on the dark web, are another plausible scenario. Even disgruntled employees or former employees with insider knowledge could have played a role, though the complexity of the attack suggests a more sophisticated actor was likely involved.

The Appleby cyberattack potentially exposing the financial details of the world’s wealthiest individuals is a stark reminder of how vulnerable even the most secure systems can be. Building robust, secure applications is crucial, and that’s where understanding the advancements in app development like those discussed in this article on domino app dev the low code and pro code future becomes incredibly important.

Ultimately, preventing future breaches requires a focus on both data security and innovative development practices to safeguard sensitive information.

The motive would have centered around accessing and exploiting sensitive financial information for profit, political gain, or to cause reputational damage.

Hypothetical Timeline of Events

A hypothetical timeline could begin with initial reconnaissance and targeting of Appleby, followed by the deployment of phishing emails or malware. Successful infiltration would allow the attackers to move laterally within the network, identifying and accessing sensitive data. The exfiltration of data would then occur, potentially over an extended period to avoid detection. The subsequent release of the data through the media would represent the final stage.

The aftermath would involve investigations, legal battles, and reputational damage for Appleby and its clients.

Attack Vectors and Impact on Data Confidentiality

| Attack Vector | Target | Potential Impact | Mitigation |

|---|---|---|---|

| Phishing | Employee Credentials | Data Breach, Identity Theft | Security Awareness Training, Multi-Factor Authentication |

| Malware | System Files, Data | Data Loss, System Compromise | Antivirus Software, Regular System Updates |

| Exploiting Software Vulnerabilities | Applications, Servers | Unauthorized Access, Data Exfiltration | Regular Software Updates, Vulnerability Scanning |

| Insider Threat | Internal Systems, Data | Data Breach, Sabotage | Access Control, Background Checks, Monitoring |

Data Breached

The Appleby leak, revealing the financial records of some of the world’s wealthiest individuals, exposed a staggering amount of sensitive data. The sheer volume and variety of information compromised necessitates a careful examination of the types of records involved and the potential ramifications for those affected. This goes beyond simple inconvenience; it represents a significant threat to personal privacy and financial security, with lasting legal and regulatory consequences.The types of financial records potentially compromised were extensive and highly sensitive.

The scale of the breach suggests that virtually any financial document held by Appleby for its clients could have been accessed.

Types of Compromised Financial Records and Potential Consequences

The leaked data likely included a wide range of documents, each carrying its own level of risk. This includes highly sensitive information capable of severe misuse. For example, bank statements could be used for identity theft or fraudulent transactions. Tax returns could be leveraged for tax evasion schemes or blackmail. Investment details could lead to market manipulation or targeted financial scams.

The potential consequences for individuals are severe and far-reaching.

- Bank Statements: Access to bank statements allows criminals to track spending habits, identify vulnerabilities, and potentially drain accounts or commit identity theft. Imagine the impact on someone whose life savings are exposed, leading to financial ruin.

- Tax Returns: Tax returns contain highly personal information, including income, assets, and liabilities. Compromised tax returns could be used for identity theft, tax fraud, or blackmail, leading to legal battles and significant financial losses. For example, a high-net-worth individual might face accusations of tax evasion based on manipulated data.

- Investment Details: Access to investment portfolios allows for targeted financial scams, market manipulation, or even insider trading. Imagine the consequences for an individual whose investment strategy is compromised, leading to substantial financial losses.

- Trust and Estate Documents: These documents often contain highly sensitive details about family members, assets, and inheritance plans. Their exposure can lead to family disputes, financial exploitation, and complex legal battles.

- Property Records: Information about property ownership can be used for various fraudulent activities, including property scams, mortgage fraud, or even targeted harassment.

Legal and Regulatory Implications

The Appleby leak has significant legal and regulatory implications for both Appleby and the affected individuals. Appleby faces potential lawsuits for negligence and data breaches, potentially leading to substantial fines and reputational damage. Affected individuals may pursue legal action for damages resulting from identity theft, financial losses, or emotional distress. Depending on the jurisdiction, data protection laws like GDPR (in Europe) or CCPA (in California) could impose substantial penalties on Appleby.

Individuals may also need to take steps to mitigate the risk of identity theft and financial fraud, which can be costly and time-consuming.

Categories of Sensitive Data and Potential for Misuse

The following categories of sensitive data highlight the potential for misuse:

- Personally Identifiable Information (PII): Names, addresses, dates of birth, national identification numbers, passport details – all crucial for identity theft.

- Financial Information: Bank account details, credit card numbers, tax information, investment details – used for financial fraud and theft.

- Confidential Business Information: Trade secrets, business strategies, client lists – used for competitive advantage theft or blackmail.

- Private Communications: Emails, letters, and other communications revealing personal details or business strategies – used for blackmail or public embarrassment.

Impact on High-Net-Worth Individuals

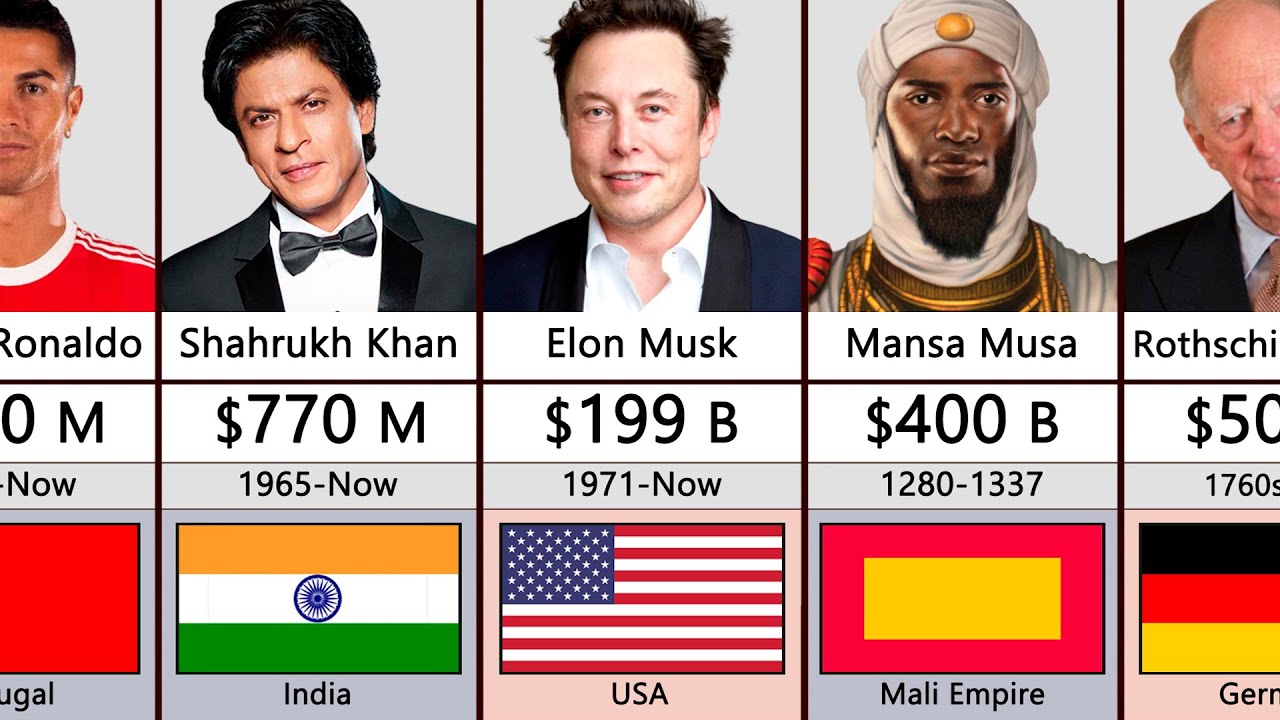

The Appleby cyberattack, exposing the financial records of the world’s wealthiest individuals, presents a significant threat with far-reaching consequences. The sheer volume and sensitivity of the data breached – including details on offshore accounts, trusts, and investments – creates a potent vulnerability for these high-profile individuals, extending beyond simple financial loss to encompass reputational damage and personal safety. The potential for exploitation is immense, and the long-term effects could be devastating.The compromised financial data can be leveraged in several ways to inflict considerable harm.

The Appleby cyberattack’s potential to expose the financial records of the world’s wealthiest individuals highlights a critical need for robust data security. This incident underscores the importance of proactive security measures, like those offered by solutions such as bitglass and the rise of cloud security posture management , which help organizations maintain control over their sensitive data in the cloud.

Ultimately, stronger cloud security is paramount to preventing future breaches and protecting the privacy of high-profile individuals and companies alike.

The scale of the breach means that even individuals with sophisticated security measures could find themselves exposed. The sheer volume of data offers numerous attack vectors for malicious actors.

Financial Repercussions

The potential financial repercussions for the world’s wealthiest individuals are substantial and multifaceted. Direct financial losses are certainly possible, ranging from fraudulent transactions to the exploitation of loopholes revealed in their financial structures. Beyond direct losses, the cost of mitigating the damage – including legal fees, security upgrades, and reputational management – could be staggering. For example, a high-net-worth individual might face costly litigation to recover assets or to defend against accusations of tax evasion based on misinterpreted data.

The indirect costs associated with restoring trust and regaining a positive public image can also be significant. Consider the case of a philanthropist whose reputation is tarnished by the leak; the damage to their legacy and ability to raise funds for their causes could outweigh direct financial losses.

Blackmail, Fraud, and Identity Theft

Compromised financial data provides a rich source for blackmail attempts. Threat actors could leverage sensitive information to extort money or demand specific actions from their victims. This is particularly effective with high-profile individuals who may prioritize protecting their privacy and reputation above all else. Fraudulent activities could involve impersonating the victim to access their accounts or initiate fraudulent transactions.

The depth of the breached data provides ample opportunity for sophisticated identity theft schemes, potentially leading to significant financial losses and legal complications. For instance, an attacker could use the details of offshore trusts to fabricate documents and claim ownership of assets, leading to complex and costly legal battles.

Impact Based on Wealth and Risk Tolerance

The impact of this data breach varies depending on an individual’s wealth and risk tolerance. While extremely wealthy individuals might absorb direct financial losses more easily, the reputational damage could be equally, if not more, devastating for all involved. Individuals with lower risk tolerance might experience greater anxiety and distress, even if the direct financial impact is minimal.

Those with less liquid assets could face more significant hardship from even minor financial losses. The psychological impact should not be underestimated; the fear of blackmail, public exposure, and legal repercussions can be extremely stressful. This underscores the need for comprehensive risk management strategies tailored to the specific circumstances of each high-net-worth individual.

Long-Term Effects on Reputation and Trust

The long-term effects on reputation and trust are potentially catastrophic. The disclosure of sensitive financial information, even if ultimately proven to be misrepresented or used out of context, can significantly damage an individual’s reputation. This is particularly true in a world of instant digital communication, where negative news spreads rapidly. Trust, both personal and professional, can be irrevocably damaged, impacting relationships with family, friends, business partners, and the public.

The ability to maintain positive relationships and secure future investments could be severely compromised. This highlights the importance of proactive measures to mitigate reputational damage and rebuild trust following such a breach.

Appleby’s Response and Prevention Measures

The Paradise Papers leak highlighted the devastating consequences of a successful cyberattack, not only for Appleby but also for its high-net-worth clients. A swift and comprehensive response, coupled with robust preventative measures, is crucial for regaining trust and preventing future breaches. Appleby’s actions following the attack will significantly impact its future reputation and operational viability.Appleby’s immediate response should have focused on damage control and securing its systems.

This involved isolating affected servers, conducting a thorough forensic investigation to determine the attack’s scope and origin, and notifying affected clients promptly and transparently. Simultaneously, they should have engaged cybersecurity experts to help assess the situation and implement immediate mitigation strategies. The longer the delay in these initial steps, the greater the potential for further damage and loss of client confidence.

Mitigating the Damage from the Cyberattack

Mitigating the damage requires a multi-pronged approach. First, Appleby needs to fully understand the extent of the data breach. This includes identifying precisely what information was compromised and which clients were affected. Second, they must implement measures to prevent further data exfiltration, such as patching vulnerabilities, resetting compromised credentials, and enhancing network security. Third, Appleby needs to proactively communicate with affected clients, providing clear and concise information about the breach, the steps being taken to address it, and resources available to help them mitigate any potential risks.

This transparent communication is key to rebuilding trust. Finally, they should collaborate with law enforcement agencies to investigate the attack and potentially prosecute those responsible. The Equifax breach serves as a cautionary tale; a delayed and opaque response only exacerbates the damage.

Implementing Security Protocols to Prevent Future Attacks

Preventing future attacks requires a significant investment in security infrastructure and personnel. This includes implementing multi-factor authentication for all employees and clients accessing sensitive data, regularly updating software and security patches, and investing in advanced threat detection systems. Regular security audits and penetration testing are also crucial for identifying vulnerabilities before attackers can exploit them. Employee training on cybersecurity best practices, including phishing awareness and password security, is equally important.

A robust incident response plan should be in place, tested regularly, and readily accessible to all relevant personnel. Appleby should also consider adopting a zero-trust security model, which assumes no implicit trust and verifies every access request.

Data Security and Incident Response Best Practices

A comprehensive data security strategy should be at the heart of Appleby’s operations. This involves implementing robust access controls, data encryption both in transit and at rest, and regular data backups. A well-defined incident response plan is essential, detailing procedures for identifying, containing, eradicating, recovering from, and learning from security incidents. This plan should include clear roles and responsibilities, communication protocols, and escalation procedures.

Regular security awareness training for all employees is crucial to foster a culture of security. Appleby should also establish a dedicated security team with the expertise to monitor threats, respond to incidents, and proactively improve security posture. Regularly reviewing and updating security policies and procedures is also vital to adapt to evolving threats.

Hypothetical Press Release: Appleby’s Response to Cyberattack

FOR IMMEDIATE RELEASEAppleby Addresses Recent Cybersecurity Incident[City, Date] – Appleby acknowledges a recent cybersecurity incident that resulted in unauthorized access to certain client data. We acted swiftly to contain the incident, engaging leading cybersecurity experts to conduct a thorough investigation and implement enhanced security measures. We have already identified the extent of the breach and are notifying affected clients directly. Our priority is protecting client data and rebuilding trust.

We have implemented multi-factor authentication, enhanced network security, and are conducting regular security audits. We are cooperating fully with law enforcement authorities. We regret any inconvenience this incident may have caused and remain committed to providing the highest level of security for our clients.

Wider Implications and Global Security

The Appleby cyberattack, revealing the financial details of the world’s wealthiest individuals, exposed far more than just private information; it illuminated the fragility of the global financial system and the increasingly sophisticated nature of cybercrime. The incident serves as a stark warning about the interconnectedness of global finance and its vulnerability to large-scale data breaches. The repercussions extend far beyond the immediate victims, impacting international regulations, trust in financial institutions, and the future trajectory of cybercrime itself.The sheer scale of the data breach highlights the systemic risks inherent in the global financial system.

The interconnected nature of offshore banking, wealth management, and international trade means that a single breach can have cascading effects, potentially triggering market instability and eroding confidence in the system. The attack underscores the need for a more robust and coordinated international response to cybercrime, moving beyond national borders and fostering collaboration between governments and private entities.

Impact on Global Financial Stability

The Appleby leak demonstrated the potential for cyberattacks to destabilize global financial markets. The release of sensitive financial information could lead to market volatility, as investors react to the uncertainty surrounding the exposed data. This could manifest in decreased investment, increased risk aversion, and potential fluctuations in currency exchange rates. Similar incidents, though perhaps not on the same scale, have already shown the potential for financial market disruption.

For example, the 2014 Sony Pictures hack, while not directly targeting financial institutions, still resulted in significant financial losses and reputational damage for the company. The Appleby case, however, highlights the potential for far greater systemic impact due to the nature of the data compromised.

Implications for International Data Privacy Regulations

The Appleby incident underscores the limitations of existing international data privacy regulations. The attack exposed the difficulties in enforcing data protection laws across jurisdictions, particularly when dealing with offshore entities and complex international financial transactions. The incident will likely accelerate the push for stronger international cooperation and harmonization of data privacy regulations. This includes increased pressure on governments to enact stricter penalties for data breaches and improved mechanisms for cross-border data sharing and enforcement.

We might see a greater emphasis on data localization requirements and the implementation of more stringent data security protocols across the globe. The European Union’s General Data Protection Regulation (GDPR), while a significant step, is not a panacea, and the Appleby case showcases the need for even more robust and globally coordinated measures.

Future Trends in Cybercrime Targeting High-Net-Worth Individuals

The Appleby attack represents a significant milestone in the evolution of cybercrime. We can expect future attacks to become more sophisticated, targeted, and potentially even more devastating. Cybercriminals are likely to leverage advanced techniques like artificial intelligence and machine learning to identify and exploit vulnerabilities in financial systems and to personalize attacks against high-net-worth individuals. Ransomware attacks targeting individuals’ digital assets, blackmail using stolen data, and the exploitation of vulnerabilities in smart home technology are all potential future trends.

The rise of the dark web and the ease with which stolen data can be traded will only exacerbate this problem. Furthermore, the use of insider threats, individuals with access to sensitive information within financial institutions, will likely continue to be a major concern.

Visual Representation of Global Financial System Vulnerability

Imagine a complex web, a vast network of interconnected nodes. Each node represents a financial institution – banks, investment firms, law firms like Appleby, and individual high-net-worth individuals. Thick lines connecting these nodes symbolize the flow of money, data, and information across international borders. These connections are diverse, representing various financial transactions, from international wire transfers to offshore accounts.

Now, imagine a single point of vulnerability, a weak link in this web, perhaps a poorly secured server at an offshore law firm. A cyberattack targeting this point can ripple through the entire network, compromising data across multiple institutions and impacting numerous individuals. The vulnerability of the system is emphasized by the fact that the disruption at a single point can cause widespread damage across the entire interconnected web.

The image would be visually dense, reflecting the complexity of the global financial system and its susceptibility to cyberattacks. The weak link would be prominently highlighted, demonstrating how a small breach can have a massive impact.

Last Recap

The Appleby cyberattack serves as a stark reminder of our increasing vulnerability in the digital age. The potential exposure of the financial records of the world’s wealthiest individuals highlights the urgent need for enhanced cybersecurity measures across the board. It’s not just about protecting individual fortunes; it’s about safeguarding the stability of the global financial system itself. This incident underscores the importance of robust data protection protocols, proactive threat intelligence, and a collective effort to combat the ever-evolving landscape of cybercrime.

The fight for financial security in the digital age is far from over, and this attack is a wake-up call we can’t afford to ignore.

Expert Answers

What type of data was potentially compromised in the Appleby cyberattack?

Reports suggest a wide range of sensitive financial documents, including bank statements, tax returns, investment details, and potentially even more confidential information.

What legal repercussions could Appleby face?

Appleby could face significant legal and regulatory penalties, including hefty fines and potential lawsuits from affected individuals and governments. Data privacy regulations like GDPR could be implicated.

How can individuals protect themselves from similar attacks?

Individuals should use strong passwords, enable two-factor authentication, be wary of phishing scams, and regularly update their software. They should also be cautious about sharing personal financial information online.

What are the long-term implications for global financial stability?

This attack could erode trust in offshore financial services and potentially destabilize certain markets. It could also lead to stricter regulations and increased scrutiny of financial institutions.