Cyber Attack NHS & Inheritance Data Leak

Cyber attack on succession wealth and NHS staff data leaked – Whoa, that’s a headline that grabs you, right? This massive breach exposes the frighteningly interconnected world of finance and healthcare. We’re talking about sensitive inheritance information and the personal data of NHS staff – a double whammy of serious consequences. Imagine the potential for identity theft, financial ruin, and the erosion of public trust.

This post dives deep into the implications of this attack, exploring the vulnerabilities exploited, the impact on individuals and institutions, and what we can do to prevent future catastrophes.

The sheer scale of this breach is staggering. We’ll examine the methods likely employed by the attackers, from phishing scams to sophisticated malware. We’ll also look at the potential motives, ranging from financial gain to pure malicious intent. The implications are far-reaching, affecting not just the individuals whose data was compromised but also the public’s faith in both the financial and healthcare systems.

Get ready for a deep dive into a critical issue impacting us all.

The Nature of the Cyberattack

The recent cyberattack targeting both succession wealth management firms and NHS staff data represents a concerning development in the landscape of digital crime. The attackers demonstrated a sophisticated understanding of both targets, employing likely different techniques to compromise each system. The scale and potential impact of this breach highlight significant vulnerabilities in data security across various sectors.

Potential Attack Methods and Exploited Vulnerabilities

The attack likely involved a multi-pronged approach. Against succession wealth firms, the attackers might have employed phishing campaigns, spear-phishing (highly targeted phishing), or even malware delivered via seemingly legitimate software updates. These methods aim to gain initial access to the network through compromised employee credentials or by exploiting vulnerabilities in outdated software. Once inside, lateral movement techniques could have been used to access sensitive data, potentially involving ransomware deployment to extort the firms.

The recent cyberattacks targeting succession wealth and the leaked NHS staff data highlight the urgent need for robust security measures. Building secure applications is crucial, and that’s where exploring options like domino app dev, the low-code and pro-code future , becomes incredibly important. This allows for faster development and potentially more secure applications, which is vital given the scale of these data breaches and the sensitive information involved.

In the case of NHS staff data, a similar approach is plausible, but also the possibility of exploiting vulnerabilities in legacy systems or poorly secured databases cannot be ruled out. The attackers might have focused on gaining access to employee accounts, using that access to steal data or deploy ransomware to disrupt services. Vulnerabilities in poorly configured firewalls, lack of multi-factor authentication, and insufficient employee training are likely factors that facilitated the attack.

Motives Behind Targeting Succession Wealth and NHS Staff Data

The motives behind targeting these two seemingly disparate groups are not mutually exclusive. Succession wealth firms hold highly valuable data – details of high-net-worth individuals, their assets, and financial plans. This data is extremely lucrative on the dark web, making it a prime target for financial gain. Stolen data can be used for identity theft, blackmail, or even to facilitate further financial crimes.

The NHS staff data breach, on the other hand, could serve multiple purposes. It could be used for identity theft on a large scale, potentially leading to fraudulent medical claims or access to benefits. Alternatively, the data could be sold to other criminal organizations for various malicious purposes. A third possibility is that the attack was motivated by disruption, aimed at damaging the reputation of the NHS and potentially undermining public trust in healthcare services.

The attackers may have chosen these two targets due to their perceived vulnerability and the high value of the data they hold.

Cyberattack Types and Their Impact

| Attack Type | Target | Method | Impact |

|---|---|---|---|

| Phishing/Spear-phishing | Succession Wealth, NHS Staff | Malicious emails, links, attachments | Credential theft, malware infection, data breaches |

| Ransomware | Succession Wealth, NHS Staff | Encryption of data, disruption of services | Data loss, financial losses, operational disruption, reputational damage |

| SQL Injection | NHS Staff | Exploiting vulnerabilities in databases | Data theft, database corruption, system compromise |

| Man-in-the-Middle Attack | Succession Wealth | Interception of communications | Data theft, financial fraud |

Impact on Succession Wealth

The recent cyberattack targeting NHS staff and potentially compromising succession wealth data presents significant financial and legal risks for high-net-worth individuals and their families. The implications extend far beyond simple data exposure; they involve the potential for sophisticated financial crimes and long-term legal battles. Understanding these risks and implementing robust preventative measures is crucial for safeguarding inherited wealth.The exposure of sensitive data related to inheritance, trusts, and financial holdings creates a fertile ground for identity theft and fraud.

The recent cyberattacks targeting succession wealth and the leaked NHS staff data highlight a critical vulnerability in our digital infrastructure. We need robust security measures now more than ever, and that’s where understanding solutions like bitglass and the rise of cloud security posture management becomes crucial. Improved cloud security is no longer optional; it’s essential to prevent future breaches and protect sensitive data like that compromised in these high-profile attacks.

Criminals can leverage this information to impersonate beneficiaries, file fraudulent claims, or even manipulate existing financial arrangements for their own gain. This can lead to substantial financial losses, erosion of trust, and significant emotional distress for those involved in succession planning.

Identity Theft and Fraud Related to Succession Wealth Data

Access to details such as dates of birth, addresses, national insurance numbers, bank account details, and information about wills and trusts allows malicious actors to create convincing fraudulent identities. They could then use this fabricated identity to open bank accounts in the name of the deceased or beneficiary, apply for loans using their stolen information, or even file fraudulent tax returns.

The sophisticated nature of these crimes often makes them difficult to detect and prosecute, resulting in significant and potentially irreversible financial losses for the victims. For instance, a criminal could use stolen data to create a fake will, altering the distribution of a substantial inheritance. Another example could involve using the details of a deceased individual to claim a large sum of money from a life insurance policy.

Preventative Measures for High-Net-Worth Individuals

Protecting succession wealth data requires a multi-layered approach. This includes regularly reviewing and updating security software on all devices used to access sensitive financial information, using strong, unique passwords for each account, and enabling two-factor authentication wherever possible. Regular credit checks can help detect early signs of fraudulent activity. Furthermore, working with reputable financial advisors and legal professionals who have expertise in cybersecurity is essential.

These professionals can help develop a comprehensive data protection strategy and guide individuals through the complex legal landscape surrounding data breaches. Consider using encrypted storage solutions for sensitive documents and utilizing secure communication channels when discussing financial matters. Regularly reviewing your financial statements for any unusual activity is also vital.

Potential Legal Ramifications for Those Affected

Individuals affected by a data breach related to succession wealth may face a range of legal ramifications. They may have grounds to sue the organization responsible for the breach for negligence, breach of contract, or violation of data protection laws. This could lead to lengthy legal proceedings, substantial legal fees, and the potential for financial compensation if negligence is proven.

Furthermore, they may need to pursue legal action against individuals who committed identity theft or fraud using the stolen data. The complexity of these legal battles depends on various factors, including the jurisdiction, the extent of the damage suffered, and the ability to prove the link between the data breach and the subsequent financial losses. Seeking legal counsel promptly after discovering a data breach is crucial to protect their rights and pursue appropriate legal action.

Impact on NHS Staff

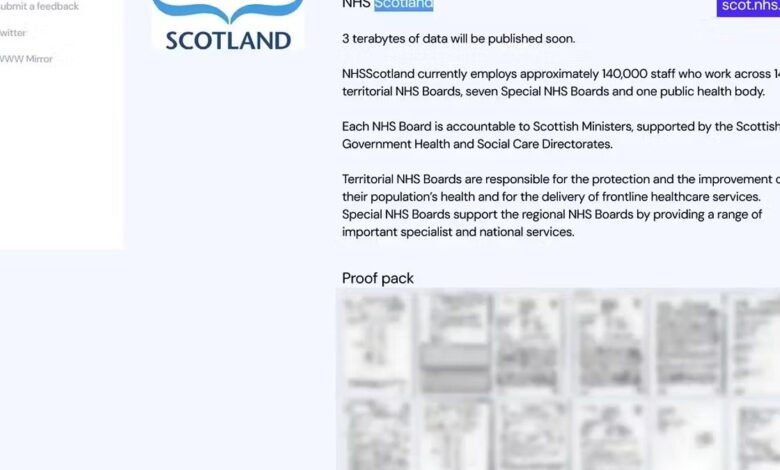

The cyberattack targeting Succession Wealth and resulting in the leak of NHS staff data presents a serious threat to the individuals employed within the National Health Service. Beyond the immediate anxieties of identity theft and financial fraud, the consequences ripple outwards, impacting patient care, public trust, and the overall reputation of the NHS. This section will explore the specific risks faced by NHS staff and the broader implications of this data breach.The leaked data, potentially including names, addresses, contact details, and potentially even more sensitive information like national insurance numbers and bank details, poses significant risks to patient confidentiality.

This is because NHS staff often have access to patient records, and a compromise of their personal data could create vulnerabilities that malicious actors could exploit. For example, an attacker possessing an employee’s login credentials, obtained through phishing or other means enabled by the data breach, could potentially gain unauthorized access to patient systems.

Patient Confidentiality Risks

The unauthorized disclosure of NHS staff data creates several pathways to compromising patient confidentiality. A compromised employee’s credentials could be used to access patient records directly. Alternatively, the leaked information could be used in phishing attacks targeting NHS staff, tricking them into revealing login details or other sensitive information that would allow access to patient data. The leaked data could also be used to target patients directly with phishing scams, using the information to create convincing fraudulent communications.

The potential for blackmail or coercion of NHS staff to gain access to patient data also exists. Such breaches could have devastating consequences, potentially leading to the exposure of highly sensitive medical information, violating patient privacy and trust. The scale of the potential damage is directly proportional to the amount of sensitive data leaked.

Reputational Damage to the NHS and its Staff, Cyber attack on succession wealth and nhs staff data leaked

A data breach of this magnitude is likely to severely damage the reputation of both the NHS and its individual employees. Public trust in the ability of the NHS to protect sensitive information will be eroded, potentially leading to decreased confidence in the healthcare system as a whole. For NHS staff, the consequences can be far-reaching, including feelings of violation, anxiety, and potential legal ramifications.

The reputational damage could impact future employment prospects, and even lead to accusations of negligence or incompetence. The media coverage surrounding the breach will further amplify these negative consequences, potentially leading to a loss of public trust in the entire organization.

Comparison to Previous Data Breaches

This data breach echoes the patterns seen in previous significant healthcare data breaches. The 2017 WannaCry ransomware attack, for instance, crippled hospitals across the UK, disrupting patient care and highlighting the vulnerability of healthcare systems to cyberattacks. Similarly, the 2018 data breach at the National Health Service in Ireland highlighted the devastating consequences of ransomware attacks, leading to the disruption of healthcare services and significant financial losses.

While the specific details may differ, this current breach shares the common thread of exposing sensitive personal information, creating vulnerabilities, and causing significant disruption and reputational damage. The scale of the impact, however, will depend on the precise nature of the leaked data and the effectiveness of the NHS’s response.

Hypothetical Scenario: Consequences for a Compromised Employee

Imagine Sarah, a nurse at a busy London hospital, whose personal data was compromised in this breach. Her address, bank details, and national insurance number are now in the hands of cybercriminals. She begins receiving phishing emails, attempting to steal her online banking credentials. Simultaneously, she experiences fraudulent transactions from her bank account. Sarah faces significant financial stress, dealing with the fallout from identity theft and the emotional distress of a security breach.

Her reputation within the hospital might also be affected, leading to questions about her security practices and potential accusations of negligence, even if she was not directly responsible for the breach. Furthermore, Sarah might face legal battles to recover her financial losses and repair her damaged credit history. This scenario illustrates the far-reaching and deeply personal consequences faced by NHS staff whose data is compromised in such attacks.

Response and Mitigation Strategies

The devastating cyberattack targeting Succession Wealth and NHS staff data necessitates a multi-pronged response focusing on immediate mitigation, long-term infrastructure improvements, and robust legal and regulatory action. Effective strategies require a collaborative effort between organizations, law enforcement, and regulatory bodies, coupled with transparent communication to affected individuals.

NHS Cybersecurity Infrastructure Improvement Plan

A comprehensive plan to bolster NHS cybersecurity infrastructure should be implemented immediately. This isn’t merely about patching vulnerabilities; it’s about a fundamental shift towards a proactive, preventative security posture. This requires significant investment and a change in organizational culture.

- Multi-Factor Authentication (MFA) Mandate: Implement mandatory MFA across all systems and devices accessing sensitive NHS data. This simple yet highly effective measure adds an extra layer of security, significantly reducing the risk of unauthorized access, even if credentials are compromised.

- Regular Security Audits and Penetration Testing: Conduct regular, independent security audits and penetration testing to identify vulnerabilities before attackers can exploit them. These assessments should simulate real-world attacks to highlight weaknesses in the system.

- Employee Cybersecurity Training: Invest in comprehensive cybersecurity awareness training for all NHS staff. Training should cover phishing scams, social engineering tactics, password security, and the importance of reporting suspicious activity. Regular refresher courses are crucial.

- Data Loss Prevention (DLP) Tools: Implement DLP tools to monitor and control the movement of sensitive data within and outside the NHS network. This helps prevent data breaches by identifying and blocking attempts to exfiltrate confidential information.

- Incident Response Plan Development and Testing: Develop and regularly test a comprehensive incident response plan. This plan should Artikel clear procedures for identifying, containing, and recovering from a cyberattack. Regular drills ensure staff are prepared to act effectively during a real-world incident.

- Network Segmentation: Segment the NHS network to limit the impact of a breach. If one segment is compromised, the rest of the network remains protected. This prevents attackers from gaining access to all systems.

- Regular Software Updates and Patching: Implement a robust system for applying security patches and updates to all software and hardware promptly. Outdated software is a major vulnerability that attackers often exploit.

Role of Law Enforcement and Regulatory Bodies

Law enforcement agencies and regulatory bodies play a crucial role in investigating cyberattacks, holding perpetrators accountable, and establishing best practices for preventing future incidents. Their coordinated response is vital for effective mitigation and deterrence.The investigation should focus on identifying the perpetrators, their methods, and the extent of the data breach. Regulatory bodies, such as the Information Commissioner’s Office (ICO) in the UK, have the power to impose significant fines for non-compliance with data protection regulations.

Their involvement ensures organizations are held accountable for failing to protect sensitive data. International collaboration is often necessary to track down perpetrators across borders.

Data Security and Privacy Best Practices

Both the financial and healthcare sectors must adopt robust data security and privacy best practices to protect sensitive information. This includes strong encryption, access control measures, and regular data backups.

“Proactive security measures are far more cost-effective than reactive responses to data breaches.”

For financial institutions, strong authentication methods, fraud detection systems, and regular security assessments are essential. Healthcare providers must comply with HIPAA (in the US) or GDPR (in Europe) regulations, ensuring patient data is handled securely and ethically. This includes implementing strict access controls, robust encryption, and comprehensive data governance policies.

Communicating with Affected Individuals Following a Data Breach

Effective communication is crucial after a data breach. Transparency and empathy are key to maintaining trust and minimizing negative consequences.

- Timely Notification: Inform affected individuals as soon as possible after a data breach is confirmed. Delays can erode trust and exacerbate the damage.

- Clear and Concise Communication: Use plain language to explain the nature of the breach, the type of data compromised, and the steps individuals can take to protect themselves.

- Provide Support Resources: Offer affected individuals access to credit monitoring services (in the case of financial data breaches) or identity theft protection resources.

- Establish a Dedicated Communication Channel: Create a dedicated phone line, email address, or website to answer questions and provide support to affected individuals.

- Regular Updates: Provide regular updates on the investigation and remediation efforts. This demonstrates transparency and keeps individuals informed.

- Apologize Sincerely: Acknowledge the impact of the breach and express sincere apologies for any inconvenience or harm caused.

Long-Term Implications: Cyber Attack On Succession Wealth And Nhs Staff Data Leaked

The recent cyberattack targeting both Succession Wealth and NHS staff data carries profound and far-reaching consequences that extend far beyond the immediate disruption and data breaches. The long-term implications will significantly impact public trust, regulatory landscapes, and future investment strategies across multiple sectors. Understanding these implications is crucial for effective recovery and prevention of similar incidents in the future.The erosion of public trust in both the financial and healthcare sectors is a major concern.

Succession Wealth’s clients, already vulnerable during a life transition, will likely experience increased anxiety about the security of their financial information. Similarly, NHS staff, already under immense pressure, may face further demoralization and distrust in the organization’s ability to protect their sensitive personal data. This loss of confidence could lead to decreased engagement with these vital services, potentially impacting healthcare access and financial planning decisions for years to come.

Decreased Public Trust in Financial and Healthcare Sectors

The scale of the data breach, particularly the sensitive nature of the information compromised, will undoubtedly shake public confidence. We’ve seen similar situations, like the Equifax breach, significantly impact consumer trust in credit reporting agencies, resulting in sustained scrutiny and regulatory action. The current situation presents a similar challenge, requiring both Succession Wealth and the NHS to actively rebuild trust through transparency, robust communication, and demonstrable improvements in cybersecurity measures.

Failure to do so will likely lead to lasting reputational damage and a reluctance by individuals to engage with these sectors.

Increased Cybersecurity Regulation

This incident will likely act as a catalyst for stricter cybersecurity regulations across the UK. Expect to see increased scrutiny of data protection practices, mandatory breach notification requirements, and potentially heavier penalties for organizations failing to meet these standards. Governments may introduce legislation mandating specific cybersecurity technologies and practices, mirroring the GDPR’s impact on data privacy. This could lead to increased costs for organizations, but ultimately aims to strengthen the overall cybersecurity posture of the nation.

The pressure to comply with stricter regulations will be significant, driving investment in security solutions and potentially influencing mergers and acquisitions within affected sectors.

Increased Investment in Cybersecurity Infrastructure

While costly in the short term, the long-term benefits of increased investment in cybersecurity infrastructure are undeniable. Organizations will likely prioritize preventative measures, such as robust multi-factor authentication, advanced threat detection systems, and employee cybersecurity training programs. This includes investing in advanced security information and event management (SIEM) systems to enhance threat detection and response capabilities. We might also see a rise in the use of artificial intelligence and machine learning for threat analysis and prevention, a significant shift driven by the urgent need to improve security posture in the wake of this breach.

The long-term cost of inaction will far outweigh the investment required to build a more resilient cybersecurity infrastructure.

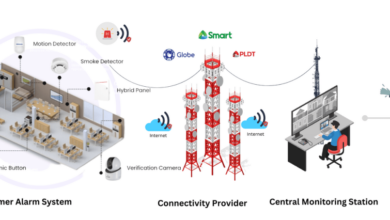

Interconnectedness of Financial and Healthcare Sectors

Imagine a network diagram. At the center, a large circle represents the NHS, with smaller circles branching out representing various departments (hospitals, GP surgeries, administrative offices). Lines connect these smaller circles, indicating the flow of data and information. Another large circle, representing Succession Wealth, is positioned nearby, also with smaller circles for different departments and client data.

A thick, highlighted line connects the two main circles, showing the potential for data transfer between the two, perhaps through shared service providers or employees with access to both systems. The cyberattack is represented by a lightning bolt striking the Succession Wealth circle, but the highlighted line shows how the impact ripples outwards, potentially compromising NHS data due to shared systems or compromised employee credentials.

The diagram visually demonstrates how an attack on one sector can quickly affect another due to interconnectedness.

Final Thoughts

The cyber attack on succession wealth and NHS staff data leaked serves as a stark reminder of our increasingly vulnerable digital landscape. The interconnectedness of our financial and healthcare systems means that a breach in one area can have devastating ripple effects throughout the other. While the immediate impact is devastating for those affected, the long-term consequences – from increased cybersecurity regulations to a decline in public trust – are equally concerning.

The only way forward is through proactive measures, improved cybersecurity infrastructure, and a collective commitment to data protection. This isn’t just a tech problem; it’s a societal one that demands our urgent attention.

Popular Questions

What type of data was leaked in the NHS staff portion of the breach?

The exact nature of the leaked NHS staff data isn’t always publicly disclosed immediately due to ongoing investigations, but it could include anything from names and addresses to more sensitive information like national insurance numbers, bank details, and potentially even patient information if access was gained through staff systems.

What is the likelihood of my inheritance being affected if my family’s financial information was compromised?

The risk depends on the type of information accessed. If only basic details were leaked, the risk might be low. However, if sensitive financial documents or account details were compromised, the risk of identity theft and fraud related to inheritance claims is significantly higher. Contacting your solicitor or financial advisor is crucial.

How can I check if my data was compromised in this specific breach?

This will depend on how the organizations involved (NHS and financial institutions) communicate about the breach. Keep an eye out for official announcements, emails, or notices regarding the data breach. Contact the organizations directly if you have concerns.