Cyber Insurance Paradigm Shift Protecting Business Without Hail Marys

Cyber insurance paradigm shift protecting the business without the hail mary remedy – Cyber Insurance Paradigm Shift: Protecting Business Without Hail Marys – that’s the exciting new reality we’re diving into today! Forget the old reactive approach to cyber security; we’re talking about a proactive revolution. The digital landscape is changing faster than ever, with increasingly sophisticated cyber threats making traditional insurance policies feel like a last-ditch gamble. This blog post explores how businesses can shift to a more robust, preventative model, turning cybersecurity into a strategic advantage rather than a costly afterthought.

We’ll unpack the limitations of relying solely on insurance as a safety net, exploring proactive risk management strategies, essential technologies, and the crucial role of employee training. Get ready to learn how to build a truly resilient business ecosystem, one that’s not just surviving cyberattacks, but thriving in the face of them. We’ll also examine the cost-benefit analysis of proactive investment versus reactive insurance and discuss the future of cyber insurance itself.

The Evolving Landscape of Cyber Threats

The digital world has become the lifeblood of modern businesses, but this interconnectedness also exposes them to an ever-growing range of sophisticated and persistent cyber threats. The frequency and impact of these attacks are escalating, demanding a proactive and comprehensive approach to security that moves beyond traditional reactive measures. The landscape is constantly shifting, requiring businesses to adapt and evolve their security strategies to stay ahead of the curve.The limitations of traditional reactive security measures are becoming increasingly apparent.

Relying solely on antivirus software, firewalls, and intrusion detection systems, while still crucial components, is no longer sufficient to combat the complexity and sophistication of modern cyberattacks. These measures often react to threatsafter* they have already breached security perimeters, resulting in significant damage, data breaches, financial losses, and reputational harm. A proactive approach, focusing on prevention and resilience, is essential.

Sophistication and Frequency of Cyberattacks

Cyberattacks are becoming increasingly sophisticated, employing advanced techniques like AI-powered phishing campaigns, polymorphic malware that constantly changes its signature to evade detection, and zero-day exploits that target previously unknown vulnerabilities. The frequency of these attacks is also rising exponentially. For example, the number of ransomware attacks targeting businesses has seen a dramatic increase in recent years, with attackers demanding increasingly higher ransoms.

The sheer volume of attacks makes it difficult for businesses to manage effectively using traditional reactive methods alone. This necessitates a shift towards a more proactive, layered security approach.

Emerging Cyber Threats and Their Impact

Several emerging cyber threats pose significant risks to businesses. One example is supply chain attacks, where attackers compromise a business’s suppliers or partners to gain access to its systems. The NotPetya ransomware attack in 2017, which spread through a compromised accounting software update, is a prime example of the devastating impact of such attacks. Another emerging threat is the increasing use of artificial intelligence (AI) by attackers to automate and scale their attacks, making them more efficient and harder to detect.

This includes AI-powered phishing campaigns that are highly personalized and difficult to distinguish from legitimate communications. Finally, the growing reliance on cloud services exposes businesses to new vulnerabilities, requiring robust cloud security measures to protect sensitive data. The potential impact of these threats includes significant financial losses, reputational damage, legal liabilities, operational disruptions, and loss of customer trust.

Cyber Insurance

For years, cyber insurance has been viewed as a Hail Mary – a last resort after a devastating breach. Businesses paid premiums, hoping they’d never need to file a claim, and often felt the policy was more of a cost center than a strategic asset. This reactive approach, however, is increasingly insufficient in today’s complex threat landscape. The traditional model falls short of providing the comprehensive protection businesses desperately need.Traditional cyber insurance policies often focus primarily on covering the financial falloutafter* a cyberattack occurs.

This includes expenses related to incident response, legal fees, regulatory fines, and business interruption. While crucial, this reactive approach neglects the proactive measures necessary to prevent breaches in the first place. It’s akin to buying fire insurance but never installing smoke detectors – you’re covered for the damage, but the risk of a fire remains significantly high.

The Shift Towards Proactive Risk Management

The paradigm is shifting. Businesses are recognizing the value of proactive risk management strategies as a crucial component of their overall cybersecurity posture. This involves a multifaceted approach encompassing regular security assessments, employee training on cybersecurity best practices, robust security architecture implementation (including firewalls, intrusion detection systems, and multi-factor authentication), and the development of comprehensive incident response plans. Investing in these preventive measures not only reduces the likelihood of a successful attack but also significantly minimizes the potential impact if a breach does occur.

This proactive approach is becoming a key factor in securing favorable cyber insurance premiums and broader policy coverage.

Comparing Traditional and Holistic Cyber Insurance Solutions

Traditional cyber insurance policies primarily focus on post-incident remediation and financial compensation. They typically involve a defined coverage amount for specific incidents, such as ransomware attacks or data breaches. Conversely, more comprehensive, holistic solutions incorporate proactive risk management components into the policy. These solutions often include pre-incident services such as security assessments, vulnerability scans, and penetration testing, which can identify and mitigate potential weaknesses before they can be exploited.

Furthermore, they may offer access to expert consultants who can guide businesses through the implementation of improved security practices. The difference is akin to comparing a simple car insurance policy that only covers accidents to a comprehensive policy that includes roadside assistance, maintenance support, and driver training. The latter is far more beneficial in preventing problems and mitigating risks, offering a greater overall value proposition.

Holistic solutions prioritize prevention, reducing the frequency and severity of incidents, thereby lowering the overall cost of risk over the long term.

Proactive Risk Management Strategies

Cybersecurity isn’t just about reacting to breaches; it’s about proactively preventing them. A robust proactive approach significantly reduces your vulnerability and minimizes the potential impact of a successful attack, making your cyber insurance policy a shield rather than a last resort. This involves building a multi-layered defense system and fostering a security-conscious culture within your organization.A comprehensive cybersecurity framework forms the bedrock of proactive risk management.

This framework should be tailored to your specific business needs and risk profile, considering factors such as industry regulations, data sensitivity, and the size of your organization. It’s not a one-size-fits-all solution, and regular review and updates are crucial to maintain its effectiveness.

Designing a Comprehensive Cybersecurity Framework

A strong cybersecurity framework integrates various preventative measures to minimize vulnerabilities. This includes implementing robust access controls (limiting who can access what data and systems), regularly patching software and operating systems to address known vulnerabilities, utilizing strong authentication methods (like multi-factor authentication), and implementing network segmentation to isolate critical systems from less sensitive ones. Furthermore, regular security audits and penetration testing can identify weaknesses before attackers do.

Imagine a bank employing robust encryption and multi-layer authentication—this significantly reduces the chances of a successful data breach compared to a bank with lax security measures.

Cyber insurance is evolving, moving beyond reactive “hail mary” fixes to proactive risk management. A key element of this shift is building robust, secure applications, and that’s where understanding the advancements in application development, like what’s discussed in this great article on domino app dev the low code and pro code future , becomes crucial. By prioritizing secure coding practices from the outset, businesses can significantly reduce their cyber risk and ultimately lower their insurance premiums, achieving true protection instead of just a last-ditch effort.

Employee Training and Security Awareness Programs

Employees are often the weakest link in a company’s cybersecurity chain. A well-structured security awareness program is crucial. This involves regular training sessions covering topics like phishing scams, social engineering tactics, password hygiene, and safe internet practices. Simulations and phishing exercises can effectively train employees to identify and report suspicious activities. Consider a scenario where an employee receives a seemingly legitimate email requesting login credentials; training can equip them to recognize this as a phishing attempt and prevent a potential breach.

The program should be engaging and tailored to the specific roles and responsibilities of employees.

Key Technologies and Tools for Proactive Threat Detection and Response

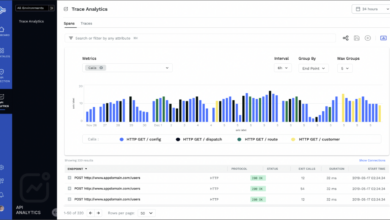

Several technologies enhance proactive threat detection and response. Intrusion Detection/Prevention Systems (IDS/IPS) monitor network traffic for malicious activity, while Security Information and Event Management (SIEM) systems collect and analyze security logs from various sources to identify patterns and anomalies. Endpoint Detection and Response (EDR) solutions monitor individual devices for malicious behavior, providing real-time alerts and response capabilities. Utilizing these tools in conjunction with regular vulnerability scans and penetration testing provides a comprehensive approach to identifying and mitigating threats before they can cause significant damage.

For instance, an IDS/IPS can detect and block a denial-of-service attack before it overwhelms a company’s network.

Risk Assessment Methodologies

Different methodologies exist for assessing cybersecurity risks. Choosing the right one depends on your organization’s size, resources, and specific needs.

| Methodology | Strengths | Weaknesses | Applicability |

|---|---|---|---|

| NIST Cybersecurity Framework | Comprehensive, widely adopted, flexible | Can be complex to implement, requires significant resources | Organizations of all sizes, particularly those subject to regulatory compliance |

| OCTAVE Allegro | Focuses on risk management, collaborative approach | Requires dedicated team and resources, time-consuming | Larger organizations with dedicated security teams |

| FAIR (Factor Analysis of Information Risk) | Quantitative approach, provides measurable risk scores | Requires specialized expertise, complex calculations | Organizations requiring precise risk quantification |

| ISO 27005 | Internationally recognized standard, provides structured approach | Can be quite generic, requires adaptation to specific context | Organizations seeking certification or seeking a structured risk management process |

The Value of Data Security and Resilience

In today’s digital landscape, data is the lifeblood of any business. A robust data security and resilience strategy isn’t just a “nice-to-have”—it’s a necessity for survival. The cost of a data breach extends far beyond the immediate financial impact, encompassing reputational damage, legal fees, and the erosion of customer trust. Building a resilient infrastructure capable of withstanding cyberattacks and recovering quickly from incidents is paramount to maintaining business continuity and long-term success.Data security and resilience aren’t mutually exclusive concepts; they are interwoven and interdependent.

Data security focuses on preventing breaches, while resilience focuses on the ability to recover quickly and efficiently from an attack. A comprehensive strategy encompasses both, creating a layered defense that minimizes risk and maximizes recovery capabilities.

Data Backup, Recovery, and Business Continuity Planning

Effective data backup, recovery, and business continuity planning are cornerstones of a robust resilience strategy. Regular backups, stored offsite and ideally in multiple locations, are crucial for data recovery in the event of a ransomware attack, hardware failure, or natural disaster. The 3-2-1 backup rule—three copies of data, on two different media, with one copy offsite—is a widely accepted best practice.

Furthermore, a comprehensive business continuity plan should detail procedures for maintaining essential business operations during and after a disruptive event. This plan should include alternative work locations, communication protocols, and procedures for restoring critical systems and data. For example, a financial institution might have a failover data center ready to instantly take over operations if their primary site experiences an outage.

A retail business might have a plan to process transactions manually in case of a system failure. Regular testing of the backup and recovery processes, as well as the business continuity plan, is essential to ensure their effectiveness.

Incident Response Planning and Execution

A well-defined incident response plan is crucial for minimizing the damage caused by a cyberattack. This plan should Artikel the steps to be taken in the event of a security incident, including identifying the incident, containing the breach, eradicating the threat, recovering data and systems, and conducting a post-incident review. The plan should assign roles and responsibilities to specific individuals or teams and include contact information for key stakeholders, such as law enforcement and legal counsel.

Regular training and drills are essential to ensure that personnel are familiar with the plan and can execute it effectively. For instance, a simulated phishing attack can help identify vulnerabilities in the organization’s security awareness and response capabilities. Post-incident analysis is critical for identifying areas for improvement and strengthening future defenses.

Financial and Reputational Implications of Data Breaches and System Failures

The financial consequences of data breaches and system failures can be devastating. Direct costs include incident response expenses, legal fees, regulatory fines, and the cost of restoring systems and data. Indirect costs can include lost revenue, damaged reputation, and decreased customer loyalty. Reputational damage can be particularly difficult to overcome, leading to a loss of customer trust and impacting the company’s ability to attract new business.

The 2017 Equifax data breach, for example, resulted in billions of dollars in fines, legal costs, and reputational damage. The long-term impact on their business, including loss of customers and diminished brand trust, continues to be felt even years later. This illustrates the far-reaching and potentially catastrophic financial and reputational consequences of a significant data breach.

Building a Resilient Business Ecosystem

A resilient business isn’t just one that survives a cyberattack; it’s one that thrives despite them. Robust cybersecurity isn’t a separate entity; it’s the bedrock upon which a truly resilient business is built. It’s about anticipating disruptions, minimizing their impact, and recovering quickly, allowing the business to continue operating effectively even in the face of significant challenges. This resilience translates directly to improved profitability, stronger investor confidence, and a more positive brand reputation.Cybersecurity is inextricably linked to business continuity.

A strong cybersecurity posture minimizes the likelihood of disruptions caused by data breaches, ransomware attacks, or other cyber threats. By proactively mitigating risks, businesses can significantly reduce downtime, protect their critical data and systems, and maintain operational efficiency. This proactive approach not only protects the business from immediate financial losses but also safeguards its long-term viability and growth.

The cost of inaction far outweighs the investment in robust cybersecurity measures.

Cybersecurity’s Contribution to Business Resilience

A robust cybersecurity framework acts as a multi-layered defense system, protecting against a wide range of threats. This includes preventative measures like firewalls and intrusion detection systems, as well as reactive measures like incident response plans and data recovery capabilities. The effectiveness of this system is directly proportional to the resilience of the business. A strong security posture minimizes the impact of successful attacks, ensuring business continuity and minimizing financial losses.

For example, a company with a well-defined incident response plan can contain a ransomware attack quickly, limiting the damage and restoring operations sooner than a company without such a plan. The speed and effectiveness of recovery directly impact the business’s ability to continue operations and maintain customer trust.

Measuring Cybersecurity Effectiveness, Cyber insurance paradigm shift protecting the business without the hail mary remedy

Understanding the effectiveness of your cybersecurity program requires regular monitoring and measurement. Key performance indicators (KPIs) provide quantifiable data to assess progress and identify areas for improvement.

The following KPIs provide a comprehensive overview of cybersecurity performance:

- Mean Time To Detect (MTTD): The average time it takes to identify a security incident. A lower MTTD indicates a more effective detection system.

- Mean Time To Respond (MTTR): The average time it takes to resolve a security incident. A lower MTTR shows a more efficient incident response process.

- Number of Security Incidents: Tracking the frequency of security incidents helps identify trends and potential vulnerabilities.

- Percentage of Vulnerabilities Remediated: This KPI measures the effectiveness of vulnerability management processes. A high percentage indicates a proactive approach to patching and remediation.

- Employee Security Awareness Training Completion Rate: Measuring employee participation in security awareness training demonstrates a commitment to building a security-conscious workforce.

- Cost of Security Incidents: Tracking the financial impact of security incidents helps justify security investments and demonstrate the return on investment (ROI).

The Role of Technology in a Paradigm Shift

The cyber insurance landscape is undergoing a dramatic transformation, driven largely by advancements in technology. No longer is a reactive, “hail Mary” approach sufficient; proactive, technology-driven strategies are becoming essential for both insurers and businesses. This shift emphasizes the critical role technology plays in strengthening cybersecurity postures and improving incident response capabilities.The integration of sophisticated technologies is fundamentally altering how we approach cybersecurity.

It’s no longer about simply deploying firewalls and antivirus software; it’s about building a multi-layered, adaptive defense system that leverages the power of artificial intelligence, machine learning, and automation.

AI and Machine Learning in Cybersecurity

AI and machine learning are revolutionizing threat detection and prevention. AI algorithms can analyze vast amounts of data from various sources – network traffic, logs, security alerts – to identify patterns indicative of malicious activity far faster than human analysts. This allows for the early detection of sophisticated attacks, such as zero-day exploits, which often go unnoticed by traditional security systems.

Machine learning models can also adapt and improve their accuracy over time, learning from past attacks to better predict and prevent future threats. For example, AI-powered systems can identify anomalies in user behavior, such as unusual login attempts or data access patterns, flagging potential insider threats or compromised accounts. The speed and accuracy offered by AI and ML represent a significant advantage in the ongoing battle against cybercriminals.

Automation in Security Operations and Incident Response

Automation is crucial for streamlining security operations and accelerating incident response. Manual processes are slow, prone to errors, and often struggle to keep pace with the ever-increasing volume and complexity of cyber threats. Automated systems can perform repetitive tasks such as vulnerability scanning, patch management, and log analysis, freeing up security personnel to focus on more strategic initiatives.

In the event of a security breach, automated incident response systems can rapidly contain the damage, minimizing the impact on the business. For instance, an automated system could automatically isolate an infected machine from the network, preventing the spread of malware, and initiate a forensic investigation to determine the root cause of the breach. This speed and efficiency significantly reduce the overall cost and disruption associated with cyber incidents.

Ethical Considerations of Advanced Technologies in Cybersecurity

The use of advanced technologies in cybersecurity also raises important ethical considerations. AI-powered systems, for example, can make decisions that have significant consequences for individuals and organizations. It’s crucial to ensure that these systems are developed and deployed responsibly, with appropriate safeguards in place to prevent bias, discrimination, and misuse. Transparency and accountability are also critical; it’s important to understand how these systems work and to be able to audit their decisions.

The potential for misuse of facial recognition technology in surveillance, for instance, highlights the need for careful consideration of the ethical implications of advanced technologies in cybersecurity. Balancing the benefits of enhanced security with the protection of privacy and individual rights is a critical challenge that requires ongoing dialogue and collaboration among stakeholders.

Cyber Insurance and its New Role

Cyber insurance is no longer simply a safety net for catastrophic breaches; it’s evolving into a crucial component of a proactive cybersecurity strategy. Forward-thinking businesses are integrating insurance not as a Hail Mary pass, but as a strategic tool to enhance their overall security posture and resilience. This shift reflects a growing understanding that comprehensive risk mitigation, including insurance, is more cost-effective than solely relying on reactive measures.The proactive approach emphasizes prevention and preparedness, leveraging insurance to incentivize and support these efforts.

Insurance providers are increasingly rewarding organizations with robust security programs through preferential pricing and broader coverage. This incentivizes businesses to invest in advanced security technologies, employee training, and robust incident response plans – all elements that significantly reduce the likelihood and impact of a cyberattack.

Cost-Benefit Analysis of Proactive Security versus Insurance Reliance

A purely reactive approach, relying solely on insurance to cover losses after a breach, carries significant hidden costs. These include not only the direct financial losses from the breach itself (data recovery, legal fees, regulatory fines) but also reputational damage, loss of customer trust, and business disruption. These indirect costs can far outweigh the immediate financial impact of the attack and are often difficult to quantify.In contrast, a proactive approach that incorporates cyber insurance strategically offers a more comprehensive cost-benefit profile.

The upfront investment in robust security measures – including employee training, security awareness programs, penetration testing, and multi-factor authentication – is offset by the reduced likelihood of a breach and the potential for lower insurance premiums. This approach leads to long-term cost savings by preventing incidents before they occur, mitigating the impact of successful attacks, and reducing the overall cost of insurance.

Consider a hypothetical scenario: Company A invests heavily in proactive security and pays a slightly higher premium for cyber insurance, while Company B relies on cheaper insurance with minimal proactive measures. If Company B experiences a significant breach, its total costs – including the breach itself and the insurance deductible – might far exceed Company A’s total expenditure on proactive security and insurance over the same period.

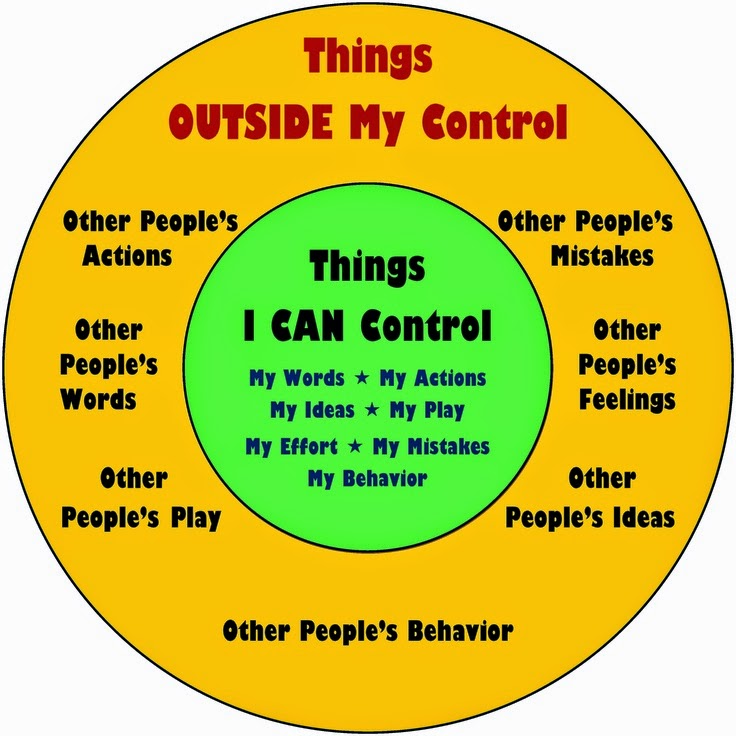

Visual Representation of the Shift from Reactive to Proactive Cybersecurity

Imagine two diagrams. The first, representing the reactive approach, shows a castle (representing the business) surrounded by a flimsy, easily breached wall (representing minimal security measures). A large, ominous cloud (representing cyber threats) looms overhead, with a lightning bolt (representing a cyberattack) striking the castle. The only defense is a small, barely visible shield (representing cyber insurance) which is insufficient to protect the castle from the full impact of the attack.The second diagram, representing the proactive approach, depicts the same castle but now surrounded by a strong, multi-layered fortress wall (representing robust security measures like firewalls, intrusion detection systems, employee training).

The same ominous cloud and potential lightning bolt are present, but the castle is largely protected by the strong defenses. The small shield (cyber insurance) remains, but its role is significantly diminished, acting as supplementary protection rather than the primary defense. This illustrates the shift from relying solely on insurance as a last resort to integrating it as a component of a robust, multi-layered security strategy.

Future Trends in Cyber Insurance: Cyber Insurance Paradigm Shift Protecting The Business Without The Hail Mary Remedy

The cyber insurance landscape is in constant flux, driven by the ever-evolving nature of cyber threats and the increasing reliance of businesses on digital technologies. Understanding emerging trends is crucial for businesses to adequately protect themselves and secure appropriate coverage. This necessitates a proactive approach to risk management and a close watch on regulatory developments.The next few years will see significant shifts in how cyber insurance is structured, priced, and utilized.

We can expect to see a move away from solely reactive models towards more proactive and preventative strategies integrated into insurance policies. This shift will be driven by both insurers seeking to mitigate risk and businesses demanding more comprehensive protection.

Expansion of Coverage for Emerging Threats

Cyber threats are constantly evolving, with new attack vectors and vulnerabilities emerging regularly. Cyber insurance policies are adapting to cover these emerging threats, including those related to artificial intelligence (AI), Internet of Things (IoT) devices, and cloud-based services. For instance, ransomware-as-a-service (RaaS) platforms have significantly increased the accessibility of sophisticated attacks, leading to broader coverage for ransomware incidents and related extortion attempts.

This includes coverage for incident response costs, data recovery, and business interruption losses specifically related to these evolving threats. Insurers are also beginning to offer specialized coverage for AI-related liabilities, such as those arising from algorithmic bias or data breaches involving AI systems.

The cyber insurance paradigm is shifting; it’s no longer about a Hail Mary play after a breach, but proactive risk mitigation. A key component of this shift is robust cloud security, and understanding tools like bitglass and the rise of cloud security posture management is crucial. By strengthening your cloud security posture, you significantly reduce your risk profile, leading to better insurance premiums and peace of mind – a far cry from hoping for a last-minute rescue.

Rise of Parametric Insurance

Parametric insurance offers a more streamlined and efficient approach to cyber risk management. Instead of relying on complex claims assessments, parametric policies pay out automatically based on pre-defined triggers, such as the number of compromised records or the duration of a service outage. This approach can significantly reduce the time it takes to receive compensation after a cyber incident, providing much-needed liquidity during a crisis.

For example, a parametric policy might specify a payout of $100,000 if a company experiences a data breach affecting over 10,000 records, regardless of the specific nature of the breach or the resulting financial losses. This provides predictable and rapid financial assistance, allowing businesses to focus on recovery and remediation efforts.

Increased Focus on Proactive Risk Management

Cyber insurance providers are increasingly emphasizing proactive risk management strategies as a key component of their policies. This involves offering discounts or preferential rates to businesses that demonstrate a strong commitment to cybersecurity best practices, such as implementing robust security controls, conducting regular security assessments, and providing employee cybersecurity training. Some insurers even offer risk management services as part of their policies, providing businesses with access to expert advice and support in improving their cybersecurity posture.

This collaborative approach benefits both the insurer and the insured, fostering a culture of proactive risk reduction and minimizing the likelihood of future cyber incidents. A real-world example would be an insurer offering a 15% discount on premiums to businesses that can demonstrate compliance with industry-standard security frameworks like NIST Cybersecurity Framework.

Impact of Evolving Regulations

The regulatory landscape surrounding cybersecurity and data privacy is constantly evolving, with new laws and regulations being introduced globally. These regulations, such as GDPR in Europe and CCPA in California, significantly impact the cyber insurance market. Insurers are adapting their policies to comply with these regulations and are increasingly incorporating regulatory compliance into their risk assessment and pricing models.

Non-compliance with relevant regulations can lead to increased premiums or even policy exclusions. For example, failure to comply with GDPR’s data breach notification requirements could result in higher premiums or even denial of coverage for data breach incidents. The evolving regulatory landscape thus compels businesses to prioritize compliance and proactively manage their cybersecurity risks to secure adequate and affordable cyber insurance.

Last Word

So, ditch the Hail Mary! Building a truly secure and resilient business isn’t about hoping for the best and having insurance as a backup plan. It’s about proactively mitigating risks, investing in robust security measures, and fostering a culture of security awareness. By embracing a proactive approach, you’re not just protecting your business from financial losses; you’re safeguarding your reputation, ensuring business continuity, and ultimately, building a stronger, more competitive future.

The cyber insurance landscape is evolving, and by understanding and adapting to this shift, you can secure your place at the forefront of digital resilience. Let’s build a future where cybersecurity is a strength, not a weakness.

Questions Often Asked

What are the biggest challenges businesses face in adopting a proactive cybersecurity approach?

Budget constraints, lack of skilled personnel, and resistance to change are common hurdles. Overcoming these requires strong leadership buy-in, strategic planning, and investment in training and technology.

How can I assess my company’s current cybersecurity posture?

Start with a thorough risk assessment, identifying vulnerabilities and potential threats. Utilize penetration testing, vulnerability scanning, and security audits to gain a comprehensive understanding of your current security level.

What’s the difference between cyber insurance and cybersecurity?

Cybersecurity is the proactive process of protecting your systems and data. Cyber insurance is a financial safety net that helps cover losses resulting from a cyberattack. Ideally, strong cybersecurity minimizes the need to rely heavily on insurance.

How often should I review and update my cybersecurity plan?

Regularly, at least annually, and more frequently if there are significant changes in your technology, operations, or the threat landscape. Consider incorporating continuous monitoring and threat intelligence feeds.