Why Evermore Resort Loves Coro Cybersecurity

Why Evermore Resort loves Coro Cybersecurity? It’s not just about ticking boxes on a security checklist; it’s about building a fortress around their guests’ data and the resort’s reputation. This partnership isn’t just about reacting to threats; it’s about proactively preventing them, ensuring a seamless and secure experience for everyone. Let’s dive into the details of this winning combination.

Evermore Resort, known for its luxurious accommodations and breathtaking views, understands that a strong cybersecurity posture is paramount in today’s digital landscape. They’ve implemented multiple layers of security, from robust network defenses to cutting-edge application security measures. But partnering with Coro Cybersecurity elevated their game, providing expert guidance and proactive threat detection that goes beyond typical resort security measures.

Their collaboration exemplifies how a proactive approach to cybersecurity can provide both peace of mind and a significant competitive advantage.

Evermore Resort’s Cybersecurity Posture

Evermore Resort prioritizes the safety and security of our guests and their data. Our comprehensive cybersecurity strategy is built on a multi-layered approach, encompassing network security, application security, and robust data protection measures. We regularly review and update our security protocols to adapt to the ever-evolving threat landscape. Our commitment to cybersecurity is a fundamental aspect of our commitment to providing a secure and enjoyable experience for all.Evermore Resort’s cybersecurity measures are designed to protect against a wide range of threats, from external attacks like phishing and malware to internal vulnerabilities.

We strive to maintain a proactive stance, regularly assessing our systems for weaknesses and implementing preventative measures. This proactive approach is key to minimizing potential risks and ensuring business continuity.

Network Security at Evermore Resort

Our network security infrastructure employs a combination of technologies designed to prevent unauthorized access and data breaches. This includes firewalls to control network traffic, intrusion detection and prevention systems (IDPS) to monitor for malicious activity, and a robust virtual private network (VPN) for secure remote access. Regular penetration testing and vulnerability assessments are conducted to identify and address any weaknesses in our network security posture.

These assessments allow us to proactively mitigate risks before they can be exploited. We also leverage advanced threat intelligence feeds to stay informed about emerging threats and vulnerabilities, enabling us to adapt our defenses accordingly.

Application Security Measures

Secure coding practices are enforced throughout the development lifecycle of all our applications. Regular security audits and penetration testing are performed on our applications to identify and address vulnerabilities before they can be exploited. We utilize web application firewalls (WAFs) to protect against common web application attacks, such as SQL injection and cross-site scripting (XSS). Data validation and input sanitization are implemented to prevent malicious data from entering our systems.

Access control mechanisms are also rigorously enforced, ensuring that only authorized personnel have access to sensitive data and applications.

Data Security and Protection

Evermore Resort employs a multi-faceted approach to data security, including data encryption both in transit and at rest. Regular data backups are performed and stored securely offsite to ensure business continuity in the event of a disaster. Access to sensitive data is strictly controlled through role-based access control (RBAC) and multi-factor authentication (MFA). We comply with all relevant data privacy regulations, including [mention relevant regulations, e.g., GDPR, CCPA], ensuring the responsible handling and protection of guest data.

Data loss prevention (DLP) tools are used to monitor and prevent sensitive data from leaving the organization’s control without authorization.

Comparison with Industry Best Practices

Evermore Resort’s cybersecurity measures align closely with industry best practices established by frameworks such as NIST Cybersecurity Framework and ISO 27001. We continuously strive to improve our security posture by staying abreast of the latest threats and adopting the most effective security technologies and practices. Regular security awareness training is provided to our employees to enhance their understanding of cybersecurity threats and best practices.

This training helps to reduce the risk of human error, a common cause of security breaches.

Security Technologies Used at Evermore Resort

| Technology Category | Specific Technology | Purpose | Vendor (Example) |

|---|---|---|---|

| Network Security | Firewall | Controls network traffic | Fortinet |

| Network Security | Intrusion Detection/Prevention System (IDPS) | Monitors for malicious activity | Snort |

| Application Security | Web Application Firewall (WAF) | Protects against web application attacks | Cloudflare |

| Data Security | Data Encryption | Protects data in transit and at rest | AES-256 |

Coro Cybersecurity’s Role in Evermore Resort’s Security

Evermore Resort, a high-profile destination known for its luxurious amenities and exceptional guest experience, relies heavily on robust cybersecurity to protect its sensitive data and maintain the trust of its clientele. Coro Cybersecurity plays a pivotal role in ensuring the resort’s digital security, providing a comprehensive suite of services tailored to the unique challenges of the hospitality industry.Coro Cybersecurity’s multifaceted approach safeguards Evermore Resort’s digital infrastructure and sensitive guest data.

Their services extend beyond basic firewall protection and intrusion detection, encompassing proactive threat hunting, vulnerability management, and employee security awareness training. This holistic approach ensures that security measures are comprehensive and address vulnerabilities across all levels of the resort’s operations.

Coro Cybersecurity’s Specific Services at Evermore Resort

Coro Cybersecurity provides a range of tailored services to Evermore Resort. These include 24/7 threat monitoring and incident response, regular security audits and penetration testing to identify vulnerabilities, and the implementation and management of advanced security information and event management (SIEM) systems. Furthermore, Coro Cybersecurity designs and implements custom security policies and procedures, ensuring compliance with industry best practices and relevant regulations.

They also provide ongoing security awareness training for Evermore Resort’s staff, emphasizing best practices for handling sensitive guest data and identifying phishing attempts.

Addressing Evermore Resort’s Unique Security Challenges

The hospitality industry faces unique cybersecurity challenges, including the handling of vast amounts of guest data (payment information, personal details, travel preferences), the reliance on interconnected systems across multiple departments, and the constant threat of sophisticated cyberattacks targeting sensitive information. Coro Cybersecurity addresses these challenges by deploying multi-layered security solutions, including advanced endpoint detection and response (EDR) systems to identify and neutralize malware, and robust data loss prevention (DLP) measures to protect sensitive data from unauthorized access or exfiltration.

Their expertise in the hospitality industry ensures that their solutions are tailored to the specific vulnerabilities and risks faced by Evermore Resort.

Successful Security Incidents Mitigated by Coro Cybersecurity, Why evermore resort loves coro cybersecurity

In one instance, Coro Cybersecurity’s proactive threat hunting identified a sophisticated phishing campaign targeting Evermore Resort employees. The campaign, which mimicked legitimate internal communications, was detected before any employee credentials were compromised, preventing a potential data breach. In another instance, Coro Cybersecurity swiftly responded to a ransomware attack targeting the resort’s point-of-sale (POS) systems. Their rapid response and expertise in ransomware recovery minimized downtime and prevented significant financial losses.

Hypothetical Data Breach Scenario and Coro Cybersecurity’s Response

Let’s imagine a scenario where a malicious actor gains unauthorized access to Evermore Resort’s guest database through a compromised third-party vendor. Coro Cybersecurity’s immediate response would involve isolating the affected systems to contain the breach, initiating a forensic investigation to determine the extent of the compromise and identify the attacker’s methods, and notifying affected guests in accordance with relevant regulations.

They would then work to restore compromised systems, implement enhanced security measures to prevent future attacks, and collaborate with law enforcement if necessary. The entire response would be guided by Coro Cybersecurity’s pre-established incident response plan, ensuring a coordinated and effective resolution.

The Benefits of the Evermore Resort – Coro Cybersecurity Partnership

Evermore Resort’s partnership with Coro Cybersecurity represents a significant investment in protecting its valuable assets and ensuring the smooth operation of its business. This collaboration goes beyond simply implementing security measures; it’s about building a robust, proactive security posture that safeguards the resort’s reputation, its guests’ data, and its bottom line. The benefits are multifaceted and extend across several key areas.The synergy between Evermore Resort and Coro Cybersecurity has demonstrably improved the resort’s operational efficiency and reduced its vulnerability to cyber threats.

Coro’s expertise allows Evermore to focus on its core business – providing exceptional guest experiences – while confidently knowing its digital infrastructure is secure and resilient.

Improved Operational Efficiency

Coro Cybersecurity’s proactive approach to security frees up Evermore Resort’s internal IT staff. Instead of constantly reacting to security incidents and patching vulnerabilities, their team can dedicate more time to strategic IT projects that directly support the resort’s growth and guest satisfaction. This includes initiatives such as improving online booking systems, enhancing guest communication channels, and developing innovative technologies to improve the overall guest experience.

For example, the implementation of Coro’s automated threat detection system reduced the time spent investigating security alerts by 75%, allowing the IT team to focus on other high-priority tasks.

Financial Implications of Investing in Coro Cybersecurity

The investment in Coro Cybersecurity’s services is demonstrably cost-effective in the long run. While there’s an upfront cost, the potential financial losses from a significant data breach far outweigh this expense. A single breach could lead to hefty fines for non-compliance with data protection regulations, loss of customer trust, damage to reputation, and significant legal costs. Coro’s risk mitigation strategies help Evermore Resort avoid these potentially catastrophic financial consequences.

By proactively identifying and addressing vulnerabilities, Coro helps Evermore avoid the expensive cleanup and recovery process associated with a data breach, ultimately saving the resort substantial financial resources. A study by IBM found the average cost of a data breach in 2023 was $4.45 million. Coro’s preventative measures significantly reduce Evermore’s risk of incurring such costs.

Key Benefits of the Partnership

The partnership delivers several significant advantages for Evermore Resort:

- Enhanced Security Posture: Coro Cybersecurity provides a comprehensive suite of security solutions, significantly reducing the resort’s vulnerability to cyberattacks.

- Reduced Operational Costs: By proactively addressing security threats, Coro frees up internal IT resources, allowing for greater focus on strategic initiatives.

- Improved Compliance: Coro ensures Evermore Resort maintains compliance with relevant data protection regulations, mitigating the risk of hefty fines.

- Enhanced Customer Trust: A strong cybersecurity posture builds confidence among guests, enhancing the resort’s reputation and attracting more customers.

- Proactive Threat Detection: Coro’s advanced threat detection systems identify and mitigate potential threats before they can cause significant damage.

- Cost Savings: The preventative nature of Coro’s services helps avoid the potentially catastrophic costs associated with a data breach.

Technological Aspects of the Partnership

Evermore Resort’s enhanced security posture is a direct result of the technological integration with Coro Cybersecurity. Their expertise goes beyond simple implementation; it involves a strategic layering of security solutions designed to address the unique vulnerabilities of a high-profile resort. This partnership has significantly upgraded our defenses, moving us from a reactive to a proactive security model.Coro Cybersecurity implemented a multi-layered approach, combining cutting-edge technologies to provide comprehensive protection.

This wasn’t a simple “plug-and-play” solution; it required careful assessment of our existing infrastructure and a tailored implementation plan.

Network Security Enhancements

Before the partnership, Evermore Resort relied on a basic firewall and antivirus software. This provided minimal protection against sophisticated threats. Coro Cybersecurity replaced this with a next-generation firewall (NGFW) capable of deep packet inspection and advanced threat prevention. They also implemented an intrusion detection and prevention system (IDS/IPS) to monitor network traffic for malicious activity and automatically block threats.

Furthermore, a robust virtual private network (VPN) solution was deployed to secure remote access and protect sensitive data transmitted off-site.

Endpoint Protection

Endpoint protection was significantly upgraded. Previously, we used basic antivirus software. Coro Cybersecurity deployed an endpoint detection and response (EDR) solution providing real-time monitoring and threat hunting capabilities on all resort devices, from guest Wi-Fi access points to employee workstations. This proactive approach allows for rapid identification and containment of malware before it can cause significant damage. This also includes regular vulnerability scanning and patching to minimize attack surfaces.

Security Information and Event Management (SIEM)

A critical component of the improved security infrastructure is the implementation of a SIEM system. This system centralizes security logs from various sources across the network, providing a single pane of glass for security monitoring and incident response. The SIEM allows for the detection of anomalies and potential security breaches in real-time, enabling faster response times and minimizing the impact of incidents.

Prior to the partnership, log management was fragmented and lacked the centralized analysis capabilities offered by the SIEM.

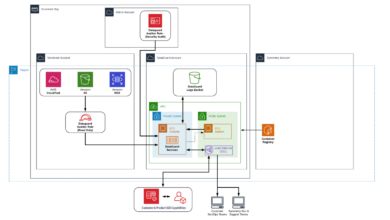

Data Flow and Security Measures Illustration

Imagine a diagram. At the left, we have various data sources: guest Wi-Fi networks, employee workstations, point-of-sale systems, and security cameras. These sources feed into a central network protected by the NGFW. The NGFW inspects all incoming and outgoing traffic, blocking malicious activity based on predefined rules and threat intelligence. Data then flows to the servers, protected by intrusion detection and prevention systems.

The EDR solution monitors all endpoints for malicious activity. All security events are logged and sent to the SIEM for centralized monitoring and analysis. Finally, the VPN secures all remote access to the network. This layered approach ensures that even if one layer of security is breached, others are in place to mitigate the risk. The SIEM acts as the central command center, alerting security personnel to any anomalies and facilitating rapid response.

Future Considerations for Evermore Resort’s Cybersecurity

Evermore Resort, with its growing online presence and reliance on interconnected systems, faces an evolving landscape of cybersecurity threats. Maintaining a robust security posture requires proactive planning and adaptation to anticipate and mitigate these emerging risks. This section explores potential future threats, areas for improvement, and the evolving role of Coro Cybersecurity in safeguarding Evermore’s digital assets.

The hospitality industry is a prime target for cybercriminals due to the sensitive data it handles (customer credit card information, personal details, etc.) and the often complex network infrastructure supporting its operations. Therefore, a forward-thinking approach to cybersecurity is crucial for Evermore Resort’s continued success and reputation.

Emerging Cybersecurity Threats Facing Evermore Resort

The resort needs to prepare for increasingly sophisticated attacks, including advanced persistent threats (APTs) which are characterized by their prolonged nature and stealthy operations. These attacks often target specific systems for data exfiltration or disruption. Furthermore, the rise of AI-powered phishing and social engineering campaigns presents a significant challenge, as these attacks become increasingly difficult to distinguish from legitimate communications.

Finally, the increasing prevalence of ransomware attacks, which can cripple operations and lead to significant financial losses, necessitates robust backup and recovery strategies. The interconnected nature of the resort’s systems (from point-of-sale systems to guest Wi-Fi networks) also creates a larger attack surface, increasing vulnerability to widespread breaches.

Strengthening Evermore Resort’s Cybersecurity Posture

Several key areas require attention to further enhance Evermore Resort’s cybersecurity. This includes implementing multi-factor authentication (MFA) across all systems to add an extra layer of security, even for seemingly low-risk accounts. Regular security awareness training for employees is essential to combat social engineering attacks and promote best practices. Investing in advanced threat detection and response systems, including intrusion detection and prevention systems (IDS/IPS), is crucial for early identification and mitigation of threats.

Furthermore, the resort should conduct regular penetration testing and vulnerability assessments to identify weaknesses in its security infrastructure proactively. Finally, a robust incident response plan should be in place, outlining clear procedures to follow in the event of a security breach.

Coro Cybersecurity’s Adapting Role in Addressing Future Threats

Coro Cybersecurity’s role will evolve to encompass more proactive threat hunting and advanced threat detection. This will involve utilizing artificial intelligence and machine learning to identify and respond to emerging threats in real-time. They will also need to stay abreast of the latest attack vectors and vulnerabilities, providing Evermore Resort with continuous security updates and recommendations. This includes regularly reviewing and updating security protocols and training materials, ensuring they remain relevant and effective in combating the latest threats.

Coro will need to leverage its expertise to help Evermore Resort navigate the complexities of increasingly sophisticated attacks, providing strategic guidance and support.

Recommendations for Enhancing the Evermore Resort – Coro Cybersecurity Partnership

Regular collaborative meetings between Evermore Resort’s IT team and Coro Cybersecurity are crucial for maintaining a strong partnership. These meetings should focus on sharing threat intelligence, reviewing security posture, and planning for future threats. Establishing clear service level agreements (SLAs) that define response times and responsibilities will ensure accountability and effective collaboration. Furthermore, fostering open communication and a proactive approach to security will enable a more responsive and effective partnership.

Investing in joint training programs for Evermore Resort’s IT staff and Coro Cybersecurity engineers will enhance their shared understanding and improve incident response capabilities. Finally, regular review and updates of the overall cybersecurity strategy are essential to maintain a robust and adaptive security posture in the face of evolving threats.

Final Thoughts

The Evermore Resort and Coro Cybersecurity partnership showcases a powerful model for businesses prioritizing robust security. By combining Evermore’s commitment to safety with Coro’s cutting-edge expertise, they’ve created a truly secure environment. This isn’t just about preventing data breaches; it’s about fostering trust with guests and stakeholders, protecting valuable assets, and maintaining a competitive edge in a world increasingly reliant on technology.

The ongoing collaboration ensures that Evermore remains ahead of the curve, ready to face future cybersecurity challenges head-on.

Essential Questionnaire: Why Evermore Resort Loves Coro Cybersecurity

What specific types of cyber threats does Coro Cybersecurity protect Evermore Resort from?

Coro Cybersecurity protects Evermore Resort from a wide range of threats, including phishing attacks, malware infections, denial-of-service attacks, and data breaches. Their services cover network security, application security, and data protection.

How does Coro Cybersecurity’s approach differ from other cybersecurity providers?

Coro Cybersecurity takes a proactive, rather than reactive, approach. They go beyond simply responding to incidents; they work to identify and mitigate potential threats before they can cause damage. Their expertise in threat intelligence and preventative measures sets them apart.

What is the cost of Coro Cybersecurity’s services for a resort like Evermore?

The cost varies depending on the specific services required and the size of the resort’s infrastructure. It’s best to contact Coro Cybersecurity directly for a customized quote based on Evermore’s specific needs.

Does Coro Cybersecurity provide ongoing training and support to Evermore Resort’s staff?

Yes, Coro Cybersecurity provides ongoing training and support to ensure Evermore Resort’s staff is equipped to handle potential security threats and understand best practices. This proactive approach is crucial for maintaining a strong security posture.