Dominos Customer Information Leaked on the Dark Web

Dominos customer information leaked on the dark web – Domino’s customer information leaked on the dark web – a chilling headline that’s unfortunately becoming all too common in today’s digital landscape. This massive data breach potentially exposes sensitive information belonging to countless Domino’s customers, raising serious concerns about identity theft, financial fraud, and the overall security of our personal data. We’ll delve into the specifics of what happened, the potential consequences for affected individuals, and what steps can be taken to mitigate the damage.

The scale of this breach is truly concerning. We’re talking about potentially millions of customers, their personal details, and possibly even financial information, now floating around the darkest corners of the internet. This isn’t just an inconvenience; it’s a serious threat, and understanding the implications is crucial for both Domino’s and its customers. We’ll examine the types of data exposed, the methods used by cybercriminals, and the potential downstream effects of this leak, comparing it to similar incidents to gauge its severity.

The Scope of the Leak

The recent Domino’s data breach, while the company has confirmed it’s been addressed, raises serious concerns about the scale of the compromised information and its potential impact on affected customers. The precise number of affected individuals remains unclear, but given Domino’s global reach and extensive customer database, it’s reasonable to assume a significant number of people were impacted. The potential consequences for those affected are far-reaching and deeply troubling.The types of information potentially compromised are crucial in assessing the risk.

If the breach included personally identifiable information (PII) like names, addresses, phone numbers, email addresses, and payment details, the consequences could be severe. This data could be used for a variety of malicious purposes, including identity theft, financial fraud, and targeted phishing attacks. The longer the data remains accessible on the dark web, the greater the risk to individuals.

Potential Impact on Affected Individuals

The impact of this data breach on affected individuals could be devastating. Identity theft, a major concern, could involve criminals using stolen information to open fraudulent accounts, apply for loans, or file taxes in the victim’s name. This can lead to significant financial losses and a lengthy process to restore credit and reputation. Financial fraud, through unauthorized access to bank accounts or credit cards, is another immediate and significant threat.

Reputational damage, though less tangible, can be equally harmful. The compromised data could be used to spread misinformation or engage in other forms of online harassment, impacting the individual’s personal and professional life. For example, someone might find their personal information used in a scam email, leading to distrust from family and friends, or even potential employers.

Comparison to Similar Incidents

This Domino’s breach shares similarities with several other data breaches in the food service industry. For example, the 2017 Equifax breach, while not directly in the food service sector, impacted millions and highlighted the vulnerability of large databases holding sensitive personal information. Similarly, breaches affecting restaurant chains have exposed customer payment information, leading to widespread fraudulent charges. The scale of this Domino’s breach, however, remains to be fully determined, making direct comparisons challenging.

The crucial difference may lie in the specific types of data compromised and the company’s response to the breach. A swift and transparent response, coupled with effective mitigation strategies, can lessen the long-term impact on customers. However, a slow or inadequate response can exacerbate the damage and lead to increased legal and financial liabilities for the company.

Data Exposed

The Domino’s data breach, as reported, represents a significant threat to customer privacy. The leaked information encompasses a range of sensitive data points, each carrying its own potential for misuse. Understanding the types of data exposed and their inherent vulnerabilities is crucial to assessing the overall impact of this incident and implementing effective mitigation strategies. This section details the specific types of data potentially compromised and the associated risks.

The severity of the breach hinges on the combination of data types exposed. A single data point, like a name, might seem innocuous in isolation, but when combined with other pieces of information – like an address and order history – it creates a far more complete and exploitable profile of an individual. This allows malicious actors to craft highly targeted phishing attempts, commit identity theft, or engage in other fraudulent activities.

Data Types and Sensitivity Levels

The following table summarizes the types of customer data potentially exposed in the Domino’s data breach, their sensitivity levels, potential misuse scenarios, and suggested mitigation strategies. It’s important to remember that the exact data compromised may vary depending on the individual customer and the timeframe of their interactions with Domino’s.

| Data Type | Sensitivity Level | Potential Misuse | Mitigation Strategies |

|---|---|---|---|

| Names and Addresses | High | Identity theft, targeted phishing, physical stalking, mail fraud. | Credit monitoring services, fraud alerts, secure password management. |

| Email Addresses and Phone Numbers | Medium-High | Spam, phishing attacks, doxing, unwanted calls, account takeovers. | Strong spam filters, two-factor authentication (2FA) on all accounts, caution when clicking links. |

| Order History | Medium | Targeted advertising, profiling, potential for revealing personal preferences (dietary restrictions, allergies, etc.), which could be used for social engineering attacks. | Review privacy settings on connected apps and services; be wary of unsolicited marketing. |

| Payment Information (Potentially Credit Card Details) | Very High | Financial fraud, unauthorized purchases, identity theft. | Immediate contact with credit card companies to report potential fraud, close affected accounts, credit monitoring services, fraud alerts. |

| Loyalty Program Information | Medium-High | Account takeover, unauthorized rewards redemption, targeted marketing. | Change passwords for loyalty accounts, monitor account activity closely, report any suspicious activity. |

The Dark Web Context

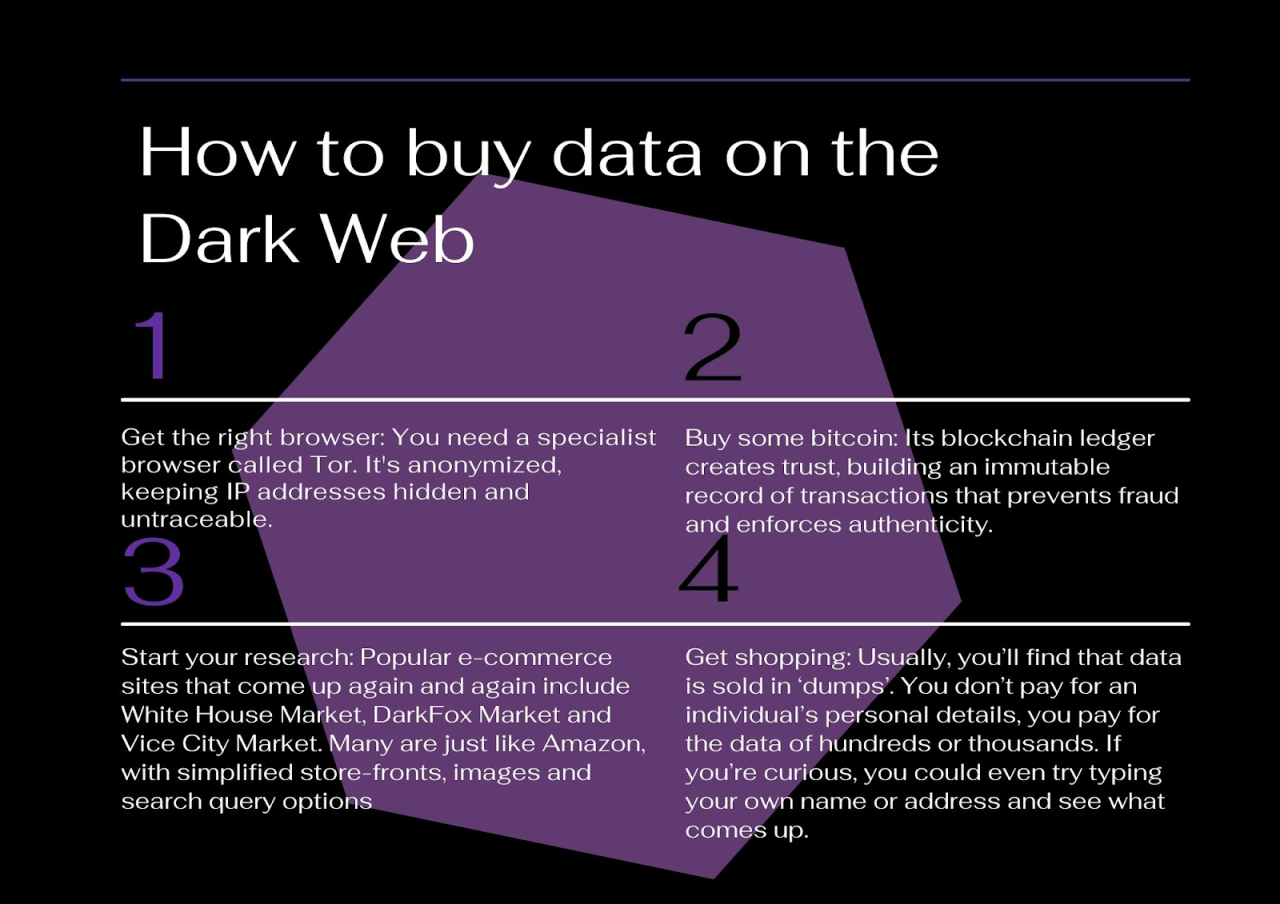

The dark web, a hidden layer of the internet accessible only through specialized software like Tor, provides a haven for illicit activities, including the buying and selling of stolen data. The anonymity offered by these networks makes it a prime location for cybercriminals to trade compromised information, like the recently leaked Domino’s customer data. Understanding how this data is handled within this environment is crucial to assessing the potential risks to affected individuals.The methods employed by cybercriminals to exploit and sell this data are surprisingly sophisticated, often leveraging established marketplaces and sophisticated marketing techniques.

They frequently package the data in various ways to maximize profit and cater to different buyer needs. The downstream effects of this data trade can range from relatively low-level phishing attempts to large-scale identity theft operations.

Data Exploitation and Sales Methods

Cybercriminals typically use a variety of methods to monetize stolen data. They might directly sell the raw data on dark web marketplaces, often categorized by data type and quality. Alternatively, they might offer services based on the data, such as custom-built phishing campaigns targeting specific individuals or businesses identified within the dataset. Data aggregation is also common, where multiple datasets are combined to create a more valuable package for sale.

The dark web forums themselves facilitate this process through discussions and advertising of the available data. Sophisticated criminals might even offer data “cleaning” services, removing personally identifiable information to reduce legal risks for buyers while maintaining the core value of the dataset for purposes such as targeted advertising or marketing fraud.

Pricing and Packaging of Leaked Data

Pricing on dark web marketplaces varies significantly depending on the type and quantity of data, its perceived quality (e.g., completeness, accuracy), and the demand. A dataset containing thousands of Domino’s customer records with names, addresses, and payment information would likely command a higher price than a smaller dataset with only email addresses. Data is often packaged in bulk, with larger datasets offering discounts.

It might be sold as a complete dataset or broken down into smaller, more targeted subsets, catering to buyers with specific needs. For instance, a subset containing only customers with high credit scores might fetch a premium price for those involved in financial fraud. Payment is typically made using cryptocurrencies like Bitcoin to maintain anonymity. The transaction process itself often involves escrow services to ensure both buyer and seller are protected from fraud.

Potential Downstream Uses of Leaked Data, Dominos customer information leaked on the dark web

The Domino’s data leak poses significant risks. Phishing campaigns are a likely outcome. Cybercriminals could use the leaked information to create convincing phishing emails that appear to come from Domino’s, tricking recipients into revealing sensitive login credentials or financial information. Identity theft is another major concern. The combination of names, addresses, and potentially payment details could be used to open fraudulent accounts or apply for loans in the victims’ names.

This can lead to significant financial losses and damage to credit scores. Furthermore, the data could be used for more sophisticated attacks, such as targeted advertising fraud or manipulating online reviews to damage Domino’s reputation. The potential for harm is significant and highlights the importance of strong data security practices by organizations and vigilance by consumers.

Domino’s Response and Mitigation

Domino’s response to the data breach, while swift in acknowledging the incident, faced criticism for its perceived lack of transparency and proactive customer support. The company’s initial statements focused on confirming the breach and assuring customers that they were investigating the matter. However, the specifics regarding the extent of the compromised data and the timeline of events remained somewhat vague initially, leading to uncertainty and anxiety among affected individuals.

This initial ambiguity contrasted with the proactive and detailed responses seen from other companies facing similar situations.

Domino’s Official Response and Actions

Following the discovery of the data breach on the dark web, Domino’s issued a press release acknowledging the incident. This statement confirmed the compromise of customer data but often lacked specific details regarding the nature and scope of the affected information. The company indicated it was working with cybersecurity experts to investigate the incident and to implement measures to prevent future breaches.

While they did not publicly detail specific technical mitigation steps, they generally emphasized their commitment to customer data security and their efforts to enhance their security protocols. The lack of detailed information, however, left many customers feeling underserved and concerned about the potential for identity theft or fraud. A more detailed timeline of events, including the date of discovery, the steps taken to contain the breach, and the ongoing investigative process, would have significantly improved the response.

Effectiveness of Domino’s Response

The effectiveness of Domino’s response is debatable. While acknowledging the breach was a necessary first step, the company’s communication strategy lacked the transparency and proactive customer support needed to effectively mitigate the damage and restore customer trust. The limited information provided left customers feeling vulnerable and unsure of what steps they should take to protect themselves. A comparison with other companies that have faced similar breaches, such as Equifax, reveals a difference in approach.

Equifax, for instance, offered extensive credit monitoring services to affected customers, a step Domino’s notably did not take. This lack of proactive support contributed to negative public perception and could have long-term implications for customer loyalty.

Hypothetical Improved Response Strategy

An improved response strategy for Domino’s would have prioritized transparency and proactive customer engagement from the outset. This would involve promptly issuing a detailed press release outlining the scope of the breach, the types of data compromised, the timeline of events, and the steps being taken to mitigate the damage. Immediate and direct communication with affected customers, via email and potentially SMS, would be crucial.

This communication should have included clear and actionable advice on steps customers could take to protect themselves, such as credit monitoring services, password changes, and fraud alerts. Furthermore, a dedicated customer support hotline and online resource center should have been established to answer customer queries and provide ongoing support. Technically, a comprehensive post-incident review should be conducted to identify vulnerabilities and implement enhanced security measures, including multi-factor authentication, regular security audits, and employee training programs.

Proactive measures like these, coupled with transparent communication, would have significantly mitigated the negative impact of the breach and fostered greater customer trust.

Legal and Regulatory Implications

The Domino’s data breach carries significant legal and regulatory implications, potentially exposing the company to substantial financial penalties and reputational damage. The severity of these consequences will depend on several factors, including the specific data compromised, the jurisdiction(s) involved, and the effectiveness of Domino’s response. This section explores the potential legal ramifications for Domino’s and the legal recourse available to affected customers.The legal landscape surrounding data breaches is complex and varies considerably across different jurisdictions.

However, several key regulations and laws are likely to be relevant in this case. These include the GDPR (General Data Protection Regulation) in Europe, the CCPA (California Consumer Privacy Act) in California, and various state-level data breach notification laws in the United States. These laws dictate how companies must handle personal data, including the implementation of security measures to prevent breaches and the notification requirements in the event of a breach.

Failure to comply with these regulations could result in substantial fines and legal action.

Potential Legal Actions by Affected Customers

Affected customers may pursue several legal avenues against Domino’s. Class-action lawsuits are a common approach in data breach cases, allowing numerous individuals to collectively sue the company for damages. These lawsuits could allege negligence, breach of contract, or violations of data protection laws. Individual lawsuits are also possible, particularly if customers can demonstrate significant financial or emotional harm resulting from the data breach, such as identity theft or fraud.

The success of these lawsuits will depend on demonstrating Domino’s negligence in securing customer data and proving a direct link between the breach and the harm suffered. For example, if a customer experiences identity theft directly traceable to the Domino’s breach, they have a stronger case.

Regulatory Consequences for Domino’s

Depending on the jurisdictions where the affected customers reside, Domino’s faces potential fines and sanctions from regulatory bodies. Under the GDPR, for instance, fines can reach up to €20 million or 4% of annual global turnover, whichever is higher. Similar penalties could be levied under state and federal laws in the US. Beyond financial penalties, regulatory bodies may also impose other sanctions, such as requiring Domino’s to implement improved data security measures, undergo independent audits, or publicly disclose details of the breach and its remediation efforts.

The severity of these sanctions will likely depend on the extent of the breach, the number of affected individuals, and Domino’s cooperation with the investigation. The Equifax data breach, for instance, resulted in significant fines and regulatory scrutiny, setting a precedent for the potential consequences Domino’s might face.

Customer Impact and Advice

The Domino’s data breach has significant implications for affected customers. Understanding the potential risks and taking proactive steps to mitigate them is crucial. The longer you wait to act, the greater the potential for harm. This section Artikels the potential consequences and provides practical advice for protecting yourself.The exposure of personal information, even seemingly innocuous details, can lead to a cascade of negative effects.

From identity theft to financial fraud, the consequences can be far-reaching and long-lasting, significantly impacting your credit score, financial stability, and overall sense of security.

Practical Steps to Protect Yourself After a Data Breach

Following a data breach like this, immediate action is vital. Waiting increases your vulnerability. The following steps can help minimize the damage.

- Change your passwords: Immediately change your Domino’s password (if you still use it) and any other passwords that you reuse across different online accounts. Use strong, unique passwords for each account. Consider a password manager to help you generate and manage these passwords securely.

- Monitor your bank and credit card accounts: Regularly check your bank and credit card statements for any unauthorized transactions. Report any suspicious activity immediately to your bank or credit card company.

- Review your credit reports: Obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) and review them carefully for any unfamiliar accounts or inquiries. Consider placing a fraud alert or security freeze on your credit reports to prevent new accounts from being opened in your name without your authorization.

- Be wary of phishing scams: Be vigilant about suspicious emails, phone calls, or text messages claiming to be from Domino’s or other organizations. Do not click on links or provide personal information unless you are absolutely certain of the source’s legitimacy.

- Consider identity theft protection services: Explore identity theft protection services that offer credit monitoring, fraud alerts, and identity restoration assistance. These services can provide an added layer of security and support in the event of identity theft.

Potential Long-Term Consequences of Data Compromise

The long-term impact of a data breach can be substantial and far-reaching. It’s not just about immediate financial losses; the effects can linger for years.The exposure of personal information can lead to various long-term consequences, including:

- Identity theft: Criminals can use your stolen data to open fraudulent accounts, file taxes in your name, or obtain loans and credit cards. This can severely damage your credit score and require extensive time and effort to rectify.

- Financial fraud: Stolen financial information can be used for unauthorized purchases, withdrawals, or transfers of funds. This can result in significant financial losses and emotional distress.

- Medical identity theft: If medical information was compromised, criminals could use it to obtain medical services fraudulently or file false insurance claims.

- Reputational damage: The breach could lead to reputational damage if your personal information is misused or shared inappropriately online.

- Ongoing monitoring and remediation costs: You may need to spend considerable time and resources monitoring your accounts, disputing fraudulent activity, and restoring your credit.

Advice for Monitoring Credit Reports and Financial Accounts

Proactive monitoring is crucial after a data breach. Regularly checking your accounts and credit reports can help you detect and address any fraudulent activity promptly.

- Regularly check your credit reports: Obtain your credit reports from each of the three major credit bureaus at least annually, or more frequently after a data breach. Look for any unfamiliar accounts, inquiries, or addresses.

- Monitor your bank and credit card statements: Review your bank and credit card statements meticulously for any unauthorized transactions. Set up alerts for unusual activity.

- Consider credit monitoring services: Credit monitoring services can provide real-time alerts of suspicious activity on your credit reports, helping you catch fraudulent activity early.

- Report suspicious activity immediately: If you notice any unauthorized activity on your accounts or credit reports, report it immediately to the relevant institutions (banks, credit card companies, credit bureaus) and law enforcement.

Preventing Future Breaches: Dominos Customer Information Leaked On The Dark Web

The Domino’s data breach highlights critical vulnerabilities in their systems and underscores the need for significant improvements in their data security infrastructure and practices. Analyzing the breach allows us to identify potential weaknesses and propose concrete steps to prevent similar incidents in the future. A multi-faceted approach, encompassing technological upgrades, enhanced employee training, and robust security policies, is crucial for safeguarding customer data.

The breach likely stemmed from a combination of factors, rather than a single point of failure. It’s probable that a lack of robust multi-factor authentication, insufficient employee training on cybersecurity best practices, and perhaps outdated or improperly configured software contributed to the vulnerability exploited by attackers. Furthermore, a lack of comprehensive penetration testing and regular security audits may have allowed weaknesses to persist undetected for an extended period.

Vulnerabilities in Domino’s Systems

Domino’s likely suffered from a combination of vulnerabilities. These could include inadequate protection against known exploits in their software, insufficiently secured databases, weak password policies, and a lack of real-time threat detection and response systems. The absence of strong multi-factor authentication (MFA) likely played a significant role, as MFA adds an extra layer of security, making it considerably harder for attackers to gain unauthorized access even if they obtain usernames and passwords.

Insufficient monitoring of network traffic and system logs also may have allowed the breach to go undetected for a period of time. For example, a failure to detect anomalous login attempts or data exfiltration attempts could have delayed the detection of the breach, allowing attackers more time to operate.

Recommendations for Improving Domino’s Data Security

Domino’s needs a comprehensive overhaul of its security infrastructure. This includes implementing robust multi-factor authentication across all systems, regularly patching and updating software to address known vulnerabilities, and conducting thorough penetration testing and vulnerability assessments to proactively identify and mitigate risks. Strengthening employee training programs on cybersecurity best practices, including phishing awareness and secure password management, is paramount. Furthermore, investing in a comprehensive security information and event management (SIEM) system for real-time threat detection and response is essential.

A robust data loss prevention (DLP) system should also be implemented to prevent sensitive data from leaving the network unauthorized. Regular security audits, both internal and external, are crucial for maintaining a strong security posture.

Comparison to Industry Best Practices

Compared to industry best practices, Domino’s security posture appears to have fallen short. Many large corporations in the food service and retail industries employ far more stringent security protocols, including more sophisticated threat detection systems, more frequent security audits, and comprehensive employee training programs. The implementation of zero-trust security models, which assume no implicit trust within the network and verify every access request, is becoming increasingly common among industry leaders.

Domino’s should adopt a similar approach, limiting access to sensitive data based on the principle of least privilege. Furthermore, the company should prioritize regular backups and disaster recovery planning to minimize the impact of future breaches. The use of encryption both in transit and at rest is also critical and appears to have been inadequate in this instance.

Examples of companies with stronger security postures include Target, which has invested heavily in security technology and employee training following its own high-profile breach, and other large multinational corporations that regularly undergo rigorous penetration testing and vulnerability assessments.

The Domino’s data breach, with customer information surfacing on the dark web, highlights the critical need for robust security in all applications. This incident underscores the importance of secure app development practices, a topic explored in detail on this insightful article about domino app dev, the low-code and pro-code future , which offers valuable perspectives on building safer and more secure systems.

Ultimately, preventing future breaches like the Domino’s incident requires a strong focus on security throughout the entire application lifecycle.

Last Word

The Domino’s data breach serves as a stark reminder of the vulnerabilities inherent in our increasingly digital world. While the immediate fallout is undeniably serious, the long-term consequences for both the company and its affected customers remain to be seen. It’s crucial that Domino’s takes swift and decisive action to address the immediate concerns and implement robust security measures to prevent future breaches.

For customers, vigilance and proactive steps to protect personal information are paramount. This incident underscores the need for heightened awareness and a collective effort to strengthen online security for everyone.

FAQ Compilation

What types of data were potentially compromised in the Domino’s data breach?

Potentially compromised data could include names, addresses, phone numbers, email addresses, order history, and payment information (depending on the payment method used).

How can I check if my information was compromised?

Domino’s should ideally provide a notification system if your data was involved. You should also monitor your credit reports and bank statements closely for any suspicious activity.

What should I do if I suspect my information has been compromised?

Immediately change your passwords, monitor your credit reports, and contact your bank and credit card companies. Consider placing a fraud alert on your credit files.

Is Domino’s liable for the damages resulting from this data breach?

Legal liability depends on various factors, including the extent of Domino’s negligence and applicable data protection laws. Affected customers may have grounds to pursue legal action.

What steps can Domino’s take to prevent future breaches?

Domino’s needs to invest in stronger security infrastructure, implement multi-factor authentication, regularly audit its systems, and provide comprehensive employee security training.