Dont Fall for the Trap Sneaky Business Email Scams Revealed

Dont fall for the trap the sneaky tactics of business email scammers revealed – Dont fall for the trap: the sneaky tactics of business email scammers revealed! In today’s digital world, business email scams are more sophisticated than ever. From cleverly crafted phishing emails to seemingly legitimate requests, scammers are constantly evolving their techniques to steal sensitive information and money. This post will delve into the world of business email compromise (BEC), exploring the various types of scams, the tactics used, and most importantly, how to protect yourself and your business from falling victim.

We’ll uncover the common characteristics of these scams, highlighting the red flags to watch out for. We’ll also examine real-world examples, showing how seemingly harmless emails can lead to devastating consequences. By the end, you’ll be equipped with the knowledge and strategies to identify and avoid these increasingly prevalent threats. Get ready to sharpen your email security skills!

Understanding the “Trap”

Business email scams are a pervasive threat, costing businesses and individuals millions annually. These sophisticated attacks exploit human psychology and technological vulnerabilities to trick recipients into revealing sensitive information or transferring money. Understanding the various types of these scams and their common characteristics is crucial for effective prevention.

Types of Business Email Scams

Business email scams come in many forms, each designed to exploit a specific vulnerability. Let’s examine some of the most prevalent types. One common example is the invoice scam, where a fraudulent invoice is sent, often mimicking a legitimate vendor’s style. The recipient, believing the invoice to be genuine, pays the scammer. Another prevalent type is the CEO fraud, where scammers impersonate high-level executives to request urgent wire transfers or other sensitive actions.

The urgency creates a sense of pressure, bypassing normal verification procedures. Fake payment requests are also common, where scammers claim a payment is overdue and pressure the recipient into sending money to a fraudulent account. Finally, account compromise scams involve hackers gaining access to an email account and sending fraudulent emails to contacts, appearing as though the legitimate account holder is making the request.

Common Characteristics of Business Email Scams

While the specific tactics vary, most business email scams share several common characteristics. A sense of urgency is frequently employed to bypass normal verification processes. Scammers often create a sense of trust by using familiar branding or mimicking legitimate communication styles. Grammatical errors and unprofessional language can be present, but sophisticated scams often employ near-perfect mimicry. Suspicious email addresses and unusual payment requests are also telltale signs.

Finally, a lack of clear communication channels or requests for unusual payment methods (e.g., wire transfers to overseas accounts) should raise red flags.

Comparison of Phishing, Spear Phishing, and Whaling Attacks, Dont fall for the trap the sneaky tactics of business email scammers revealed

The following table compares and contrasts three common types of phishing attacks:

| Characteristic | Phishing | Spear Phishing | Whaling |

|---|---|---|---|

| Target | Broad, indiscriminate audience | Specific individuals or groups within an organization | High-profile executives or wealthy individuals |

| Approach | Generic emails sent to many recipients | Highly targeted emails with personalized information | Extremely targeted emails with highly personalized information, often involving extensive research |

| Sophistication | Can range from simple to sophisticated | Generally more sophisticated than phishing | Extremely sophisticated, often involving social engineering and extensive research |

| Success Rate | Relatively low success rate | Higher success rate than phishing | Highest success rate, but attempts are less frequent |

Sneaky Tactics Employed by Scammers

Business email scammers are masters of deception, employing a range of psychological and technical tricks to lure unsuspecting victims into their traps. Understanding these tactics is crucial to protecting yourself and your business from BEC (Business Email Compromise) attacks. They don’t rely on brute force; instead, they meticulously craft their messages to exploit human vulnerabilities.Scammers leverage several core deceptive techniques to increase their chances of success.

These techniques often work in concert, creating a powerful and persuasive message that bypasses rational thought.

Deceptive Techniques in Scam Emails

The most common deceptive techniques used in scam emails revolve around creating a sense of urgency, authority, and scarcity. Urgency pressures recipients into immediate action without critical thinking. Authority implies legitimacy and trustworthiness, while scarcity creates a fear of missing out (FOMO). For example, an email might claim an urgent invoice is overdue, threatening legal action unless paid immediately.

This combines urgency and authority to create a compelling, albeit false, narrative. Another example might advertise a limited-time offer on a highly sought-after product, using scarcity to drive quick decisions.

Social Engineering Principles in Scam Emails

Scammers expertly manipulate recipients using social engineering principles. This involves exploiting human psychology to gain access to information or influence behavior. They often build rapport by impersonating trusted individuals or organizations, crafting personalized emails that seem to come from someone the recipient knows and trusts. This creates a sense of familiarity and trust, making the recipient more likely to comply with the scammer’s requests.

For example, an email might appear to be from a colleague requesting urgent payment for an invoice, or from a supplier requesting updated banking details. The scammer carefully crafts the email to mimic the communication style and tone of the impersonated individual, further enhancing its credibility.

Typical Steps in a Successful Business Email Compromise

The following flowchart illustrates the typical steps a scammer takes to execute a successful BEC attack:Imagine a flowchart with these steps:

1. Research

The scammer researches the target company and its employees, identifying key individuals involved in financial transactions. This might involve publicly available information on the company website or social media.

2. Impersonation

The scammer creates a fake email address that closely resembles the email address of a legitimate employee or business partner. This could involve a slight misspelling or the use of a similar domain name.

3. Crafting the Email

A convincing email is crafted, mimicking the communication style and tone of the impersonated individual. The email contains a request for a financial transaction, often involving a change of bank details or an urgent payment request. Urgency, authority, and scarcity tactics are used to pressure the recipient into acting quickly.

4. Sending the Email

The email is sent to the target recipient, often exploiting existing communication channels or relationships to increase credibility.

5. Response and Action

If successful, the recipient responds to the email, providing the requested information or making the payment.

6. Funds Transfer

The scammer receives the funds and disappears, leaving the victim with no recourse.This process highlights the importance of verifying requests, particularly those involving financial transactions, before taking any action. Always confirm requests through alternative channels, such as a phone call or in-person conversation, to avoid falling victim to BEC scams.

Recognizing Warning Signs

Spotting a phishing email isn’t always easy, but scammers often leave behind telltale clues. By learning to recognize these red flags, you can significantly reduce your risk of falling victim to their schemes. Paying close attention to the details can save you from significant financial and personal consequences. This section will Artikel several common warning signs to look out for.

The more red flags you identify in an email, the higher the likelihood it’s fraudulent. Don’t rely on just one indicator; consider the email as a whole. A combination of suspicious elements should always trigger a deep level of scrutiny.

Suspicious Sender Addresses and Email Structure

The sender’s email address is often the first clue. Scammers frequently use addresses that look almost identical to legitimate companies but have subtle differences. They might also use free email services like Gmail or Yahoo when a legitimate business would use a professional-looking domain. Additionally, pay attention to the overall structure of the email. Is the formatting sloppy?

Are there grammatical errors and typos?

- Example 1: An email claiming to be from “PayPal” might use an address like “[email protected]” instead of a legitimate PayPal address.

- Example 2: An email purportedly from your bank might contain numerous grammatical errors and misspellings, a stark contrast to the polished communication you’d expect from a financial institution.

Unusual Requests and Urgent Actions

Legitimate businesses rarely request urgent or unusual actions. Be wary of emails demanding immediate payment, sharing personal information, or clicking on links without verification.

- Example 1: An email demanding immediate payment to avoid account suspension, often with a threat of legal action.

- Example 2: An email asking for your social security number or bank account details under the guise of updating your information.

Suspicious Links and Attachments

Never click on links or open attachments from unknown or untrusted senders. Hover your mouse over links to see the actual URL; it might be different from what’s displayed. Avoid opening attachments unless you’re absolutely certain of their origin and safety.

- Example 1: An email containing a shortened link (like bit.ly) that leads to a malicious website.

- Example 2: An email with an attachment claiming to be an invoice or important document, but actually containing malware.

Generic Greetings and Personal Information

Legitimate businesses usually personalize their emails. Be wary of emails that use generic greetings like “Dear Customer” or “Valued User,” especially if they claim to have personal information about you. Check if they actually know your name correctly.

- Example 1: An email starting with “Dear Customer” despite having access to your name.

- Example 2: An email claiming to know your address or phone number, but containing slight inaccuracies, suggesting they may have obtained it through less legitimate means.

Threats and Intimidation

Legitimate businesses will not threaten or intimidate you. Be cautious of emails that use aggressive language, threatening legal action, or claiming to have compromising information about you.

- Example 1: An email threatening to report you to the authorities unless you pay a certain amount of money.

- Example 2: An email claiming to have access to your personal data and threatening to release it unless you comply with their demands.

Protecting Your Business from Email Scams

Email scams are a persistent threat to businesses of all sizes, potentially leading to financial losses, reputational damage, and disruption of operations. Implementing a robust preventative strategy is crucial for safeguarding your business from these attacks. This involves a multi-faceted approach encompassing employee education, technological safeguards, and clear reporting procedures.Effective preventative measures significantly reduce the likelihood of successful email scams.

By combining technological solutions with proactive employee training, businesses can create a strong defense against these sophisticated attacks. A proactive approach is far more cost-effective than dealing with the aftermath of a successful scam.

So, you’re trying to avoid those phishing emails? Smart! It’s crucial to stay vigilant, especially when dealing with sensitive business information. But building secure internal apps can also be a game-changer; that’s where learning about domino app dev the low code and pro code future comes in handy. Developing robust, secure applications can minimize your reliance on potentially vulnerable external communications, ultimately reducing your risk of falling prey to email scams.

Employee Training Programs

Regular and comprehensive employee training is paramount. Training should cover various types of phishing emails, including spear phishing (highly targeted attacks), whaling (targeting high-level executives), and clone phishing (mimicking legitimate emails). Employees should be educated on how to identify suspicious emails, including those with grammatical errors, unusual sender addresses, urgent requests for sensitive information, and links to unfamiliar websites.

Practical exercises, such as simulated phishing campaigns, can reinforce learning and help employees develop critical thinking skills when dealing with potentially malicious emails. Furthermore, employees should be explicitly instructed on the company’s policy regarding handling suspicious emails and the reporting procedures. This includes providing clear contact information for reporting suspected scams. For instance, a designated security team or a specific email address can be established for reporting such incidents.

Email Authentication and Security Measures

Implementing strong email authentication protocols is a critical technological safeguard. SPF (Sender Policy Framework), DKIM (DomainKeys Identified Mail), and DMARC (Domain-based Message Authentication, Reporting & Conformance) are crucial technologies that help verify the authenticity of emails and prevent spoofing. These protocols work together to validate the sender’s identity, ensuring that emails appear to originate from legitimate sources. Additionally, businesses should utilize robust spam filters and regularly update their antivirus software.

These tools can effectively block many malicious emails before they even reach employees’ inboxes. Regularly reviewing and updating these filters and software ensures they remain effective against evolving scam tactics.

Password Policies and Multi-Factor Authentication

Strong password policies and multi-factor authentication (MFA) are essential for protecting business accounts. Password policies should mandate the use of complex passwords that meet specific length and character requirements (including uppercase and lowercase letters, numbers, and symbols). Regular password changes should also be enforced. Multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of verification before accessing their accounts.

This could involve a one-time code sent to a mobile device, a biometric scan, or a security token. Implementing MFA significantly reduces the risk of unauthorized access even if an attacker obtains a password. For example, even if a scammer obtains an employee’s password through phishing, they will still be unable to access the account without the second verification factor provided by MFA.

Reporting Suspected Business Email Scams

Reporting suspected scams promptly is crucial for mitigating potential damage and assisting law enforcement in investigating and disrupting criminal activities. A step-by-step guide should be implemented and readily available to employees.

- Identify the Scam: Carefully review the suspicious email, noting the sender’s address, subject line, content, and any links or attachments.

- Preserve Evidence: Do not delete the email. Forward it to the designated security team or email address established for reporting scams. Take screenshots of relevant parts of the email and any suspicious websites.

- Report to Your Internal Security Team: Contact your company’s IT security department or designated point of contact immediately. Provide them with all the information you have gathered.

- Report to External Authorities: Depending on the nature and severity of the scam, report it to the appropriate law enforcement agencies (such as the FBI’s Internet Crime Complaint Center (IC3) in the US, or your country’s equivalent). You may also need to report it to your financial institution if financial losses have occurred.

- Document Everything: Maintain a detailed record of all communication and actions taken related to the reported scam. This documentation will be useful for internal investigations and potential legal proceedings.

Case Studies

Understanding the devastating impact of business email compromise (BEC) scams requires examining real-world examples. These cases highlight the sophistication of these attacks and the significant financial and reputational damage they can inflict. By analyzing these examples, businesses can better understand the tactics used and implement preventative measures.

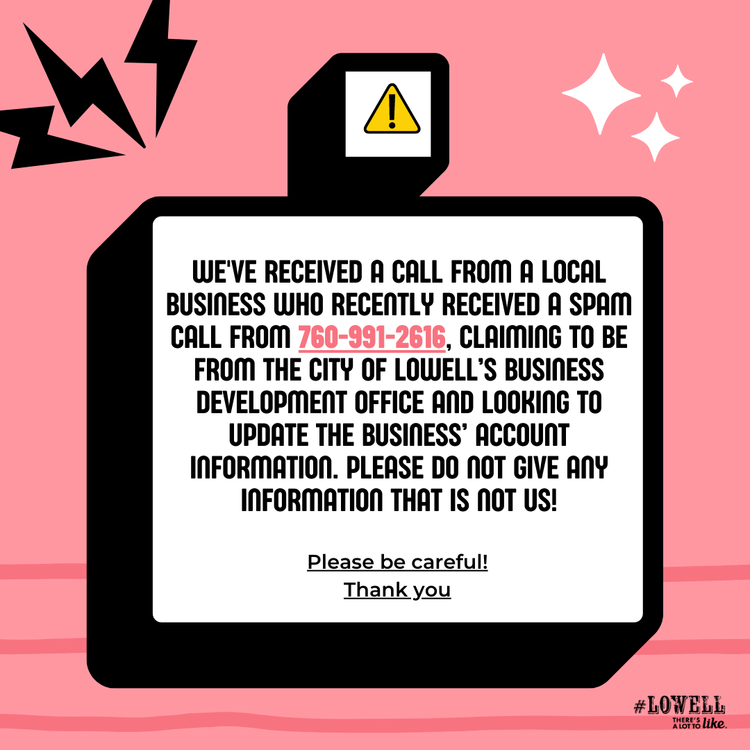

The CEO Fraudulent Wire Transfer

A small manufacturing company received an email seemingly from their CEO, requesting an urgent wire transfer to a supplier in China. The email was meticulously crafted, mimicking the CEO’s writing style and using company-specific details. The finance department, unaware of the scam, processed the transfer immediately. The money was never recovered, resulting in significant financial losses for the company.

The scammer employed several key tactics. First, they conducted thorough reconnaissance, gathering information about the company’s internal communication style, leadership, and financial processes. Second, they crafted a convincing email that exploited the urgency and trust placed in the CEO’s instructions. The victim’s response was immediate compliance, driven by the perceived urgency and trust in the sender. The outcome was a complete loss of the transferred funds, impacting the company’s financial stability and damaging employee morale.

The email itself would have appeared perfectly normal, containing legitimate company details and mimicking the CEO’s signature style, making it virtually indistinguishable from a genuine communication. The urgency of the request was a critical component, bypassing typical verification processes.

The Invoice Redirection Scam

A large construction firm received a fraudulent invoice from a seemingly legitimate subcontractor. The invoice requested payment to a different bank account than usual. The accounts payable department, following their standard procedures, processed the payment. Only after the subcontractor contacted them about a missing payment did the company realize they had been scammed.

This scam relied on the familiarity and trust established between the company and its subcontractors. The scammer cleverly altered the bank account details on the invoice, making the change subtle enough to evade detection. The victim’s response, adhering to established payment processes, facilitated the fraud. The outcome involved the loss of a substantial sum of money and the need to conduct a thorough internal audit to identify vulnerabilities.

The fraudulent invoice would have appeared nearly identical to a genuine one, with the only difference being the subtly altered bank account details. The scammer likely obtained the original invoice format through phishing or other means, adding a layer of legitimacy to the scam.

The Compromised Email Account Scam

A marketing agency had its CEO’s email account compromised. The scammer sent emails to several clients, requesting urgent payments to a new account. Several clients, recognizing the CEO’s email address, processed the payments without question. The agency discovered the breach only after receiving concerned calls from clients.

This scam leveraged the established trust between the agency and its clients. The scammer exploited the compromised email account to impersonate the CEO, using the legitimate email address to lend credibility to the fraudulent requests. The victim’s response, based on the perceived legitimacy of the sender’s email address, led to significant financial losses. The outcome included lost revenue, damaged client relationships, and the costs associated with recovering the compromised account and enhancing security protocols.

The emails sent by the scammer would have appeared to originate from the CEO’s genuine email address, making it difficult for clients to detect the fraud. The urgent requests for payment were designed to bypass normal verification processes.

The Role of Technology in Combating Email Scams: Dont Fall For The Trap The Sneaky Tactics Of Business Email Scammers Revealed

The digital age has brought about incredible advancements, but it’s also created a breeding ground for cybercriminals. Email scams, in particular, have become increasingly sophisticated, demanding equally advanced technological solutions to combat them. Fortunately, a range of technological tools are available to help businesses and individuals protect themselves from these malicious attacks. These technologies offer various layers of defense, from preventing scam emails from even reaching inboxes to verifying the authenticity of received messages.Email filtering and anti-spam software act as the first line of defense against email scams.

These tools utilize a variety of techniques to identify and block suspicious emails before they reach the user’s inbox. These techniques include analyzing email headers, checking sender reputations, and using machine learning algorithms to identify patterns associated with spam and phishing attempts. While not foolproof, effective email filtering significantly reduces the volume of scam emails received, improving inbox security and reducing the chance of employees falling victim to attacks.

Email Authentication Protocols

DMARC, SPF, and DKIM are three crucial email authentication protocols that work together to verify the authenticity of emails and prevent spoofing. DMARC (Domain-based Message Authentication, Reporting & Conformance) builds upon SPF (Sender Policy Framework) and DKIM (DomainKeys Identified Mail) to provide a comprehensive authentication system. SPF verifies that the email’s sending server is authorized by the domain it claims to represent.

DKIM uses digital signatures to verify that the email’s content hasn’t been tampered with during transit. DMARC then combines these verifications and specifies how receiving mail servers should handle emails that fail authentication, often resulting in rejection or quarantine. By implementing these protocols, organizations can significantly reduce the number of spoofed emails that mimic legitimate senders. For example, a company using DMARC can prevent attackers from sending phishing emails that appear to originate from their own domain.

Comparison of Email Security Solutions

Various email security solutions exist, each with its own strengths and weaknesses. Some solutions focus solely on email filtering, while others offer more comprehensive protection, including anti-virus scanning, data loss prevention (DLP), and advanced threat detection. Cloud-based solutions often provide scalability and ease of management, but may raise concerns about data privacy and security. On-premise solutions offer greater control over data but can be more expensive and require dedicated IT resources for maintenance and updates.

For example, a small business might opt for a cloud-based solution due to its cost-effectiveness and ease of use, while a large enterprise might prefer an on-premise solution to maintain greater control over its sensitive data. The choice depends on the specific needs and resources of the organization. A thorough assessment of security requirements, budget, and technical expertise is crucial when selecting an email security solution.

Final Conclusion

So, remember, the fight against business email scams is a continuous battle. Staying vigilant, educating your employees, and implementing robust security measures are crucial to safeguarding your business. Don’t let scammers win – arm yourself with knowledge and protect your valuable assets. By understanding the tactics employed by these cybercriminals and implementing the preventative measures Artikeld above, you can significantly reduce your vulnerability and safeguard your business from the devastating consequences of a successful email scam.

Stay informed, stay safe!

Quick FAQs

What is the difference between phishing and spear phishing?

Phishing is a broad term for sending deceptive emails to a large group. Spear phishing targets specific individuals or organizations with personalized information to increase the likelihood of success.

How can I report a suspected business email scam?

Report it to your internet service provider (ISP), the Federal Trade Commission (FTC), and law enforcement. Your bank should also be notified immediately if financial information is involved.

What is multi-factor authentication (MFA), and why is it important?

MFA adds an extra layer of security by requiring multiple forms of verification (e.g., password and a code from your phone) to access accounts, making it much harder for scammers to gain unauthorized access.

Are there any free tools to help detect email scams?

Many email providers offer built-in spam filters and security features. Additionally, several free online resources and browser extensions can help analyze email links and attachments for malicious content.