Enhancing Internal Controls Correlation Mapping & Risk Mitigation

Enhancing internal controls correlation mapping and risk mitigation is more than just a buzzphrase; it’s the key to building a resilient and thriving business. This journey delves into the fascinating world of risk management, exploring how effectively mapping internal controls to risks allows for proactive mitigation strategies. We’ll uncover the secrets to creating a robust internal control framework, visualize control-risk relationships, and discover how continuous improvement keeps your business one step ahead.

From understanding different types of internal controls and their importance to implementing effective risk mitigation plans, we’ll cover everything you need to know to strengthen your organization’s defenses. We’ll explore practical examples, helpful tools, and actionable strategies you can implement immediately. Get ready to transform your approach to risk management and build a more secure future for your business!

Understanding Internal Controls

Internal controls are the backbone of any organization, providing a framework to mitigate risks and ensure the reliability of financial reporting, operational efficiency, and compliance with laws and regulations. A strong internal control system isn’t just about preventing fraud; it’s about building confidence and trust in the organization’s processes and outcomes. This understanding is crucial for every business, regardless of size.Internal Controls: Types and Importance in Risk MitigationInternal controls can be broadly categorized into preventative and detective controls.

Preventative controls aim to stop errors or irregularities before they occur, while detective controls identify errors or irregularities after they have happened. Both types are essential for a comprehensive risk mitigation strategy. For example, a preventative control might be a mandatory two-factor authentication system for accessing sensitive data, preventing unauthorized access. A detective control, on the other hand, might be a regular audit of financial records to detect any discrepancies.

The importance of these controls lies in their ability to reduce the likelihood and impact of risks, ultimately protecting the organization’s assets and reputation.

Key Components of a Robust Internal Control Framework

A robust internal control framework typically incorporates five key components, often referred to as the COSO framework: control environment, risk assessment, control activities, information and communication, and monitoring activities. The control environment sets the tone at the top, influencing the ethical values and integrity within the organization. Risk assessment involves identifying and analyzing potential risks that could affect the achievement of objectives.

Control activities are the specific actions taken to mitigate identified risks. Information and communication ensure that relevant information is effectively communicated throughout the organization. Finally, monitoring activities assess the effectiveness of the internal control system over time. These five components work together to create a comprehensive and effective system.

Common Internal Control Weaknesses and Their Potential Consequences

Several common weaknesses can undermine even the most well-designed internal control systems. One example is a lack of segregation of duties, where a single individual has too much control over a process, increasing the risk of fraud or error. Another common weakness is inadequate authorization procedures, leading to unauthorized transactions or actions. Poor documentation of processes and controls makes it difficult to understand how a system works and identify weaknesses.

The consequences of these weaknesses can range from minor errors to significant financial losses, reputational damage, and even legal repercussions. For instance, a lack of segregation of duties could allow an employee to embezzle funds without detection.

Hypothetical Internal Control System for a Small Business, Enhancing internal controls correlation mapping and risk mitigation

Let’s consider a small bakery. A robust internal control system for this business could include:

- Inventory Management: Regular physical inventory counts to compare against recorded levels, preventing theft or spoilage.

- Cash Handling: Segregation of duties for cash register operation, reconciliation, and bank deposits. Daily cash counts and bank reconciliations.

- Sales Transactions: Use of a point-of-sale (POS) system to record all sales electronically, providing a detailed audit trail.

- Supplier Payments: A two-signature requirement for all checks issued to suppliers, preventing unauthorized payments.

- Employee Access: Limited access to sensitive information and systems based on job roles and responsibilities.

This system incorporates preventative controls (e.g., segregation of duties) and detective controls (e.g., regular inventory counts and reconciliations) to mitigate various risks, from theft to inaccurate financial reporting. Regular reviews and updates to this system would further strengthen its effectiveness.

Correlation Mapping of Internal Controls: Enhancing Internal Controls Correlation Mapping And Risk Mitigation

Understanding the intricate relationship between internal controls, risks, and business objectives is crucial for effective risk management. Correlation mapping provides a systematic approach to visualize and analyze these relationships, enabling organizations to identify control gaps and optimize their control environment. This process involves linking specific controls to the risks they mitigate and the objectives they support, creating a comprehensive picture of the organization’s control landscape.Effective correlation mapping requires a structured methodology.

It begins with a thorough understanding of the organization’s risk profile and its strategic objectives. This lays the foundation for identifying the relevant controls needed to manage those risks and achieve those objectives.

Methods for Mapping Internal Controls

Several methods facilitate the effective mapping of internal controls to risks and business objectives. A common approach involves using a risk register that lists identified risks, their likelihood and impact, and the corresponding controls designed to mitigate them. Another method uses a control matrix, where controls are listed along one axis and risks along the other. The intersection of a control and a risk indicates the control’s effectiveness in mitigating that specific risk.

Finally, some organizations utilize specialized software to automate the mapping process, allowing for dynamic updates and easier analysis. These tools often provide visual representations and reporting capabilities.

Visual Representation of Control-Risk Correlation

A visual representation significantly enhances understanding and communication. The following table illustrates a simple correlation mapping exercise:

| Control ID | Risk ID | Control Description | Mitigation Strategy |

|---|---|---|---|

| C001 | R001 | Segregation of Duties for Cash Handling | Implementing a system where different individuals are responsible for authorization, custody, and recording of cash transactions. |

| C002 | R002 | Regular Bank Reconciliations | Monthly reconciliation of bank statements by an independent individual. Discrepancies are investigated and resolved promptly. |

| C003 | R003 | Access Controls for Financial Systems | Implementing role-based access controls to restrict access to sensitive financial data based on job responsibilities. Regular access reviews are conducted. |

| C004 | R004 | Inventory Management System | Utilizing a real-time inventory tracking system to monitor stock levels, identify discrepancies, and prevent stock-outs or overstocking. |

Benefits of Visual Mapping

Visual mapping offers several key benefits. It provides a clear and concise overview of the organization’s control environment, making it easier to identify gaps and overlaps in controls. This facilitates communication and collaboration among stakeholders, ensuring everyone understands the organization’s risk profile and the controls in place to manage it. Furthermore, visual mapping supports effective monitoring and reporting, allowing for timely identification and remediation of control weaknesses.

The visual nature of the maps aids in risk assessment and the prioritization of control improvements.

Comparison of Correlation Mapping Techniques

Different correlation mapping techniques exist, each with its strengths and weaknesses. Spreadsheet-based methods are simple and accessible but may lack the sophistication of dedicated software solutions. Specialized software provides advanced features such as automated mapping, risk scoring, and reporting capabilities, but can be more expensive and complex to implement. The choice of technique depends on the organization’s size, complexity, and resources.

Smaller organizations may find spreadsheet-based methods sufficient, while larger, more complex organizations may benefit from dedicated software solutions. The key is selecting a method that is both effective and practical for the organization’s specific needs.

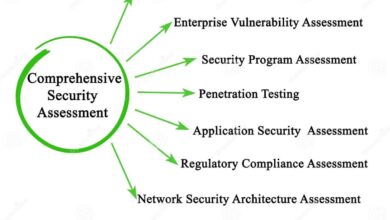

Risk Assessment and Mitigation Strategies

Understanding and managing risk is crucial for any organization’s success. A robust risk management framework involves identifying potential threats, assessing their impact, and implementing strategies to mitigate those threats. This process allows organizations to proactively address vulnerabilities and protect their assets, reputation, and bottom line. This section delves into the core elements of risk assessment and the various mitigation strategies available.

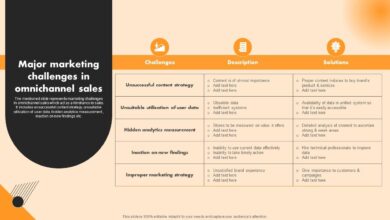

Common Risks and Categorization

Organizations face a wide array of risks, spanning financial, operational, compliance, and reputational areas. Categorizing these risks based on their likelihood and potential impact is vital for prioritizing mitigation efforts. A common approach uses a risk matrix, plotting likelihood (e.g., low, medium, high) against impact (e.g., low, medium, high). This creates four quadrants: low risk (low likelihood, low impact), medium risk (medium likelihood or impact), high risk (high likelihood and high impact), and very high risk (high likelihood and very high impact).For example, a small software company might face a low likelihood, high impact risk of a major security breach.

The likelihood is low because they have implemented some security measures, but the impact of a successful breach (loss of customer data, reputational damage, legal penalties) would be severe. Conversely, a high likelihood, low impact risk might be the occasional minor software bug requiring a patch; it happens frequently but has minimal consequences. Understanding this categorization helps prioritize resources.

Risk Mitigation Strategies

Several strategies can be employed to mitigate identified risks. The choice of strategy depends on the risk’s characteristics and the organization’s risk appetite.

- Avoidance: This involves completely eliminating the risk by not engaging in the activity that creates the risk. For instance, a company might choose not to expand into a new, highly volatile market to avoid political and economic instability risks.

- Reduction: This aims to lessen the likelihood or impact of a risk. Examples include implementing robust security measures (reducing the likelihood of a cyberattack), improving employee training (reducing the likelihood of human error), or investing in disaster recovery planning (reducing the impact of a natural disaster).

- Transfer: This shifts the risk to a third party. Purchasing insurance to cover potential financial losses from a lawsuit or outsourcing a risky task to a specialized vendor are common examples.

- Acceptance: This involves acknowledging the risk and accepting the potential consequences. This is often used for low-impact risks where the cost of mitigation outweighs the potential loss. For example, a small chance of equipment malfunction might be accepted if the cost of preventative maintenance is too high.

Risk Mitigation Plans: Examples

Effective risk mitigation requires a tailored plan for each identified risk. Financial Risk Mitigation Plan (Example: Currency Fluctuations): A company heavily reliant on international trade might mitigate currency fluctuation risk by hedging its foreign exchange exposure using financial instruments like forward contracts or options. This reduces the impact of unfavorable currency movements on its profits. Operational Risk Mitigation Plan (Example: Supply Chain Disruption): Diversifying suppliers, building strategic inventory buffers, and developing strong relationships with key suppliers can mitigate the risk of supply chain disruptions.

This reduces the likelihood of production delays or shortages. Compliance Risk Mitigation Plan (Example: Data Privacy Regulations): Implementing robust data security measures, conducting regular security audits, and providing comprehensive employee training on data privacy regulations can help mitigate the risk of non-compliance. This reduces the likelihood of fines and reputational damage.

Streamlining internal controls is key to effective risk mitigation, and a crucial part of that is accurate correlation mapping. Building robust systems to achieve this can be significantly simplified using modern development approaches, like those explored in this article on domino app dev the low code and pro code future. Leveraging these techniques allows for faster development cycles and easier integration of new controls, ultimately enhancing our overall risk management strategy.

Key Performance Indicators (KPIs) for Monitoring Risk Mitigation

Monitoring the effectiveness of risk mitigation strategies is essential. Key Performance Indicators (KPIs) provide quantifiable measures to track progress and identify areas needing improvement.

- Number of security incidents: Tracks the frequency of security breaches or other incidents.

- Mean Time To Resolution (MTTR) for incidents: Measures the efficiency of incident response.

- Cost of risk events: Tracks the financial impact of realized risks.

- Compliance audit results: Assesses adherence to relevant regulations.

- Employee training completion rates: Measures the effectiveness of risk awareness training.

- Insurance claim frequency and severity: Tracks the effectiveness of risk transfer strategies.

- Number of near misses reported: Identifies potential risks that were narrowly avoided.

Enhancing Internal Control Effectiveness

Strong internal controls are the bedrock of a well-functioning organization, safeguarding assets, ensuring reliable financial reporting, and promoting operational efficiency. However, simply implementing controls isn’t enough; continuous improvement and enhancement are crucial for maintaining their effectiveness over time. This section delves into practical strategies for bolstering the effectiveness of your internal control system.Regular review and testing are vital for ensuring that internal controls remain relevant, accurate, and effective in mitigating identified risks.

A robust system requires a proactive approach to identifying weaknesses and implementing necessary improvements before they lead to significant problems. This involves more than just a cursory check; it requires a deep dive into processes and procedures to ensure they’re functioning as intended and aligned with evolving business needs.

Regular Review and Testing of Internal Controls

Regular review and testing of internal controls involve a systematic and documented process of assessing the design and operating effectiveness of controls. This includes both preventative and detective controls. Preventative controls aim to stop errors or irregularities from occurring in the first place, while detective controls are designed to identify errors or irregularities that have already occurred. Testing methods can include observation, walkthroughs, re-performance, and analytical procedures.

For example, a company might regularly test its inventory control system by physically counting inventory and comparing it to the system’s records. Discrepancies would trigger an investigation to identify the cause and implement corrective actions. The frequency of testing should be determined by the inherent risk associated with each control. High-risk controls, such as those related to cash management, should be tested more frequently than lower-risk controls.

The results of testing should be documented and reported to management.

Importance of Documenting Internal Control Procedures and Processes

Comprehensive documentation is the cornerstone of effective internal control. Clearly defined procedures and processes, readily available to all relevant personnel, eliminate ambiguity and ensure consistency in application. This documentation serves as a training manual for new employees, a reference point for existing staff, and a vital tool for auditors in assessing the design and operating effectiveness of controls.

The documentation should include flowcharts, narratives, and other visual aids to clearly illustrate the steps involved in each process. For instance, a detailed procedure for processing customer payments should Artikel each step, from receipt of payment to posting to the accounts receivable ledger. Regular updates to the documentation are crucial to reflect changes in processes or systems.

The Role of Technology in Enhancing Internal Control Effectiveness

Technology plays a transformative role in enhancing internal control effectiveness. Automation streamlines processes, reducing manual intervention and the associated risk of human error. Data analytics provides powerful tools for identifying anomalies and trends that might indicate control weaknesses. For example, using data analytics to identify unusual patterns in expense reports can help detect fraudulent activities. Automated workflows can ensure that approvals and authorizations are obtained at each stage of a transaction, minimizing the risk of unauthorized actions.

Robust access controls, implemented through technology, limit access to sensitive data to authorized personnel only. The use of robotic process automation (RPA) can further automate repetitive tasks, freeing up human resources for higher-value activities.

Checklist for Conducting a Periodic Review of Internal Controls

A periodic review of internal controls should be a structured process, following a pre-defined checklist to ensure thoroughness and consistency. The checklist should be tailored to the specific organization and its risk profile.

- Review the organization’s risk assessment to identify key risks and associated controls.

- Examine the design of existing internal controls to ensure they are appropriate and effective in mitigating identified risks.

- Test the operating effectiveness of key controls through various testing methods (e.g., observation, walkthroughs, re-performance, analytical procedures).

- Document the results of the review and testing, including any identified weaknesses or deficiencies.

- Develop and implement corrective actions to address any identified weaknesses or deficiencies.

- Update internal control documentation to reflect any changes made.

- Report the findings of the review to management.

- Schedule the next review and testing cycle.

Communication and Reporting

Effective communication is the cornerstone of a robust internal control system. Without clear, consistent, and timely dissemination of information regarding internal controls and risk mitigation strategies, even the best-designed system will fall short. A comprehensive communication plan ensures that all relevant stakeholders understand their roles and responsibilities in maintaining the integrity of the organization’s operations.A well-structured communication plan ensures that information reaches the right people at the right time.

This minimizes misunderstandings and promotes a culture of accountability. Furthermore, regular reporting on the effectiveness of internal controls provides valuable insights into the system’s performance, allowing for proactive adjustments and improvements.

Communication Plan Design

A comprehensive communication plan should identify key stakeholders, including senior management, employees, auditors, and regulators. The plan should Artikel specific communication channels, such as email, meetings, intranet postings, and training sessions. The frequency of communication should be determined based on the nature of the information and the needs of the stakeholders. For example, updates on significant control deficiencies should be communicated immediately, while routine performance reports can be delivered monthly or quarterly.

The plan should also specify who is responsible for creating and disseminating each communication. Finally, a feedback mechanism should be included to allow stakeholders to provide input and address any concerns.

Reporting Methods for Internal Control Effectiveness

Several methods exist for reporting on the effectiveness of internal controls and risk mitigation efforts. Dashboards provide a visual representation of key performance indicators (KPIs) related to internal controls, allowing management to quickly identify areas needing attention. Detailed reports, on the other hand, offer a more in-depth analysis of control effectiveness, including specific examples of control failures or successes.

These reports can include metrics such as the number of control deficiencies identified, the severity of those deficiencies, and the timeliness of remediation efforts. Regular management reviews of these reports are crucial for ongoing improvement. Another effective method is the use of automated reporting tools that can track key metrics in real-time, providing immediate alerts when thresholds are breached.

Importance of Clear and Concise Communication

Clear and concise communication is paramount in managing internal controls and mitigating risks. Ambiguous messaging can lead to confusion, errors, and ultimately, control failures. A clear communication style ensures that everyone understands their responsibilities and the consequences of non-compliance. Concise communication saves time and prevents information overload. Using plain language, avoiding technical jargon, and focusing on key messages are essential elements of effective communication in this context.

For example, a simple email outlining a new policy on expense reporting is far more effective than a lengthy, complex memo that may not be read thoroughly.

Effective Communication Tools and Techniques

Effective communication tools and techniques include the use of visual aids, such as charts and graphs, to present complex data in an easily understandable format. Regular training sessions can educate employees on internal control procedures and risk mitigation strategies. Interactive workshops and simulations can enhance understanding and engagement. Regular meetings, both formal and informal, provide opportunities for discussion and feedback.

The use of a centralized internal control management system (ICMS) can streamline communication and reporting. This system could track control activities, deficiencies, and remediation efforts, providing a single source of truth for all stakeholders. Finally, utilizing storytelling techniques in reports can improve engagement and memorability. For example, instead of simply stating a statistic about fraud prevention, a report could include a brief case study illustrating the impact of a strong internal control.

Continuous Improvement

Building a robust internal control system isn’t a one-time project; it’s an ongoing journey. Continuous improvement is crucial for adapting to evolving risks, regulatory changes, and operational shifts. A dynamic approach ensures your internal controls remain effective and relevant, safeguarding your organization’s assets and reputation.Effective internal controls require a proactive and iterative approach to enhancement. This involves regularly reviewing and updating processes, leveraging lessons learned, and actively seeking feedback to identify weaknesses and areas for improvement.

A culture of continuous improvement fosters a more resilient and secure organization.

Strategies for Continuous Improvement

Regular review and updates of internal control processes are paramount. This involves analyzing the effectiveness of existing controls against identified risks. For example, a company might conduct a periodic review of its cybersecurity controls, updating its firewall rules and employee training programs in response to emerging threats. Additionally, benchmarking against industry best practices can highlight areas for improvement and provide insights into innovative control solutions.

Formalizing this process through documented procedures and schedules ensures consistency and accountability.

The Role of Internal Audit in Identifying Areas for Improvement

Internal audit plays a vital role in identifying areas needing improvement within internal controls. Independent assessments, performed by the internal audit function, provide an objective evaluation of the design and operating effectiveness of controls. They can use various techniques such as walkthroughs, testing of controls, and data analysis to identify control gaps or weaknesses. For example, an internal audit might identify weaknesses in the segregation of duties, leading to recommendations for process redesign to mitigate the associated risks.

Their reports often include recommendations for enhancements, prioritized by risk level.

Using Lessons Learned from Past Incidents

Past incidents, whether near misses or actual breaches, provide invaluable lessons for enhancing internal controls. A thorough post-incident review should be conducted to understand the root causes and contributing factors. This analysis should identify control weaknesses that allowed the incident to occur and inform the development of new or improved controls. For instance, a data breach might lead to enhanced access controls, improved employee training on cybersecurity best practices, and a more robust incident response plan.

Documenting these lessons learned and disseminating them throughout the organization is crucial to preventing similar incidents in the future.

Incorporating Stakeholder Feedback

Incorporating feedback from stakeholders is essential for a holistic approach to continuous improvement. Regular communication with employees, management, and external stakeholders can provide valuable insights into potential control weaknesses or areas needing improvement. This can be achieved through surveys, interviews, focus groups, and regular feedback mechanisms. For example, a survey might reveal employee concerns about the complexity of a particular process, suggesting the need for simplification and improved training.

Actively soliciting and addressing stakeholder feedback demonstrates a commitment to continuous improvement and enhances the overall effectiveness of the internal control system.

Wrap-Up

Mastering the art of enhancing internal controls correlation mapping and risk mitigation isn’t just about ticking boxes; it’s about building a culture of proactive risk management. By understanding your risks, mapping your controls, and implementing effective mitigation strategies, you’re not just protecting your business – you’re empowering it to reach its full potential. Remember, continuous improvement is key, so regularly review your processes, adapt to change, and stay ahead of the curve.

The journey to robust risk management is ongoing, but the rewards are immeasurable.

User Queries

What’s the difference between risk avoidance and risk mitigation?

Risk avoidance means completely eliminating the activity that creates the risk. Risk mitigation involves reducing the likelihood or impact of a risk that you can’t avoid.

How often should internal controls be reviewed?

The frequency of review depends on the criticality of the controls and the nature of the business, but at least annually is a good starting point. More frequent reviews might be necessary for high-risk areas.

What role does technology play in enhancing internal controls?

Technology, such as automation and data analytics, can significantly improve the efficiency and effectiveness of internal controls by streamlining processes, providing real-time monitoring, and identifying potential issues early.

How can I ensure buy-in from stakeholders for internal control improvements?

Clearly communicate the benefits of improved internal controls, involve stakeholders in the process, and demonstrate the value of the changes through measurable results.