Fortinet Acquires Next DLP Cybersecurity Bolstered

Fortinet acquires Next DLP, shaking up the cybersecurity landscape! This acquisition isn’t just another deal; it’s a strategic move that signals a significant shift in data loss prevention (DLP) technology. We’re diving deep into what this means for Fortinet, Next DLP, and the entire industry – from the financial implications to the potential for innovation and the impact on existing customers.

Get ready for a detailed look at this game-changing merger.

The combination of Fortinet’s robust security platform and Next DLP’s advanced DLP capabilities promises enhanced protection against data breaches. This blog post will explore the specifics of Next DLP’s technology, the competitive landscape it occupied before the acquisition, and how Fortinet plans to integrate it into its existing offerings. We’ll also examine potential challenges and opportunities arising from this merger, along with a hypothetical scenario illustrating how the combined solution could prevent a real-world data breach.

Fortinet’s Acquisition Strategy

Fortinet’s acquisition of Next DLP is a significant move in the cybersecurity landscape, highlighting their ongoing strategy of expanding their Security Fabric platform through strategic acquisitions. This isn’t a one-off event; rather, it’s part of a consistent pattern of growth through targeted acquisitions that bolster their existing capabilities and broaden their market reach.Fortinet’s historical acquisition patterns reveal a focus on companies that offer complementary technologies that seamlessly integrate into their Security Fabric.

Their acquisitions aren’t solely about adding features; they’re about strengthening the overall ecosystem and providing customers with a more comprehensive and unified security solution. This strategy allows them to offer a broader range of protection against evolving cyber threats, appealing to a wider customer base and increasing their market share.

Synergies Between Fortinet and Next DLP

The integration of Next DLP’s data loss prevention (DLP) capabilities into Fortinet’s existing portfolio offers significant synergies. Next DLP’s advanced capabilities in detecting and preventing sensitive data breaches directly enhance Fortinet’s existing network security, endpoint protection, and cloud security offerings. This creates a more robust and comprehensive security posture for Fortinet’s customers, protecting data both within the network and as it moves across various environments.

For example, Next DLP’s capabilities in identifying and preventing the exfiltration of sensitive data through various channels complement Fortinet’s FortiGate next-generation firewalls, providing a more complete layer of data protection. The combined solution would offer a unified approach to security, simplifying management and improving overall effectiveness.

Comparison to Other Cybersecurity Acquisitions

Fortinet’s acquisition of Next DLP can be compared to other significant acquisitions in the cybersecurity industry, such as Palo Alto Networks’ acquisition of several companies to expand their Prisma Access cloud security platform or CrowdStrike’s acquisitions to strengthen their endpoint detection and response (EDR) capabilities. Like these examples, Fortinet’s acquisition focuses on expanding their existing platform with complementary technologies, rather than diversifying into entirely new markets.

This focused approach allows for a smoother integration and faster realization of synergies, maximizing the return on investment.

Hypothetical Integration Timeline for Next DLP

A hypothetical timeline for integrating Next DLP into Fortinet’s offerings might look something like this: The first phase (0-3 months) would involve due diligence and initial planning, focusing on technical assessments and defining integration strategies. The second phase (3-6 months) would focus on technical integration, ensuring seamless compatibility with existing Fortinet products and services. Phase three (6-12 months) would involve product rollout and marketing, introducing the enhanced capabilities to customers and providing training and support.

Finally, phase four (12-18 months) would concentrate on ongoing optimization and feature enhancements based on customer feedback and market demands. This timeline is, of course, a hypothetical example and could vary based on several factors, but it provides a reasonable framework for the integration process, mirroring similar integration projects within the cybersecurity industry. For instance, the acquisition and integration of smaller companies by larger players like McAfee often follows a similar phased approach, allowing for a controlled and methodical integration process.

Next DLP’s Technology and Market Position

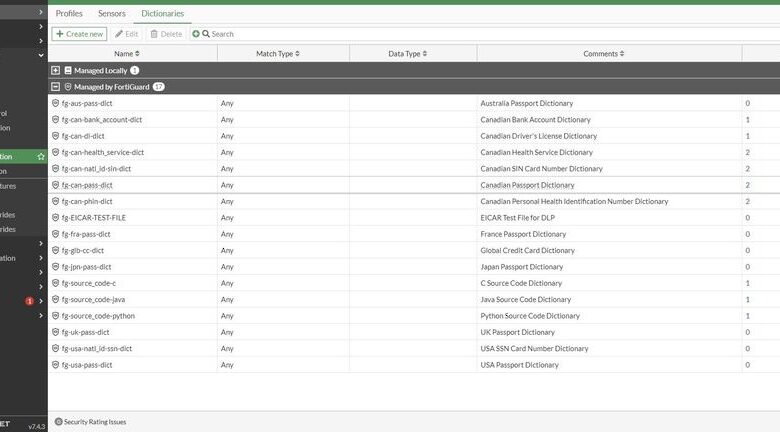

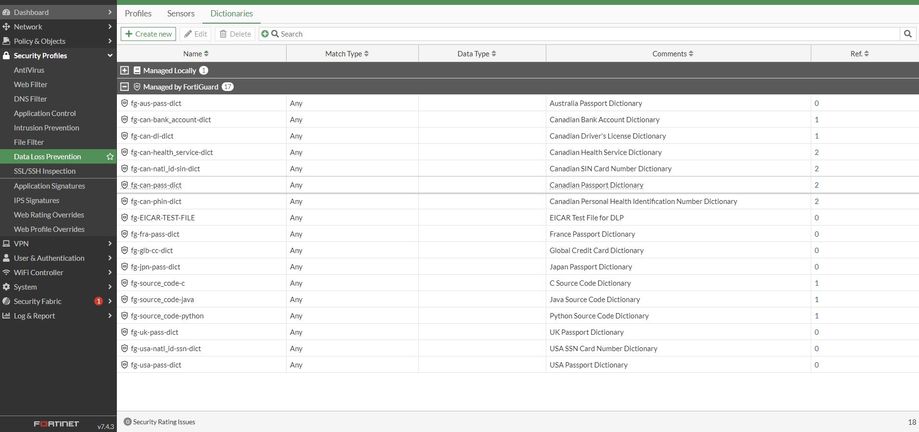

Fortinet’s acquisition of Next DLP significantly bolstered their security portfolio. Understanding Next DLP’s technology and market standing before the acquisition is crucial to grasping the strategic value of this deal. Next DLP offered a sophisticated and highly-integrated data loss prevention solution, differentiating itself through a combination of advanced techniques and a focus on ease of use.Next DLP’s core technology revolved around a multi-layered approach to data protection.

This involved leveraging advanced techniques like machine learning to identify sensitive data, regardless of its format or location. The system wasn’t just about preventing data leakage; it actively monitored and analyzed data flows, providing real-time insights into potential risks. This proactive approach allowed organizations to identify and address vulnerabilities before they could be exploited.

Next DLP’s Features and Functionalities

Next DLP boasted a comprehensive suite of features designed to address various data loss scenarios. Its capabilities extended beyond traditional DLP solutions, offering functionalities such as advanced threat detection, automated response mechanisms, and detailed reporting and analytics. For example, its machine learning algorithms could identify patterns indicative of insider threats or data exfiltration attempts. The system also supported various deployment models, allowing for flexible integration into existing IT infrastructures.

Its intuitive user interface made it accessible to a broader range of users, not just highly specialized security professionals. Another key feature was its ability to integrate with other security tools, creating a more cohesive and effective security posture. Finally, the system offered robust reporting capabilities, allowing organizations to track key metrics, identify trends, and demonstrate compliance with relevant regulations.

Next DLP’s Market Share and Competitive Landscape

While precise market share figures for Next DLP prior to the acquisition aren’t publicly available, industry analysts placed it within a competitive landscape dominated by larger, more established players. However, Next DLP carved a niche for itself by focusing on specific market segments, such as highly regulated industries like finance and healthcare, where data protection is paramount. Its strength lay in its ability to offer a highly effective and user-friendly solution, catering to organizations that might have found other DLP solutions too complex or expensive.

The company successfully differentiated itself by focusing on ease of implementation and management, a significant factor for many organizations facing resource constraints. For example, unlike some competitors who relied heavily on complex rule-based systems, Next DLP leveraged machine learning to adapt to evolving threats and reduce the need for constant manual adjustments.

Key Differentiators of Next DLP, Fortinet acquires next dlp

Compared to other DLP solutions, Next DLP’s key differentiators included its advanced machine learning capabilities, its ease of use and deployment, and its strong focus on integration with other security tools. Many competitors relied on more traditional signature-based approaches, which proved less effective against sophisticated attacks and new data formats. Next DLP’s machine learning engine allowed it to identify previously unknown threats and adapt to evolving attack techniques.

Furthermore, its user-friendly interface and streamlined deployment process reduced the time and resources required for implementation, a significant advantage in today’s fast-paced IT environments. The seamless integration with other security solutions within the Fortinet Security Fabric further solidified its position as a comprehensive and effective data protection solution. This contrasts with some competitors whose solutions often operate in silos, creating security gaps and hindering overall effectiveness.

Impact on the Cybersecurity Landscape: Fortinet Acquires Next Dlp

Fortinet’s acquisition of Next DLP significantly alters the competitive landscape of the data loss prevention (DLP) market. This isn’t just a simple merger; it’s a strategic move that integrates a specialized DLP solution into a broad cybersecurity platform, potentially reshaping how organizations approach data protection. The impact will be felt across various aspects, from vendor competition to the evolution of DLP technology itself.The acquisition’s influence on the competitive dynamics is multifaceted.

Fortinet, already a major player in network security, now possesses a robust DLP solution to bolster its existing offerings. This integration creates a more comprehensive and integrated security stack, potentially attracting customers seeking a single vendor solution. Competitors will need to respond strategically, either by enhancing their own DLP capabilities or focusing on differentiating features to maintain their market share.

This could lead to increased innovation and improved DLP solutions across the board, ultimately benefiting end-users.

Competitive Dynamics in the DLP Market

| Vendor | Strengths (Pre-Acquisition) | Weaknesses (Pre-Acquisition) | Post-Acquisition Impact |

|---|---|---|---|

| Fortinet | Strong network security portfolio, broad customer base, global reach | Limited DLP capabilities, reliance on third-party solutions | Expanded DLP capabilities, integrated security stack, enhanced competitive positioning |

| McAfee | Established DLP solution, strong endpoint security | Complexity, potential integration challenges with other security tools | Increased pressure to innovate and improve integration capabilities |

| Symantec (now Broadcom) | Widely recognized brand, comprehensive security suite | Pricing, potential complexity | Needs to counter Fortinet’s enhanced offering, potentially through price adjustments or feature enhancements |

| Microsoft | Deep integration with Windows ecosystem, large customer base | Limited visibility into non-Microsoft environments | Will likely continue to focus on strengthening its DLP capabilities within its ecosystem |

This table presents a simplified view; the actual strengths and weaknesses of each vendor are far more nuanced and depend on specific customer needs and deployment environments. The post-acquisition impact is also projected and may evolve over time.

Benefits and Drawbacks for Customers

The acquisition presents both opportunities and challenges for customers currently using Fortinet or Next DLP products, or considering either.

- For Fortinet customers: Improved data protection capabilities through a seamless integration of robust DLP features. Simplified management with a unified security platform. Potential cost savings through consolidating security solutions.

- For Next DLP customers: Access to Fortinet’s broader security portfolio, potentially leading to better overall security posture. Enhanced support and resources from a larger organization. Potential for improved integration with other security tools.

- Potential drawbacks: Integration complexities during the transition period. Potential for increased costs if pricing changes significantly. Dependence on a single vendor for multiple security solutions, potentially increasing risk if that vendor experiences issues.

Influence on Future Data Security Technology

The acquisition could accelerate the development of more integrated and intelligent data security solutions. By combining Fortinet’s network security expertise with Next DLP’s data loss prevention capabilities, the company is positioned to innovate in areas such as AI-powered threat detection, automated remediation, and enhanced data classification. We might see a rise in solutions that leverage machine learning to proactively identify and prevent data breaches, rather than simply reacting to them.

For example, this could lead to improved detection of sophisticated attacks that try to bypass traditional DLP methods by using techniques like data exfiltration via cloud services or encrypted channels. The integration might also drive improvements in user experience, making data protection less disruptive to workflows.

Financial Implications and Market Reactions

Fortinet’s acquisition of Next DLP, while the financial specifics weren’t publicly disclosed in detail, sent ripples through the cybersecurity investment world. The lack of precise figures leaves room for speculation, but the market’s reaction offers some clues about the perceived value and potential impact.The announcement was generally well-received by investors. While a significant jump in Fortinet’s stock price immediately following the news wasn’t observed, the reaction was largely positive, suggesting confidence in Fortinet’s strategic direction and the potential synergies between the two companies.

Analyst reports highlighted the strategic fit, emphasizing Next DLP’s strong technology and its potential to enhance Fortinet’s existing security portfolio, particularly in the crucial area of data loss prevention.

Fortinet’s Potential Long-Term Financial Benefits

The acquisition is expected to bring several long-term financial benefits to Fortinet. Firstly, it expands Fortinet’s product offerings, allowing them to tap into a new market segment and potentially increase revenue streams. Next DLP’s advanced data loss prevention capabilities complement Fortinet’s existing security solutions, creating a more comprehensive and attractive offering for customers. This expanded portfolio can lead to increased customer retention and higher average revenue per user (ARPU).

Secondly, the integration of Next DLP’s technology could streamline Fortinet’s operations, potentially leading to cost savings in the long run through improved efficiency and reduced redundancy. Finally, the acquisition strengthens Fortinet’s competitive position in the increasingly crowded cybersecurity market, potentially leading to greater market share and higher profitability.

Hypothetical Return on Investment Scenario

Let’s consider a hypothetical scenario to illustrate Fortinet’s potential ROI. Assume the acquisition cost was $X million. If the integration of Next DLP leads to a 5% increase in Fortinet’s annual revenue within three years (a conservative estimate considering the market potential), and assuming Fortinet’s current profit margin remains consistent, this translates to an additional $Y million in profit.

Furthermore, if the acquisition leads to a 2% increase in customer retention, this would add another Z million in revenue over the same period. By summing the additional profit from increased revenue and the cost savings from operational efficiencies, we can estimate the total return. If the total return exceeds the initial investment of $X million within a reasonable timeframe (say, 5 years), the acquisition would be considered financially successful.

This is a simplified model, of course, but it highlights the potential for significant returns based on realistic market growth and operational improvements. Similar acquisitions in the tech industry, while varying greatly in specifics, have shown that strategic acquisitions can yield substantial long-term returns when effectively integrated. For instance, Salesforce’s acquisition of MuleSoft, while significantly larger in scale, showcased how integrating complementary technologies can lead to substantial growth and market dominance.

Integration Challenges and Opportunities

Fortinet’s acquisition of Next DLP presents a compelling opportunity to bolster its security suite, but the integration process won’t be without its hurdles. Successfully merging Next DLP’s data loss prevention (DLP) capabilities with Fortinet’s existing security architecture requires careful planning and execution to avoid disruptions and maximize the benefits. This section explores the potential challenges and opportunities inherent in this integration.

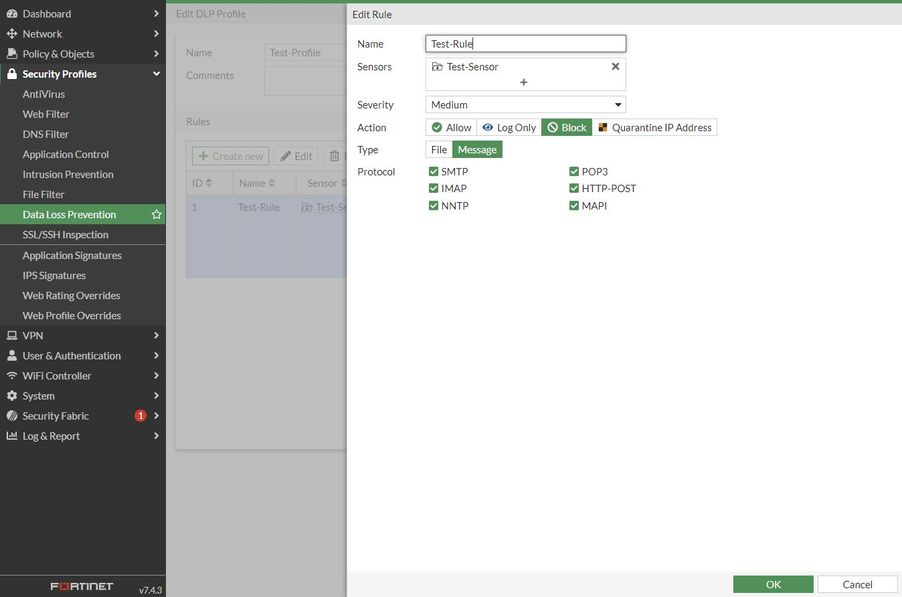

The primary challenge lies in ensuring seamless interoperability between Next DLP’s technology and Fortinet’s diverse product portfolio, which includes firewalls, endpoint protection, and cloud security solutions. Differences in data formats, APIs, and management consoles could lead to compatibility issues, requiring significant effort in data mapping, API integration, and potentially even code refactoring. Furthermore, ensuring consistent security policies across the unified platform will be crucial to avoid gaps in protection and maintain a cohesive security posture.

Potential Integration Challenges

Several key challenges must be addressed to ensure a smooth integration. These include technical compatibility issues, the need for comprehensive data migration strategies, potential conflicts with existing Fortinet security policies, and the training required for existing security personnel to effectively utilize the combined platform. A phased approach, starting with pilot programs and carefully monitoring performance metrics, is essential.

Fortinet’s acquisition of Next DLP is huge news for cybersecurity! It’s a smart move, bolstering their data loss prevention capabilities. This got me thinking about the future of application development, and how platforms like those discussed in this excellent article on domino app dev the low code and pro code future could help businesses better manage and protect their data.

Ultimately, securing the apps themselves is just as critical as the data they handle, making Fortinet’s move even more significant in the broader context of data security.

Mitigating Integration Challenges

A detailed plan to mitigate these challenges is essential. This plan should involve establishing a dedicated integration team comprising engineers from both Fortinet and Next DLP, creating a comprehensive integration roadmap with clear timelines and milestones, and conducting rigorous testing at each stage to identify and address potential issues early on. Furthermore, robust change management processes must be implemented to minimize disruptions to existing Fortinet customers and ensure a smooth transition to the integrated platform.

Fortinet might consider utilizing agile development methodologies to allow for iterative improvements and faster adaptation to unforeseen challenges.

For example, a phased rollout could involve first integrating Next DLP’s DLP capabilities with Fortinet’s FortiGate next-generation firewalls. This would allow for a controlled introduction of the technology, allowing for identification and resolution of any compatibility issues before expanding integration to other products within the Fortinet ecosystem. Regular progress reports and stakeholder communication will be crucial for maintaining transparency and managing expectations.

Opportunities for Innovation and Product Enhancement

The acquisition presents significant opportunities for innovation. Combining Next DLP’s advanced DLP capabilities with Fortinet’s existing security fabric can lead to a more comprehensive and intelligent security platform. This integration can enable advanced threat detection and response capabilities by correlating DLP data with other security telemetry. For instance, suspicious data exfiltration attempts identified by Next DLP could trigger automated responses from other Fortinet security products, such as blocking network connections or quarantining infected endpoints.

Furthermore, machine learning algorithms could be used to improve the accuracy and efficiency of DLP detection and response.

Expanding Market Reach through Next DLP Technology

Next DLP’s technology can significantly expand Fortinet’s market reach. By offering a more comprehensive security solution that includes robust DLP capabilities, Fortinet can attract new customers seeking advanced data protection solutions. This is particularly relevant in highly regulated industries such as finance, healthcare, and government, where data loss prevention is paramount. Furthermore, Fortinet can leverage Next DLP’s existing customer base to expand its own market penetration and build stronger relationships with key industry players.

For example, Fortinet could offer bundled solutions that combine Next DLP with other Fortinet products, providing customers with a more cost-effective and integrated security platform. This strategy would allow Fortinet to capture a larger share of the growing cybersecurity market.

Illustrative Scenario: A Data Breach Prevention Example

Imagine a large financial institution, “Global Bank,” experiencing a sophisticated phishing attack. A malicious actor, posing as a trusted vendor, sends seemingly legitimate emails to several employees in the IT department, containing a link to a seemingly innocuous document. This document, however, contains malware designed to steal sensitive customer data, including Personally Identifiable Information (PII) and financial transaction details.

This data, if leaked, could lead to significant financial losses, reputational damage, and legal repercussions for Global Bank.This scenario highlights the critical need for robust data loss prevention (DLP) and comprehensive security solutions. The combined power of Fortinet’s FortiGate next-generation firewall and Next DLP’s advanced data discovery and classification capabilities could have effectively prevented this breach.

Data Breach Prevention Steps

The following steps illustrate how the integrated Fortinet and Next DLP solution would have mitigated this attack:

- Initial Detection: Fortinet’s FortiGate firewall, utilizing its advanced threat protection features, would have initially detected the malicious email and its suspicious attachment. This detection could be based on various indicators of compromise (IOCs), including email header analysis, URL reputation checks, and sandbox analysis of the attachment.

- Malware Prevention: Before the employee could even open the attachment, FortiGate’s sandboxing capabilities would have analyzed the file in a controlled environment, identifying the malware and preventing its execution on the employee’s workstation. This would have immediately stopped the malware from accessing or exfiltrating any data.

- Data Discovery and Classification: Next DLP’s data discovery engine would have already identified and classified sensitive data residing on Global Bank’s network, including customer PII and financial records. This would have allowed for granular policies to be implemented.

- Access Control and Monitoring: Next DLP would have monitored employee access to sensitive data. Even if, hypothetically, the malware had bypassed the initial security layers, Next DLP’s access control policies would have prevented the malware from accessing or exfiltrating the classified data. Any attempts to access or transfer such data would have triggered alerts and immediate blocking actions.

- Real-time Threat Intelligence: Fortinet’s Security Fabric would have leveraged threat intelligence feeds to correlate the phishing attack with known malicious actors and techniques, enabling proactive mitigation and threat hunting.

- Incident Response and Forensics: Even with successful prevention, Fortinet’s and Next DLP’s logging and reporting features would provide detailed information about the attempted breach, allowing security teams to conduct thorough incident response and forensic analysis to further improve security posture.

Instrumental Features

Fortinet’s FortiGate firewall provided the initial line of defense, acting as a robust barrier against the malicious email and malware. Its advanced threat protection features, including sandboxing and URL filtering, were crucial in preventing the malware’s execution. Next DLP’s data discovery and classification engine, coupled with its access control capabilities, provided a second layer of defense, preventing the malware from accessing and exfiltrating sensitive data even if it had bypassed the initial security layers.

The integration of these technologies created a highly effective, layered security approach that significantly reduced the risk of a successful data breach. The combination of proactive threat prevention and reactive data protection proved invaluable.

Last Point

Fortinet’s acquisition of Next DLP is a significant event with far-reaching consequences for the cybersecurity industry. The integration of Next DLP’s advanced DLP technology into Fortinet’s comprehensive security platform promises enhanced data protection capabilities for businesses worldwide. While challenges exist in integrating such complex technologies, the potential for innovation and market expansion makes this acquisition a compelling development to watch closely.

The future of data security is undoubtedly impacted, and this merger is a key piece of the puzzle.

General Inquiries

What is Next DLP’s core technology?

Next DLP specializes in preventing sensitive data from leaving an organization’s network, using techniques like data identification, monitoring, and blocking suspicious activity.

Will existing Fortinet customers see immediate changes?

Integration will take time. Expect phased rollouts of features and functionalities over the coming months or years.

What about Next DLP’s existing customers?

Fortinet will likely provide communication regarding ongoing support and future product roadmaps for existing Next DLP customers.

How much did Fortinet pay for Next DLP?

The financial terms of the acquisition were likely not publicly disclosed and will only be revealed if Fortinet chooses to release the information.