EU Mandates Domain Registration Detail Disclosure

EU makes it mandatory to reveal domain registration details – a seismic shift in online privacy? This new regulation is shaking things up, forcing a much-needed conversation about transparency versus anonymity in the digital world. It’s not just about who owns what website anymore; it’s about the implications for individual privacy, freedom of speech, and the very nature of the internet as we know it.

This post dives into the details, exploring the impact on individuals, businesses, and the future of online activity.

The EU’s decision to mandate the disclosure of domain registration details stems from a desire for greater accountability and transparency online. This move has sparked debate, with concerns raised about potential impacts on privacy, freedom of expression, and the ease of doing business online, particularly for smaller players. We’ll examine both sides of the argument, weighing the benefits of increased transparency against the potential drawbacks.

We’ll also look at how different countries are approaching similar issues, and what the future might hold for online identity and regulation.

The EU Regulation

The European Union has implemented a regulation mandating the disclosure of domain registration details, marking a significant shift in online transparency and accountability. This move has sparked considerable debate, raising questions about privacy versus public interest and the practical implications for individuals and businesses alike. This post will summarize the key provisions of the regulation, explore its rationale, and compare it to similar laws in other jurisdictions.

Key Provisions of the EU Regulation

The core of the EU regulation centers around the mandatory disclosure of Whois information associated with domain names registered within the EU. This information typically includes the registrant’s name, address, and contact details. The specific details required may vary slightly depending on the specific top-level domain (TLD) and the registrar’s policies, but the overall principle remains consistent: greater transparency regarding domain ownership.

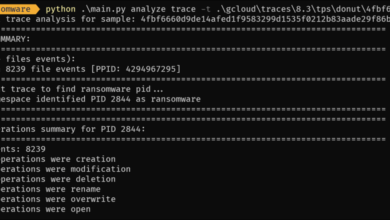

The regulation aims to improve law enforcement capabilities, enabling easier identification of individuals or entities engaging in illegal online activities, such as fraud, copyright infringement, or hate speech. It also seeks to facilitate the resolution of domain name disputes. The implementation details and enforcement mechanisms are left to individual member states to define within the framework of the overarching EU regulation.

Rationale Behind the Regulation

The EU’s decision to mandate domain registration disclosure stems from a confluence of factors. Firstly, there’s a growing recognition of the need to combat online crime. Anonymous online activities have been exploited for various illegal purposes, making it challenging for law enforcement agencies to track down perpetrators. This regulation is seen as a tool to address this challenge, offering a more efficient method of identifying those responsible for illegal online activities.

Secondly, the regulation aligns with broader EU policy objectives concerning digital security and the fight against cybercrime. It builds upon existing legal frameworks addressing data protection and online safety, aiming for a more harmonized approach across member states. Relevant legal precedents, such as rulings from the European Court of Justice on data protection and freedom of expression, have informed the development and shaping of this regulation.

The balancing act between individual privacy and the need for public safety and efficient law enforcement is central to the legal justification of this regulation.

Comparison with Similar Laws in Other Jurisdictions

Several countries have implemented similar regulations regarding domain name registration disclosure, although the specifics vary. The following table offers a comparison:

| Country | Law | Requirements | Enforcement |

|---|---|---|---|

| United States | ACPA, UDRP | Varying requirements depending on the registrar and TLD; generally includes registrant contact information. | Through ICANN, registrars, and courts. |

| Canada | Personal Information Protection and Electronic Documents Act (PIPEDA) | Disclosure of certain registrant information is required, but specifics are subject to privacy regulations. | Through the Office of the Privacy Commissioner of Canada. |

| Australia | Various state and federal laws | Requirements vary across states and territories; generally, some registrant information is disclosed. | Through relevant state and federal agencies. |

Impact on Domain Registrants

The mandatory disclosure of domain registration details within the EU represents a significant shift in online privacy, impacting both individuals and businesses alike. This regulation, while aiming to increase transparency and combat online fraud, introduces several challenges and considerations for those who register and maintain domain names within the European Union. The ramifications extend beyond simple administrative burdens, touching upon fundamental rights related to data protection and the ease of doing business online.This new requirement necessitates a careful examination of the potential implications, particularly regarding the privacy concerns raised by the disclosure of personal information and the practical challenges faced by smaller entities in complying with the new regulations.

The impact will vary depending on the nature of the registrant, their resources, and the type of domain registered.

Privacy Implications for Domain Registrants

The disclosure of personal information associated with domain registration raises significant privacy concerns. Previously, registrants could utilize privacy services to mask their personal details, offering a layer of protection against unwanted contact or potential misuse of their information. The removal of this option means that personal information, including names, addresses, and contact details, becomes publicly accessible via the WHOIS database.

This increased exposure could lead to an upsurge in unsolicited marketing, phishing attempts, or even more serious forms of identity theft or harassment. For individuals, this poses a direct threat to their personal safety and security. Businesses, particularly those operating in sensitive sectors, might face increased risks of data breaches or targeted attacks. The lack of robust mechanisms to control the dissemination of this data after its disclosure is a key concern.

For example, a small business owner could find their home address publicly available, potentially increasing vulnerability to theft or other crimes.

Challenges for Small Businesses and Individuals

Compliance with the new regulation presents unique challenges for small businesses and individuals with limited resources. The costs associated with updating registration details, implementing new security measures to mitigate the risks of increased data exposure, and potentially seeking legal advice to navigate the complexities of the regulation can be prohibitive. This disproportionately impacts smaller entities that may lack the technical expertise or financial resources to easily comply.

The EU’s new mandate to reveal domain registration details is a big deal for online privacy, highlighting the growing need for robust security measures. This increased transparency makes understanding cloud security even more critical, which is why I’ve been digging into the latest advancements – like bitglass and the rise of cloud security posture management – to see how they can help businesses navigate this changing landscape.

Ultimately, stronger security practices are essential, especially given the EU’s focus on data transparency.

For example, a freelance writer relying on a personal domain might struggle to balance the costs of compliance with their income, particularly if they lack technical skills to manage security risks. Furthermore, navigating the legal complexities of the regulation without specialized legal assistance could be a considerable hurdle. This uneven playing field could lead to smaller players being disadvantaged compared to larger corporations with more substantial resources to dedicate to compliance.

Enforcement and Penalties

The EU’s new regulation mandating the disclosure of domain registration details isn’t just a suggestion; it carries significant weight in terms of enforcement and penalties. Failure to comply isn’t a minor infraction; it can lead to substantial repercussions for both individuals and organizations. This section will detail the mechanisms used to ensure compliance and the consequences of non-compliance.The enforcement of this regulation will likely vary across EU member states, mirroring existing practices for data protection and other similar regulations.

However, the core principles will remain consistent. National regulatory bodies, often working in conjunction with the European Commission, will be responsible for overseeing compliance. This could involve investigations triggered by complaints, proactive audits, or even collaboration with international organizations to address cross-border issues.

Enforcement Mechanisms

Enforcement will likely involve a multi-pronged approach. Initial stages might include warnings and requests for corrective action. More serious breaches could lead to formal investigations, involving the collection of evidence and interviews with relevant parties. The regulatory bodies will have the power to demand access to relevant documents and systems, ensuring a thorough assessment of compliance. They may also collaborate with internet service providers (ISPs) and registrars to gather information and enforce compliance.

Penalties for Non-Compliance

Penalties for non-compliance are likely to be significant and vary depending on the severity and nature of the violation. These could range from substantial fines – potentially reaching millions of euros for large organizations – to suspension or revocation of domain registrations. In some cases, criminal charges could even be brought against individuals or entities found to be deliberately obstructing the enforcement process.

The exact amount of fines will likely be determined based on factors such as the size of the organization, the duration of the non-compliance, and the potential harm caused.

Examples of Non-Compliance Scenarios

Consider a scenario where a large e-commerce company operating across the EU fails to update its WHOIS information to reflect the new regulation’s requirements. This could result in significant fines, potentially impacting their reputation and leading to customer distrust. Alternatively, a smaller business deliberately providing false or misleading information in their WHOIS data could face both fines and the potential revocation of their domain name, severely disrupting their online operations.

A more serious scenario might involve an organization actively attempting to conceal its ownership of a domain, deliberately obstructing investigations; this could lead to substantial penalties and even criminal prosecution.

Impact on Online Activities

The EU’s mandatory disclosure of domain registration details significantly impacts various online activities, altering the landscape of e-commerce, blogging, and activism. Increased transparency, while aiming to combat illegal activities, presents a complex interplay between the benefits of accountability and the potential drawbacks to privacy and freedom of expression. This shift necessitates a careful examination of its effects on different online spaces.The increased transparency brought about by this regulation has the potential to reshape online interactions in profound ways.

The ease with which individuals can be identified through their domain registrations might discourage certain forms of online expression, particularly those considered controversial or sensitive. This could lead to self-censorship and a chilling effect on online discourse, especially for individuals or groups who fear repercussions for their views.

E-commerce and Transparency

The impact on e-commerce is multifaceted. While increased transparency might enhance consumer trust by making businesses more accountable, it could also create burdens for smaller businesses who might lack the resources to manage the increased compliance requirements. For instance, a small online shop owner might struggle with the administrative overhead of maintaining accurate registration details, potentially impacting their ability to focus on their core business.

Larger corporations, on the other hand, are likely to have the infrastructure to adapt to these changes more easily. The long-term effects on market competition remain to be seen.

Blogging and Freedom of Expression

For bloggers, the regulation raises concerns about freedom of expression. While the aim is to combat illegal activities, the increased ability to identify bloggers could lead to intimidation or censorship, especially for those who express critical or dissenting opinions. This could lead to a reduction in diverse viewpoints online, as individuals might choose to self-censor to avoid potential legal or social repercussions.

This effect is particularly relevant for bloggers covering sensitive topics like politics or human rights in countries with less robust protections for freedom of speech.

Activism and Anonymity

Online activism often relies on anonymity to protect activists from potential harassment or retaliation. The new regulation, by requiring disclosure of domain registration details, potentially undermines this anonymity, putting activists at greater risk. Organisations involved in sensitive campaigns, such as those focused on human rights abuses or political dissent, might find their operations significantly hampered. This could lead to a decrease in online activism and a chilling effect on the ability of individuals and groups to organize and mobilize for change.

This is particularly concerning in authoritarian regimes where online activism is already heavily restricted.

Balancing Transparency and Privacy

The benefits of increased transparency, such as the potential for combating illegal activities and enhancing accountability, must be weighed against the potential harms to privacy and freedom of expression. The regulation presents a challenge in striking a balance between these competing interests. Finding a solution that effectively addresses illegal activities without unduly restricting legitimate online activities requires careful consideration and ongoing evaluation.

This requires a robust legal framework that protects fundamental rights while also addressing concerns about misuse of the internet.

Technological Implications: Eu Makes It Mandatory To Reveal Domain Registration Details

The EU’s mandatory disclosure of domain registration details presents significant technological challenges and opportunities for domain registrars. Successfully navigating this new landscape requires careful consideration of efficient compliance methods, robust data security protocols, and proactive mitigation of potential technical hurdles. This section explores these key areas.Domain registrars will need to adapt their existing systems and processes to meet the new requirements.

This involves not only updating their databases but also implementing new functionalities for data handling, access control, and secure storage. The scale of this undertaking will vary depending on the size and infrastructure of each registrar.

Methods for Efficient Compliance

Efficient compliance hinges on the adoption of automated processes and the integration of new technologies. Domain registrars could leverage several methods to streamline the disclosure process. This might involve integrating the disclosure functionality directly into their existing registration platforms, allowing for automated data extraction and submission to the relevant authorities. They might also utilize API integrations with government databases to ensure real-time updates and compliance.

Furthermore, employing advanced data validation techniques can minimize errors and ensure data accuracy, reducing the risk of penalties. A well-designed system will allow for efficient processing of requests for data access and will provide clear audit trails for all data handling activities.

Secure Storage and Management of Disclosed Information, Eu makes it mandatory to reveal domain registration details

Secure storage and management of disclosed domain registration information is paramount. A robust system should incorporate several key features to meet data protection regulations like GDPR. This includes employing strong encryption both in transit and at rest, implementing robust access control mechanisms based on the principle of least privilege, and maintaining detailed audit logs of all data access and modification activities.

Regular security audits and penetration testing are essential to identify and address vulnerabilities. The system should also be designed to comply with data retention policies, ensuring that data is only stored for the legally mandated period. Consideration should also be given to data anonymization techniques where appropriate, further enhancing data protection. A decentralized storage solution, perhaps utilizing blockchain technology, could provide an added layer of security and transparency.

Potential Technical Challenges

Implementing the new requirements will present several technical challenges for domain registrars. These challenges necessitate careful planning and resource allocation.

- System Upgrades and Integration: Integrating new functionalities into existing systems requires significant development effort and testing to ensure compatibility and stability. This may necessitate substantial investments in IT infrastructure and personnel.

- Data Security and Privacy: Protecting the disclosed data from unauthorized access and breaches is crucial. Implementing robust security measures, including encryption, access controls, and regular security audits, is essential but also resource-intensive.

- Scalability and Performance: The system must be able to handle a large volume of data requests and maintain acceptable performance levels, especially during peak demand periods. This requires careful capacity planning and optimization.

- Data Validation and Error Handling: Ensuring data accuracy is critical to avoid penalties. Implementing robust data validation mechanisms and effective error handling processes is crucial.

- Compliance with Multiple Regulations: Domain registrars must comply with various data protection regulations, including GDPR and potentially national laws, adding complexity to the implementation process.

- International Data Transfer: If data needs to be transferred internationally, compliance with data transfer regulations, such as the EU-US Privacy Shield or Standard Contractual Clauses, is necessary, adding another layer of complexity.

Public Perception and Reactions

The EU’s mandatory domain registration disclosure has sparked a wave of diverse reactions across the digital landscape. While the regulation aims to enhance transparency and combat online illegality, its impact on public perception is multifaceted, varying significantly depending on the stakeholder group involved. The debate highlights the complex interplay between online freedom, security, and individual privacy.The introduction of this regulation has generated considerable debate and varied reactions across different stakeholder groups.

Businesses, particularly smaller online businesses and independent content creators, have expressed concerns about increased administrative burdens and potential chilling effects on free speech. Conversely, law enforcement agencies and victim advocacy groups largely welcome the increased transparency, viewing it as a crucial tool in combating online crime and protecting vulnerable individuals. The general public’s reaction is more nuanced, with a significant portion expressing concerns about privacy implications, while others believe the benefits of increased accountability outweigh these concerns.

Reactions from Different Stakeholder Groups

The impact of the regulation is not uniformly perceived. Large corporations with established legal teams may find the compliance costs manageable, even if burdensome. However, smaller businesses and individual bloggers may face significant challenges in meeting the new requirements, potentially leading to increased operational costs or even the abandonment of online activities. Privacy advocates have voiced serious concerns about the potential for misuse of the disclosed information, highlighting the need for robust data protection measures to prevent identity theft or harassment.

Conversely, law enforcement agencies have praised the regulation’s potential to facilitate investigations and prosecutions of online crimes, including fraud, hate speech, and intellectual property theft. Public opinion polls show a mixed response, with some supporting the increased transparency and accountability, while others prioritize online privacy and freedom of expression.

Hypothetical Impact on an Online Community

Consider a hypothetical online forum dedicated to discussing a controversial political topic. Before the regulation, users could participate anonymously, fostering open and sometimes heated debate. Under the new rules, the requirement to disclose domain registration details might lead to a chilling effect. Users fearing potential repercussions – legal or otherwise – might become less willing to express strong or dissenting opinions, leading to a decline in participation and a narrowing of the range of viewpoints expressed.

The EU’s new mandate to reveal domain registration details is a big shift for online privacy. This increased transparency impacts app developers too, especially those building complex applications. For instance, understanding the implications is crucial when considering the future of application development, as outlined in this insightful article on domino app dev the low code and pro code future , which explores how these changes could shape the landscape.

Ultimately, this new regulation means developers need to be even more mindful of data security and user privacy.

This could stifle important public discourse and create an echo chamber effect. Furthermore, the increased risk of doxing – publicly revealing someone’s personal information – could deter users from engaging in the forum altogether, potentially silencing marginalized voices and impacting the diversity of perspectives.

Examples of Public Statements

While comprehensive collation of all public statements is beyond the scope of this blog post, we can highlight the contrasting viewpoints. For instance, several digital rights organizations have publicly expressed concerns about the potential for chilling effects on freedom of expression and the increased risk of online harassment. Conversely, law enforcement agencies have issued statements emphasizing the regulation’s value in tackling online crime and improving public safety.

Statements from individual bloggers and small business owners often reflect concerns about the increased administrative burden and potential financial strain. These diverse perspectives highlight the complexities of balancing online freedom with the need for accountability and safety.

Future Developments

The EU’s mandatory domain registration disclosure regulation, while a significant step towards online accountability, is likely to evolve considerably in the coming years. Its implementation and impact will undoubtedly shape future amendments, presenting both opportunities and challenges for stakeholders. The initial phase will likely focus on refining enforcement mechanisms and addressing unforeseen consequences.The regulation’s success hinges on effective enforcement.

Initial challenges will likely revolve around cross-border cooperation, jurisdictional issues, and the sheer volume of registrations needing scrutiny. Different member states may interpret and apply the rules differently, leading to inconsistencies. For example, a small EU member state might struggle to effectively monitor and enforce the regulation compared to a larger one with more resources. This disparity could create loopholes and uneven application of the law.

Furthermore, the rapid pace of technological advancements, such as the increasing use of decentralized technologies, will present ongoing challenges to enforcement.

Enforcement Challenges and Harmonization

Effective enforcement requires a coordinated approach across all EU member states. Differences in national legal systems and administrative capabilities could lead to inconsistencies in enforcement, creating a fragmented regulatory landscape. A key challenge will be developing standardized procedures for investigations, penalties, and data sharing among member states. This might involve creating a dedicated EU agency to oversee enforcement or strengthening existing cooperation mechanisms.

Furthermore, the regulation must adapt to evolving technologies, such as decentralized domain name systems (DNS) or blockchain-based identity solutions, which could make tracing and identifying registrants more complex. A lack of harmonization could result in registrants exploiting inconsistencies to circumvent the regulation. For instance, a registrant might choose to register a domain in a member state with weaker enforcement mechanisms.

Impact on Future Online Privacy Legislation

This regulation could serve as a precedent for future legislation concerning online privacy and data protection. Its focus on transparency and accountability in online activities might influence the development of stricter rules governing data collection, processing, and storage. The experience gained from enforcing this regulation, particularly regarding the balance between transparency and individual privacy rights, could inform future legislative initiatives.

For example, the success or failure of the regulation in balancing these competing interests could shape future discussions on anonymization techniques and the use of pseudonyms online. The EU’s broader data protection framework, such as the GDPR, will be significantly impacted by how effectively this regulation addresses issues of transparency and accountability in the online space.

Technological Adaptations and Emerging Technologies

The rapid pace of technological innovation will require continuous adaptation of the regulation. The rise of decentralized technologies, such as blockchain and distributed ledger technologies, could pose significant challenges to enforcement. These technologies could potentially make it more difficult to identify and track domain registrants, thereby undermining the regulation’s effectiveness. The regulation will need to consider how to address these challenges, potentially through the development of new technological solutions or by adapting existing enforcement mechanisms.

This might involve exploring collaborative efforts with technology providers to develop tools that facilitate the identification and verification of registrants while respecting data privacy. Failure to adapt could render the regulation obsolete in the face of rapid technological advancements.

Closure

The EU’s decision to make domain registration details public is a bold step with far-reaching consequences. While proponents celebrate increased transparency and accountability, critics worry about the potential chilling effect on free speech and the erosion of online privacy. The long-term impact remains to be seen, but one thing is certain: this regulation will reshape the online landscape, prompting further discussions about the balance between individual rights and societal needs in the digital age.

It’s a conversation we all need to be a part of.

FAQ Corner

What specific information will be revealed under this new regulation?

The exact details vary, but expect at least the registrant’s name and contact information to be publicly accessible.

How does this impact individuals who use pseudonyms online?

It could significantly impact those who rely on anonymity for personal safety or professional reasons. The level of protection afforded will likely depend on the specific circumstances.

What are the penalties for non-compliance?

Penalties can vary, but could include fines and potential legal action from both the EU and national authorities.

Will this regulation affect websites hosted outside the EU?

The regulation primarily applies to domains registered within the EU, but its impact could extend to websites hosted elsewhere if they target EU audiences.