Brexits Impact on UK Startup Growth

How Brexit will impact startups growth in UK is a critical question for the UK’s entrepreneurial ecosystem. Navigating the new trade landscape, talent acquisition, investment opportunities, regulations, and market access strategies will be pivotal for the future of UK startups. The changes post-Brexit present both challenges and opportunities, demanding adaptability and innovation.

This analysis examines the multifaceted impact of Brexit on UK startups, covering key areas like trade relationships with the EU, access to talent pools, investment prospects, regulatory adjustments, and market expansion strategies. We’ll explore the challenges and potential solutions, and provide actionable insights for startups navigating this evolving environment.

Impact on Trade and Supply Chains

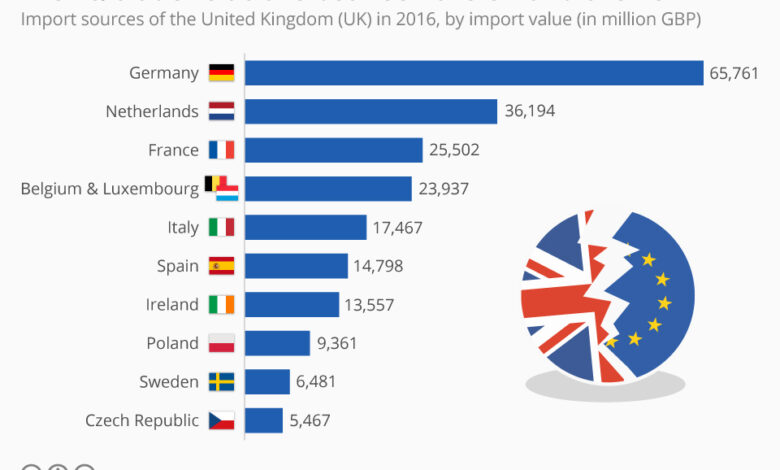

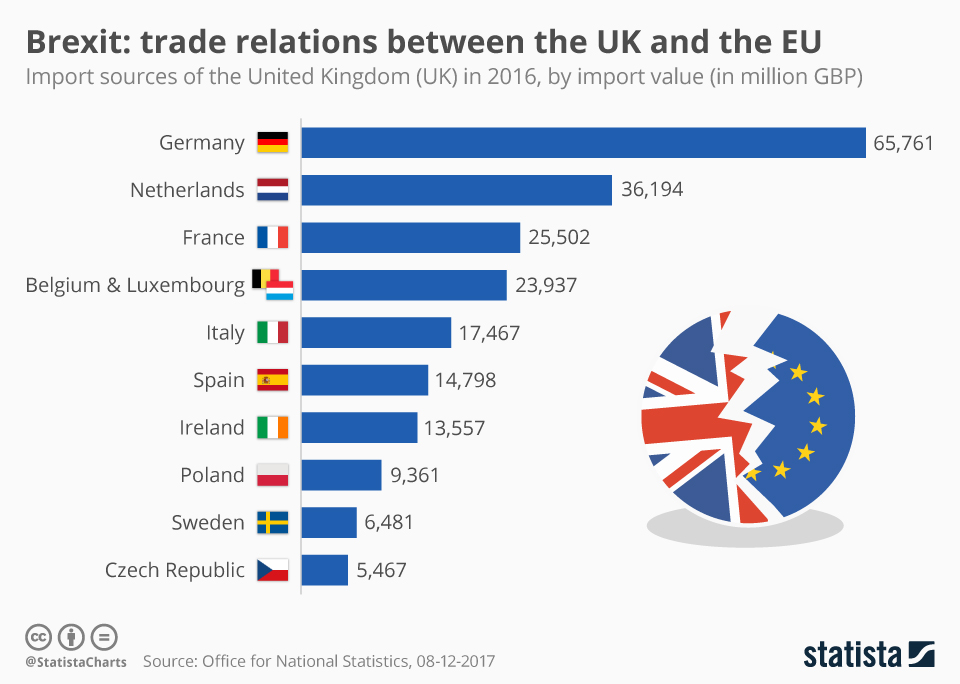

Brexit has significantly reshaped the UK’s trade relationships with the EU, impacting startups in various sectors. The removal of frictionless trade has introduced new complexities and challenges for businesses reliant on seamless supply chains across the English Channel. This has been particularly pronounced for startups, often operating on lean margins and with limited resources to navigate the new landscape.

Altered UK-EU Trade Relationships

The UK’s departure from the EU’s single market and customs union has eliminated the previous frictionless trade environment. This has led to the introduction of customs checks, tariffs, and regulatory hurdles for goods moving between the UK and the EU. For startups, particularly those focused on exporting or importing components and finished products, these changes have significantly altered the cost and logistical aspects of their operations.

The new import/export procedures, combined with increased administrative burdens, are adding significant overhead costs.

Supply Chain Disruptions

Startups relying on EU supply chains have faced substantial disruptions. For example, a UK-based software company reliant on components manufactured in the EU now experiences longer lead times, increased costs, and potential stock shortages due to the added complexities of customs clearance. Similarly, startups in the fashion industry have encountered delays and higher costs due to new regulations impacting the import of raw materials and finished goods.

Brexit’s impact on UK startup growth is a complex issue, and while the specifics are still unfolding, navigating the new trade landscape is proving tricky. It’s vital for startups to adapt to the changing regulations, and that includes understanding the nuances of AI-driven solutions like those described in “Deploying AI Code Safety Goggles Needed” Deploying AI Code Safety Goggles Needed.

This is crucial for boosting efficiency and competitiveness, which is essential for surviving and thriving in the current market. The overall effect on UK startups remains to be seen, but the need for adaptable strategies is clear.

These disruptions are directly impacting startups’ ability to meet deadlines, maintain profitability, and scale their operations.

Comparison of Trade Landscapes

Pre-Brexit, the UK benefited from the seamless flow of goods and services within the EU’s single market. This facilitated easy access to a large consumer base and a streamlined supply chain. Post-Brexit, this frictionless trade environment has been replaced by a more complex landscape with tariffs, customs checks, and differing regulatory standards. Startups now face a trade-off between accessing the EU market and the challenges of navigating these new procedures.

While accessing the larger EU market still presents significant advantages, the complexities of the new trade relationships pose challenges for UK-based startups.

Impact of New Trade Agreements and Tariffs

The UK has negotiated new trade agreements with various countries. However, these agreements do not entirely offset the complexities of trading with the EU. For instance, the UK-Australia trade agreement, while potentially beneficial for some sectors, does not address the specific challenges posed by trading with the EU. Furthermore, tariffs on specific goods can impact startup profitability and competitiveness.

A food technology startup, for example, exporting ingredients to the EU, may now face higher costs due to tariffs on specific ingredients, which might reduce their profitability.

Potential Solutions for Startups

Startups can adopt strategies to mitigate the impact of Brexit-related trade complexities. These include diversifying supply chains to reduce reliance on EU suppliers, exploring alternative markets outside the EU, and investing in customs expertise to streamline import/export processes. Additionally, leveraging technology to automate and optimize logistics, and building strong relationships with EU partners can be valuable strategies.

Brexit’s impact on UK startup growth is a complex issue, with potential hurdles in securing funding and navigating new trade regulations. However, recent developments like the Department of Justice Offers Safe Harbor for MA Transactions ( Department of Justice Offers Safe Harbor for MA Transactions ) might offer some unexpected opportunities for navigating these challenges. Ultimately, the long-term effect on UK startups hinges on how well the government addresses these evolving global market conditions.

Table: Import/Export Procedures

| Procedure | Pre-Brexit | Post-Brexit |

|---|---|---|

| Customs Clearance | Streamlined process within EU customs union | More complex process involving customs checks and declarations |

| Tariffs | Generally minimal tariffs for intra-EU trade | Tariffs may apply based on the specific goods and the trade agreement |

| Regulatory Compliance | Harmonized EU regulations | Separate UK and EU regulatory frameworks |

| Documentation | Simplified documentation | Increased documentation requirements |

| Logistics | Simplified logistics due to seamless trade | More complex logistics with additional delays and costs |

Access to EU Talent Pool: How Brexit Will Impact Startups Growth In Uk

Brexit has significantly altered the landscape for UK startups seeking skilled employees from the EU. The pre-Brexit ease of movement for EU citizens has been replaced by a more complex and often less predictable system, impacting recruitment strategies and potentially hindering growth. This shift has necessitated adaptations from UK startups, requiring them to navigate new regulations and explore alternative recruitment avenues.The post-Brexit era has brought about substantial changes in the way EU citizens can work in the UK.

Pre-Brexit, EU citizens could generally work in the UK without significant visa hurdles, contributing to a readily available pool of talent for UK businesses. Post-Brexit, this has become considerably more complex, with varying visa requirements and stringent application processes.

Challenges for UK Startups in Attracting EU Talent

UK startups face numerous hurdles in attracting EU talent. Visa application processes are often lengthy and bureaucratic, demanding extensive documentation and potentially incurring significant costs. The uncertainty surrounding the UK’s relationship with the EU also contributes to uncertainty for potential employees. Finding suitable candidates with the necessary skills amidst these complexities is a major challenge. Additionally, salary expectations and benefits packages for EU workers may differ from those of UK-based counterparts.

Comparison of Pre-Brexit and Post-Brexit Visa Processes

Pre-Brexit, EU citizens generally enjoyed straightforward access to the UK labor market. The post-Brexit landscape is markedly different. A variety of visas are now available for EU workers, each with its own specific criteria and application procedures. The process can be more time-consuming and costly, requiring potential employees to navigate a complex web of rules and regulations.

Alternative Recruitment Strategies

UK startups are responding to the changing environment by adopting various strategies. These include expanding their recruitment efforts to include talent from other countries beyond the EU, focusing on attracting and retaining UK-based skilled workers through competitive packages, and leveraging digital platforms to connect with a broader pool of global candidates.

Impact on Skilled Labor Availability

The availability of skilled labor, particularly in tech-related fields, has been impacted. UK startups are experiencing a noticeable decrease in EU talent due to the stricter visa requirements and the associated costs. This has led to a shift in hiring priorities and strategies. Some startups are exploring international recruitment strategies, recognizing that EU talent is not the sole source of skilled labor.

Financial Implications of Hiring EU Talent

Hiring EU talent comes with financial implications. Visa application fees, potential accommodation assistance, and potential differences in salary expectations compared to UK-based employees must be considered. These costs can be substantial, potentially impacting a startup’s budget. The costs associated with employing EU talent are a critical factor in the startup ecosystem’s response to Brexit.

Visa Options for EU Workers in the UK

| Visa Type | Description | Eligibility Criteria |

|---|---|---|

| Skilled Worker Visa | For skilled workers with specific qualifications. | Requires a job offer, minimum salary threshold, and proof of skills. |

| General Skilled Worker Visa | For workers in various sectors. | Similar to Skilled Worker Visa, with broader eligibility. |

| Exceptional Talent Visa | For individuals with exceptional skills in specific fields. | Requires demonstrably high-level expertise and exceptional contribution potential. |

| Intra-Company Transfer Visa | For employees transferring from a company based in the EU. | Requires a valid job offer from a UK-based company. |

Investment and Funding Opportunities

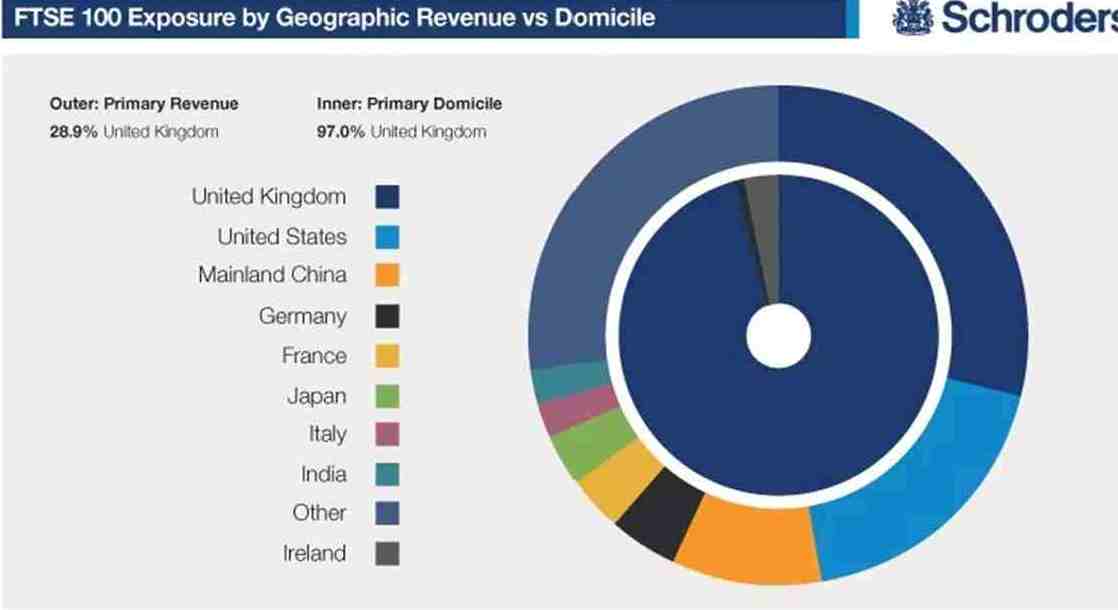

Brexit has significantly impacted the UK startup ecosystem, and one of the most critical areas affected is investment. The shift in the regulatory landscape and the altered relationship with the EU have created uncertainties that have influenced investment flows, both from within the UK and globally. This has led to a need for startups to adapt and develop new strategies to attract capital.The pre-Brexit investment landscape was characterized by a robust flow of funding, particularly from EU sources.

UK startups benefited from a large pool of European venture capital, angel investors, and other funding opportunities. The post-Brexit era has seen a recalibration of this landscape, with adjustments in funding sources and strategies. The future of investment in UK startups depends heavily on how the UK positions itself within the global market and addresses the specific concerns of investors.

Influence of Brexit on Investment Flows

Brexit has introduced complexities into the investment process for UK startups. The movement of capital across borders has become more complicated due to new regulations and procedures. The loss of seamless access to the EU’s funding mechanisms and investor networks has altered the competitive landscape, impacting both the volume and types of investment available to UK-based startups. Furthermore, the overall uncertainty surrounding Brexit has created a degree of risk aversion among some investors, particularly those based in the EU.

Comparison of Investment Landscape Before and After Brexit

The pre-Brexit investment climate was characterized by relatively easy access to EU funding and investor networks. This provided a significant boost to UK startups. Post-Brexit, access to these resources has been more challenging. The EU’s investment policies and funding opportunities are no longer as readily accessible, creating a shift in investment strategies. This necessitates UK startups to explore new avenues for capital, including alternative funding sources.

This shift in investment strategies also necessitates an adaptation in the investment strategies of UK startups.

Impact on Venture Capital and Angel Investor Interest

Venture capital and angel investor interest in UK startups has seen fluctuations since Brexit. While some investors remain committed to the UK market, others have shifted their focus to other regions. This shift is due to factors like the added complexity in navigating post-Brexit investment procedures and the perceived uncertainty in the UK market. Investors are carefully considering the long-term implications of Brexit on their investments.

Strategies for UK Startups to Attract Investment

UK startups can adopt several strategies to attract investment despite the uncertainties associated with Brexit. These strategies include clearly articulating a strong business plan with a clear exit strategy, emphasizing the UK’s strengths in specific sectors, and actively promoting the UK as a desirable investment destination. Diversifying funding sources beyond the EU is another crucial strategy.

- Focusing on Specific Niches: Specializing in high-growth sectors that are in high demand globally can attract investment, regardless of the broader Brexit-related uncertainties.

- Strengthening International Partnerships: Developing strategic partnerships with companies and investors in non-EU countries can provide alternative funding avenues.

- Improving Transparency and Communication: Transparent communication about the company’s financial performance and future projections can build investor confidence.

Potential Financial Implications of Investment Restrictions

Investment restrictions resulting from Brexit can lead to several financial implications for UK startups. For example, a startup relying heavily on EU funding for expansion may face difficulties in securing necessary capital. The delay in obtaining funding can significantly impact their ability to scale operations and achieve growth milestones. This could lead to reduced hiring, product development delays, and potentially, business closure.

Reduced access to capital may also mean a decline in the startup’s overall valuation.

Funding Options Available to Startups Before and After Brexit

| Funding Option | Availability Before Brexit | Availability After Brexit |

|---|---|---|

| EU Venture Capital Funds | High | Lower |

| UK Angel Investors | Moderate | Moderate |

| UK Venture Capital Firms | Moderate | Moderate to High (depending on sector) |

| Crowdfunding Platforms | Moderate | Moderate |

| Government Grants and Schemes | Moderate | Moderate to High (with adjustments) |

Regulations and Compliance

Brexit has introduced a complex web of new regulations for UK startups, particularly those operating in or exporting to the EU. Navigating these changes is crucial for maintaining market access and avoiding costly compliance failures. The shift in trading relationships requires careful attention to product compliance, data protection, intellectual property, and overall regulatory landscapes.The UK’s departure from the EU has altered the regulatory environment, necessitating significant adjustments for startups accustomed to the seamless trading conditions within the single market.

This shift demands proactive measures to ensure continued success in the EU market and other global regions.

Product Compliance Adjustments for Exporting Startups

Understanding the varying product safety standards and labeling requirements across different EU member states is paramount for UK startups exporting to the EU. Failure to meet these standards can lead to product rejection and significant financial losses. Specific regulations regarding electrical appliances, food products, and chemicals differ between member states, demanding thorough research and adaptation.

- Different product standards exist across EU countries. Startups need to research and comply with each country’s specific requirements, which might involve obtaining different certifications or adjustments to packaging.

- Accurate labeling is essential. Labels must adhere to EU regulations regarding product information, including warnings, ingredients, and origin. Errors in labeling can result in penalties and product recalls.

- UK startups need to be aware of specific certifications or approvals necessary for certain products. For example, some products require CE marking, demonstrating compliance with EU safety standards.

Data Protection and Privacy Implications

Brexit has led to a divergence in data protection regulations between the UK and the EU. UK startups dealing with EU customers or data need to understand the GDPR (General Data Protection Regulation) and any subsequent UK equivalents. This includes establishing robust data protection policies, ensuring data security measures, and obtaining explicit consent for data processing.

- The UK’s data protection legislation, while similar in spirit to GDPR, has its own nuances. Startups need to be familiar with both sets of regulations to avoid potential legal issues.

- Startups handling EU personal data must comply with GDPR. This includes transparent data practices, data subject rights, and security measures. Failure to do so can lead to substantial fines and reputational damage.

- Contracts with EU customers should include clauses explicitly addressing data transfer and processing in line with GDPR requirements. This ensures clarity and accountability.

Intellectual Property Rights

Intellectual property rights, including patents, trademarks, and copyrights, are crucial for startups. Brexit has impacted the enforcement and protection of these rights in the EU. UK startups need to adapt their IP strategies to maintain protection in the EU market and across their global operations.

- Startups must ensure their IP rights are registered and protected in the relevant EU jurisdictions.

- Enforcement of IP rights may differ in the EU post-Brexit. Startups should be prepared for potential differences in procedures and legal avenues.

- Startups operating in multiple jurisdictions should consult with legal professionals specializing in IP law to ensure compliance with specific requirements in the EU and the UK.

Key Regulatory Changes for UK Startups Operating in the EU Market

| Area of Change | Impact on UK Startups |

|---|---|

| Product Compliance | Increased complexity in understanding and adhering to varied EU product standards. |

| Data Protection | Navigating different data protection frameworks (GDPR vs. UK equivalents). |

| Customs Procedures | Increased paperwork and customs duties. |

| Investment and Funding | Potential for regulatory hurdles and compliance costs. |

| Intellectual Property | Maintaining IP protection across EU jurisdictions and the UK. |

Market Access and Expansion Strategies

Brexit has significantly altered the landscape for UK startups seeking to expand into the EU market. The removal of frictionless trade and the need for new regulatory compliance have created hurdles, but also presented opportunities for innovative approaches. Understanding these shifts and developing robust expansion strategies are crucial for UK startups to thrive in the post-Brexit world.The shift from a seamless single market to a more complex international trading relationship requires UK startups to adapt their strategies and adopt new tools to navigate the intricacies of EU regulations and customs procedures.

This necessitates a strategic shift in mindset, from relying on ease of access to a proactive approach to market entry.

Impact on EU Market Expansion

The UK’s departure from the EU has introduced trade barriers, such as tariffs and customs checks, impacting the competitiveness of UK-produced goods and services within the EU. Increased administrative burdens and the need for specialized expertise in navigating EU regulations present challenges. However, this change also forces startups to become more globally focused and adaptable, driving innovation in supply chain management and international trade strategies.

Market Access Strategies Before and After Brexit

Before Brexit, UK startups could leverage the free movement of goods, services, capital, and people within the EU. This facilitated relatively straightforward market entry, with a focus on localizing products or services to adapt to varying national needs. Post-Brexit, startups must adopt a more nuanced approach. This involves detailed market research to understand specific regulations, tariffs, and potential cultural sensitivities in each EU nation.

A strategic focus on partnerships with EU-based distributors or local businesses becomes increasingly important.

Strategies for EU and International Market Expansion, How brexit will impact startups growth in uk

UK startups can leverage several strategies for international market expansion. These include establishing strategic partnerships with EU-based businesses, engaging with local distributors, and utilizing digital marketing strategies tailored to specific EU markets. Building relationships with key influencers and local experts can also be crucial in understanding market dynamics. Additionally, participating in EU-focused trade shows and conferences can offer opportunities for networking and market exploration.

A comprehensive understanding of EU regulations and compliance requirements is essential.

Strategies to Enter and Navigate the EU Market Post-Brexit

UK startups need to develop a robust understanding of the specific regulations and requirements for each EU market they target. Navigating customs procedures, complying with labeling and product standards, and adapting their products or services to meet specific EU demands are essential. For example, a UK-based software company targeting the French market needs to ensure compliance with French data protection regulations.

This often involves collaborating with EU-based legal and compliance specialists to ensure adherence to EU standards.

Brexit’s impact on UK startup growth is a complex issue, with potential disruptions to supply chains and access to European talent pools. While the specifics remain to be seen, security vulnerabilities like those detailed in the Azure Cosmos DB Vulnerability Details highlight the importance of robust infrastructure for startups navigating this new landscape. Ultimately, UK startups will need to adapt to these changes, investing in resilience and diversification to ensure continued growth.

Key Steps for Accessing the EU Market

| Step | Description | Required Documentation |

|---|---|---|

| 1. Market Research | Thorough research on target markets, regulations, and competition. | Market reports, competitor analysis, EU regulatory information. |

| 2. Legal and Regulatory Compliance | Ensure products and services comply with EU regulations. | Product certifications, compliance documents, legal advice. |

| 3. Supply Chain Optimization | Establish efficient and compliant supply chains for the EU market. | Customs documentation, import/export licenses, shipping information. |

| 4. Local Partnerships | Establish relationships with local distributors, agents, or partners. | Letters of intent, partnership agreements, distributor contacts. |

| 5. Marketing and Sales Strategy | Develop a targeted marketing and sales strategy for the EU market. | Marketing materials, sales collateral, social media presence. |

| 6. Financial Planning | Budget for market entry costs and ongoing expenses. | Financial projections, budgets, investment strategies. |

Closing Notes

In conclusion, Brexit presents a complex set of challenges and opportunities for UK startups. While navigating new trade rules, securing talent, and adapting to regulatory changes is crucial, the potential for innovation and market diversification is also significant. The success of UK startups in the post-Brexit era hinges on their ability to adapt, innovate, and seize the emerging opportunities in the global market.

User Queries

What are the key differences in import/export procedures for startups before and after Brexit?

Import and export procedures have become more complex. Pre-Brexit, startups benefited from streamlined processes with the EU. Post-Brexit, new documentation, tariffs, and customs regulations have emerged, demanding careful attention to detail. Startups now need to navigate complex paperwork and potentially higher costs. A detailed comparison table is crucial for understanding these changes.

How has Brexit affected the availability of skilled labor for UK startups?

Attracting skilled EU talent has become more challenging post-Brexit. Visa processes have become more stringent, and EU workers face higher hurdles. Startups need to adapt their recruitment strategies, exploring alternative talent pools and upskilling existing employees. The cost of hiring EU talent, including visa fees and salary expectations, has also risen.

What are some strategies UK startups can use to attract investment despite Brexit uncertainties?

Startups should highlight their resilience and adaptability in the face of Brexit challenges. Demonstrating a clear growth strategy, a strong management team, and a solid business plan will attract investors. Furthermore, focusing on international expansion beyond the EU, emphasizing the UK’s strengths in specific sectors, and emphasizing their potential to succeed despite Brexit-related headwinds are key.

How can UK startups navigate the complexities of regulatory changes after Brexit?

Keeping abreast of updated regulations, seeking expert advice, and investing in compliance resources are essential. Understanding the implications for product compliance, data protection, and intellectual property rights is paramount. Startups need to ensure they meet the evolving legal requirements in both the UK and the EU.