Exploring Company Culture and Insider Threats

Exploring the relationship between company culture and insider threats sets the stage for this fascinating journey. We’ll delve into how a company’s atmosphere – from supportive and collaborative to toxic and stressful – directly impacts the risk of internal security breaches. Think of it: are your employees happy, engaged, and feeling valued, or are they simmering with resentment and feeling overlooked?

This exploration will uncover how those feelings directly translate into the potential for insider threats, examining everything from employee screening to robust security protocols.

We’ll dissect the various facets of company culture, exploring how a healthy, positive environment can act as a powerful deterrent, while a toxic one can inadvertently cultivate an atmosphere ripe for malicious intent. We’ll also investigate the crucial role of technology and data security in mitigating these risks, from implementing strong access controls to leveraging data loss prevention (DLP) technologies.

Finally, we’ll discuss the importance of open communication, trust, and a supportive environment in fostering loyalty and reducing the likelihood of insider threats. Get ready to uncover the hidden connections between workplace harmony and cybersecurity!

Defining Company Culture and its Impact

Company culture, often an intangible yet powerful force, significantly influences employee behavior and, consequently, the risk of insider threats. A strong, positive culture can act as a deterrent, while a negative one can create fertile ground for malicious or negligent actions. Understanding this dynamic is crucial for organizations aiming to mitigate insider risk.

Exploring the relationship between company culture and insider threats is crucial for any organization. A strong, ethical culture can significantly reduce risk, but even the best cultures need robust technological safeguards. That’s where understanding the importance of cloud security comes in, especially with solutions like those discussed in this excellent article on bitglass and the rise of cloud security posture management.

Ultimately, a layered approach combining a positive work environment and cutting-edge security is the best defense against insider threats.

Facets of a Healthy Company Culture

A healthy company culture fosters a sense of belonging, trust, and open communication. It prioritizes ethical conduct, promotes transparency in decision-making, and provides ample opportunities for professional development. Employees feel valued, respected, and empowered to contribute their best work. This environment discourages secrecy and encourages reporting of potential issues, thereby reducing the likelihood of undetected malicious activity.

For example, a company with robust ethics training and a clearly defined code of conduct, coupled with open channels for reporting concerns, creates a less conducive environment for insider threats to flourish.

Toxic Work Environments and Insider Threats

Conversely, a toxic work environment characterized by micromanagement, lack of trust, poor communication, and unfair treatment breeds resentment and frustration among employees. This negativity can manifest as sabotage, data theft, or other harmful actions. Employees feeling undervalued, overlooked, or unfairly treated may seek revenge or financial gain through insider actions. Imagine a scenario where an employee consistently ignored for promotion, despite exceeding expectations, feels justified in accessing sensitive company data for personal gain – a direct consequence of a toxic work environment.

Employee Satisfaction and Insider Threats

Employee satisfaction is directly correlated with the likelihood of insider threats. High levels of satisfaction often translate to increased loyalty and commitment, making employees less likely to engage in harmful behavior. Conversely, low satisfaction can lead to disengagement, resentment, and a higher risk of insider threats. Studies have shown a strong link between employee morale, feelings of fairness, and the incidence of security breaches.

For instance, a company with high employee turnover and low job satisfaction may experience a higher rate of security incidents compared to a company with high employee retention and satisfaction.

Comparison of Company Culture Models and Vulnerability to Insider Threats

Different company culture models exhibit varying degrees of vulnerability to insider threats. For example, a highly hierarchical, secretive culture, where information is tightly controlled and communication is limited, may be more susceptible to insider threats than a more collaborative, transparent culture. In a hierarchical structure, an employee feeling powerless or unheard might resort to actions outside the established norms.

In contrast, a collaborative environment encourages open communication and shared responsibility, making it harder for malicious activities to go unnoticed. The difference lies in the level of trust and openness fostered within the organization.

So, I’ve been digging into the fascinating (and slightly scary) relationship between company culture and insider threats. It’s amazing how much a positive and supportive environment can mitigate risk, but it’s also clear that robust security measures are crucial. For example, efficient app development, like what’s discussed in this article on domino app dev the low code and pro code future , can help streamline access control and data protection, ultimately contributing to a stronger security posture.

Ultimately, it all boils down to building trust and implementing smart tech solutions to minimize insider threat vulnerabilities.

Identifying Vulnerable Employees

Identifying employees who might pose an insider threat is a crucial aspect of cybersecurity. It’s not about profiling or unfairly targeting individuals, but about proactively mitigating risks by understanding potential vulnerabilities. This involves recognizing behavioral patterns, implementing robust screening processes, and establishing effective monitoring systems.

Personality Traits and Behavioral Patterns

Certain personality traits and behavioral patterns can increase the likelihood of an employee becoming an insider threat. These aren’t definitive indicators, but rather factors to consider within a broader risk assessment. For example, employees exhibiting signs of financial distress, extreme dissatisfaction with their job or management, or a history of substance abuse may be more susceptible to external pressures or internal frustrations that could lead to malicious actions.

Similarly, individuals with a strong sense of entitlement or a history of rule-breaking could be more likely to disregard security protocols. It’s important to remember that these are potential risk factors and not absolute predictors of malicious intent. A holistic approach is crucial, considering multiple factors rather than relying on single indicators.

Designing a Screening Process

A comprehensive screening process should go beyond simply verifying credentials. Background checks, including criminal history and credit reports (where legally permissible), can provide valuable insights. However, the process should also incorporate behavioral assessments. These might include personality tests designed to identify traits associated with risk-taking or impulsivity, and structured interviews focusing on ethical dilemmas and past experiences.

Reference checks should extend beyond confirming employment history to gauge the candidate’s integrity and work ethic. Furthermore, the interview process should focus on assessing a candidate’s understanding of and commitment to data security policies. This multi-faceted approach helps paint a more complete picture of the candidate’s suitability and potential risk.

Detecting Early Warning Signs

Regular monitoring and vigilant observation are key to detecting potential insider threats among existing employees. This involves actively tracking employee behavior, access patterns, and system usage. Unusual activity, such as accessing sensitive data outside of normal working hours or downloading large quantities of data, warrants investigation. Changes in employee behavior, such as increased secrecy, irritability, or withdrawal, should also be noted and addressed.

Furthermore, implementing regular security awareness training and encouraging employees to report suspicious activity helps foster a culture of security and provides an avenue for early detection. These proactive measures allow for timely intervention and prevent potential threats from escalating.

Red Flags Indicating Potential Insider Threats

Understanding potential red flags is crucial for proactive threat management. The following table summarizes key indicators, their severity, and potential mitigation strategies.

| Red Flag | Description | Severity | Mitigation Strategy |

|---|---|---|---|

| Unusual Access Patterns | Accessing sensitive data outside normal working hours or from unusual locations. | High | Implement access controls, monitor user activity, and conduct regular audits. |

| Excessive Data Downloads | Downloading large amounts of data without clear business justification. | High | Implement data loss prevention (DLP) tools, monitor data transfers, and enforce data usage policies. |

| Financial Difficulties | Evidence of significant financial stress, such as debt or bankruptcy filings. | Medium | Offer employee assistance programs (EAPs) and provide resources for financial counseling. |

| Changes in Behavior | Significant shifts in personality, increased secrecy, or withdrawal from colleagues. | Medium | Encourage open communication, provide opportunities for feedback, and monitor employee well-being. |

| Violation of Security Policies | Repeated or serious breaches of company security protocols. | High | Reinforce security training, implement stricter enforcement of policies, and consider disciplinary action. |

| Unexplained Technological Skills | Sudden acquisition or display of advanced technological skills relevant to company systems. | Medium | Review employee skillsets, conduct regular security awareness training, and investigate unusual activities. |

| Social Engineering Attempts | Attempts to manipulate or deceive colleagues to gain access to sensitive information or systems. | High | Conduct regular security awareness training focusing on social engineering tactics and implement strong access controls. |

| Suspicious Communication | Unusual or secretive communication with external parties, particularly those known to be involved in malicious activities. | High | Monitor employee communication, implement data loss prevention (DLP) tools, and investigate suspicious contacts. |

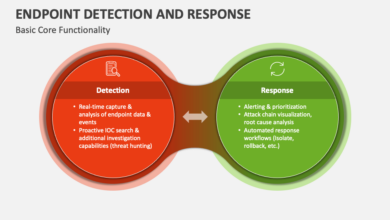

The Role of Technology and Data Security

Company culture plays a significant role in insider threat prevention, but even the strongest culture can be undermined by weak technological safeguards. The digital landscape presents unique vulnerabilities, and a robust security framework is crucial in mitigating the risks posed by malicious or negligent insiders. This section explores the critical intersection of technology, data security, and insider threat prevention.

Weak Access Controls and Insider Threats

Insufficient access controls are a major contributor to insider threats. When employees have access to more data than necessary for their roles, the opportunity for misuse or accidental disclosure increases dramatically. For example, a junior marketing assistant with access to sensitive financial data poses a significantly higher risk than one with access only to marketing materials. Implementing the principle of least privilege, which grants users only the minimum access required to perform their job duties, is paramount.

Regular access reviews, where permissions are checked and updated to reflect current job responsibilities, are equally important to maintain this principle. Failure to do so creates an environment ripe for exploitation, whether intentional or unintentional.

Data Encryption and Insider Threat Mitigation

Data encryption is a cornerstone of a robust security strategy. By encrypting sensitive data both in transit (while it’s being transferred) and at rest (while it’s stored), organizations significantly reduce the impact of a potential insider threat. Even if an employee gains unauthorized access or exfiltrates data, the encryption renders it unusable without the decryption key. Consider, for example, a scenario where a disgruntled employee downloads confidential client lists.

If these lists are encrypted, the employee is left with only useless ciphertext. Different encryption methods exist, from simple password protection to more sophisticated techniques like AES-256 encryption, and the choice depends on the sensitivity of the data. Strong encryption protocols should be coupled with strict key management practices to maximize their effectiveness.

Implementing Robust Monitoring Systems

Effective monitoring systems are essential for detecting suspicious activities indicative of insider threats. These systems should continuously monitor user behavior, network traffic, and data access patterns. Anomalies, such as unusual access times, large data transfers, or attempts to access unauthorized files, should trigger alerts. Sophisticated systems can employ machine learning algorithms to establish baselines of normal user behavior and identify deviations from those baselines.

For instance, a system might flag an employee who suddenly begins accessing files outside their normal working hours or downloading significantly more data than usual. These alerts allow security teams to investigate potential threats promptly and take appropriate action.

Data Loss Prevention (DLP) Technologies

Several DLP technologies exist to prevent sensitive data from leaving the organization’s control. These range from simple -based filters that block emails containing specific confidential information to advanced technologies that use machine learning to identify and prevent the exfiltration of sensitive data regardless of its format. Network-based DLP solutions monitor network traffic for suspicious activity, while endpoint DLP solutions monitor data on individual computers and devices.

Cloud-based DLP solutions protect data stored in cloud services. The effectiveness of each technology varies depending on the sophistication of the threat and the specific implementation. A layered approach, combining multiple DLP technologies, is often the most effective strategy. For example, using network-based DLP to monitor outbound traffic coupled with endpoint DLP to prevent data from being copied to unauthorized devices offers a more comprehensive level of protection.

Addressing Insider Threats Through Policies and Procedures

Proactive measures are crucial in mitigating the risk of insider threats. A robust framework of policies and procedures, coupled with comprehensive training, forms the bedrock of a strong security posture. This goes beyond simply installing software; it’s about fostering a culture of security awareness and responsibility at every level of the organization.A multi-faceted approach is needed to effectively address the challenges posed by insider threats.

This includes clearly defined policies, thorough training programs, and established procedures for reporting and investigation. The goal is to create a system where employees understand their responsibilities, know how to report suspicious activity, and feel confident in doing so.

Comprehensive Security Awareness Training, Exploring the relationship between company culture and insider threats

Effective security awareness training is paramount. It shouldn’t be a one-time event, but rather an ongoing process that reinforces key concepts and adapts to evolving threats. The training should cover various aspects of data security, including recognizing phishing attempts, understanding social engineering tactics, and the importance of strong passwords. Real-world examples of insider threat incidents and their consequences can be particularly impactful in driving home the seriousness of the issue.

Interactive modules, simulations, and regular quizzes can help maintain employee engagement and ensure knowledge retention. For example, a scenario involving a simulated phishing email could be used to teach employees how to identify and report such attempts. This interactive approach proves far more effective than simply delivering a lecture.

Acceptable Use of Company Resources and Data Policy

A clearly articulated acceptable use policy (AUP) is non-negotiable. This policy should explicitly Artikel what constitutes acceptable and unacceptable behavior regarding the use of company resources, including computers, networks, software, and data. The policy must cover areas such as data handling, access control, internet usage, and the use of personal devices within the workplace. It should also clearly define the consequences of violating the policy, ranging from warnings to termination of employment.

For instance, the AUP should prohibit employees from downloading unauthorized software, sharing sensitive information with unauthorized individuals, or using company resources for personal gain. The policy should be readily accessible to all employees and acknowledged by them upon employment and periodically reviewed.

Procedures for Reporting and Investigating Suspected Insider Threats

Establishing a clear and confidential reporting mechanism is vital. Employees need to feel comfortable reporting suspicious activities without fear of retaliation. This could involve a dedicated hotline, an online reporting system, or designated individuals within the organization. The reporting process should be simple, straightforward, and confidential. Once a report is received, a well-defined investigation process should be initiated.

This process should involve a multidisciplinary team, including IT security personnel, HR representatives, and potentially legal counsel. The investigation should be thorough, objective, and documented meticulously. The goal is to gather evidence, determine the extent of the damage, and take appropriate action. A clear chain of command and well-defined roles and responsibilities are crucial for efficient and effective investigations.

Managing Employee Access Privileges and Data Permissions

The principle of least privilege should guide access control. Employees should only have access to the data and systems necessary to perform their job duties. Regular reviews of access privileges are essential to ensure that permissions remain appropriate. This involves periodically auditing user accounts, removing access for employees who have left the company, and updating permissions based on changing job roles.

Implementing strong authentication methods, such as multi-factor authentication, can further enhance security. Role-based access control (RBAC) can automate the process of assigning and managing permissions based on an employee’s role within the organization, ensuring efficient and consistent application of the principle of least privilege. This proactive approach minimizes the potential damage caused by compromised accounts.

The Impact of External Factors

Company culture, while crucial internally, is significantly impacted by external forces. These external pressures can profoundly affect employee behavior, creating vulnerabilities that increase the risk of insider threats. Understanding these external influences is critical for proactively mitigating such risks. Ignoring them leaves organizations susceptible to breaches stemming from factors completely outside their immediate control.External pressures, such as financial difficulties or personal problems, can significantly influence employee behavior and increase the likelihood of insider threats.

Organizational changes, like mergers or downsizing, can also create a climate of uncertainty and anxiety, making employees more vulnerable to making poor decisions.

Financial Difficulties and Personal Problems

Financial hardship can drive employees to desperate measures. The stress of mounting debt, unexpected medical bills, or family emergencies can lead individuals to compromise their ethical standards and engage in actions they wouldn’t otherwise consider. This could manifest as embezzlement, data theft for financial gain, or sabotage to secure a better position elsewhere. Similarly, personal problems such as divorce, addiction, or serious illness can severely impact an employee’s judgment and emotional stability, increasing the risk of impulsive or reckless behavior.

A supportive and understanding environment can mitigate these risks, but proactive identification and intervention are crucial.

Organizational Changes and Their Impact

Mergers and acquisitions, downsizing, and restructuring are common occurrences in the business world. However, these changes often lead to increased stress, uncertainty, and insecurity among employees. Fear of job loss, changes in responsibilities, and a general sense of instability can create a breeding ground for insider threats. Employees might feel a sense of betrayal or resentment, leading them to retaliate by stealing data, sabotaging systems, or leaking confidential information.

The lack of clear communication and transparency during these periods further exacerbates the problem.

Creating a Supportive Environment

Creating a supportive work environment is vital in mitigating the risks associated with external pressures. This includes offering employee assistance programs (EAPs) that provide confidential counseling, financial guidance, and other support services. Open communication channels, where employees feel comfortable voicing their concerns and seeking help, are also crucial. Regular training sessions on stress management techniques and resilience-building can equip employees with the tools to cope with difficult situations.

Furthermore, fostering a culture of trust and transparency helps reduce the likelihood of employees resorting to destructive behaviors out of fear or frustration. A strong, empathetic leadership that actively addresses employee concerns is paramount.

Examples of External Factors Contributing to Insider Threats

The impact of external factors on insider threats is significant. Several real-world examples illustrate this point:

- Employee facing foreclosure: An employee facing foreclosure on their home embezzled funds from their company to avoid losing their house. The stress of financial hardship overwhelmed their ethical considerations.

- Downsizing and data theft: During a company-wide downsizing, a disgruntled employee who felt unfairly targeted leaked sensitive customer data to a competitor, causing significant financial damage to their former employer.

- Merger and sabotage: Following a merger, an employee whose role was eliminated due to redundancy sabotaged the company’s IT systems, disrupting operations and causing significant financial losses.

Mitigating Insider Threats Through Communication and Trust: Exploring The Relationship Between Company Culture And Insider Threats

Open communication and a strong culture of trust are fundamental to mitigating insider threats. When employees feel heard, valued, and respected, they’re less likely to resort to harmful actions, even unintentionally. A transparent environment fosters a sense of shared responsibility for security, encouraging employees to proactively report potential risks. This proactive approach is far more effective than relying solely on reactive measures after a breach has occurred.A culture of trust significantly reduces the likelihood of insider threats by creating an environment where employees feel comfortable reporting issues without fear of retribution.

This openness encourages early identification of potential problems, allowing for swift intervention and preventing minor issues from escalating into major security breaches. Conversely, a culture of secrecy and distrust can breed resentment and suspicion, creating fertile ground for malicious or negligent actions.

Fostering Loyalty and Commitment

Building loyalty and commitment among employees is crucial for reducing insider threats. This involves providing opportunities for professional development, offering competitive compensation and benefits, and creating a positive and supportive work environment. Regular employee feedback sessions, opportunities for advancement, and recognition for achievements can significantly boost morale and foster a sense of belonging. Employees who feel valued and appreciated are more likely to be loyal and committed to the organization’s success, reducing the likelihood of them engaging in harmful activities.

For example, a company offering tuition reimbursement for employees pursuing relevant certifications demonstrates a commitment to their growth, strengthening their loyalty.

Confidential Reporting Systems

Establishing a confidential reporting system is vital for allowing employees to voice concerns without fear of reprisal. This system should be accessible, easy to use, and guarantee anonymity where appropriate. The reporting process should be clearly defined, with assurances that reports will be investigated thoroughly and fairly. A dedicated, independent team or external entity should handle these reports to ensure impartiality and maintain employee trust.

For instance, a company might utilize a third-party hotline or an anonymous online reporting platform to ensure confidentiality and encourage open communication about potential threats.

Improving Employee Morale and Job Satisfaction

High employee morale and job satisfaction are strong deterrents to insider threats. A positive work environment reduces stress and frustration, which are often contributing factors to malicious or negligent behavior. Regular team-building activities, opportunities for social interaction, and a focus on work-life balance can significantly improve morale. Addressing employee concerns promptly and fairly, providing regular feedback, and offering opportunities for growth and development all contribute to a more positive and supportive work environment.

For example, flexible work arrangements and generous vacation policies can significantly reduce employee stress and increase job satisfaction, ultimately decreasing the risk of insider threats.

Concluding Remarks

Ultimately, understanding the intricate relationship between company culture and insider threats isn’t just about implementing security measures; it’s about cultivating a workplace where employees feel valued, respected, and empowered. By fostering a culture of trust, open communication, and strong ethical standards, organizations can significantly reduce their vulnerability to insider threats. It’s a proactive approach that moves beyond simply reacting to threats, and instead focuses on building a resilient and secure organizational environment from the ground up.

Remember, a happy, engaged workforce is a much safer workforce.

Essential FAQs

What are some common misconceptions about insider threats?

Many believe insider threats are always malicious. Often, they stem from negligence, lack of training, or even accidental errors. Another misconception is that only disgruntled employees pose a threat; sometimes, even well-intentioned employees can unintentionally cause security breaches.

How can we measure the effectiveness of our insider threat program?

Effectiveness can be measured through key metrics like the number of security incidents, the time it takes to detect and respond to incidents, the cost associated with incidents, and employee feedback on security awareness training.

What role does HR play in mitigating insider threats?

HR plays a crucial role in the hiring process, conducting thorough background checks and assessing candidates’ integrity. They also contribute to fostering a positive work environment and implementing policies that address employee concerns and grievances, reducing the likelihood of disgruntled employees.