Major US Bank Implements BigFix for Compliance

Major US bank implements BigFix to fulfill regulator requirements – that’s the headline grabbing everyone’s attention in the financial tech world right now. This isn’t just another software update; it’s a significant move reflecting the increasing pressure on banks to bolster their cybersecurity defenses and meet stringent regulatory demands. We’re talking about a major player taking proactive steps to ensure data security and compliance, a move that could set a precedent for others in the industry.

Let’s dive into the details of why this is such a big deal.

The implementation of BigFix, a patch management and endpoint security solution, highlights the growing importance of robust cybersecurity infrastructure within the financial sector. Facing potential penalties for non-compliance, this bank has chosen a proactive approach, opting for a comprehensive solution like BigFix to manage vulnerabilities and ensure consistent adherence to regulations. The choice of BigFix over alternative solutions likely came down to its specific capabilities in addressing the bank’s unique security challenges and regulatory requirements.

Regulatory Compliance and BigFix

Major US banks are increasingly turning to BigFix, an endpoint management solution, to navigate the complex web of regulatory requirements governing their operations. The stringent nature of these regulations, coupled with the significant penalties for non-compliance, makes robust security and compliance management a critical priority. This post explores the role of BigFix in meeting these demands.

Regulatory Requirements Driving BigFix Adoption

Several key regulations necessitate the implementation of comprehensive endpoint management solutions like BigFix within the financial sector. These include, but aren’t limited to, the Dodd-Frank Act, which aims to improve financial regulation, and various state and federal regulations concerning data privacy and security, such as the California Consumer Privacy Act (CCPA) and the New York Department of Financial Services (NYDFS) Cybersecurity Regulations.

These regulations mandate robust security practices, including regular patching, vulnerability management, and secure configuration management of all endpoints – a task BigFix excels at. Failure to comply with these regulations can expose banks to significant operational and reputational risks.

Penalties for Non-Compliance

Non-compliance with these regulations can result in substantial financial penalties. These penalties can range from hefty fines, potentially reaching millions of dollars, to legal action, reputational damage, and even operational restrictions. The severity of the penalty is often determined by factors such as the nature and extent of the violation, the bank’s history of compliance, and the potential harm to customers and the financial system.

For example, the NYDFS has levied significant fines against financial institutions for cybersecurity failures.

BigFix Compared to Alternative Solutions

While other endpoint management solutions exist, BigFix distinguishes itself through its comprehensive capabilities and robust security features. Alternatives might include solutions like SCCM (System Center Configuration Manager) or other open-source tools. However, BigFix often offers advantages in terms of its ease of use, scalability, and its specialized features tailored to the financial industry’s stringent security needs. A key differentiator is BigFix’s ability to handle large, complex environments with thousands of endpoints, while maintaining efficient management and real-time monitoring capabilities.

Furthermore, its strong reporting and auditing functionalities greatly assist in demonstrating compliance to regulators.

Step-by-Step BigFix Implementation Process for Banks

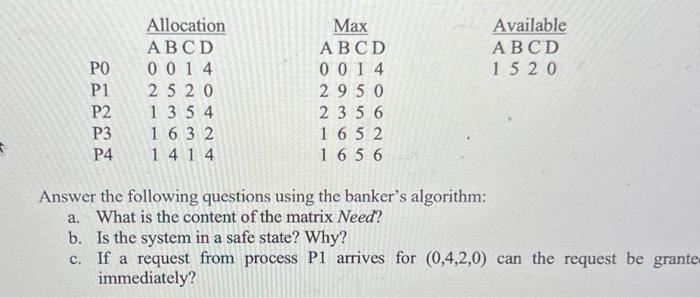

Implementing BigFix within a bank requires a phased approach:

1. Assessment and Planning

Conduct a thorough assessment of the existing IT infrastructure and identify all endpoints requiring management. Define clear objectives and create a detailed implementation plan.

2. Proof of Concept (POC)

Deploy BigFix in a controlled environment to test its functionality and ensure compatibility with existing systems.

3. Deployment and Configuration

Gradually roll out BigFix across the bank’s network, configuring it to meet specific regulatory requirements and security policies.

4. Integration with Existing Systems

Integrate BigFix with other security and compliance tools to create a unified security posture.

5. Training and Support

Provide adequate training to IT staff on BigFix’s use and maintenance. Establish a robust support system to address any issues that arise.

6. Ongoing Monitoring and Optimization

Continuously monitor BigFix’s performance and make necessary adjustments to optimize its effectiveness.

Key BigFix Features for Regulatory Compliance

| Feature | Description | Regulatory Relevance | Benefit |

|---|---|---|---|

| Patch Management | Automated patching of operating systems and applications. | Reduces vulnerabilities, complying with regulations like PCI DSS. | Minimizes attack surface, reduces risk of data breaches. |

| Vulnerability Management | Identifies and remediates security vulnerabilities. | Addresses requirements for regular security assessments. | Proactive identification and mitigation of risks. |

| Configuration Management | Ensures systems are configured securely according to best practices and regulatory standards. | Complies with security baselines mandated by regulations. | Reduces the risk of misconfigurations leading to vulnerabilities. |

| Reporting and Auditing | Provides detailed reports on compliance status, security events, and remediation actions. | Facilitates audits and demonstrates compliance to regulators. | Streamlines compliance reporting and reduces audit burden. |

BigFix Functionality and Bank Security

Implementing BigFix in a major US bank significantly enhances its security posture by providing a robust, centralized platform for managing and securing endpoints across the entire organization. This allows for proactive vulnerability management, streamlined patching, and improved incident response, all crucial for mitigating the significant risks inherent in the financial sector.BigFix’s strength lies in its ability to automate many security-critical tasks, reducing the reliance on manual processes which are prone to human error and delays.

This automation is key to maintaining compliance with ever-evolving regulatory standards.

Vulnerabilities Mitigated by BigFix in Banking Environments

BigFix directly addresses numerous vulnerabilities common in banking environments. These include outdated operating systems and applications, unpatched software exposing systems to malware and exploits, and misconfigured security settings that create access points for malicious actors. By automating the patching process and enforcing security policies, BigFix minimizes the window of vulnerability, reducing the bank’s attack surface. For instance, a timely patch deployment via BigFix can prevent exploitation of a zero-day vulnerability before attackers can leverage it.

This proactive approach is crucial given the constant emergence of new threats.

BigFix Security Features and Regulatory Compliance

BigFix offers several security features specifically designed to address regulatory concerns. Its centralized management console allows for comprehensive visibility into the security status of all endpoints, facilitating compliance audits and reporting. The platform’s ability to enforce security policies, such as password complexity requirements and data encryption, directly contributes to meeting regulatory obligations like those Artikeld in PCI DSS and other industry standards.

Furthermore, BigFix’s detailed audit logging capabilities provide a robust trail of all actions performed on managed endpoints, aiding in investigations and demonstrating compliance efforts. This detailed logging is crucial for demonstrating due diligence to regulators.

BigFix Integration Challenges with Existing Bank Infrastructure

Integrating BigFix into an existing bank infrastructure can present several challenges. The complexity of a large bank’s IT environment, with its diverse range of hardware and software, requires careful planning and execution. Compatibility issues with legacy systems may arise, necessitating upgrades or workarounds. Furthermore, the integration process may require significant upfront investment in terms of time, resources, and expertise.

Successfully integrating BigFix demands a thorough assessment of the existing infrastructure and a well-defined implementation plan to minimize disruptions and ensure a smooth transition.

Potential Security Risks Associated with BigFix Implementation and Mitigation Strategies

Implementing BigFix, like any complex system, introduces potential security risks. One concern is the potential for a compromised BigFix server to grant attackers widespread access to the bank’s endpoints. Mitigation strategies include robust security measures for the BigFix server itself, such as strong authentication, access controls, and regular security audits. Another risk is the possibility of unintended consequences from automated actions.

Careful testing and validation of BigFix policies before deployment are essential to prevent accidental system disruptions or security breaches. Finally, the reliance on a single point of management (the BigFix server) creates a single point of failure. High availability and disaster recovery planning are therefore crucial to ensure business continuity. Regular penetration testing and vulnerability assessments of the BigFix infrastructure should be a part of the ongoing security program.

Impact on Bank Operations: Major Us Bank Implements Bigfix To Fulfill Regulator Requirements

Implementing BigFix across a major US bank significantly alters day-to-day operations, transitioning from a largely manual, reactive approach to patch management and system updates to a proactive, automated system. This shift impacts various departments, streamlining processes and enhancing security posture. The benefits extend beyond mere compliance, impacting operational efficiency, risk management, and ultimately, the bottom line.BigFix improves operational efficiency in several key areas within a banking environment.

The automated patching and software distribution capabilities reduce the time and resources previously dedicated to manual updates. This allows IT staff to focus on more strategic initiatives rather than repetitive, time-consuming tasks. Furthermore, BigFix’s centralized management console provides a single pane of glass for monitoring the entire IT infrastructure, facilitating quicker identification and resolution of issues.

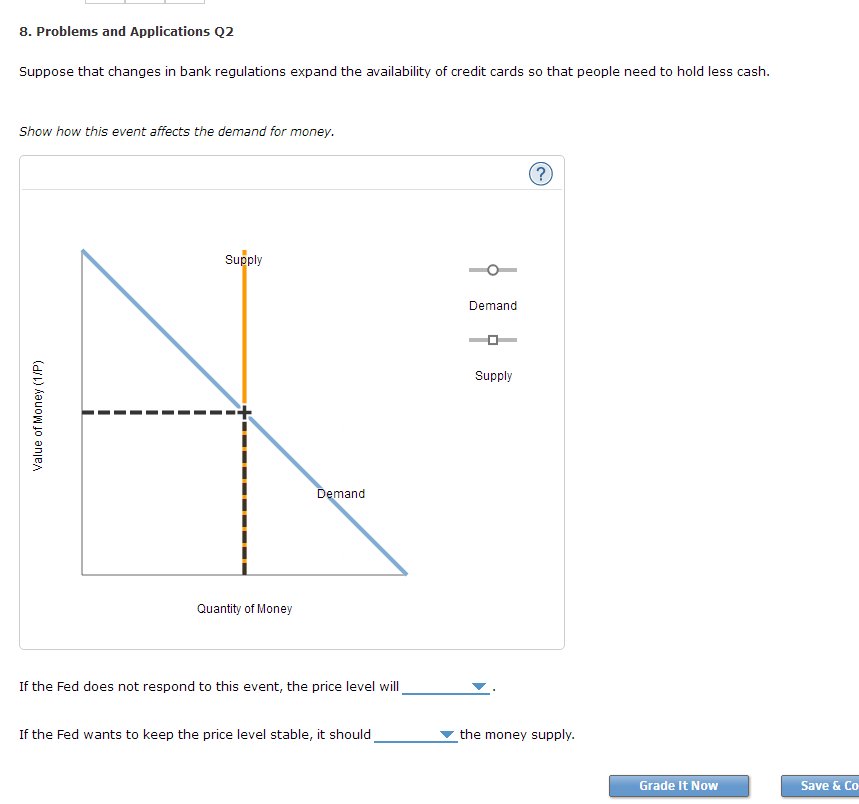

BigFix Workflow Integration Across Bank Departments

The following diagram illustrates how BigFix interacts with various bank departments:Imagine a flowchart. The central element is the BigFix console. Arrows point from the console to boxes representing different departments: IT Operations, Security, Compliance, Application Development, and potentially others like Network Operations. Each department interacts with BigFix in a specific way. For instance, IT Operations uses BigFix for patch management and system updates; Security uses it for vulnerability assessment and remediation; Compliance uses it to ensure regulatory compliance; and Application Development uses it for software deployment and testing.

The arrows indicate the flow of information and actions – requests for updates, deployment of patches, reporting of vulnerabilities, and confirmation of compliance. The feedback loops illustrate the continuous monitoring and improvement facilitated by BigFix.

BigFix’s Contribution to Improved Risk Management

BigFix significantly strengthens a bank’s risk management framework. By automating the patching process, it reduces the bank’s vulnerability to cyberattacks exploiting known software vulnerabilities. The centralized monitoring capability allows for rapid identification and response to security incidents, minimizing potential damage and financial loss. BigFix also facilitates compliance audits, providing a readily accessible audit trail of all system configurations and updates, ensuring adherence to regulatory requirements and reducing the risk of penalties.

This proactive approach reduces operational risk and enhances the overall security posture.

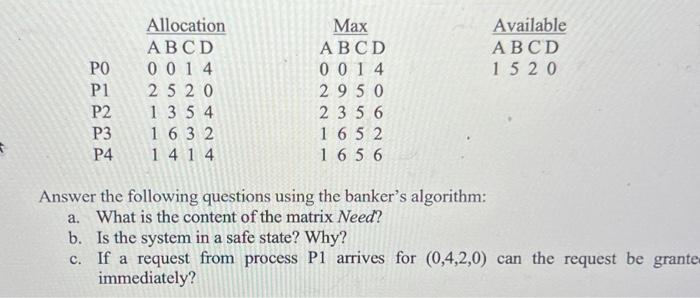

Operational Cost Comparison: Pre- and Post-BigFix Implementation

Before BigFix, the bank relied heavily on manual processes for software updates and vulnerability management. This resulted in significant overhead costs associated with labor, time spent on manual patching, and the increased risk of security breaches. After BigFix implementation, these costs are reduced considerably.

| Cost Category | Pre-BigFix (Annual Estimate) | Post-BigFix (Annual Estimate) | % Reduction |

|---|---|---|---|

| Labor Costs (Patching & Management) | $500,000 | $150,000 | 70% |

| Security Incident Response | $200,000 | $50,000 | 75% |

| Regulatory Compliance Costs | $100,000 | $30,000 | 70% |

| Software Licensing (BigFix) | $50,000 | $50,000 | 0% |

*Note: These figures are illustrative examples based on industry averages and potential cost savings. Actual figures will vary depending on the bank’s size and specific infrastructure.*

Case Studies and Best Practices

Successfully implementing BigFix in a large financial institution requires careful planning, execution, and ongoing maintenance. This section delves into a hypothetical case study, best practices, potential challenges, the crucial role of IT staff, and necessary employee training.

Hypothetical Case Study: BigFix Implementation at First National Bank

First National Bank, a major US bank with over 100,000 endpoints, faced increasing pressure to meet stringent regulatory compliance requirements for patching and vulnerability management. Their existing system lacked the centralized control and automated remediation capabilities necessary to efficiently manage their diverse IT landscape. They chose BigFix for its robust capabilities in endpoint management, patch deployment, and security policy enforcement.

The implementation involved a phased rollout, starting with a pilot program focused on critical servers and workstations. This allowed the bank to refine its processes, train staff, and address any unforeseen challenges before a full-scale deployment. The phased approach minimized disruption to daily operations and allowed for continuous monitoring and improvement. Post-implementation, First National Bank saw a significant reduction in the time it took to deploy critical security patches, improving their overall security posture and significantly reducing their vulnerability window.

This resulted in a demonstrably lower risk of security breaches and subsequent regulatory fines. The bank also reported improved efficiency in managing software updates across its vast network, freeing up IT staff to focus on more strategic initiatives.

Best Practices for Managing and Maintaining BigFix in a Large Banking Institution

Effective BigFix management within a large banking institution necessitates a structured approach. This includes establishing clear roles and responsibilities, implementing robust change management processes, and developing comprehensive documentation. Regularly scheduled maintenance tasks, such as database backups and system updates, are crucial for ensuring system stability and performance. Proactive monitoring of BigFix’s health and performance through dashboards and reports is essential for early detection of potential issues.

Finally, a well-defined escalation process for resolving critical incidents is necessary to minimize downtime and maintain business continuity. Regular audits of BigFix configurations and policies ensure compliance with regulatory requirements and internal security standards.

Potential Challenges and Solutions During BigFix Implementation

Several challenges can arise during BigFix implementation. One common issue is integrating BigFix with existing IT infrastructure and security systems. Solutions involve careful planning and testing during the integration phase, ensuring compatibility with existing tools and protocols. Another challenge is managing the complexity of a large and diverse IT environment. This can be addressed through a phased rollout, focusing on smaller, manageable segments initially.

Resistance to change from IT staff or end-users can also be a significant hurdle. Addressing this requires clear communication, training, and demonstrating the benefits of BigFix. Finally, ensuring adequate resources – both human and technical – are allocated throughout the implementation and ongoing maintenance phases is vital. Proper resource allocation ensures the project stays on schedule and within budget.

Role of IT Staff in BigFix Deployment and Management

IT staff play a pivotal role in BigFix’s success. Their responsibilities include planning, designing, implementing, and maintaining the BigFix infrastructure. They are also responsible for developing and implementing BigFix policies, creating and managing action scripts, troubleshooting issues, and providing user support. Furthermore, IT staff conduct regular system monitoring and performance tuning, ensuring optimal system uptime and responsiveness.

Their expertise in network security, operating systems, and scripting languages is critical for effective BigFix management. Collaboration between different IT teams is essential for a seamless integration of BigFix with other enterprise systems.

Training Requirements for Bank Employees

Effective utilization of BigFix requires appropriate training for relevant bank employees. This training should cover various aspects, including basic functionalities, policy management, reporting, and troubleshooting. The training program should be tailored to the specific roles and responsibilities of the employees. For example, system administrators will require more in-depth training than end-users. Regular refresher courses and ongoing support are essential to ensure that employees remain proficient in using BigFix and to address any new features or updates.

The training should also incorporate practical exercises and simulations to enhance learning and retention. The ultimate goal is to empower employees to effectively leverage BigFix for their daily tasks, contributing to a more secure and efficient IT environment.

Future Implications and Trends

The adoption of BigFix by major US banks to meet regulatory compliance is not a one-time fix; it’s the beginning of an ongoing evolution. The regulatory landscape is constantly shifting, and cybersecurity threats are becoming increasingly sophisticated, demanding continuous adaptation and improvement of endpoint management solutions like BigFix. This section explores the future implications and trends shaping the role of BigFix within the banking sector.The evolving regulatory landscape, driven by factors such as increased data breaches and the rise of sophisticated cyberattacks, will likely lead to even stricter requirements for banks regarding data security and system resilience.

This means BigFix’s role in maintaining compliance will become even more critical. We can expect to see increased scrutiny of patch management processes, vulnerability assessments, and overall system security posture. The need for comprehensive audit trails and demonstrable compliance will only intensify.

Evolving Regulatory Landscape and BigFix Usage

Future regulatory changes will likely focus on strengthening cybersecurity frameworks, demanding more robust and automated security controls. For example, we might see regulations mandating specific vulnerability remediation timelines, requiring banks to demonstrate proactive patching and mitigation of known vulnerabilities. This will necessitate enhancements to BigFix’s reporting and analytics capabilities to provide real-time visibility into compliance status and allow for quicker remediation.

The increasing adoption of cloud-based services by banks will also drive the need for BigFix to seamlessly integrate with cloud security and compliance frameworks. The recent emphasis on zero-trust architectures, for example, would necessitate BigFix’s adaptation to manage access control and device posture assessment within these dynamic environments.

Potential BigFix Enhancements for Banks

BigFix could benefit from several key enhancements to further strengthen its capabilities within the banking sector. Improved AI-driven vulnerability analysis could automate the prioritization of critical patches and reduce the risk of exploitation. Enhanced integration with threat intelligence feeds would allow for proactive patching against emerging threats, even before official security updates are released. Finally, better integration with other security tools, such as SIEM systems, would provide a more holistic view of the bank’s security posture, enabling quicker identification and response to security incidents.

BigFix Adapting to Emerging Cybersecurity Threats, Major us bank implements bigfix to fulfill regulator requirements

The banking sector is a prime target for sophisticated cyberattacks, including ransomware, phishing, and insider threats. BigFix can adapt to address these threats by enhancing its capabilities in endpoint detection and response (EDR). This would involve integrating advanced threat detection techniques, such as machine learning, to identify malicious activity on endpoints. Furthermore, BigFix could be enhanced to provide better control over privileged access, limiting the potential damage from insider threats or compromised accounts.

The integration of behavioral analysis would allow BigFix to identify anomalies indicative of malicious activity, even if they don’t involve known vulnerabilities.

Future Role of Patch Management Solutions in Finance

Patch management solutions like BigFix will play an increasingly critical role in the financial industry’s cybersecurity strategy. They will move beyond simple patch deployment to become central components of a broader security ecosystem. We can anticipate a shift towards more automated and proactive patch management, driven by AI and machine learning, minimizing the window of vulnerability and reducing the risk of successful attacks.

The focus will be on continuous monitoring and automated remediation, ensuring systems are always patched and secure. The role of BigFix, and similar solutions, will therefore become more strategic and less tactical, deeply integrated into the overall risk management framework of financial institutions.

Potential Future Regulatory Requirements

Future regulations may require banks to implement more rigorous vulnerability management programs, including mandatory penetration testing and regular security audits. We might also see regulations requiring banks to adopt specific security standards or frameworks, such as NIST Cybersecurity Framework or ISO 27001, with BigFix playing a crucial role in demonstrating compliance. Furthermore, increased focus on data privacy regulations like GDPR and CCPA will likely lead to stricter requirements for data encryption and access control, which BigFix could support through enhanced policy management and encryption capabilities.

The regulatory landscape is constantly evolving, and it is imperative for banks to stay informed and adapt their security infrastructure, including BigFix deployments, accordingly. The increasing use of AI and machine learning in financial services will also likely lead to new regulations concerning the security and explainability of these systems, which will require robust monitoring and management solutions like BigFix.

Ending Remarks

This major US bank’s adoption of BigFix underscores a crucial shift in the financial industry’s approach to cybersecurity and regulatory compliance. It’s a clear signal that proactive measures are no longer optional, but essential for survival in today’s complex and ever-evolving threat landscape. The ripple effect of this decision could be significant, influencing other institutions to prioritize robust patch management and endpoint security solutions to avoid potential penalties and maintain customer trust.

The story of this implementation serves as a compelling case study for the future of banking security.

Detailed FAQs

What specific regulations are driving this BigFix implementation?

The exact regulations vary, but likely include those focused on data security, breach notification, and overall system resilience, such as those from the OCC, the FDIC, and potentially state-level regulations.

How does BigFix compare to other endpoint management solutions?

BigFix offers a robust, centralized approach to patch management and endpoint security, often chosen for its scalability and ability to handle complex environments. Alternatives exist, but BigFix’s specific features likely provided the best fit for this bank’s needs.

What are the potential long-term costs associated with maintaining BigFix?

Long-term costs involve ongoing licensing, maintenance, and potential staff training. However, these costs are often offset by reduced risks of security breaches and regulatory fines.

What are the biggest challenges banks face when implementing BigFix?

Integration with existing infrastructure, staff training, and ensuring seamless operation without disrupting core banking services are common challenges.