Myths Compliance Is Too Much

Myths compliance is too much – Myths: Compliance Is Too Much – that’s the common cry from many businesses today. We’re constantly bombarded with regulations, often feeling overwhelmed by the sheer volume and complexity. But is it really as burdensome as it seems? This post dives into the common misconceptions surrounding compliance, exploring the actual costs versus the benefits, and offering strategies to make the process more manageable and even, dare I say, efficient.

We’ll tackle real-world examples, examine the financial implications of non-compliance, and discover how technology can be a game-changer. Prepare to rethink your approach to compliance – you might be surprised at how much you can achieve with the right tools and mindset. Let’s debunk those myths and streamline your operations!

The Perceived Burden of Compliance

The perception that compliance is excessively burdensome is a common complaint among businesses of all sizes. This feeling often stems from a combination of factors, including the sheer volume of regulations, the complexity of the rules themselves, and the significant resources required for implementation and maintenance. While compliance is undeniably important for ethical operations and legal protection, the perceived cost – both financially and in terms of time and effort – can be a significant deterrent.The common reasons businesses feel compliance is overly burdensome are multifaceted.

Many regulations are incredibly detailed and intricate, requiring specialized expertise to interpret and implement correctly. The constant evolution of legal landscapes, with new laws and amendments being introduced regularly, necessitates continuous updates and training, adding to the already significant workload. Furthermore, the fear of non-compliance and the potential for hefty fines or legal repercussions can create a climate of anxiety and over-caution, leading to inefficient processes and added administrative burdens.

Specific Compliance Regulations Frequently Cited as Overly Complex or Time-Consuming

Numerous regulations are frequently cited as excessively complex. For example, the intricacies of HIPAA (Health Insurance Portability and Accountability Act) in the healthcare industry require extensive training and robust security measures, adding significant overhead costs. Similarly, the Sarbanes-Oxley Act (SOX), designed to protect investors from corporate accounting fraud, demands rigorous internal controls and documentation processes, which can be extremely demanding for smaller companies.

In the environmental sector, navigating the various permits and reporting requirements under the Clean Water Act or the Clean Air Act can be a significant administrative burden, especially for businesses operating in multiple jurisdictions. Finally, GDPR (General Data Protection Regulation) in Europe presents substantial challenges for organizations handling personal data, demanding meticulous data management practices and stringent consent procedures.

Real-World Case Studies Illustrating Compliance Challenges

Consider the case of a small medical practice struggling to maintain HIPAA compliance. The costs associated with implementing and maintaining a secure electronic health record system, along with the ongoing training requirements for staff, can significantly strain their limited resources. This often leads to choices between investing in compliance or other crucial aspects of the business, such as hiring additional staff or upgrading equipment.

Another example is a manufacturing company facing significant challenges in meeting environmental regulations. The costs associated with installing and maintaining pollution control equipment, along with the ongoing monitoring and reporting requirements, can be substantial, potentially impacting their competitiveness. Many small businesses lack the internal resources or expertise to manage these complex regulations effectively.

Hypothetical Scenario: Impact of Overly Stringent Compliance on a Small Business

Imagine a small bakery, “Sweet Success,” attempting to navigate increasingly stringent food safety regulations. New regulations mandate expensive equipment upgrades for temperature control, detailed record-keeping for ingredient sourcing and traceability, and frequent inspections. These requirements strain the bakery’s limited budget, forcing them to raise prices, potentially impacting sales. The additional paperwork and administrative tasks divert the owner’s time and energy from baking and customer interaction, ultimately affecting the quality of their products and customer service.

The increased compliance burden could lead to reduced profitability, hindering growth and potentially forcing the bakery to close, despite its success in the local market.

Cost-Benefit Analysis of Compliance

Compliance, while often perceived as burdensome, is ultimately an investment in a company’s long-term health and stability. A thorough cost-benefit analysis reveals that the perceived costs of adhering to regulations are significantly outweighed by the potential financial and reputational losses associated with non-compliance. This analysis needs to consider both short-term expenses and the potentially catastrophic long-term consequences of ignoring regulatory frameworks.

Comparing Perceived Costs and Potential Benefits

The perceived costs of compliance often include the time and resources dedicated to implementing and maintaining compliance programs, hiring specialized personnel, and investing in new technologies. These upfront investments can seem substantial. However, these costs pale in comparison to the potential penalties, legal fees, and reputational damage resulting from non-compliance. Avoiding penalties such as fines, which can reach millions of dollars depending on the severity and nature of the violation, is a key benefit.

Maintaining a positive reputation, crucial for attracting investors, customers, and talent, is another significant advantage. A company known for its ethical and compliant practices enjoys a competitive edge in the market.

Long-Term Financial Implications of Non-Compliance

Non-compliance carries significant long-term financial risks. Fines levied by regulatory bodies can cripple even large companies. Furthermore, lawsuits from customers, employees, or other stakeholders harmed by non-compliant practices can lead to exorbitant legal fees and damage awards. Beyond direct financial penalties, reputational damage can severely impact a company’s bottom line. Loss of customer trust, decreased investor confidence, and difficulty attracting and retaining top talent all contribute to reduced profitability and long-term sustainability.

The BP Deepwater Horizon oil spill, for instance, resulted in billions of dollars in fines, cleanup costs, and reputational damage, demonstrating the devastating financial consequences of non-compliance.

Streamlining Compliance Processes for Cost Reduction

Businesses can significantly reduce compliance costs and improve efficiency through strategic process optimization. This includes implementing robust compliance management systems, automating tasks such as data entry and reporting, and leveraging technology to streamline regulatory compliance processes. Investing in employee training programs can enhance understanding of regulations and minimize the risk of unintentional violations. Regular audits and risk assessments can identify potential vulnerabilities and allow for proactive mitigation strategies.

Outsourcing certain compliance functions to specialized firms can also be a cost-effective solution for smaller businesses lacking the internal resources.

Comparative Costs of Compliance and Non-Compliance Across Industries

The costs of compliance and non-compliance vary significantly across different industry sectors due to differing regulatory landscapes and risk profiles. The following table provides a simplified comparison, highlighting the potential net benefit of compliance:

| Industry | Compliance Costs (Estimated Annual) | Non-Compliance Costs (Potential, per major violation) | Net Benefit of Compliance |

|---|---|---|---|

| Pharmaceuticals | $1M – $5M | $10M – $100M+ (fines, lawsuits, recalls) | Significant cost savings and reputational protection outweigh compliance costs. |

| Finance | $500k – $2M | $5M – $50M+ (fines, lawsuits, reputational damage) | Compliance prevents significant financial and reputational harm. |

| Healthcare (Hospitals) | $250k – $1M | $1M – $20M+ (fines, lawsuits, loss of accreditation) | Compliance protects patient safety and ensures continued operation. |

| Manufacturing | $100k – $500k | $500k – $10M+ (fines, lawsuits, product recalls) | Compliance minimizes operational disruptions and avoids costly penalties. |

*Note: These figures are estimates and can vary widely based on company size, specific regulations, and the nature of any violations.*

Effective Compliance Strategies

Successfully navigating the complexities of compliance requires a proactive and strategic approach. It’s no longer enough to simply react to regulatory changes; businesses must integrate compliance into their core operations, fostering a culture that values ethical conduct and legal adherence. This involves a multifaceted strategy encompassing best practices, technological solutions, robust employee training, and a forward-thinking mindset.

Best Practices for Effective and Efficient Compliance Management

Effective compliance isn’t about simply checking boxes; it’s about embedding a culture of compliance throughout the organization. This involves establishing clear lines of responsibility, implementing robust internal controls, and consistently monitoring compliance performance. Regular audits, both internal and external, are crucial for identifying weaknesses and ensuring ongoing adherence to regulations. Furthermore, fostering open communication and providing clear channels for reporting potential compliance issues is essential for early detection and remediation.

A commitment to continuous improvement, adapting to evolving regulations and best practices, is vital for long-term success.

Technology and Tools for Streamlining Compliance Efforts

A range of technologies can significantly enhance compliance efforts. Compliance management software, for example, can automate tasks such as policy distribution, training tracking, and audit scheduling, freeing up valuable time and resources. Data analytics tools can help identify potential compliance risks by analyzing large datasets for patterns and anomalies. Workflow automation software can streamline processes, reducing the risk of human error and ensuring consistency.

Finally, secure document management systems help organizations maintain accurate and readily accessible records, crucial for audits and investigations. These technologies, when integrated effectively, can significantly reduce the burden of compliance while enhancing its effectiveness.

Employee Training and Education for a Culture of Compliance

Employee training is the cornerstone of a strong compliance program. Comprehensive training programs should cover relevant regulations, company policies, and ethical considerations. Training should be engaging and interactive, utilizing various methods such as online modules, workshops, and role-playing exercises to ensure knowledge retention. Regular refresher training is essential to keep employees updated on changes in regulations and best practices.

Furthermore, establishing a clear reporting mechanism for compliance concerns empowers employees to raise issues without fear of reprisal, fostering a culture of transparency and accountability. A well-trained workforce is more likely to understand and adhere to compliance requirements, minimizing risks and improving overall performance.

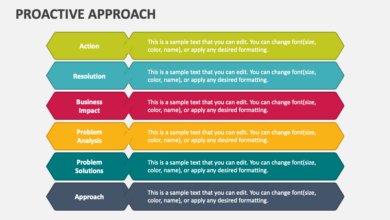

Proactive Compliance: Minimizing Risks and Improving Business Performance

A proactive approach to compliance goes beyond simply reacting to regulations; it anticipates potential issues and takes steps to mitigate them. This involves conducting regular risk assessments to identify potential vulnerabilities, developing comprehensive compliance policies and procedures, and implementing robust monitoring mechanisms. A proactive approach allows organizations to address issues before they escalate, reducing the risk of fines, legal action, and reputational damage.

Furthermore, a strong compliance program can enhance investor confidence, improve operational efficiency, and strengthen relationships with stakeholders. By embedding compliance into the organization’s DNA, businesses can reap both ethical and financial benefits.

Misconceptions About Compliance

Many businesses struggle with compliance, often feeling overwhelmed by the perceived burden. However, a significant portion of this struggle stems not from the regulations themselves, but from widespread misconceptions about their nature and impact. These misconceptions inflate the perceived cost and difficulty, leading to ineffective strategies and ultimately, increased risk. Understanding these myths is crucial for developing a more realistic and effective approach to compliance.Many businesses harbor incorrect assumptions about compliance regulations, significantly impacting their approach and resource allocation.

These misconceptions often stem from a lack of clear understanding of the regulations, coupled with fear of penalties. This leads to a perception that compliance is a costly and time-consuming process with little tangible benefit, hindering the adoption of effective compliance strategies. In reality, a proactive and well-planned approach to compliance can actually reduce costs and risks in the long run.

Compliance is Only About Avoiding Penalties

This is perhaps the most prevalent misconception. While avoiding penalties is certainly a key outcome, compliance is far more than simply ticking boxes to avoid fines. A robust compliance program fosters a culture of ethical conduct, enhances operational efficiency, protects brand reputation, and builds trust with stakeholders. For example, a company that prioritizes data privacy not only avoids hefty fines for non-compliance with GDPR but also strengthens customer trust, attracting and retaining valuable clients.

This translates into a competitive advantage and increased profitability.

Compliance is a One-Time Project

Compliance is not a one-off task; it’s an ongoing process that requires continuous monitoring, adaptation, and improvement. Regulations change, business operations evolve, and new risks emerge. A static compliance program is quickly rendered obsolete and ineffective. For instance, a company that achieves ISO 9001 certification must maintain rigorous internal audits and adapt its processes to remain compliant with the evolving standard.

Ignoring this dynamic nature leads to increased vulnerability and potential non-compliance.

Compliance Hinders Innovation

Some believe that compliance regulations stifle innovation and creativity. However, this is a false dichotomy. A well-structured compliance program can actually facilitate innovation by providing a framework for responsible development and deployment of new products and services. By proactively addressing potential compliance issues during the design phase, businesses can avoid costly setbacks and delays later on. For example, a pharmaceutical company adhering to stringent clinical trial regulations may face initial delays, but the rigorous testing process ultimately ensures the safety and efficacy of its products, fostering greater trust and innovation in the long run.

Small Businesses are Exempt from Compliance

The size of a business does not exempt it from compliance obligations. While the specific regulations and their enforcement may differ, all businesses, regardless of size, must adhere to relevant laws and regulations. Ignoring this can lead to significant penalties and reputational damage. A small bakery, for example, must still comply with food safety regulations, just as a large multinational corporation must comply with international trade laws.

The misconception of exemption often leads to a lack of preparedness and increases the risk of non-compliance.

Common Myths Surrounding Compliance

Let’s address some common myths with factual evidence:

- Myth: Compliance is too expensive. Fact: The cost of non-compliance (fines, lawsuits, reputational damage) often far outweighs the cost of proactive compliance.

- Myth: Compliance is only for large corporations. Fact: All businesses, regardless of size, are subject to various regulations.

- Myth: Compliance is a burden, not a benefit. Fact: Compliance fosters trust, improves efficiency, and mitigates risks.

- Myth: Compliance is a static process. Fact: Regulations evolve, requiring continuous monitoring and adaptation.

- Myth: Compliance stifles innovation. Fact: A well-designed compliance program can actually support responsible innovation.

The Role of Technology in Compliance: Myths Compliance Is Too Much

Navigating the complex landscape of regulatory compliance can feel overwhelming, but technology offers a powerful toolkit to simplify and streamline the process. By automating tasks, analyzing data, and providing real-time insights, technological solutions can significantly reduce the perceived burden of compliance, improve efficiency, and ultimately minimize the risk of non-compliance. This allows businesses to focus on their core activities while maintaining a strong commitment to ethical and legal standards.

Automating Compliance Processes

Technology plays a crucial role in automating many repetitive and time-consuming compliance tasks. For example, software can automate the collection and processing of employee data for background checks, ensuring consistent application of policies and reducing manual errors. Automated workflows can also track training completion, manage document version control, and generate reports, freeing up compliance officers to focus on more strategic initiatives.

The benefits extend to areas like data privacy, where automated systems can assist with data subject requests and the implementation of data retention policies. Consider the example of a large financial institution using robotic process automation (RPA) to automatically reconcile transactions and flag potential irregularities for review, drastically reducing the time and resources needed for this critical compliance function.

Benefits of Compliance Management Software

Compliance management software (CMS) provides a centralized platform for managing all aspects of a company’s compliance program. This includes features like policy management, risk assessment, audit tracking, and reporting. Using CMS improves efficiency by centralizing information, automating workflows, and providing a single source of truth for compliance data. This reduces the risk of errors associated with manual processes and ensures consistent application of policies across the organization.

Furthermore, CMS often incorporates features to facilitate communication and collaboration among compliance teams and stakeholders, fostering a more robust and effective compliance culture. For instance, a healthcare provider might use CMS to manage HIPAA compliance, ensuring all employees receive necessary training, documents are properly secured, and audit trails are maintained, all within a single, easily accessible system.

Utilizing Data Analytics for Risk Identification, Myths compliance is too much

Data analytics offers a powerful tool for identifying potential compliance risks. By analyzing large datasets, companies can identify patterns and anomalies that might indicate non-compliance. For example, analyzing transaction data can reveal potential instances of fraud or money laundering. Analyzing employee data can help identify potential conflicts of interest or violations of internal policies. This proactive approach to risk management allows companies to address potential issues before they escalate, preventing costly fines and reputational damage.

Imagine a retail company using data analytics to detect unusual patterns in sales transactions, which might signal fraudulent activity or indicate a need to review and update their anti-fraud policies.

Visual Representation of Streamlined Compliance Workflows

Imagine a flowchart. The process begins with a “Request for Information” box, representing the initial trigger for a compliance activity. This flows into a “Data Collection” box, where automated systems gather relevant information from various sources. Next, the flow moves to a “Data Analysis” box, where algorithms identify potential risks and inconsistencies. From there, the process branches.

If no risks are identified, the flow goes to a “Compliance Confirmed” box, concluding the process. If risks are identified, the flow moves to a “Risk Assessment” box, where the severity and potential impact of the risk are determined. This leads to a “Remediation Plan” box, where steps are Artikeld to address the identified risk. Finally, the process concludes with a “Compliance Achieved” box, signifying the successful resolution of the compliance issue.

This entire workflow is managed within the compliance management software, significantly reducing manual intervention and ensuring a consistent and efficient approach to compliance.

Last Word

So, is compliance too much? The answer, as with most things, is nuanced. While the initial perception might be one of overwhelming burden, a strategic and proactive approach, coupled with the right technology and employee training, can transform compliance from a dreaded chore into a streamlined, even beneficial, process. By understanding the real costs of non-compliance and leveraging available resources, businesses can not only meet their regulatory obligations but also strengthen their reputations and improve their bottom line.

It’s about shifting from reactive firefighting to proactive risk management – a change that can make all the difference.

FAQ Resource

What are the most common penalties for non-compliance?

Penalties vary widely depending on the industry and the severity of the violation. They can range from hefty fines and legal fees to reputational damage, loss of contracts, and even criminal charges in some cases.

How can I determine which compliance regulations apply to my business?

Start by identifying your industry and location. Government websites and industry associations are great resources for finding relevant regulations. Consult with legal counsel for expert guidance.

Is there a single, universally applicable compliance software solution?

No, the ideal solution depends on your specific needs and industry. Research different options and choose one that aligns with your size, complexity, and regulatory requirements.