A Spell Check Equivalent for Building Security In

A spell check equivalent for building security in? It sounds strange, right? But think about it: spell check catches typos, preventing miscommunication. Similarly, robust building security systems aim to catch vulnerabilities before they become disasters. This post explores the parallels between catching a simple typo and preventing a catastrophic building failure, examining automated security checks, the crucial role of human expertise, and the importance of continuous monitoring to build a truly secure structure.

We’ll delve into the types of automated checks used in construction and maintenance, highlighting their strengths and limitations. We’ll also explore how human oversight is essential to catch those “typos” that automated systems might miss – those critical flaws that only a trained eye can detect. Think of it as having a highly skilled proofreader reviewing your most important document – your building’s safety and security.

Analogies to Spell Check: A Spell Check Equivalent For Building Security In

We all know and love spell check. That little squiggly red line under a misspelled word is a constant companion for writers everywhere. But how well does this familiar tool translate to the world of building security? Thinking about building security through the lens of spell check offers a surprisingly insightful analogy, highlighting both the strengths and limitations of automated security checks.Spell check operates by comparing the words you type against a massive dictionary.

If a word isn’t found, it flags it as potentially misspelled. It can also identify some grammatical errors, though its capabilities are limited. For instance, spell check might miss a misused word (e.g., “there” instead of “their”) because both words are correctly spelled. Similarly, it can’t catch more nuanced errors in sentence structure or style. Its power lies in quickly identifying common, easily fixable errors.

Spell Check’s Error Detection and Building Security Vulnerabilities

The analogy to building security is straightforward. Think of a building security scan as a sophisticated spell check for your physical structure. Just as spell check looks for misspelled words, a security scan looks for vulnerabilities – weaknesses in the building’s design, construction, or security systems that could be exploited by intruders. A missing window lock (like a misspelled word) is easily identified and relatively simple to fix.

However, more complex issues, such as structural weaknesses or poorly designed access control systems, require a much deeper analysis.

Differences Between Identifying Typos and Identifying Security Flaws

Identifying a typo is a relatively simple task. Spell check provides a clear indication of the problem, and the correction is often straightforward. Identifying security flaws, on the other hand, is far more complex. It requires specialized knowledge, advanced tools, and a thorough understanding of potential threats. A security flaw might not be immediately apparent, and its implications could be far-reaching.

For example, a seemingly minor flaw in a fire suppression system could have catastrophic consequences.

Speed and Accuracy Comparison: Spell Check vs. Automated Building Security Scans

Spell check is incredibly fast and generally quite accurate at identifying simple spelling errors. It provides near-instant feedback, allowing for quick corrections. Automated building security scans are also relatively fast, but their accuracy can vary significantly depending on the sophistication of the scan and the complexity of the building’s systems. A basic scan might quickly identify obvious vulnerabilities, but a thorough assessment, including physical inspections and penetration testing, is often necessary to uncover more subtle flaws.

The speed-accuracy trade-off is a key consideration in both contexts. A quick scan might miss crucial vulnerabilities, while a comprehensive scan can be time-consuming and expensive.

Automated Security Checks

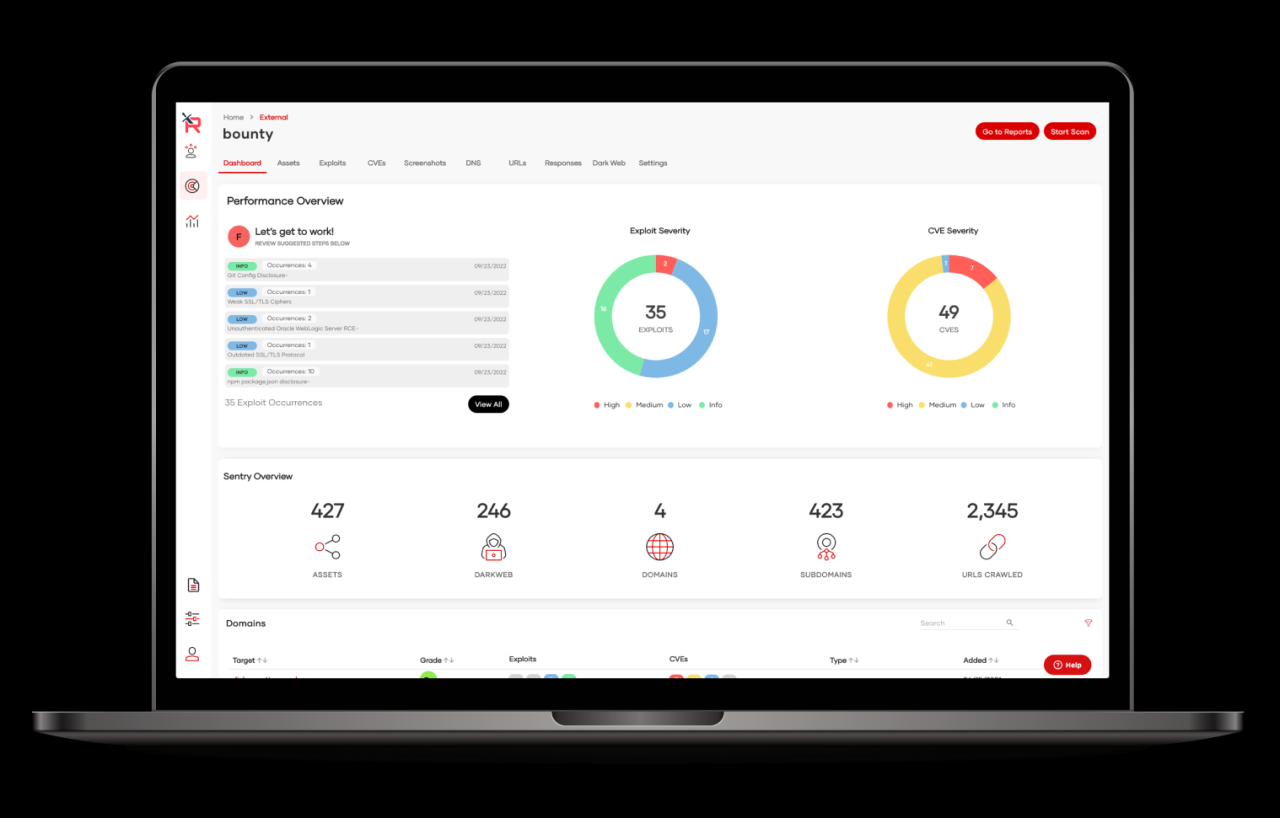

Building security, much like the grammar of a well-written sentence, requires careful attention to detail and a robust system of checks and balances. Automated security checks play a crucial role in ensuring that buildings are safe, functional, and compliant with regulations. These checks, performed during construction and throughout the building’s lifecycle, help to identify potential vulnerabilities before they can lead to serious incidents.Automated security checks in building construction and maintenance encompass a wide range of technologies and processes, from simple visual inspections to sophisticated sensor networks.

The goal is proactive identification of weaknesses and potential threats to ensure the safety and security of occupants and assets.

Types of Automated Security Checks

Automated security checks can be broadly categorized into several types. Structural integrity checks might involve using drones equipped with high-resolution cameras and sensors to inspect facades for cracks or deterioration. Electrical system checks might leverage thermal imaging to detect overheating components that could lead to fires. Fire safety checks often utilize automated smoke detectors and sprinkler system testing.

Access control systems can be monitored remotely for unauthorized entry attempts. Finally, sophisticated building management systems (BMS) integrate data from various sensors and systems to provide a holistic view of building security. This allows for early detection of anomalies and potential issues across multiple systems.

Potential Building Security Vulnerabilities

Buildings are susceptible to various security vulnerabilities across different systems. Understanding these vulnerabilities is the first step towards implementing effective mitigation strategies. Ignoring these vulnerabilities can lead to significant financial losses, reputational damage, and even loss of life.

Wouldn’t it be amazing to have a spell check equivalent for building secure applications? Something that instantly flags vulnerabilities before they become a problem. This is especially crucial when you consider the rapid development enabled by platforms like those discussed in this insightful article on domino app dev the low code and pro code future , where speed and security must go hand-in-hand.

A built-in security “spell check” could revolutionize app development, catching potential flaws early and preventing costly headaches down the line.

| Vulnerability Type | Potential Impact | Mitigation Strategies | Automated Check Example |

|---|---|---|---|

| Structural | Collapse, injury, property damage | Regular inspections, load testing, reinforcement | Drone-based visual inspection, structural analysis software |

| Electrical | Fire, electrocution, power outages | Regular maintenance, circuit breaker testing, grounding | Thermal imaging, automated circuit testing |

| Fire | Loss of life, property damage, business interruption | Fire alarms, sprinklers, fire-resistant materials | Automated smoke detector testing, sprinkler system pressure checks |

| Access Control | Unauthorized entry, theft, vandalism | Secure locks, keycard systems, surveillance cameras | Real-time monitoring of access control logs, intrusion detection systems |

How Automated Checks Identify Vulnerabilities

Different automated checks employ various methods to detect vulnerabilities. For instance, drone-based inspections can quickly identify cracks or damage on building facades, which might indicate structural weaknesses. Thermal imaging can pinpoint electrical hotspots that could indicate a fire risk. Automated smoke detector testing ensures that these critical safety devices are functioning correctly. Finally, the analysis of access control logs can reveal patterns of unauthorized access attempts, alerting security personnel to potential breaches.

The integration of these automated checks allows for a more comprehensive and proactive approach to building security, leading to earlier identification and mitigation of potential risks.

Human Oversight and Expertise

Automated security checks, while incredibly valuable in identifying many potential vulnerabilities, are not a panacea. They represent a powerful first line of defense, akin to a spell checker catching obvious typos, but they can’t replace the nuanced understanding and critical thinking of a human expert. A truly robust building security system requires a blend of automated tools and skilled human oversight.Building security is far more complex than simply identifying a missing bolt or a faulty alarm system.

Human expertise is crucial in interpreting data, understanding context, and anticipating threats that automated systems might miss. Think of it like this: a spell checker can flag “teh” as incorrect, but only a human can understand the subtle nuances of language and context to correct “their” to “there” when the automated system fails to detect the error.

Examples of Automated System Failures, A spell check equivalent for building security in

Automated systems often struggle with identifying subtle, context-dependent vulnerabilities. For instance, an access control system might flag an unusual number of entries during a specific time, but it wouldn’t necessarily understand that this is due to a legitimate large-scale event, like a conference, occurring within the building. Similarly, a fire alarm system might correctly detect smoke, but a human expert is needed to assess whether the smoke indicates a real fire or a false alarm triggered by cooking fumes.

Automated intrusion detection systems might flag unusual network activity, but a human is needed to determine if this activity is malicious or simply a result of a software update. These are just a few examples of where automated systems alone can fall short.

Essential Skills and Knowledge for Building Security Review

Effective building security review requires a diverse skillset. Experts need a strong understanding of building codes and regulations, as well as knowledge of various security systems, including access control, CCTV, intrusion detection, and fire protection. Furthermore, they should possess a deep understanding of potential threats and vulnerabilities, including both physical and cyber threats. Critical thinking, problem-solving abilities, and the ability to interpret data from multiple sources are also essential.

A strong background in risk assessment and mitigation strategies is also paramount.

Human Expertise Complementing Automated Checks

Human expertise acts as a crucial layer of verification and interpretation for the data generated by automated systems. A human expert can analyze the output of automated checks, identify false positives, and investigate potential vulnerabilities that the automated systems might have missed. This combination creates a more comprehensive and effective security system. For example, an automated system might flag a consistently unlocked door, but a human expert can investigate the reason behind this – perhaps it’s a designated emergency exit or a door requiring frequent access for deliveries.

By combining the speed and efficiency of automated checks with the critical thinking and contextual understanding of human experts, organizations can significantly enhance their overall building security posture.

Continuous Monitoring and Improvement

Building security, much like a complex software program, requires constant vigilance and iterative improvement. A single security check, like a single spell check, isn’t enough to guarantee long-term protection. Continuous monitoring, regular updates, and a proactive approach to vulnerability management are essential for maintaining a robust and effective security posture. This involves a multi-faceted strategy that combines technological solutions with human expertise and a commitment to ongoing learning.A comprehensive system for continuous monitoring needs to encompass several key components.

This ensures that potential weaknesses are identified and addressed promptly, preventing breaches before they occur. It also provides valuable data to inform future improvements and enhance the overall effectiveness of the security system.

Regular Inspections and System Updates

Regular inspections should be scheduled and documented. These inspections aren’t simply visual sweeps; they involve a thorough assessment of all security systems, including access control points, surveillance cameras, alarm systems, and fire safety equipment. A checklist approach, detailing specific points to examine, ensures consistency and thoroughness. For example, a monthly inspection might focus on the functionality of door access readers, while a quarterly inspection might delve into the effectiveness of CCTV camera coverage and blind spots.

These inspections should be carried out by trained personnel and the findings meticulously recorded. Simultaneously, regular software and firmware updates for all security systems are crucial. These updates often patch known vulnerabilities and improve system performance, minimizing the risk of exploitation. Failure to update systems creates significant security risks, leaving the building vulnerable to known attack vectors.

For example, outdated access control software might contain vulnerabilities that allow unauthorized access.

Vulnerability Remediation and System Improvements

Identifying vulnerabilities is only half the battle; addressing them effectively is crucial. Regular security audits, penetration testing, and vulnerability scans should be conducted to identify weaknesses in the building’s security infrastructure. For instance, a penetration test might reveal a weakness in the network security that allows unauthorized access to internal systems. Once identified, these vulnerabilities should be addressed promptly through appropriate remediation strategies.

This might involve upgrading software, implementing stronger access controls, improving physical security measures, or retraining personnel. For example, if a vulnerability is discovered in the building’s fire alarm system, it would require immediate attention, potentially involving repairs, replacements, or even a complete system overhaul. The process should be documented, and the effectiveness of the remediation verified.

Importance of Regular Maintenance and Updates

Regular maintenance is paramount in maintaining building security. This goes beyond software updates; it includes the physical upkeep of security equipment and infrastructure. For instance, ensuring that surveillance cameras are properly cleaned and adjusted to maintain optimal viewing angles is critical. Similarly, regular testing of fire suppression systems and emergency exits is crucial to ensure their functionality in the event of an emergency.

Neglecting maintenance can lead to system failures, rendering security measures ineffective. The cost of preventative maintenance is significantly lower than the cost of responding to a security breach or a system failure. Proactive maintenance also helps to extend the lifespan of security equipment, reducing the need for frequent replacements.

Incorporating Feedback and Lessons Learned

The process of continuous improvement involves actively incorporating feedback and lessons learned from past incidents, audits, and inspections. This feedback loop is crucial for refining security protocols and adapting to evolving threats. For example, if a security breach reveals a weakness in the access control system, the feedback should be used to improve the system’s design, strengthen access controls, or implement additional security measures.

This iterative process allows for the continuous refinement of security protocols, ensuring they remain effective against emerging threats and vulnerabilities. Post-incident analysis should be conducted to understand the root causes of security incidents, identify areas for improvement, and develop strategies to prevent similar incidents in the future. This might involve changes to procedures, training programs, or even the acquisition of new security technologies.

Visual Representations of Security Flaws

Identifying security weaknesses in a building often involves recognizing visual cues. These visible signs can range from subtle cracks indicating structural compromise to obvious signs of electrical system damage. Understanding these visual indicators is crucial for proactive security management. This section details common visual representations of building security flaws across structural, electrical, and fire safety systems.

Compromised Structural Element

A compromised structural element, such as a load-bearing wall or column, might exhibit several visible signs of weakness. Cracks, especially those that are wide, deep, or running vertically, are significant indicators. These cracks might be accompanied by bulging or bowing of the wall or column, indicating a shift in the structural integrity. Loose or crumbling mortar between bricks or blocks is another clear sign.

In severe cases, visible deflection or leaning of the structural element may be evident, posing an immediate safety risk. For instance, a load-bearing wall showing significant diagonal cracking and a noticeable outward bulge clearly indicates a serious structural compromise, potentially caused by foundation settlement or overloading. This requires immediate professional assessment and remediation.

Compromised Electrical System

Visible signs of a compromised electrical system can range from minor issues to serious hazards. Frayed or exposed wiring, particularly if it’s sparking or showing signs of burning, is a major safety concern and a clear indication of a compromised system. Overloaded circuits might manifest as flickering lights, tripped circuit breakers, or even burning outlets. Loose connections or improperly installed wiring may be visible, especially in older buildings or areas where modifications have been made without proper electrical expertise.

Burn marks on walls or outlets near electrical fixtures can indicate overheating and potential fire hazards. For example, exposed wiring hanging from a ceiling, showing signs of insulation damage and sparking, is a clear sign of an immediate and serious electrical system compromise that needs immediate attention from qualified professionals.

Fire Safety Deficiency

Fire safety deficiencies often present visible signs of neglect or malfunction. Blocked fire exits, whether by stored materials or debris, are a serious violation and easily identifiable. Damaged or missing fire extinguishers, along with expired pressure gauges, are obvious indicators of neglect. Malfunctioning smoke detectors, indicated by a non-responsive alarm or a blinking light indicating a low battery, represent a critical fire safety risk.

Similarly, a fire alarm system that is not properly maintained might show signs of corrosion, damage to the control panel, or broken or missing components. For example, a fire exit blocked by stacked boxes and construction materials is a clear visual indication of a fire safety deficiency that can lead to dangerous delays during evacuation.

End of Discussion

Building security, much like writing a flawless document, requires a multi-faceted approach. While automated checks are invaluable for identifying common vulnerabilities, they are only part of the equation. Human expertise, continuous monitoring, and a commitment to improvement are crucial for creating truly secure buildings. By combining the speed and efficiency of automated systems with the insight and experience of human professionals, we can build structures that are not only structurally sound but also safe and secure for everyone who occupies them.

Think of it as a robust, layered security system, where each layer adds to the overall protection.

User Queries

What are the limitations of automated building security checks?

Automated checks excel at identifying common vulnerabilities, but they can miss complex or subtle issues requiring human expertise. They may also struggle with interpreting ambiguous data or adapting to unexpected situations.

How often should building security inspections be conducted?

The frequency depends on factors like building type, age, and use. Regular inspections, at least annually, are recommended, with more frequent checks for high-risk structures or those in need of maintenance.

What is the cost of implementing a comprehensive building security system?

Costs vary greatly depending on the size and complexity of the building, the types of security measures implemented, and the level of ongoing maintenance required. A thorough cost-benefit analysis is essential.