The Price of a Breach Is an Executives Future

The price of a breach is an executives future – The price of a breach is an executive’s future. This isn’t just a dramatic statement; it’s the harsh reality facing leaders in today’s hyper-connected world. Data breaches are no longer a matter of “if,” but “when,” and the consequences for those at the helm can be devastating – financially, reputationally, and even legally. This post dives into the very real risks executives face, exploring the financial fallout, reputational damage, and the proactive steps needed to safeguard both their careers and their companies.

We’ll examine real-world examples of executives who paid the price for security failures, analyzing the specific actions (or lack thereof) that led to their downfall. We’ll also explore the evolving legal landscape, the crucial role of cybersecurity insurance, and the importance of fostering a culture of security awareness within an organization. Ultimately, we aim to provide a clear picture of the stakes involved and offer practical strategies for mitigating risk and protecting the future.

Defining the Scope: Executive Accountability for Data Breaches

The increasing reliance on digital systems and the interconnected nature of modern businesses have made data breaches a significant threat, carrying substantial legal and financial repercussions. Executives, as the ultimate decision-makers and leaders within their organizations, are increasingly held accountable for the prevention and mitigation of such breaches. This accountability stems from a complex interplay of legal frameworks, industry best practices, and the inherent responsibility of leadership to protect organizational assets, including sensitive data.Executive liability in data breaches isn’t simply a matter of negligence; it extends to a spectrum of actions and inactions, from failing to implement adequate security measures to actively concealing or mismanaging a breach.

The severity of consequences directly correlates with the scale of the breach, the type of data compromised, and the demonstrable level of executive oversight (or lack thereof).

Legal and Regulatory Frameworks Impacting Executive Liability

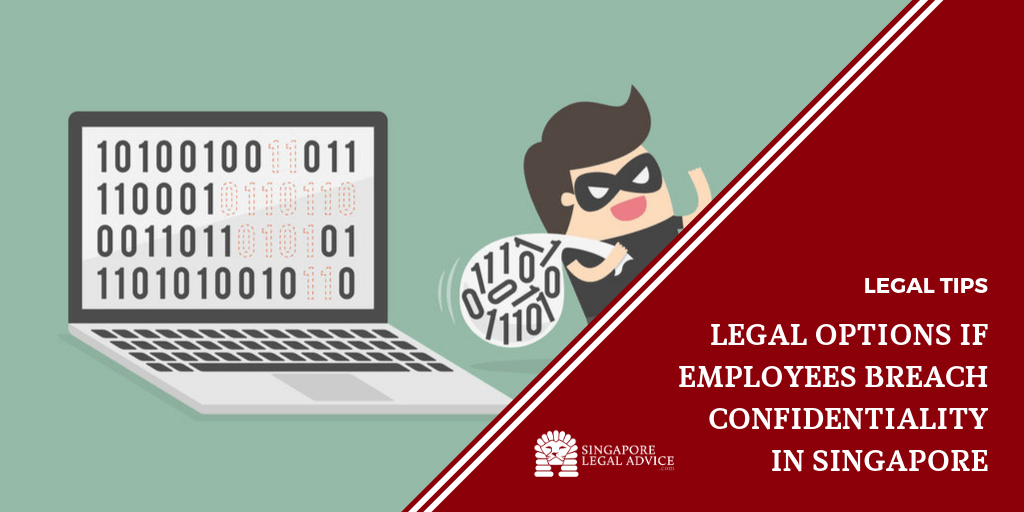

Several legal and regulatory frameworks globally impact executive liability in data breaches. The General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA) in the United States, and similar legislation in other jurisdictions impose stringent requirements on organizations to protect personal data. Failure to comply can result in significant fines, levied not only on the company but also potentially on individual executives responsible for data protection.

These laws often include provisions for personal liability for directors and officers, particularly when negligence or willful misconduct is demonstrated. Furthermore, common law principles of negligence and breach of fiduciary duty can also be invoked to hold executives accountable. These principles often hold executives liable for failing to exercise reasonable care in protecting company assets, including data.

Types of Breaches and Their Consequences

Data breaches vary widely in nature and severity. A simple phishing attack leading to the compromise of a few employee accounts differs drastically from a sophisticated ransomware attack targeting an entire company database. The type of data breached is also crucial. The unauthorized access to personally identifiable information (PII), financial data, or protected health information (PHI) carries significantly higher consequences than the compromise of less sensitive data.

The response to a breach is equally important. A timely and transparent response can mitigate damage, while a delayed or inadequate response can significantly exacerbate the consequences, leading to greater financial losses, reputational damage, and increased legal liability for executives.

Real-World Cases of Executive Repercussions

Several real-world cases illustrate the potential consequences executives face due to data breaches. For example, the Yahoo! data breaches, which exposed billions of user accounts, resulted in significant fines and reputational damage for the company. While no executives were directly prosecuted, the incident highlighted the severe consequences of inadequate security measures and their impact on executive credibility. Similarly, the Equifax data breach, which exposed sensitive personal information of millions of consumers, led to investigations, lawsuits, and the resignation of several top executives, including the CEO.

These cases underscore the critical importance of robust data security protocols and effective executive oversight.

Executive Responsibilities in Different Industries

| Industry | Executive Role | Responsibilities | Potential Consequences of Breach |

|---|---|---|---|

| Healthcare | CEO | Ensuring HIPAA compliance, implementing robust data security measures, overseeing incident response planning. | Significant fines, legal action, reputational damage, criminal charges (in severe cases). |

| Finance | CFO | Protecting financial data, implementing strong cybersecurity controls, complying with regulations like PCI DSS. | Heavy fines, legal repercussions, loss of investor confidence, potential criminal charges. |

| Technology | CTO | Developing and maintaining secure systems, implementing vulnerability management programs, ensuring data encryption. | Significant fines, reputational damage, loss of market share, potential legal action. |

| Retail | COO | Protecting customer data, complying with data privacy regulations, managing incident response. | Fines, legal action, reputational damage, loss of customer trust. |

Financial Ramifications: The Price Of A Breach Is An Executives Future

Data breaches are devastating, not just for the compromised data itself, but for the significant financial fallout they unleash. The costs extend far beyond the immediate expenses of investigation and remediation, impacting a company’s bottom line in ways that can take years to recover from. Understanding the multifaceted nature of these costs is crucial for effective risk management.The direct and indirect financial consequences of a data breach can be staggering.

Direct costs include immediate expenses like incident response, legal fees, regulatory fines, and credit monitoring services for affected individuals. Indirect costs, however, often dwarf these figures. They encompass reputational damage leading to customer churn and loss of future business, decreased stock value, increased insurance premiums, and the expense of rebuilding trust. The longer a breach goes undetected and the more sensitive the data compromised, the greater the potential financial burden.

Direct Financial Costs of Data Breaches

Direct costs are the immediate, tangible expenses incurred as a direct result of a data breach. These include the costs associated with investigating the breach, notifying affected individuals, implementing remediation measures, and paying fines levied by regulatory bodies. For instance, the cost of hiring forensic investigators to determine the extent of the breach, the nature of the compromised data, and the source of the attack can run into tens of thousands of dollars.

Legal fees, particularly if lawsuits ensue, can escalate exponentially. Furthermore, regulatory fines, such as those imposed under GDPR or CCPA, can reach millions depending on the severity and nature of the breach and the number of affected individuals. The cost of providing credit monitoring services to victims adds another layer of expense. These costs are immediate and easily quantifiable, forming a substantial portion of the overall financial impact.

Indirect Financial Costs of Data Breaches

The indirect costs associated with a data breach are often more significant and harder to quantify than the direct costs. These costs stem from the long-term consequences of a breach, including reputational damage, loss of customer trust, and decreased market value. Reputational harm can manifest in various ways, from negative media coverage and social media backlash to a decline in customer loyalty and a loss of potential business.

The cost of rebuilding trust and restoring a positive brand image is difficult to measure but can represent a substantial financial investment. A drop in stock price following a public disclosure of a breach can wipe millions or even billions off a company’s market capitalization, impacting investor confidence and making future fundraising more difficult.

Hypothetical Scenario: Stock Price Impact

Imagine a major retailer, “MegaMart,” experiences a data breach exposing millions of customer credit card numbers and personal information. News of the breach breaks, leading to immediate negative media coverage and social media outrage. Investor confidence plummets, causing a significant drop in MegaMart’s stock price, perhaps as much as 20% within the first week. This immediate loss represents a considerable financial blow, and further losses could be sustained as customers switch to competitors, resulting in decreased sales and profits in subsequent quarters.

The long-term impact on the company’s market value could be substantial, requiring years to fully recover. This scenario highlights the devastating consequences of a data breach that extends far beyond the direct costs of remediation.

Cyber Insurance and Mitigation

Cyber insurance policies are designed to help organizations mitigate the financial risks associated with data breaches. These policies typically cover costs associated with incident response, legal fees, regulatory fines, notification costs, and even business interruption losses. However, the cost of cyber insurance premiums varies significantly based on the size and nature of the organization, the type of data handled, and the organization’s existing security posture.

Choosing the right coverage is critical; a poorly designed policy might leave significant gaps in protection, while an overly comprehensive policy could prove prohibitively expensive. The key is to find a balance that provides adequate protection without placing an undue financial burden on the organization.

Cost-Saving Measures to Reduce Vulnerability

Implementing robust security measures is not just about compliance; it’s a crucial investment in protecting a company’s financial future. Proactive steps can significantly reduce the likelihood and impact of a data breach.

- Regular security awareness training for employees to reduce human error, a major cause of many breaches.

- Multi-factor authentication (MFA) to enhance account security and make it more difficult for attackers to gain unauthorized access.

- Regular vulnerability scanning and penetration testing to identify and address security weaknesses before attackers can exploit them.

- Robust data encryption both in transit and at rest to protect sensitive data even if a breach occurs.

- Implementing a comprehensive incident response plan to minimize the impact of a breach should one occur.

- Investing in advanced security technologies, such as intrusion detection and prevention systems (IDS/IPS), to detect and block malicious activity.

Reputational Damage and Career Impact

A data breach isn’t just a technical problem; it’s a crisis that can irrevocably damage a company’s reputation and severely impact the careers of its executives. The loss of customer trust, the erosion of brand loyalty, and the potential for legal repercussions create a perfect storm that can sink even the most successful businesses and the individuals at their helm.

Understanding the scope of this damage is crucial for effective mitigation and proactive risk management.The fallout from a data breach extends far beyond immediate financial losses. A compromised database can lead to a significant decline in customer confidence. Customers may switch to competitors, fearing the security of their personal information. This loss of trust can take years, even decades, to rebuild, impacting future revenue streams and overall business viability.

The negative publicity surrounding the breach can also damage a company’s brand image, potentially making it harder to attract investors and recruit top talent. This reputational damage isn’t merely an abstract concept; it translates into quantifiable losses in market share, brand value, and overall profitability.

Executive Communication Strategies During and After a Data Breach

Effective communication is paramount in mitigating reputational harm following a data breach. Executives must be transparent and proactive in their communication with customers, employees, and investors. A swift and honest acknowledgment of the breach, coupled with a detailed explanation of the steps taken to address the situation and prevent future incidents, can help build trust and limit the spread of misinformation.

Conversely, a delayed or obfuscated response can exacerbate the crisis, leading to increased public anger and regulatory scrutiny. A well-defined communication plan, including pre-prepared statements and designated spokespeople, is essential for a coordinated and effective response. This plan should Artikel key messages, target audiences, and communication channels to ensure consistent messaging across all platforms. For example, a company might use press releases, social media updates, and direct customer communications to disseminate information and address concerns.

Impact of a Data Breach on Executive Careers

The consequences of a data breach can be severe for executives. Depending on the severity of the breach, the executive’s level of responsibility, and the regulatory environment, an executive may face job loss, diminished future career opportunities, and even legal ramifications. In some instances, executives have been forced to resign or have been terminated due to perceived failures in data security oversight.

This can severely impact their future employability, as potential employers may be hesitant to hire individuals associated with a major data breach. Furthermore, executives may face civil lawsuits from affected individuals or regulatory fines from government agencies. The reputational damage can extend beyond the immediate employment situation, making it difficult to secure future leadership positions or board memberships.

The case of Equifax, where executives faced congressional scrutiny and legal action following a massive data breach, serves as a stark reminder of the personal stakes involved.

Reputational Damage Comparison Across Breach Types

The reputational damage caused by a data breach varies depending on the type of data compromised and the affected parties. A breach involving sensitive personal information, such as medical records or financial data, typically results in more severe reputational harm than a breach involving less sensitive information. For instance, a breach exposing customer credit card details will likely generate more negative media attention and public outrage than a breach exposing only email addresses.

Similarly, breaches targeting government agencies or healthcare providers tend to attract more intense scrutiny and criticism than breaches affecting private sector companies. The scale of the breach also matters significantly. A breach affecting millions of individuals will undoubtedly cause more widespread damage than a breach affecting only a few hundred. The company’s response to the breach also plays a critical role; a transparent and proactive response can mitigate some of the reputational damage, while a slow or inadequate response can worsen the situation significantly.

Proactive Measures

The price of a data breach extends far beyond financial losses; it jeopardizes an executive’s career and the organization’s future. A proactive cybersecurity strategy is not merely a cost; it’s an investment in long-term stability and success. This strategy must encompass prevention, response, and a robust culture of security awareness.A comprehensive cybersecurity strategy requires a multi-faceted approach. It’s not enough to rely on a single solution; a layered defense is crucial to effectively mitigate risks.

This involves a combination of technical safeguards, robust incident response planning, and consistent employee training.

Preventative Measures

Implementing preventative measures is the cornerstone of a strong cybersecurity posture. This involves establishing strong access controls, regularly updating software and hardware, and employing robust network security protocols. For example, implementing multi-factor authentication (MFA) adds an extra layer of security, making it significantly harder for unauthorized individuals to access sensitive data, even if they obtain a password. Regular patching of software vulnerabilities prevents attackers from exploiting known weaknesses.

Investing in firewalls and intrusion detection systems provides a crucial first line of defense against malicious actors attempting to penetrate the network. Finally, robust data encryption protects sensitive information even if it falls into the wrong hands.

Incident Response Planning

A well-defined incident response plan is critical for minimizing the damage caused by a successful breach. This plan should Artikel clear procedures for identifying, containing, eradicating, and recovering from a security incident. This includes establishing clear communication channels, designating roles and responsibilities, and conducting regular drills to ensure preparedness. A hypothetical scenario might involve a ransomware attack; the incident response plan would dictate steps to isolate affected systems, negotiate with attackers (if necessary), restore data from backups, and inform relevant stakeholders.

The speed and effectiveness of the response directly impacts the overall damage and reputational harm.

Employee Training Programs

Human error remains a significant vulnerability in many organizations. Comprehensive employee training programs are vital to fostering a culture of cybersecurity awareness. These programs should cover topics such as phishing awareness, password security, social engineering tactics, and safe data handling practices. Regular training sessions, coupled with simulated phishing attacks, help employees identify and report suspicious activity. For instance, employees should be trained to recognize phishing emails that attempt to trick them into revealing sensitive information, such as usernames and passwords.

Investing in training is not merely a compliance requirement; it is a crucial step in building a resilient security posture.

Best Practices for Fostering a Culture of Cybersecurity Awareness

A strong security culture isn’t solely reliant on technology; it necessitates a commitment from leadership and engagement from every employee.

- Lead by Example: Executives must demonstrate their commitment to cybersecurity by actively participating in training and promoting secure practices.

- Clear Communication: Regularly communicate cybersecurity risks and best practices to all employees through various channels.

- Incentivize Security: Reward employees for reporting security incidents and participating in training programs.

- Regular Security Awareness Campaigns: Conduct ongoing campaigns to reinforce security best practices and raise awareness of emerging threats.

- Transparent Reporting: Establish a clear process for reporting and addressing security incidents, fostering trust and open communication.

Regular Security Audits and Vulnerability Assessments

Regular security audits and vulnerability assessments are essential for identifying and addressing potential weaknesses in an organization’s security posture. These assessments provide a snapshot of the current security landscape, highlighting vulnerabilities that could be exploited by attackers. Penetration testing, a simulated attack, helps identify weaknesses before malicious actors can exploit them. Vulnerability scanning tools automate the process of identifying known vulnerabilities in software and hardware.

The findings from these assessments should be prioritized and addressed promptly to minimize the risk of a data breach.

Emerging Security Solutions, The price of a breach is an executives future

The cybersecurity landscape is constantly evolving, with new threats and solutions emerging regularly. Staying abreast of these advancements is crucial for maintaining a strong security posture. Artificial intelligence (AI) and machine learning (ML) are playing an increasingly important role in threat detection and response, automating tasks and improving accuracy. Blockchain technology offers potential for enhancing data security and integrity.

Cloud security solutions provide scalable and flexible security measures for organizations leveraging cloud infrastructure. Investing in and implementing these emerging technologies can significantly enhance data protection and reduce the likelihood of breaches.

The Role of Governance and Oversight

Strong corporate governance is no longer a nice-to-have; it’s a critical component of a robust cybersecurity strategy. A well-defined governance structure isn’t just about compliance; it’s about proactively mitigating risks, fostering a culture of security, and ultimately, protecting the executive team from the devastating consequences of a data breach. This involves clear lines of responsibility, effective oversight mechanisms, and a commitment to continuous improvement.Effective governance structures directly impact an organization’s ability to prevent data breaches and hold executives accountable.

When responsibilities are clearly defined and oversight is robust, individuals are more likely to adhere to security protocols and promptly address vulnerabilities. Conversely, weak governance creates ambiguity, hindering proactive risk management and making it difficult to assign accountability when breaches occur. This directly translates to increased financial losses, reputational damage, and potential legal repercussions for executives.

Board of Directors and Audit Committee Responsibilities

The board of directors bears ultimate responsibility for an organization’s cybersecurity posture. This responsibility extends beyond simply approving budgets; it encompasses setting the strategic direction for cybersecurity, ensuring adequate resources are allocated, and reviewing progress against established goals. The audit committee plays a crucial role in providing independent oversight of the organization’s risk management processes, including cybersecurity. Their responsibilities include reviewing the effectiveness of internal controls, evaluating the organization’s cybersecurity risk assessment and management program, and ensuring that appropriate reporting mechanisms are in place.

Regular, detailed reports from management on cybersecurity incidents and vulnerabilities are essential for the board and audit committee to effectively fulfill their oversight function.

Examples of Effective Governance Frameworks

Several frameworks provide guidance on establishing effective governance structures for cybersecurity. The National Institute of Standards and Technology (NIST) Cybersecurity Framework, for example, offers a voluntary framework that organizations can adapt to their specific needs. It emphasizes risk management, identifying and assessing cybersecurity risks, and developing strategies to manage those risks. Similarly, the ISO 27001 standard provides a comprehensive framework for establishing, implementing, maintaining, and continually improving an information security management system (ISMS).

These frameworks provide a structured approach to managing cybersecurity risks and help organizations demonstrate their commitment to data security, thereby reducing the likelihood of executive liability in the event of a breach. Effective implementation requires clear communication, consistent training, and regular review and updates to reflect evolving threats and best practices.

Comparison of Regulatory Frameworks

Different regulatory frameworks around the world influence executive accountability in data breaches. The impact on executives varies depending on the specific regulations and the jurisdiction.

| Framework | Jurisdiction | Key Provisions | Impact on Executives |

|---|---|---|---|

| General Data Protection Regulation (GDPR) | European Union | Strict data protection rules, high fines for non-compliance, personal liability for data controllers and processors. | Executives can face significant fines, legal action, and reputational damage. Personal liability is a key feature. |

| California Consumer Privacy Act (CCPA) | California, USA | Provides consumers with rights regarding their personal data, including the right to access, delete, and opt-out of data sales. Includes provisions for data breaches. | Executives can face fines and legal action for non-compliance, potentially impacting their careers. |

| New York Cybersecurity Regulations | New York, USA | Mandates specific security practices for businesses handling New York residents’ data, including breach notification requirements. | Executives can face fines and legal action for non-compliance. |

| Australian Privacy Act 1988 | Australia | Sets out principles for the handling of personal information, including requirements for breach notification. | Executives can face fines and legal action for non-compliance, impacting their careers and reputations. |

Closing Summary

In a world increasingly reliant on data, the responsibility for cybersecurity rests squarely on the shoulders of executives. Failing to prioritize data protection isn’t just a business risk; it’s a personal one. The price of a breach extends far beyond financial losses; it impacts careers, reputations, and even personal freedom. By understanding the potential consequences and proactively implementing robust security measures, executives can protect their companies, their employees, and, most importantly, their own futures.

It’s not about avoiding risk entirely, but about mitigating it effectively and strategically.

Questions and Answers

What types of insurance cover data breaches?

Cybersecurity insurance policies often cover various costs associated with data breaches, including legal fees, regulatory fines, public relations expenses, and notification costs to affected individuals.

Can an executive be personally sued after a data breach?

Yes, depending on the jurisdiction, the severity of the breach, and the executive’s role in its occurrence, they could face personal lawsuits, fines, or even criminal charges.

How can I build a strong culture of cybersecurity within my organization?

Start with comprehensive employee training, regular security awareness campaigns, clear security policies, and a robust reporting mechanism for potential vulnerabilities.

What is the best way to communicate during a data breach?

Transparency and prompt communication are key. Develop a pre-written communication plan outlining how and when you will inform stakeholders, including customers, employees, and regulators.