Checkpoint Software Acquires Israeli Firm Dome9

Check point software technologies acquires israeli firm dome9 – Checkpoint Software Technologies acquires Israeli firm Dome9: This major acquisition shakes up the cloud security landscape. Checkpoint, a veteran in network security, bolsters its cloud security capabilities by bringing Dome9’s expertise in cloud-native security solutions under its wing. This move signals a significant shift in the industry, promising enhanced security for businesses navigating the increasingly complex world of cloud computing.

The financial details, while not yet fully disclosed, hint at a substantial investment by Checkpoint, underlining the strategic importance of this merger.

The acquisition brings together two powerhouses: Checkpoint, known for its robust network security solutions, and Dome9, a leader in cloud security posture management (CSPM). The combined entity will offer a comprehensive security solution spanning both traditional network and modern cloud environments. This integration is expected to streamline security operations for businesses, providing a unified platform to manage risks across their entire IT infrastructure.

The competitive landscape will undoubtedly see shifts as other players react to this powerful consolidation of resources and expertise.

Checkpoint Software Technologies and Dome9

Checkpoint Software Technologies’ acquisition of Dome9 marked a significant moment in the cybersecurity landscape, uniting a veteran in network security with a rising star in cloud security. This merger brought together complementary strengths, enhancing their combined offerings and market reach. Let’s delve into the individual histories and market positions of these two companies before the acquisition.

Checkpoint Software Technologies: A History, Check point software technologies acquires israeli firm dome9

Founded in 1993, Checkpoint Software Technologies quickly established itself as a leader in network security. Their pioneering firewall technology became a cornerstone of network security infrastructure for businesses worldwide. Over the years, Checkpoint expanded its product portfolio to encompass a comprehensive suite of security solutions, including intrusion prevention systems, data loss prevention tools, and endpoint security. Their consistent innovation and strong market presence solidified their position as a major player in the enterprise security market.

Checkpoint Software Technologies’ acquisition of Dome9 highlights the growing importance of cloud security. This move underscores the need for robust solutions, especially considering the rise of cloud security posture management (CSPM) tools like those discussed in this insightful article on bitglass and the rise of cloud security posture management. The deal shows Checkpoint’s commitment to staying ahead in a rapidly evolving landscape, solidifying their position in the cloud security market.

They’ve consistently adapted to evolving threats, transitioning from primarily on-premise solutions to incorporate cloud-based and hybrid security models.

Dome9: Expertise in Cloud Security

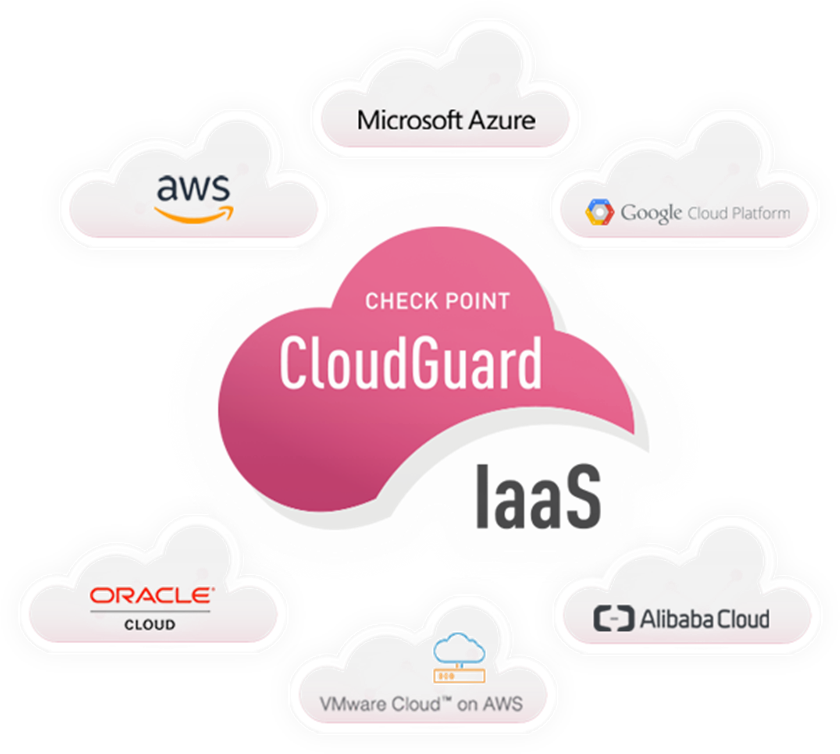

Dome9, established in 2012, focused specifically on cloud security. They developed a cloud-native security platform designed to manage and protect cloud environments, particularly those utilizing Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). Their expertise lay in providing visibility, compliance, and security automation within dynamic cloud infrastructures. Dome9’s platform offered features such as automated security policy enforcement, vulnerability management, and threat detection, addressing the unique challenges posed by cloud environments.

Their strength was in the agility and scalability they offered to organizations rapidly adopting cloud technologies.

Market Positions Before the Acquisition

Before the acquisition, Checkpoint held a strong position in the established network security market, boasting a large customer base and a well-recognized brand. Their focus, however, was primarily on traditional network security, while the cloud security market was rapidly expanding. Dome9, on the other hand, was a rapidly growing player in the burgeoning cloud security market, specializing in the unique security needs of cloud-native applications and infrastructure.

While Checkpoint had begun to expand its cloud security offerings, Dome9 possessed a more mature and comprehensive cloud-specific platform. The acquisition allowed Checkpoint to rapidly expand its cloud security capabilities and directly compete with other major cloud security providers.

Financial Aspects Before the Merger

Precise financial figures prior to the merger are not publicly available in granular detail due to the private nature of some financial information and the complexities of mergers and acquisitions. However, it’s widely known that Checkpoint, being a publicly traded company, had significantly larger revenue and market capitalization than Dome9. Checkpoint’s annual revenue was in the billions of dollars, reflecting its established position and broad product portfolio.

Dome9, as a privately held company, did not publicly disclose its financial details, but its rapid growth and successful funding rounds indicated a significant valuation before the acquisition. The acquisition itself represented a substantial investment by Checkpoint, reflecting the strategic value they placed on Dome9’s technology and expertise. The financial details of the transaction were publicly announced, illustrating Checkpoint’s commitment to strengthening its cloud security division.

Reasons Behind the Acquisition

Checkpoint Software Technologies’ acquisition of Dome9 wasn’t a spur-of-the-moment decision; it was a strategic move designed to bolster their position in the rapidly expanding cloud security market. The deal solidified Checkpoint’s commitment to comprehensive cloud security solutions and reflects the increasing importance of protecting businesses operating in multi-cloud environments.Checkpoint’s strategic motivations were multifaceted, driven by the need to expand their cloud security capabilities and better serve their existing customer base.

The acquisition provided Checkpoint with immediate access to Dome9’s advanced cloud security posture management (CSPM) and cloud workload protection platform (CWPP) technologies, filling a significant gap in their portfolio. This move also allowed Checkpoint to tap into Dome9’s established customer base and expertise in the cloud security domain.

Synergies Between Checkpoint and Dome9

The combination of Checkpoint’s established network security expertise and Dome9’s cloud security prowess created significant synergies. Checkpoint’s existing on-premises and network security solutions could be seamlessly integrated with Dome9’s cloud security platform, providing customers with a unified security architecture that spans both on-premises and cloud environments. This integration offers a holistic security approach, simplifying management and improving overall security posture.

For example, Checkpoint’s firewall expertise combined with Dome9’s cloud workload protection offers a comprehensive defense against threats, regardless of location.

Impact on the Competitive Landscape

The acquisition significantly shifted the competitive landscape in the cloud security market. By acquiring Dome9, Checkpoint gained a competitive edge, offering a more comprehensive and integrated cloud security solution compared to many of its competitors. This strengthened Checkpoint’s position against other major players in the cloud security space, such as AWS, Azure, and Google Cloud Platform, allowing them to better compete for larger enterprise clients with complex multi-cloud deployments.

The combined entity now possesses a broader product portfolio and a more robust technology stack, creating a formidable competitor. This acquisition forced other vendors to re-evaluate their cloud security strategies and potentially accelerate their own acquisitions or product development cycles.

Strengthening Checkpoint’s Cloud Security Offerings

The acquisition directly strengthened Checkpoint’s cloud security offerings by adding Dome9’s advanced capabilities. Dome9’s CSPM and CWPP technologies provided Checkpoint with immediate access to cutting-edge solutions for managing and protecting cloud workloads. This broadened Checkpoint’s ability to address the growing security challenges associated with cloud adoption, such as misconfigurations, vulnerabilities, and compliance issues. The integration of Dome9’s technology into Checkpoint’s existing platform provides a more comprehensive and integrated solution for customers, streamlining management and improving overall security effectiveness.

This improved offering allows Checkpoint to better address the needs of businesses moving to the cloud, ensuring that their security infrastructure can adapt to the dynamic nature of cloud environments.

Impact on the Cloud Security Market

Checkpoint’s acquisition of Dome9 sends ripples throughout the cloud security market, primarily because it significantly strengthens Checkpoint’s already robust portfolio with Dome9’s cloud-native security expertise. This move allows Checkpoint to offer a more comprehensive and integrated security solution, potentially impacting competition and pricing strategies across the board.The acquisition integrates Dome9’s strong position in cloud security posture management (CSPM) and cloud workload protection platforms (CWPP) with Checkpoint’s established network security infrastructure.

This combination creates a powerful one-stop shop for organizations seeking a unified approach to securing their cloud environments. The impact extends beyond simple product integration; it alters the competitive landscape, forcing other players to reassess their strategies.

Checkpoint Software Technologies’ acquisition of Dome9 definitely shakes things up in the cloud security space. This kind of strategic move makes me wonder about the future of app development, especially considering the rapid advancements discussed in this great article on domino app dev the low code and pro code future. Will this impact how quickly secure, scalable apps are built?

The Checkpoint/Dome9 deal certainly highlights the ongoing evolution of cybersecurity and its close relationship with application development.

Competitive Landscape Shifts

The acquisition alters the competitive landscape by creating a more formidable competitor. Before the acquisition, organizations might have chosen separate vendors for network security and cloud security, potentially leading to integration challenges. Now, Checkpoint offers a consolidated solution, potentially reducing complexity and increasing efficiency for clients. This consolidation directly challenges competitors offering similar integrated solutions, such as Palo Alto Networks or Fortinet, forcing them to innovate and potentially consolidate their own offerings to remain competitive.

The market may see a shift towards larger, more comprehensive security providers, potentially squeezing out smaller, more specialized firms.

Pricing Strategies Following the Acquisition

Predicting the exact pricing changes post-acquisition is challenging, but several scenarios are plausible. Checkpoint might leverage the combined strengths of both companies to offer bundled packages at competitive prices, potentially undercutting competitors. Alternatively, they could maintain existing pricing structures for individual products while introducing premium packages incorporating the full suite of features. A third possibility is that prices for certain Dome9 products might increase slightly due to integration costs and enhanced features.

This strategy would mirror that of other large acquisitions in the tech industry where premium features are introduced post-merger, justifying price increases. For example, Salesforce’s acquisition of companies often leads to price adjustments as features are integrated into the main platform.

Hypothetical Competitor Response

Let’s imagine a hypothetical scenario: Palo Alto Networks, a major competitor, observes Checkpoint’s increased market share and enhanced product offering. In response, Palo Alto Networks might accelerate its own R&D efforts to develop more comprehensive cloud security solutions, potentially focusing on areas where Checkpoint’s combined offering is weaker. They might also pursue strategic acquisitions of their own to bolster their cloud security capabilities or enhance their integration capabilities.

Furthermore, they might launch aggressive marketing campaigns highlighting the superior aspects of their own cloud security solutions, emphasizing areas where their products surpass Checkpoint’s offerings, perhaps focusing on specific niche markets or advanced threat detection capabilities. This reactive strategy would aim to mitigate the impact of Checkpoint’s acquisition and retain its market share.

Integration and Future Plans

Checkpoint’s acquisition of Dome9 represents a significant strategic move, aiming to bolster its cloud security offerings. The integration process will be crucial in realizing the full potential of this merger, requiring careful planning and execution across technology, personnel, and overall business strategy. Success will depend on Checkpoint’s ability to seamlessly integrate Dome9’s cloud security expertise into its existing infrastructure while minimizing disruption to both customer bases.Checkpoint will likely employ a phased integration strategy.

Initially, this will focus on aligning Dome9’s cloud security platform with Checkpoint’s existing infrastructure. This will involve careful mapping of functionalities, identifying areas of overlap and redundancy, and developing a roadmap for migrating key features and functionalities. Simultaneously, Checkpoint will need to focus on integrating Dome9’s workforce, leveraging their specialized cloud security knowledge to enhance its existing team and product development.

This may involve retaining key personnel, providing training opportunities, and fostering a collaborative environment. The success of this integration will depend heavily on the cultural fit between the two organizations and the ability to create a unified vision.

Checkpoint’s Integration Strategy

Checkpoint’s integration strategy will likely involve a multi-pronged approach. Firstly, a thorough technical assessment of Dome9’s technology will be undertaken to identify synergies and areas for improvement. This will inform decisions regarding which Dome9 features will be directly integrated into Checkpoint’s existing products, and which might require separate but compatible offerings. Secondly, a cultural integration plan will be essential.

This will focus on fostering collaboration between the two teams, ensuring that the unique strengths of both organizations are preserved and combined effectively. Finally, a customer-centric approach will be crucial, ensuring a smooth transition for Dome9 customers and minimizing any service disruptions during the integration process. This could involve dedicated support teams and clear communication strategies to keep customers informed of progress and address any concerns.

Potential Integration Challenges

Integrating two distinct technological platforms always presents challenges. One major hurdle could be compatibility issues between Dome9’s cloud-native architecture and Checkpoint’s existing on-premises and hybrid solutions. Differences in data formats, APIs, and security protocols could require significant effort to resolve. Another potential challenge lies in integrating the two companies’ respective customer bases. Maintaining customer satisfaction and ensuring a seamless transition for both existing Checkpoint and Dome9 customers will require careful planning and communication.

Finally, managing the cultural integration of two distinct organizational cultures could be complex, potentially leading to conflicts in working styles and priorities. Successful integration will require effective change management and a clear communication strategy to address potential concerns and foster a unified company culture.

Predictions for Checkpoint’s Cloud Security Products

Following the acquisition, we can anticipate several key changes in Checkpoint’s cloud security product line. We’ll likely see enhanced cloud-native security capabilities, with a stronger emphasis on automation and orchestration. Checkpoint’s existing portfolio will likely incorporate Dome9’s strengths in cloud workload protection, leveraging its expertise in multi-cloud environments. This could result in a more comprehensive and integrated security solution for customers operating across various cloud providers.

Furthermore, we can expect increased innovation in areas like cloud security posture management (CSPM) and cloud workload protection platforms (CWPP), driven by the combined expertise of both organizations. This could lead to more proactive threat detection and response capabilities. Similar to how Palo Alto Networks’ acquisition of several security companies has led to a more comprehensive product suite, Checkpoint’s integration of Dome9 is expected to create a broader, more competitive offering in the cloud security market.

Timeline for Integration Milestones

The integration process is likely to unfold over several phases, spanning a period of 12-18 months.

- Phase 1 (Months 1-3): Assessment and planning. This phase will involve a detailed technical and organizational assessment, defining integration strategies, and establishing clear goals and timelines.

- Phase 2 (Months 4-9): Technical integration. This will focus on integrating Dome9’s technology into Checkpoint’s infrastructure, resolving compatibility issues, and conducting thorough testing.

- Phase 3 (Months 10-12): Product launch and customer migration. This phase will involve launching updated products incorporating Dome9’s capabilities and migrating Dome9 customers to the new platform.

- Phase 4 (Months 13-18): Optimization and expansion. This final phase will focus on optimizing the integrated platform, expanding its capabilities, and exploring new market opportunities.

This timeline is, of course, a prediction and may be subject to adjustments based on unforeseen challenges or opportunities. However, it provides a reasonable framework for understanding the potential progression of the integration process.

Customer Impact

The Checkpoint acquisition of Dome9 presents a complex picture for customers of both companies. While the integration promises enhanced security capabilities, it also introduces potential changes to service delivery, support, and contractual agreements. Understanding these potential shifts is crucial for both existing Dome9 users and Checkpoint’s established customer base.The immediate impact on existing Dome9 customers will largely depend on Checkpoint’s integration strategy.

A smooth transition would ideally involve minimal disruption to existing services and support channels. However, potential changes to pricing, feature sets, and support procedures are likely, even with a well-executed plan. The long-term benefits should outweigh any short-term inconveniences, provided Checkpoint prioritizes a customer-centric approach.

Impact on Existing Dome9 Customers

Checkpoint’s acquisition strategy will determine the immediate experience of Dome9’s existing customers. A phased integration, allowing for continued use of Dome9’s current platform with gradual integration of Checkpoint’s technologies, would likely be the least disruptive. Conversely, a rapid, complete integration could lead to a steeper learning curve and potential temporary service interruptions. Checkpoint’s communication strategy regarding the integration timeline and support plans will be key to mitigating any negative customer experience.

Transparency and proactive communication are vital for maintaining customer confidence during this transition. Examples of successful integrations from other tech acquisitions can provide a framework for Checkpoint to follow, ensuring minimal customer disruption. For instance, if Checkpoint adopts a strategy similar to Salesforce’s acquisition of MuleSoft, where a phased integration allowed customers to continue using the existing platform while gradually incorporating new features, the impact on Dome9 customers should be significantly reduced.

Impact on Checkpoint Customers

Checkpoint’s existing customer base will likely benefit from access to Dome9’s cloud security expertise. This acquisition expands Checkpoint’s cloud security offerings, potentially adding features and capabilities not previously available. However, the integration process may involve learning new tools and workflows. Checkpoint needs to clearly communicate these changes and provide adequate training and documentation to ensure a smooth transition for its existing clients.

Successful integration will require Checkpoint to clearly define how Dome9’s features will complement their existing solutions and to avoid creating unnecessary complexities. For example, if Checkpoint seamlessly integrates Dome9’s cloud security posture management (CSPM) capabilities into its existing network security platform, customers will benefit from a more unified and comprehensive security solution.

Customer Support Strategies: Before and After the Acquisition

Before the acquisition, Dome9 customers received support directly from Dome9, while Checkpoint customers relied on Checkpoint’s support channels. Post-acquisition, a unified support structure is anticipated. This could involve consolidating support channels, potentially leading to a single point of contact for both sets of customers. The success of this consolidation will depend on Checkpoint’s ability to effectively integrate support teams and knowledge bases.

Ideally, the combined support organization should offer improved response times, broader expertise, and a more streamlined support experience. A poorly executed integration could lead to longer wait times, fragmented support resources, and a less efficient overall support experience. A clear communication plan outlining the new support structure and processes will be essential. For example, a multi-lingual support system, encompassing the languages of both existing customer bases, will be critical for seamless support provision.

Potential Changes in Service Level Agreements (SLAs)

Existing SLAs with both Dome9 and Checkpoint may undergo revisions following the acquisition. Checkpoint will likely need to harmonize the different service level commitments to create a unified set of SLAs that applies to both customer bases. This process could involve changes to response times, uptime guarantees, and other key performance indicators (KPIs). Transparent communication about these potential SLA changes is crucial to maintaining customer trust.

Any modifications should be clearly communicated and justified, outlining the benefits and rationale behind the changes. For instance, if Checkpoint upgrades its infrastructure to support the combined customer base, leading to improved overall performance and reliability, this can be used to justify potential changes to existing SLAs, emphasizing the enhanced services provided.

Illustrative Example

Let’s consider a hypothetical scenario involving a large financial institution, “GlobalBank,” heavily invested in cloud infrastructure. GlobalBank utilizes numerous cloud services from different providers and needs a robust security posture across all these environments. This example will illustrate how the combined Checkpoint and Dome9 platform can improve their cloud security compared to their pre-acquisition solutions.

Before the acquisition, GlobalBank relied on disparate security tools, leading to fragmented visibility and management. The integration of Checkpoint and Dome9 addresses this fragmentation, providing a unified and comprehensive approach to cloud security.

Feature Comparison: GlobalBank’s Cloud Security Before and After

The following table compares the features of a hypothetical Dome9 product before and after its integration with Checkpoint’s platform, focusing on GlobalBank’s specific needs. Note that this is a simplified illustration and actual features may vary.

| Feature | Dome9 (Pre-Acquisition) | Checkpoint (Pre-Acquisition) | Combined Platform (Post-Acquisition) |

|---|---|---|---|

| Cloud Visibility & Compliance | Good visibility into AWS, Azure, limited GCP support. Basic compliance reporting. | Strong network security, but limited cloud-native visibility and compliance automation. | Comprehensive visibility across AWS, Azure, GCP, and other major cloud providers. Automated compliance reporting and remediation. |

| Vulnerability Management | Identifies vulnerabilities but lacks automated remediation capabilities. | Strong vulnerability scanning for on-premise infrastructure, but limited cloud integration. | Unified vulnerability management across on-premise and cloud environments. Automated remediation workflows. |

| Security Policy Enforcement | Provides basic policy enforcement but lacks integration with other security tools. | Robust policy enforcement for network security but limited cloud-native policy management. | Centralized policy management across all environments. Automated enforcement with integrated remediation. |

| Threat Detection & Response | Basic threat detection capabilities, limited integration with SIEM. | Advanced threat detection and prevention for network traffic, but lacks comprehensive cloud-native threat detection. | Advanced threat detection and response across all environments, including cloud-native threats. Integrated SIEM integration for enhanced threat intelligence. |

Visual Representation

The Checkpoint-Dome9 acquisition significantly altered the competitive landscape of the cloud security market. To visualize this shift, a bar chart effectively illustrates the pre- and post-acquisition market share dynamics of key players. The chart provides a clear picture of how the combined entity of Checkpoint and Dome9 impacts the overall market distribution.The chart’s horizontal axis represents the major cloud security providers, including Checkpoint, Dome9 (pre-acquisition), AWS, Azure, Google Cloud, and other significant competitors.

The vertical axis represents the market share percentage, ranging from 0% to 100%. Each bar represents a specific provider’s market share, with separate bars for the pre- and post-acquisition scenarios. Different colors distinguish the pre- and post-acquisition data points for easy comparison.

Market Share Dynamics Before and After Acquisition

Before the acquisition, Checkpoint and Dome9 held distinct, albeit smaller, market shares compared to the larger cloud providers like AWS, Azure, and Google Cloud. Dome9, specializing in cloud security posture management (CSPM), occupied a niche market segment. Checkpoint, a well-established network security player, had a presence in the cloud security space but not as dominant a share as the hyperscalers.

The pre-acquisition bars would show this disparity, with AWS, Azure, and Google Cloud having significantly taller bars than Checkpoint and Dome9.Post-acquisition, the combined Checkpoint-Dome9 entity would be represented by a single, taller bar. This bar would visually demonstrate a substantial increase in market share compared to Checkpoint’s pre-acquisition position. While it might not surpass the hyperscalers immediately, the combined entity’s market share would demonstrate a significant jump, representing the consolidation of both companies’ strengths and customer bases.

The bars representing AWS, Azure, and Google Cloud would likely remain relatively similar in height, though their relative proportions compared to the new Checkpoint-Dome9 entity would change noticeably. The “Other” category would likely show a slight decrease to reflect the market share absorbed by the merged entity. This visual representation clearly highlights the increased competitive pressure on other players and Checkpoint’s strengthened position within the cloud security sector.

Conclusive Thoughts: Check Point Software Technologies Acquires Israeli Firm Dome9

Checkpoint’s acquisition of Dome9 marks a pivotal moment in the cloud security market. The combination of Checkpoint’s established reputation and Dome9’s innovative cloud security technology promises to deliver a more robust and comprehensive security solution for businesses. The long-term impact remains to be seen, but this merger is likely to drive innovation and further consolidate the cloud security market, setting a new benchmark for future acquisitions in the sector.

The integration process will be crucial, but if successful, this union promises to significantly benefit both Checkpoint’s and Dome9’s existing customer bases, creating a stronger, more secure future for all.

Question Bank

What are the potential job security implications for Dome9 employees?

While some restructuring is likely, Checkpoint has generally indicated a commitment to retaining Dome9’s talent and expertise. The exact impact on individual roles will depend on the integration process.

How will this affect pricing for Dome9’s existing products?

Pricing changes are possible, but the specifics haven’t been announced. It’s likely that Checkpoint will evaluate pricing strategies to optimize the combined product offerings.

Will Dome9’s technology be integrated with Checkpoint’s existing platform immediately?

No, the integration will be a phased process. Checkpoint will likely prioritize key features and functionalities for integration first.

What about support for existing Dome9 customers?

Checkpoint has committed to ensuring continued support for existing Dome9 customers during and after the integration. Specific support plans are likely to be communicated directly to customers.