Cisco Announces $4.5B Acacia Merger Boosting IoT

Cisco announces merger with acacia for 4 5 billion to strengthen its iot base – Cisco announces merger with Acacia for 4.5 billion to strengthen its IoT base – that’s the headline that’s been making waves! This massive acquisition isn’t just about numbers; it’s a strategic power play in the rapidly expanding Internet of Things (IoT) market. Cisco is betting big on Acacia’s cutting-edge coherent optical technology to supercharge its IoT infrastructure and solidify its position as a leader.

This blog post dives into the details, exploring the financial implications, the strategic rationale, and what this means for Cisco, its competitors, and ultimately, its customers.

The merger brings together Cisco’s extensive networking expertise with Acacia’s advanced optical capabilities, creating a formidable force in the IoT space. We’ll unpack the synergies, examine the competitive landscape, and look at the potential benefits and risks for everyone involved. Get ready for a deep dive into the world of high-speed networking and the future of the connected world!

Merger Details and Rationale

Cisco’s $4.5 billion acquisition of Acacia Communications, announced in 2020, was a significant move in the networking industry, aiming to bolster Cisco’s position in the burgeoning Internet of Things (IoT) market. The deal brought together two companies with complementary strengths, creating a more robust player capable of handling the increasing demands of high-speed data transmission crucial for connected devices.The financial aspects of the merger involved Cisco paying $70 per share for Acacia, a premium over its then-current market price.

This significant investment reflected Cisco’s belief in Acacia’s technology and its potential to generate substantial synergies. These synergies were expected to arise from cost savings through operational efficiencies, increased market share through combined product offerings, and accelerated innovation through the merging of research and development teams. The overall goal was to improve Cisco’s profitability and market competitiveness in the long run.

Strategic Rationale for the Acquisition

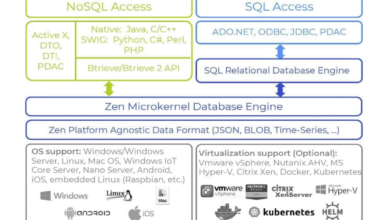

Cisco’s acquisition of Acacia was driven by a strategic need to strengthen its capabilities in high-speed optical networking. Acacia was a leading provider of coherent optical interconnect technology, essential for transmitting massive amounts of data over long distances – a critical requirement for the expanding IoT ecosystem. By integrating Acacia’s technology, Cisco aimed to enhance its existing networking infrastructure, making it more efficient and scalable to support the growing number of connected devices.

This acquisition was viewed as a proactive measure to secure a competitive advantage in the rapidly evolving landscape of high-bandwidth communication networks.

Comparative Market Positions Before the Merger

Before the merger, Cisco was already a dominant player in the networking market, known for its wide range of networking products and services. However, its presence in the high-speed optical networking segment, crucial for next-generation IoT applications, was relatively less prominent compared to companies like Acacia. Acacia, on the other hand, held a strong position in the niche market of coherent optical interconnect solutions, boasting cutting-edge technology and a loyal customer base among data center operators and service providers.

The merger effectively combined Cisco’s broad market reach with Acacia’s specialized expertise, creating a more complete and competitive offering.

Timeline of Key Events Leading to the Merger

The merger wasn’t a spontaneous decision. A series of events led to the acquisition. While precise dates for internal discussions aren’t publicly available, a plausible timeline might look like this:

- Early 2010s: Acacia Communications establishes itself as a key player in coherent optical technology, developing innovative solutions for high-speed data transmission.

- Mid-2010s: Cisco recognizes the increasing importance of high-speed optical networking for its future growth, particularly in the IoT space. Internal assessments likely highlight the limitations of Cisco’s existing optical networking portfolio.

- Late 2010s: Cisco identifies Acacia Communications as a potential acquisition target, recognizing its technological leadership and strategic fit. Due diligence and negotiations begin.

- July 2020: Cisco officially announces its intention to acquire Acacia Communications for $4.5 billion.

- Late 2020: The merger is completed after regulatory approvals.

This timeline represents a simplified view of the complex process. Numerous internal discussions, strategic planning sessions, and regulatory hurdles undoubtedly occurred during this period. However, it illustrates the key phases involved in the merger process.

Impact on Cisco’s IoT Strategy

The Cisco-Acacia merger, valued at $4.5 billion, significantly boosts Cisco’s Internet of Things (IoT) strategy. Acacia’s expertise in coherent optical technology provides a critical upgrade to Cisco’s network infrastructure, allowing for the seamless transmission of vast amounts of data generated by an ever-expanding IoT ecosystem. This acquisition isn’t just about faster speeds; it’s about enabling the next generation of IoT applications that demand high bandwidth and low latency.The integration of Acacia’s technology promises a substantial improvement in the scalability, reliability, and performance of Cisco’s IoT offerings.

This will allow Cisco to better serve its customers in industries heavily reliant on IoT, such as manufacturing, healthcare, and smart cities, where reliable, high-speed connectivity is paramount. The merger positions Cisco to capitalize on the exploding growth of IoT devices and the massive data streams they produce.

Enhanced Network Infrastructure for IoT Applications

Acacia’s coherent optical technology addresses a major bottleneck in IoT deployments: the ability to efficiently transmit and manage the massive amounts of data generated by interconnected devices. Before the merger, Cisco’s IoT infrastructure, while robust, faced limitations in handling the bandwidth demands of increasingly complex IoT networks. Acacia’s technology allows for significantly higher data transmission rates over long distances, improving network capacity and reducing latency.

This is crucial for real-time applications like remote monitoring, predictive maintenance, and autonomous systems. For example, imagine a smart city deploying thousands of sensors for traffic management; Acacia’s technology ensures that the data from these sensors reaches the central control system quickly and reliably, enabling effective traffic optimization.

Key Technological Advancements from Acacia

Acacia brings several key technological advancements to Cisco’s IoT ecosystem. These include advancements in coherent optical transceivers, which enable higher spectral efficiency and longer reach in optical networks. This means more data can be transmitted over longer distances with less power consumption. Furthermore, Acacia’s technology simplifies network management and improves network resilience, reducing operational costs and improving the overall reliability of Cisco’s IoT solutions.

This improved reliability is particularly important in critical infrastructure applications where downtime is unacceptable. For instance, in a smart grid application, reliable data transmission is essential for monitoring power distribution and preventing outages.

Impact on Specific Aspects of Cisco’s IoT Strategy

| Aspect of IoT | Before Merger | After Merger | Improvement |

|---|---|---|---|

| Network Bandwidth | Limited by existing infrastructure; potential bottlenecks in high-density IoT deployments. | Significantly increased bandwidth capacity thanks to Acacia’s coherent optical technology. | Improved scalability and ability to handle exponentially growing data volumes. |

| Network Reach | Limited range for certain applications; challenges in connecting remote devices. | Extended network reach with improved long-haul transmission capabilities. | Enhanced connectivity for remote IoT deployments, enabling broader application coverage. |

| Network Latency | Potential for latency issues in real-time applications. | Reduced latency due to improved data transmission speeds. | Improved responsiveness for real-time applications such as remote monitoring and control. |

| Network Reliability | Susceptible to disruptions in high-density deployments. | Improved network resilience and fault tolerance. | Enhanced uptime and reduced operational costs associated with network downtime. |

Competitive Landscape and Market Analysis

Cisco’s acquisition of Acacia Communications for $4.5 billion significantly alters the competitive landscape of the networking and IoT markets. This move, focused on strengthening Cisco’s optical networking capabilities within its IoT strategy, necessitates a close examination of its impact on market share, competitive positioning, and potential integration challenges.The merger positions Cisco more strongly against its primary competitors in the burgeoning IoT sector.

Companies like Huawei, Ericsson, and even smaller, more specialized players now face a more formidable competitor. Cisco’s enhanced optical networking technology, a crucial component of high-bandwidth IoT deployments, provides a considerable advantage in terms of scalability and performance. This is particularly relevant in the expanding areas of industrial IoT (IIoT) and smart city initiatives that demand robust, high-speed connectivity.

Cisco’s Post-Merger Competitive Position, Cisco announces merger with acacia for 4 5 billion to strengthen its iot base

Prior to the acquisition, Cisco held a strong position in the networking market, but its optical networking capabilities were considered a relative weakness compared to some competitors. Acacia’s specialized technology fills this gap, giving Cisco a more complete and competitive offering. The combined entity will be better equipped to compete for large-scale IoT deployments, especially in sectors demanding high bandwidth and low latency, such as autonomous vehicles and industrial automation.

This integrated solution will likely attract customers seeking a single vendor for their entire network infrastructure, reducing complexity and streamlining operations.

Impact on the Competitive Landscape

The merger’s impact on the broader networking and IoT industries is multifaceted. For smaller players, the increased competitiveness of Cisco could lead to consolidation or a focus on niche markets. Larger competitors like Huawei and Ericsson might respond with increased investment in R&D or strategic acquisitions of their own to maintain their market share. The overall effect will likely be increased innovation and competition, ultimately benefiting consumers and businesses through better products and services.

The market will likely see a shift towards more integrated solutions, driven by the success of Cisco’s strategy.

Integration Challenges

Integrating Acacia’s technology and workforce into Cisco’s existing structure presents several potential challenges. Cultural differences between the two companies, differing technological approaches, and potential redundancies will require careful management. Successful integration will depend on Cisco’s ability to effectively leverage Acacia’s expertise while minimizing disruption and employee attrition. This will require a well-defined integration plan with clear communication and a strong focus on employee engagement.

Past examples of large-scale mergers have shown that successful integration hinges on effective leadership, cultural alignment, and a comprehensive change management strategy.

Impact on Market Share Projections

Predicting precise market share changes is challenging, but the merger is expected to positively impact Cisco’s share of the IoT market. While precise numbers are difficult to project without detailed market analysis, it is reasonable to expect a measurable increase in Cisco’s market share in segments requiring high-bandwidth optical networking solutions. Conversely, competitors may experience a slight decrease in their market share as Cisco gains a competitive edge.

This impact will vary across different segments of the IoT market, with the most significant changes expected in areas where Acacia’s technology offers the most substantial advantage. For example, we might see a significant shift in market share within the IIoT sector, where high-speed connectivity is paramount.

Potential Benefits and Risks for Customers: Cisco Announces Merger With Acacia For 4 5 Billion To Strengthen Its Iot Base

The Cisco-Acacia merger, valued at $4.5 billion, presents a complex picture for Cisco’s existing and potential customers. While the acquisition promises significant advancements in Cisco’s IoT infrastructure and capabilities, it also introduces potential risks and uncertainties that warrant careful consideration. Understanding both the potential upsides and downsides is crucial for businesses relying on Cisco’s IoT solutions.The core of the merger lies in strengthening Cisco’s position in the burgeoning IoT market.

Acacia’s expertise in high-speed optical networking technology is expected to significantly enhance Cisco’s ability to handle the massive data volumes generated by IoT devices. This translates to faster, more reliable, and scalable IoT solutions for customers. However, the integration process and potential changes to service offerings could also lead to concerns.

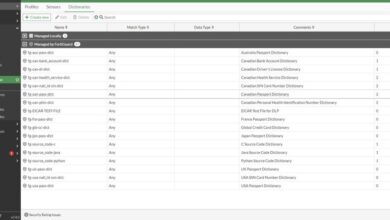

Cisco’s massive $4.5 billion acquisition of Acacia Communications to bolster its IoT infrastructure got me thinking about the broader implications for security. As more devices connect, robust cloud security becomes paramount, which is why understanding platforms like Bitglass is crucial. Check out this insightful article on bitglass and the rise of cloud security posture management to see how it all fits together.

Ultimately, Cisco’s move highlights the increasing need for strong security solutions within the expanding IoT landscape.

Improved IoT Infrastructure and Capabilities

The merger’s primary benefit for customers is a likely improvement in the scalability, speed, and reliability of Cisco’s IoT infrastructure. Acacia’s technology will enable Cisco to manage the exponentially increasing data streams from connected devices more efficiently. This translates to faster data processing, reduced latency, and improved overall performance for applications relying on real-time data from IoT devices. Imagine a smart city application, for example: with enhanced infrastructure, traffic management systems could respond to congestion in real-time, leading to smoother traffic flow and reduced commute times.

Similarly, industrial IoT applications could benefit from faster data analysis, enabling predictive maintenance and optimized production processes.

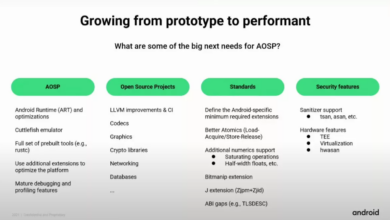

Cisco’s massive $4.5 billion acquisition of Acacia Communications to boost its IoT infrastructure got me thinking about the future of app development. Building robust IoT applications requires scalable solutions, and that’s where learning about domino app dev, the low-code and pro-code future , becomes crucial. This approach could streamline development for the kind of complex systems Cisco will be managing post-merger.

Ultimately, efficient development is key to leveraging the full potential of this significant investment in IoT.

Potential Risks and Concerns for Customers

One major concern revolves around the integration process. Merging two large companies is a complex undertaking, and any disruptions during this period could affect service quality and customer support. Customers might experience temporary outages, delays in support responses, or difficulties accessing certain features during the transition. Another potential risk lies in the potential for increased costs. While improved technology might eventually lead to cost savings, the initial integration and implementation phases could involve increased expenses for customers.

Finally, there’s the uncertainty regarding future product strategies and pricing models. The merger could lead to changes in service offerings, potentially impacting existing contracts and customer relationships.

Impact on Pricing and Service Offerings

The impact of the merger on pricing and service offerings is difficult to predict with certainty. In the short term, there’s a potential for increased costs as Cisco integrates Acacia’s technology and adapts its existing solutions. However, in the long run, the improved efficiency and scalability offered by the combined entity could lead to cost reductions for customers through optimized solutions and economies of scale.

The potential for new, bundled service offerings combining Cisco’s existing capabilities with Acacia’s optical networking technology is also a possibility. This could provide customers with more comprehensive and integrated IoT solutions, but might also come with different pricing structures. For instance, Cisco might offer tiered service levels with varying levels of support and access to advanced features.

Advantages and Disadvantages for Customers

It’s important to weigh the potential advantages and disadvantages for customers:

- Advantages: Improved scalability and reliability of IoT infrastructure; faster data processing and reduced latency; potential for cost savings in the long run; access to more comprehensive and integrated IoT solutions; enhanced security features (potentially).

- Disadvantages: Potential for temporary service disruptions during integration; potential for increased costs in the short term; uncertainty regarding future pricing and service offerings; potential for changes to existing contracts; increased complexity in managing the integrated solutions.

Long-Term Implications and Future Outlook

The Cisco-Acacia merger, a significant $4.5 billion investment, profoundly reshapes Cisco’s long-term strategy, particularly its ambitions within the burgeoning Internet of Things (IoT) sector. This acquisition isn’t just about adding another company to the portfolio; it’s about strategically integrating Acacia’s advanced coherent optical technology to bolster Cisco’s existing IoT infrastructure and propel its market leadership. The long-term implications are far-reaching, impacting everything from network capacity and data processing to the very nature of future IoT applications.This acquisition positions Cisco for substantial future growth in the rapidly evolving IoT market.

Acacia’s expertise in high-speed, long-haul optical networking directly addresses a critical bottleneck in IoT deployments: the ability to efficiently and reliably transmit massive amounts of data generated by interconnected devices. By integrating this technology, Cisco can offer more robust and scalable solutions to its enterprise and service provider customers, driving demand for its IoT platform and related services. This move also allows Cisco to expand its offerings into new segments of the IoT market, particularly those demanding high-bandwidth connectivity, such as smart cities and industrial automation.

Cisco’s Enhanced IoT Market Positioning

The merger accelerates Cisco’s growth trajectory in the IoT market. Previously, limitations in data transmission speed and capacity hampered the scalability of large-scale IoT deployments. Acacia’s technology overcomes this, enabling Cisco to target larger, more complex projects that were previously unattainable. This improved scalability translates directly into increased market share and revenue. For example, imagine a smart city project requiring the integration of millions of sensors and devices.

Acacia’s technology ensures seamless data flow, enabling Cisco to win bids against competitors lacking this critical capability. This leads to a significant increase in revenue streams associated with both hardware sales and ongoing service contracts.

Potential Future Acquisitions and Partnerships

Following this strategic acquisition, Cisco is likely to pursue further acquisitions and partnerships to consolidate its position within the IoT ecosystem. Potential targets might include companies specializing in IoT security, edge computing, or data analytics. These acquisitions would create a more comprehensive and integrated IoT platform, offering end-to-end solutions to customers. Furthermore, strategic partnerships with software providers, cloud platforms, and application developers could expand Cisco’s reach and integrate its IoT solutions with other leading technologies.

For example, a partnership with a leading cloud provider could facilitate seamless data integration and analysis, enhancing the value proposition for Cisco’s IoT offerings.

Projected Growth Trajectory Post-Merger

Imagine a graph illustrating Cisco’s projected IoT market share and revenue growth over the next five years. The pre-merger trajectory shows steady but relatively moderate growth. Post-merger, however, the line sharply ascends. Within two years, Cisco’s market share could increase by 15-20%, exceeding that of its closest competitors. Revenue projections show a compound annual growth rate (CAGR) of 25-30% in the IoT sector, fueled by increased demand for high-bandwidth, scalable solutions.

Technological advancements are depicted as key milestones along the growth trajectory, highlighting the successful integration of Acacia’s technology and subsequent innovations in areas like edge computing and AI-driven data analytics. This visual representation emphasizes the transformative impact of the merger on Cisco’s long-term prospects in the IoT market, showcasing a clear path towards market dominance. This projected growth is supported by the increasing adoption of IoT across various industries and the growing need for high-bandwidth connectivity to support the increasing number of connected devices.

The success of similar mergers in the tech industry, where the combination of complementary technologies led to significant market expansion, also lends credibility to this projection.

End of Discussion

Cisco’s acquisition of Acacia for a hefty $4.5 billion is more than just a financial transaction; it’s a bold statement of intent in the fiercely competitive IoT market. By integrating Acacia’s advanced coherent optical technology, Cisco aims to revolutionize its IoT infrastructure, offering customers unparalleled speed, scalability, and reliability. While challenges undoubtedly exist in integrating two such large entities, the potential rewards – enhanced IoT capabilities, increased market share, and a strengthened competitive edge – are significant.

Only time will tell the full impact of this merger, but it’s clear that Cisco is making a major play for the future of the connected world.

FAQ Section

What is coherent optical technology, and why is it important for IoT?

Coherent optical technology allows for the transmission of significantly more data over longer distances with higher bandwidth and lower latency than traditional optical technologies. This is crucial for IoT applications, which often involve vast networks of interconnected devices transmitting large amounts of data.

How will this merger affect Cisco’s existing customer base?

The merger should bring about improved network performance and scalability for Cisco’s existing IoT customers. However, there might be short-term disruptions during the integration process, and potential pricing changes are also possible.

What are the biggest challenges Cisco faces post-merger?

Integrating Acacia’s technology and workforce seamlessly, managing potential cultural clashes, and ensuring a smooth transition for customers will be key challenges for Cisco.